My approach to investing for the last 20 years or so has been almost exclusively1 DIY. The other popular approach to investing is to have a fee-based advisor who typically charges anywhere from 1% to 2% of your overall holdings. For that princely sum, you probably get an in-person meeting or two annually, all the trades deemed necessary, and some nicely formatted full-colour report once a year. Value for money for a fee-based advisor is too low for me to consider it. Nobody will ever care as much about my own investments as I do.

I am trying to be realistic about the future, however. My current retirement payment scheme is rather labour-intensive, for instance:

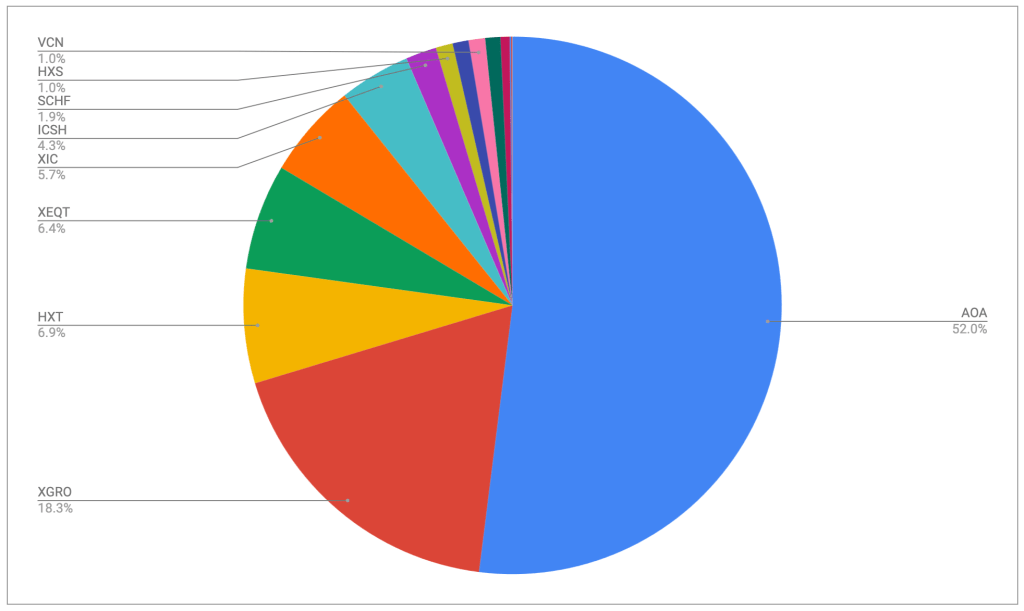

- I have to manually sell RRIF funds every month to make my RRIF-minimum payments. This normally means selling XGRO which makes up the bulk of my RRIF accounts.

- I have to manually move money around between brokerage accounts to tweak VPW’s cash cushion; excess funds here get invested in ZMMK or ICSH so they generate a return

- Since RRIF-minimum payments are not currently sufficient to fund my lifestyle, I augment this with sales of non-registered funds…and I have to pick which fund to sell considering capital gains impact as well as asset-allocation2

- …and I have to manually move the cash resulting from the sale to my bank account

- I continue to maintain a heavy allocation to USD-denominated funds, and since most of my spending is in Canadian dollars, I have to systematically3 convert my USD holdings to CAD, typically using Norbert’s Gambit

- And I continue to contribute to a TFSA monthly, so appropriate4 purchases have to made there, too

So I will start looking at alternative (and more costly) arrangements. Right now, I’m thinking robo-advisors5. Off the top of my head, there are three I want to take a look at:

- Nest Wealth: They are immediately interesting to me because of their flat fee structure. Most other advisors charge you a percentage based on the size of your portfolio, which strikes me as unfair. Is a 50k portfolio really ten times easier to manage than a 500k portfolio? If you looked at the fees most providers charge, you’d believe it to be the case.

- Wealthsimple: I do self-directed business with Wealthsimple today, and have actually talked to one of their advisors about this service. I need to understand their service better.

- Questrade: I do self-directed business with Questrade today. I’ve not investigated their robo-advisor service much.

Is there a robo that you use that I should know about? Let me know at comments@moneyengineer.ca!

- Before I retired this year, I did pay for an advice-only advisor to make sure my retirement savings would support my retirement needs. I do recommend doing that, as it’s helpful to have somebody else look at your numbers if only for peace of mind. Beyond that, I don’t pay any management fees except what’s embedded in the ETFs I use, most of which are on my ETF All-Stars list. ↩︎

- Meaning, for example: should I sell HXT (a fund fully invested in Canadian equities) or HXS (a fund fully invested in US equities)? Should I sell from MY non-registered account or that of my spouse? ↩︎

- Currently quarterly, at a rate consistent with the percentages dictated by RRIF minimum. For example, at age 57, RRIF minimum is 3.03% of RRIF value. So in January, I look at how many USD I have in my RRIF, multiply that by 3.03%, and divide by 4. That determines how much USD I have to convert every quarter. . ↩︎

- Relying on my multi-asset tracker spreadsheet ↩︎

- This term seems to be falling out of fashion in favour of “managed” portfolios. As long as the fees are low, they will be robo-advisors to me… ↩︎