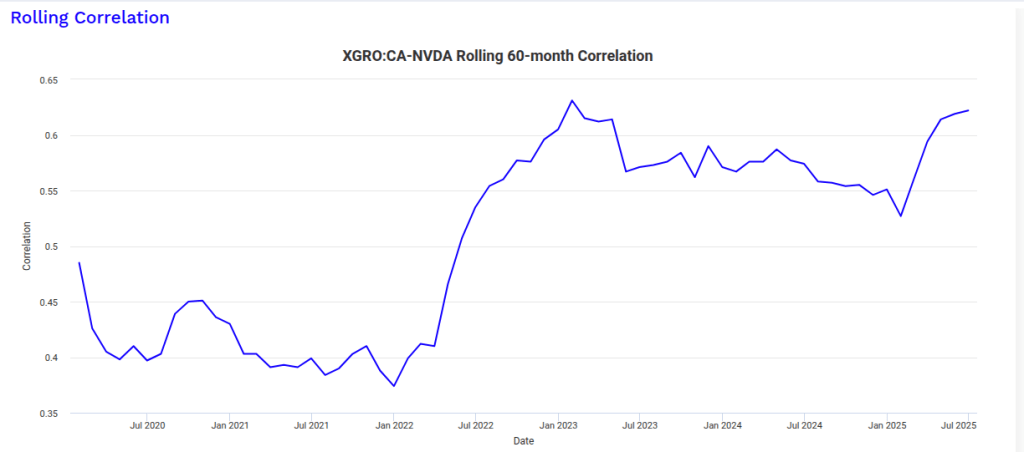

One nagging concern I’ve heard about index investing1 is that you can end up overly concentrated in a handful of stocks. For example, as of today, per XGRO’s fact sheet, for every $100 I have invested in XGRO, I’m actually investing almost $5 between two companies, NVIDIA and Microsoft. And for every $100 I have invested in AOA, it’s $7 in these two companies. Although that sounds like it might be a significant concentration, I found a way to test the correlation using https://www.portfoliovisualizer.com/asset-correlations. As you can see, XGRO and NVIDIA are not terribly well-correlated:

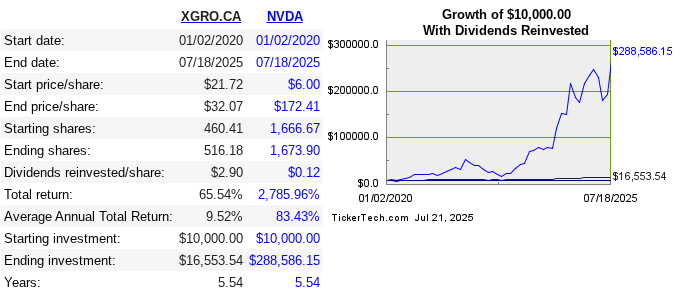

…even though perhaps I perhaps wish they were (sigh):

Anyway, if you’re still not comfortable with having too much concentration in your holdings, there are ETFs that limit exposure to any one stock in an index. iShares launched an ETF last year that tracks the S&P 500 while limiting the contribution of any member of that index to 3%. That product is called XUSC, which serves as a complement to its XUS uncapped S&P 500 ETF2. So when you compare XUS’s top holdings to those of XUSC, you can quickly spot the difference:

| Top Holdings | XUS (S&P 500) | XUSC (capped S&P 500)3 |

|---|---|---|

| NVIDIA | 7.86% | 3.49% |

| Microsoft | 7.09% | 3.12% |

| Apple | 5.90% | 3.07% |

| Amazon | 4% | 3.07% |

| Meta | 2.86% | 2.93% |

| Broadcom | 2.49% | 2.96% |

| Alphabet class A | 2% | 1.66% |

| Tesla | 1.73% | 2.05% |

| Alphabet class C | 1.63% | 1.35% |

| Berkshire Hathaway | 1.62% | 1.93% |

For the TSX, there’s not a full equivalent. The closest pairing for the TSX is XIC4 and XIU:

| Ticker | Index | Capped? | # of stocks |

|---|---|---|---|

| XIC | S&P/TSX Capped Composite | Yes | 214 |

| XIU | S&P/TSX 60 | No | 615 |

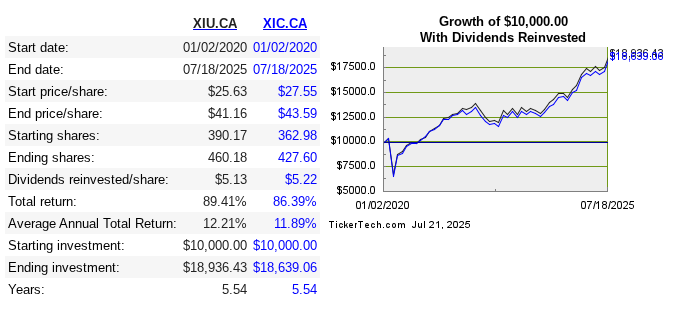

XIC holds a lot more companies, and in addition to capping any single company, this has the effect of shifting the emphasis to smaller companies. So does this make a big difference in performance? Let’s check using this calculator.

So not much difference; over the past 5.5 years, we see a very slight edge to XIU, the uncapped TSX60 fund.

Whether the relationship between XIU and XIC will be the same as XUS/XUSC is anybody’s guess. In my own case, I don’t own the capped version of the S&P 500, but I do own XIC over XIU, mostly because of its significantly lower MER (0.06% versus 0.18% for XIU).

- And my biggest holdings (AOA and XGRO) are nothing more than a collection of index funds: S&P 500, TSX, MSCI EAFE… ↩︎

- There’s also currency-hedged variants of these, but I never bother with hedging, it just adds expense and tracking errors. ↩︎

- You may wonder why an ETF that advertises itself as capping components at 3% has components that exceed 3%. I also have this question. I suppose they probably only trade when the exception is maintained for a period of time, or perhaps by a more significant margin. Otherwise, they’d trade stocks that hovered around the 3% threshold excessively. ↩︎

- The “C” is either for “Capped” or “Composite”, you decide. ↩︎

- I can’t explain why a “TSX 60” ETF has 61 assets. Maybe they count cash as the 61st? ↩︎

Discover more from The Money Engineer

Subscribe to get the latest posts sent to your email.