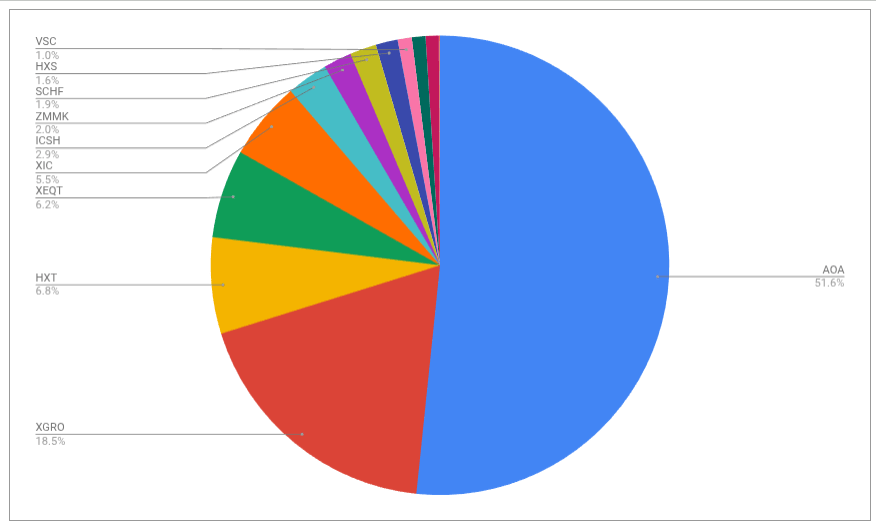

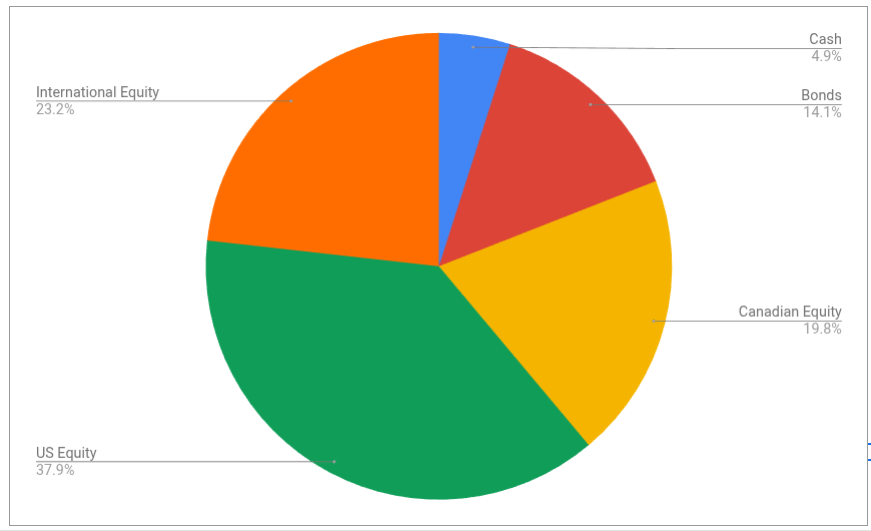

I have a dedicated non-registered account in my retirement portfolio that is the cash cushion for VPW’s decumulation strategy. You can read about the details of how I currently get paid in retirement here.

That non-registered account holds about 85% Canadian dollars, invested in ZMMK, with the remaining 15% invested in ICSH. Both of these ETFs are very short-term bond funds and give me a slight advantage over investing in zero-risk HISAs. ZMMK and ICSH are part of my ETF all-stars lineup, and I track HISA rates on a monthly basis.

The fact is that US interest rates are a lot higher than Canadian interest rates, almost 2% higher as of July 2025. It seems to me that I should take advantage of that fact. Taking advantage of this situation would mean selling some ZMMK, performing Norbert’s Gambit with the resultant cash, and then buying ICSH. There are costs involved at every step of the way1:

- Selling ZMMK means I’ll get dinged with the bid/ask spread2

- Performing Norbert’s Gambit costs $9.95 plus HST on Questrade to do the necessary journaling

- There will be bid/ask spreads to pull off the Gambit…once when buying DLR, once when selling DLR.U

- Buying ICSH means another bid/ask spread

So at what point is it worth it? Let’s do a bit of math using the following assumptions:

- The delta between US and Canadian rates is 1.8% in favor of the US rate. That’s an annual rate, and I’ll just divide by 12 to get a monthly rate3.

- The bid/ask spread for DLR per the ETF fact sheet is 0.1% on the CAD side and 0.07% on the USD side

- The bid/ask spread for ZMMK is 0.02% per its fact sheet

- …and the bid/ask spread for ICSH is 0.02% as well per its fact sheet

- No change in the FX rate for the duration of this exercise4

- No fees to trade DLR, DLR.U, ZMMK or ICSH5

So for various amounts, the time to profitability6 of doing the Gambit looks like this.

| $ CAD changed | Journaling Fee7 | DLR Spread Fee8 | ZMMK/ICSH spread | Total cost | TTP9 |

|---|---|---|---|---|---|

| $1k | $12 | $1.70 | $0.40 | $14.10 | ~10 months |

| $10k | $12 | $17.10 | $4 | $33.10 | ~10 weeks |

| $100k | $12 | $170 | $40 | $222 | ~6 weeks |

So clearly, for amounts around $1k this isn’t such an attractive proposition as the costs will take a fair bit of time to be negated by the bump in interest rates. For larger amounts, I’d say it’s worth it. Given ZMMK hasn’t yet paid out its dividend for the month, I guess I’ll wait until I’m ex-dividend (July 30, 2025, per the fact sheet) before doing this transaction.

- I’m also ignoring the tax on any capital gains I might pull off. It will be quite small, and will be close to 0. ↩︎

- Bid/ask spread is the difference between what the price holders are willing to sell at versus the price offered by a buyer. For ZMMK this is typically 1 cent. ↩︎

- Whether this delta continues to hold is anybody’s guess. ↩︎

- Which, admittedly, has no hope of being correct. If you do this sort of thing frequently enough, it ought to even out over time. ↩︎

- This is true at Questrade. YMMV with your broker. ↩︎

- Henceforth “TTP”, naturally ↩︎

- Adding HST and rounding ↩︎

- Buying DLR is 0.1% and selling it is 0.07% ↩︎

- Investing all holdings at 1.8% annual rate of return ↩︎