Since I hold a fair amount of USD in my retirement portfolio and most of my expenses are in CAD, I do have to convert between the two worlds from time to time. Most of the time I’m converting USD to CAD, but because of higher US interest rates, I’ve recently converted some CAD into USD to take advantage of that fact and earn a little more money on my cash positions1. My normal way of dealing with this conversion is using Norbert’s Gambit, which I’ve talked about here and here.

Anyway, I’ve decided to keep track on what these movements are costing me using my current broker of choice, Questrade. The answer is not quite as straightforward as you might think.

Fixed Cost

With Questrade, a journaling2 fee is charged every time you do the Gambit. This costs $9.95 plus HST for a total of $11.24, always charged in Canadian dollars. If you choose to subscribe to Questrade Plus, then your monthly fee covers these costs. I’ve done the Gambit twice this year, with one more planned in the 4th quarter. So for me, the cost of journaling is a pay-as-you-go cost. This cost is the same whether you are journaling one share or 10,000 shares, so larger transactions are better here.

Variable Cost: Changes in USD/CAD rate

Performing the Gambit using Questrade takes several business days. The foreign exchange rate moves all the time, so by the time you complete the conversion, the rate has almost certainly changed from when you started the process. Sometimes this works in your favour, sometimes not. Most of the reading I’ve done suggests you ignore this variability, since over time it should even out. For kicks, I’m tracking it.

Variable Cost: Buying and Selling DLR/DLR.u

Any trade you do has an inherent cost, even if you pay $0 commissions3, as I do. That cost is buried in the bid/ask spread. You may have noticed this at work immediately after completing a trade — it almost always seems that the market value of what you just bought is a little lower than what you just paid4. This variable cost is buried, but can be estimated by looking at the average bid/ask spread of DLR, which is featured on its fact sheet. It’s currently stated to be 0.07% when buying/selling DLR and 0.1% when buying/selling DLR.U5 . So, on average, you will sustain a total 0.17% cost when doing the Gambit. But I must reiterate — this cost is buried in the actual price per share you get when buying/selling DLR. Now, I actually paid very close attention to the bid/ask pricing last time I did the Gambit and I paid about half that rate but that’s all down to things like the volume of trading on the day, how many shares you’re moving and a whole bunch of other things that I don’t fully comprehend.

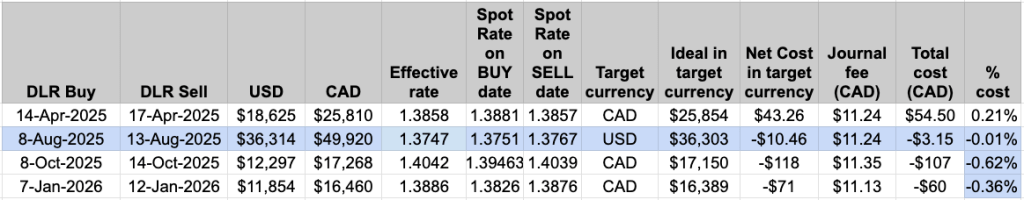

Anyway, here’s my tracking table that I’ll update as I do more of these trades:

Some definitions are in order:

- DLR Buy: date upon which DLR (or DLR.u) was purchased.

- DLR Sell: date upon which DLR (or DLR.u) was sold. There’s a lag because that’s how long Questrade takes to complete the journaling request. Seems like it’s 3 business days.

- USD: The USD value of DLR bought or sold as reported by the trade confirmation6

- CAD: The CAD value of DLR bought or sold as reported by the trade confirmation7

- Effective rate: divide the previous two columns to come up with a USD in CAD rate8

- Spot Rate on BUY/SELL date: daily average exchange rate9 as reported by the Bank of Canada

- Target currency: what we end up with, USD or CAD. It’s the opposite of what we start with

- Ideal in target currency: This is a calculation that takes the starting currency and applies the spot Rate on the DLR buy day to come up with the target amount. The ideal would be what you would have gotten if you had access to a no-cost conversion on the day you decided you wanted it.

- Net Cost subtracts either the USD or CAD column from the ideal amount. If it’s negative, it means the foreign exchange rate moved in our favour between the buy and sell dates. Net Cost is given in the target currency.

- Journal fee is charged by Questrade

- Total cost adds the journal fee and the net Cost and converts everything to CAD using the spot Rate on the buy day. If it’s negative, we actually made money doing the conversion.

- % cost takes total cost and divides by the CAD column

If you want a comparative cost, a typical broker charges 1.5% of the amount changing hands. Looks like I’m doing far better than that so far!

- And by “cash” I mean either ICSH or ZMMK, which are ultra-short-term bond funds denominated in USD and CAD, respectively. They are both featured as ETF All-Stars. ↩︎

- “Journaling” is the technical term for moving an interlisted stock/ETF from the CAD side to the USD side of your account or vice versa. ↩︎

- An attractive feature of Questrade, among others ↩︎

- This effect is often masked by the volatility in the asset you’re buying, but when you buy very stable priced assets like ZMMK or ICSH or CASH it becomes quite noticeable. ↩︎

- And 0.07% happens to be one cent divided by the current DLR Canadian price of $14.12. And 0.1% happens to be one cent divided by the current DLR.u price of $10.24 USD. ↩︎

- And thus includes the bid/ask spread ↩︎

- And thus includes the bid/ask spread ↩︎

- And 1/effective rate gives you CAD in USD ↩︎

- And this is an approximation since the rate changes throughout the day ↩︎

Discover more from The Money Engineer

Subscribe to get the latest posts sent to your email.

[…] importance of ICSH to my portfolio at the expense of ZMMK. I did the math to justify performing a Norbert’s Gambit of the CAD generated by selling ZMMK and picking up ICSH. The amount of HXS remaining in the […]

LikeLike

[…] I continue to maintain a heavy allocation to USD-denominated funds, and since most of my spending is in Canadian dollars, I have to systematically3 convert my USD holdings to CAD, typically using Norbert’s Gambit […]

LikeLike

[…] tracking all my Gambit transactions over here, so I can see how often I come out […]

LikeLike

[…] So last week, I had to convert some of my AOA holdings into XGRO holdings and so I updated the log I’m keeping. So far, I’ve done the Gambit three times this year, and twice I’ve lucked out on the […]

LikeLike

[…] every quarter, and last month was when I did it. The majority of my spending is in CAD, so I use Norbert’s Gambit to move funds […]

LikeLike

[…] My own calculations4 show that my household RRIF-minimum income will be up 19% YoY, a result of good returns in the RRIF (roughly 11% YoY by my calculation) and being a year older. Selling XGRO every month will cover the required payments, and quarterly I will shift a portion of AOA into XGRO, converting the USD to CAD using Norbert’s Gambit. […]

LikeLike

[…] blog. The #3 blog entry explains how it works if Questrade is your broker. I would also recommend https://moneyengineer.ca/2025/08/21/tracking-norberts-gambit-costs-with-questrade/ for a very clear picture of what it actually costs (in time and fees) to execute the Gambit: in […]

LikeLike

[…] And, I did my quarterly Norbert’s Gambit to shift some AOA to XGRO. And again, I came out ahead! […]

LikeLike

[…] also supports Norbert’s Gambit, and I’ve used it multiple times already to convert USD holdings into CAD […]

LikeLike