This is a monthly look at what’s in my retirement portfolio. The original post is here.

Portfolio Construction

The retirement portfolio is spread across a bunch of accounts:

- 6 RRIF accounts

- 3 for me (Questrade, QTrade, Wealthsimple)

- 3 for my spouse (Questrade, QTrade)

- 2 TFSA accounts (Questrade)

- 4 non-registered accounts, (1 for me, 1 for my spouse, 2 joint, all at Questrade)

The view post-payday

I pay myself monthly in retirement, so that’s a good trigger to update this post. On January 26, this is what it looks like:

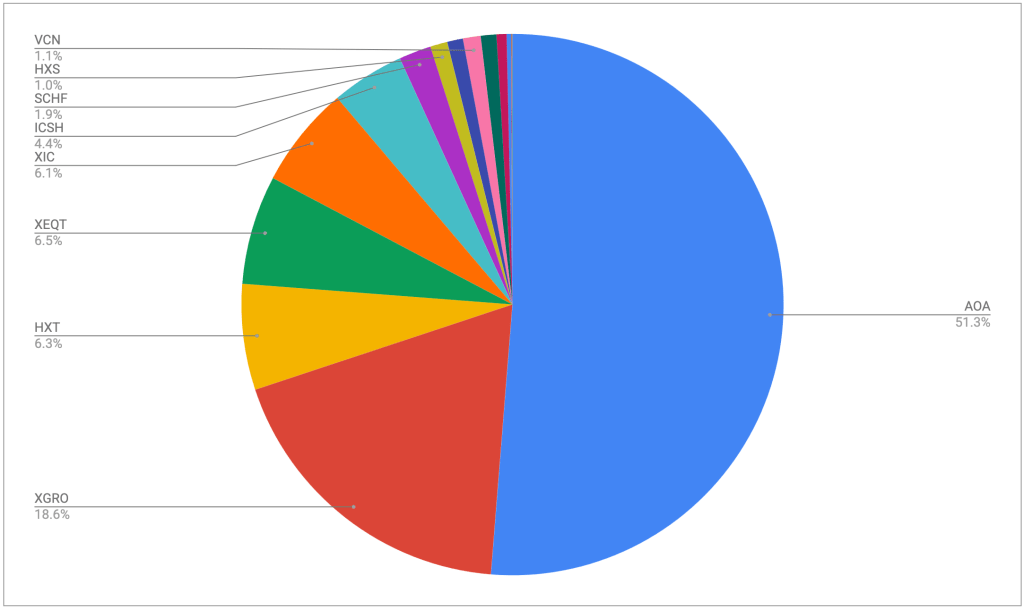

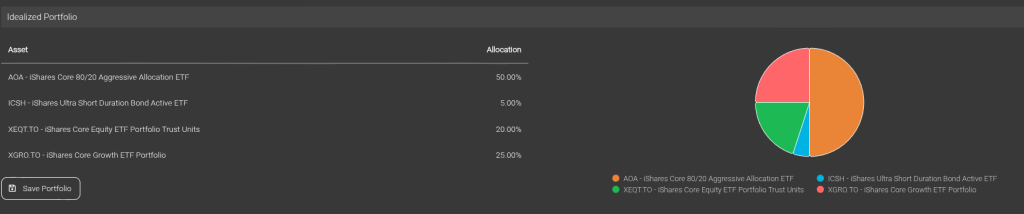

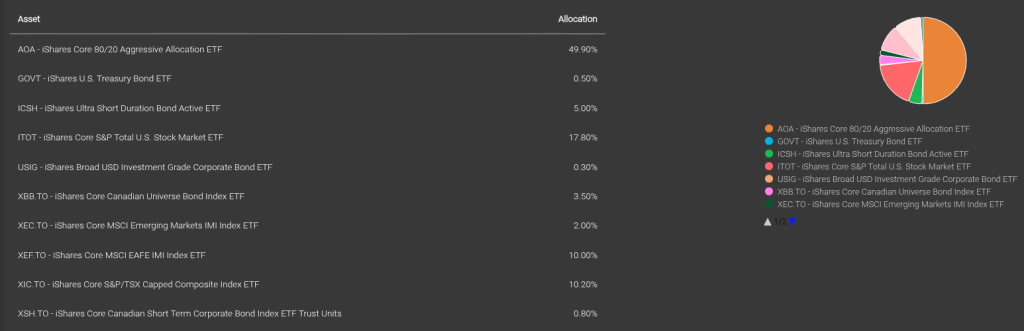

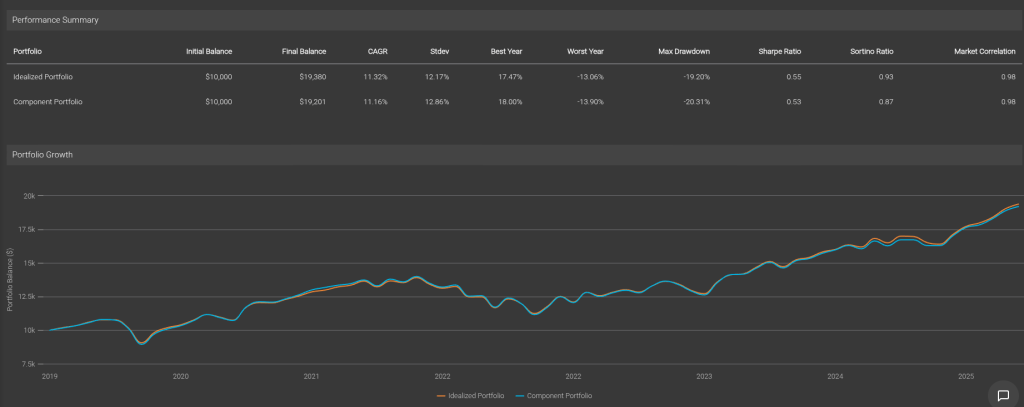

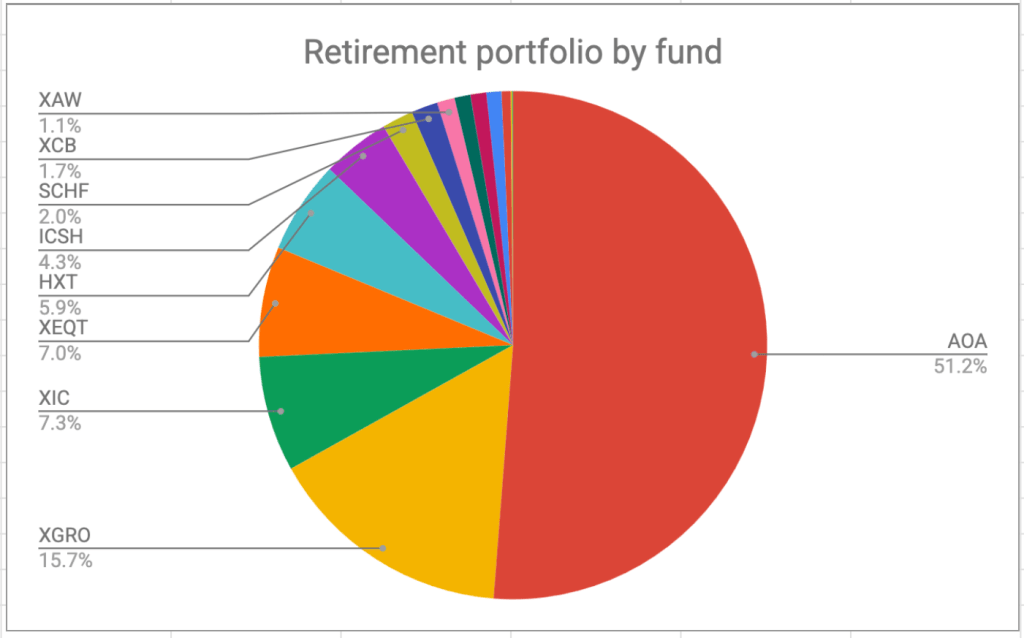

The portfolio is dominated by my ETF all-stars, but if you’ve been following along, you’ll see a few changes.

- As mentioned in a previous post, I did some shifting around and you now see XAW and XIC increasing their contribution to the portfolio at the expense of XGRO.

- I also tidied up some extra funds that aren’t needed — VCN was replaced with XIC1, and I turfed some small holdings.

- I sold more HXT than I needed to for my monthly paycheque, and when I discovered the mistake2, I just bought XIC instead.

- And, I did my quarterly Norbert’s Gambit to shift some AOA to XGRO. And again, I came out ahead!

Plan for the next month

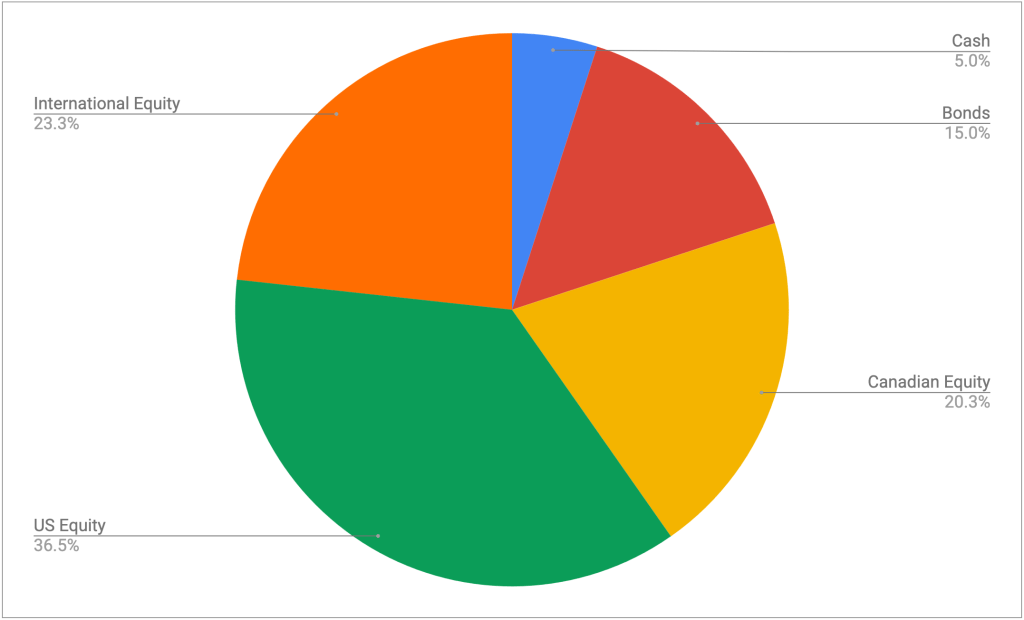

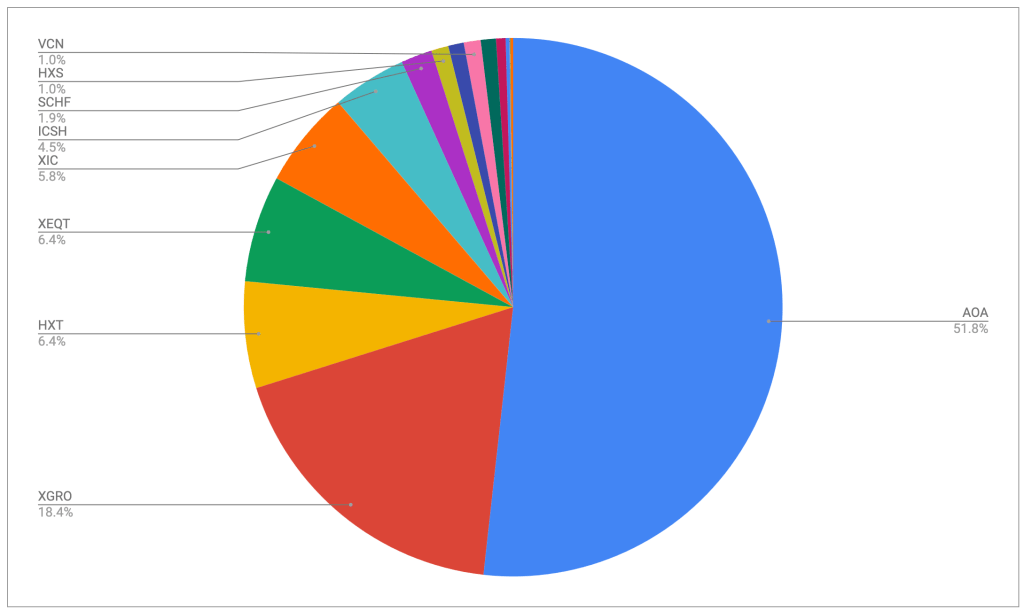

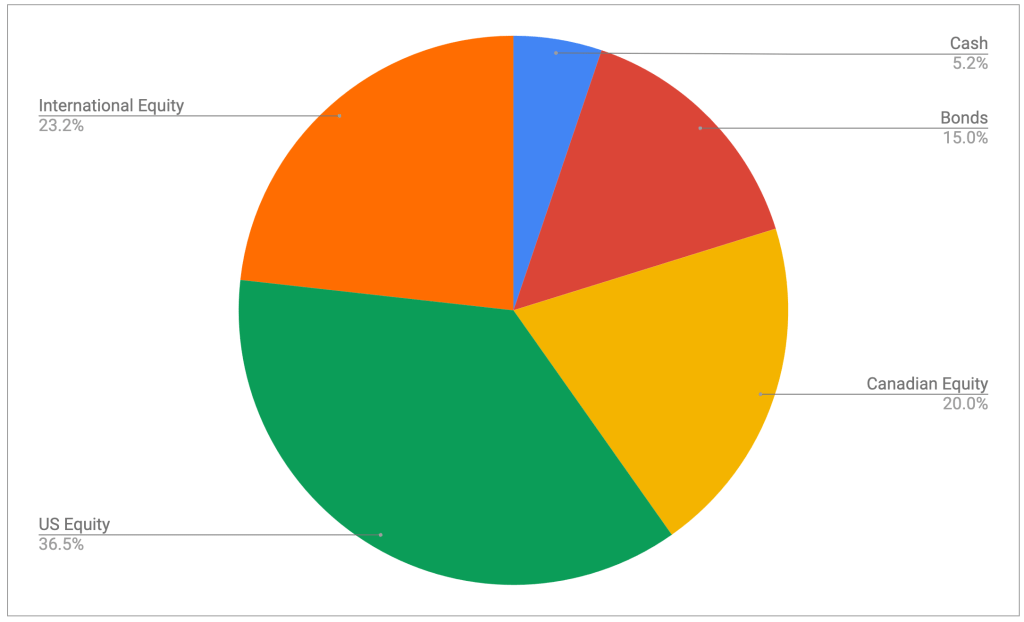

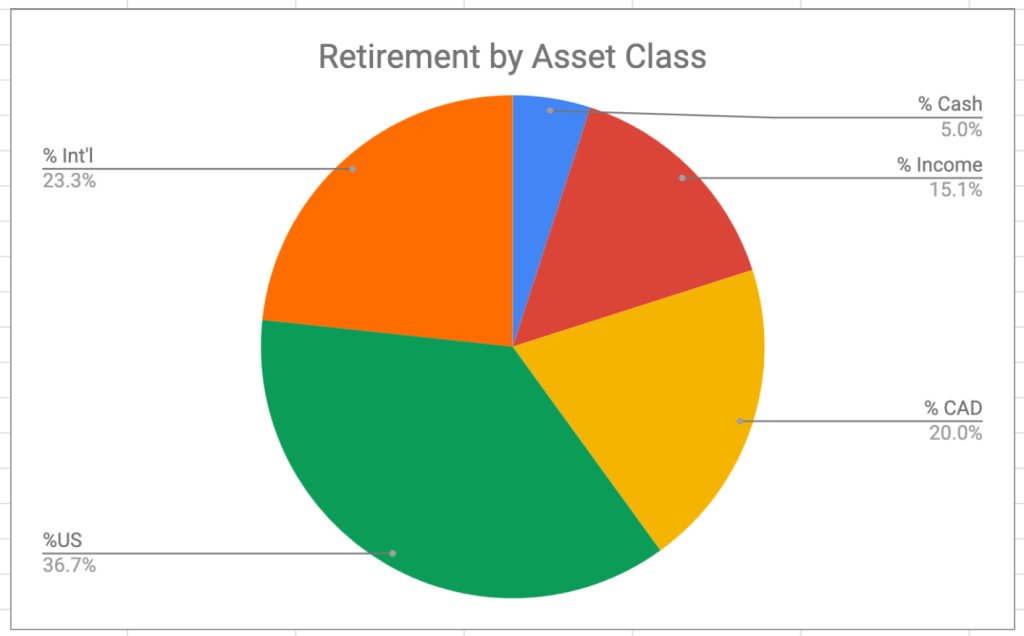

The asset-class split looks like this; you can read about my asset-allocation approach to investing over here.

It’s looking pretty close to the targets I have, which are unchanged:

- 5% cash or cash-like holdings like ICSH and ZMMK

- 15% bonds (most are buried in XGRO and AOA, some are in XCB)

- 20% Canadian equity (mostly based on ETFs that mirror the S&P/TSX)

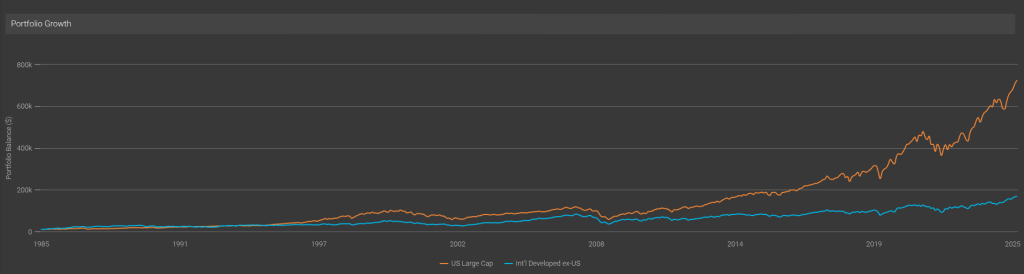

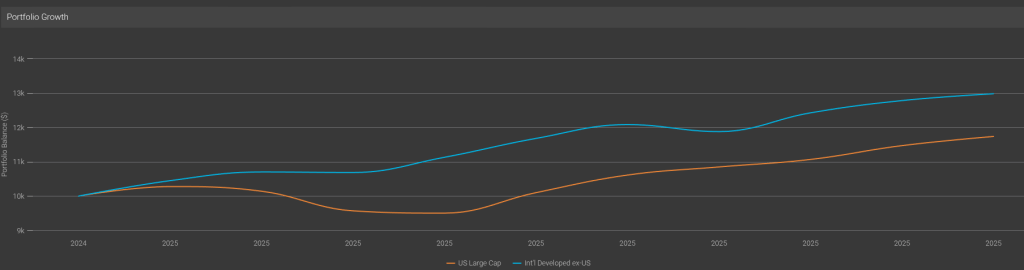

- 36% US equity (dominated by ETFs that mirror the S&P 500)

- 24% International equity (mostly, but not exclusively, developed markets)

Overall

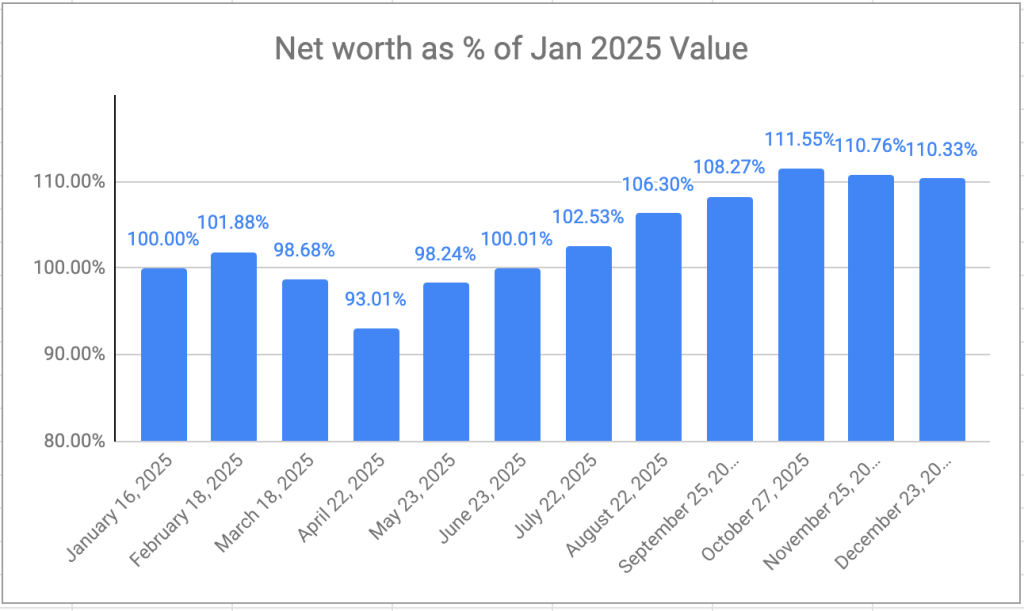

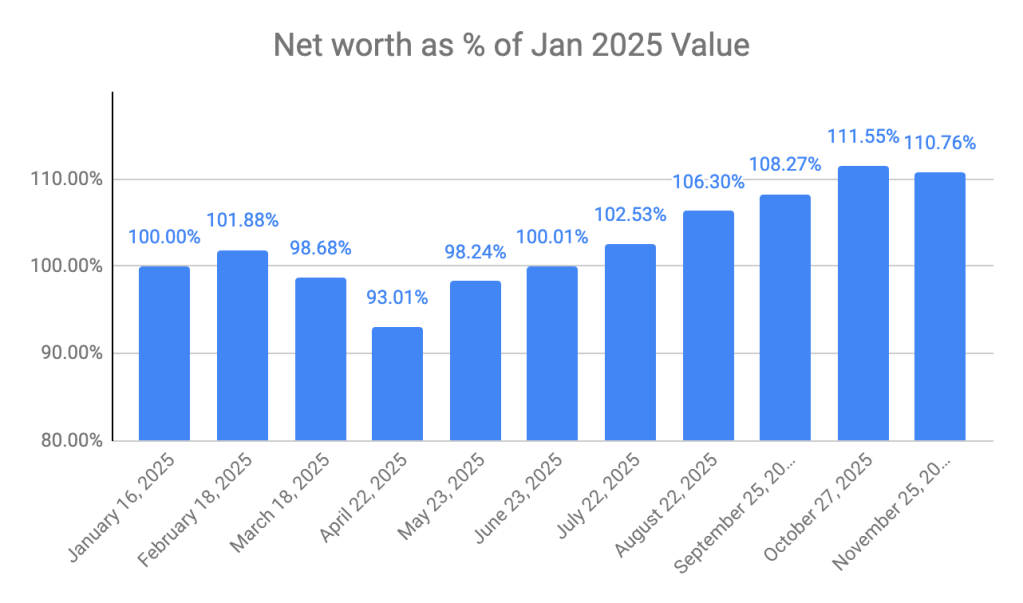

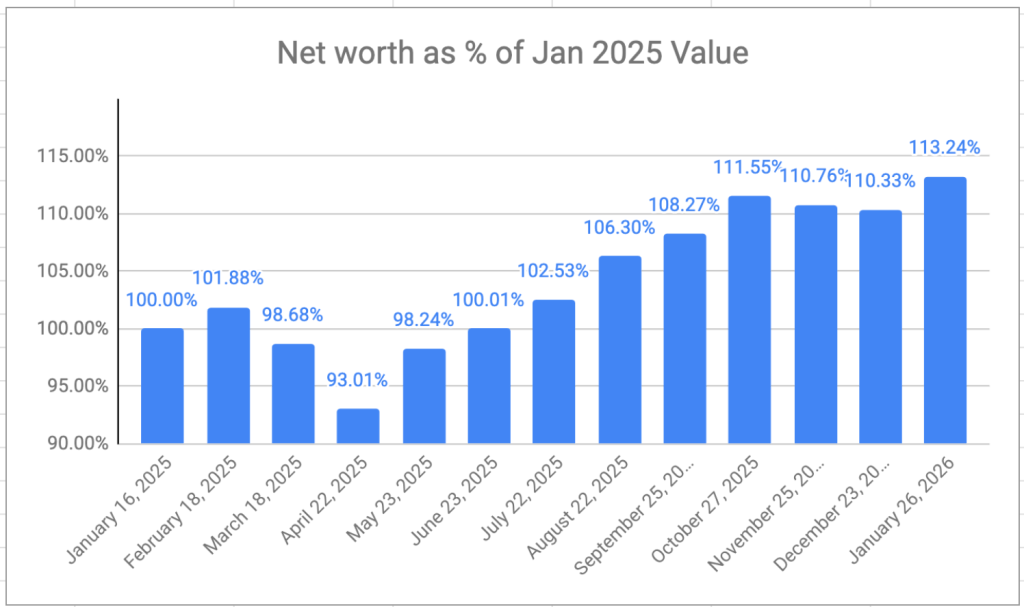

Net worth overall is up month over month, reversing a 2 month losing streak and hitting a new all-time-high:

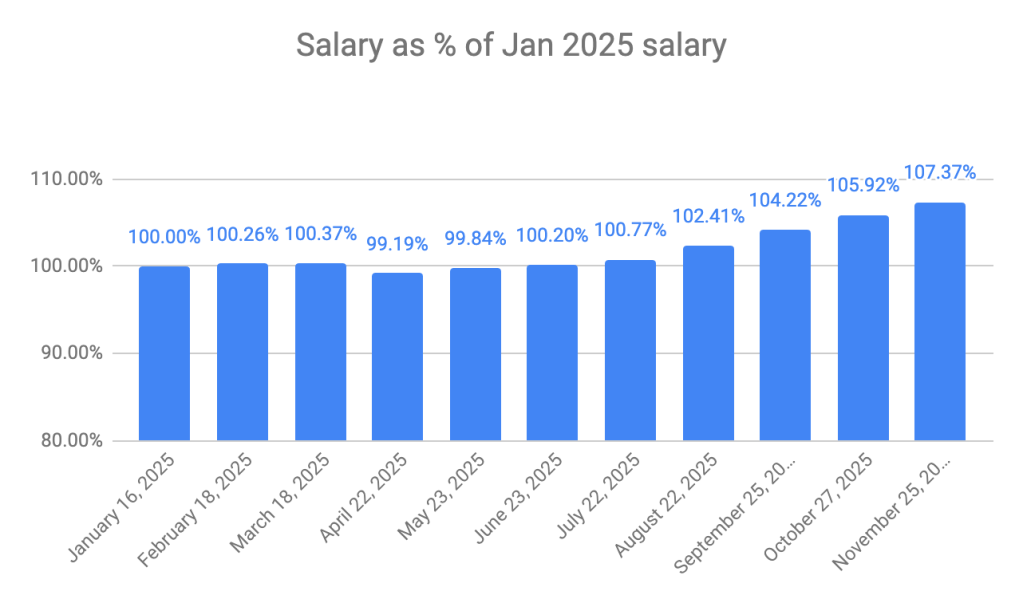

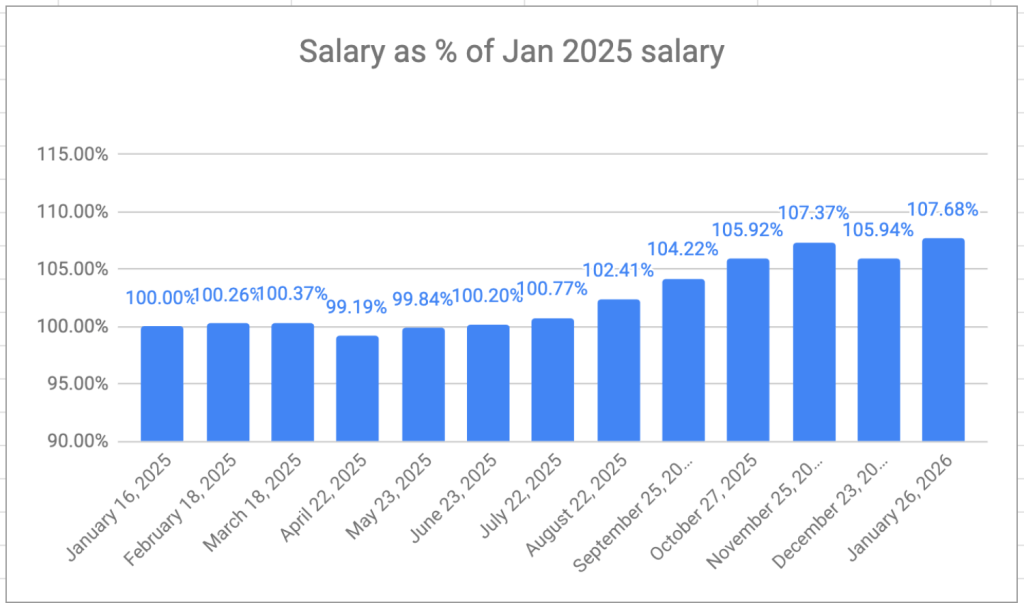

My VPW-calculated salary resumed its upward trend, also hitting an all-time high.

My QTrade RRIFs should move perhaps this week, but I’m no longer confident about that. More on that once resolved.

- Which, in my mind, are equivalent. This post goes in lots more detail. ↩︎

- I had to do some quick manual calculations because I had already updated my auto-calculating spreadsheet to reflect fewer RRIF accounts. My RRIF transfers are 2 months in progress and counting. I guess trying to move a RRIF near the end of the year was a bad idea. ↩︎