Summary: If you’re changing online providers with an active RRIF, the old provider is (apparently) obligated to pay out the ENTIRE RRIF amount for the current year before releasing your funds.

As you may have read previously, I’m (still) in the middle of changing online brokers from QTrade to Questrade1. Things are moving along…glacially2. I’m at step 6 of the guide.

Background

If you’re not that familiar with RRIFs, you may want to give Demystifying RRIFs a read.

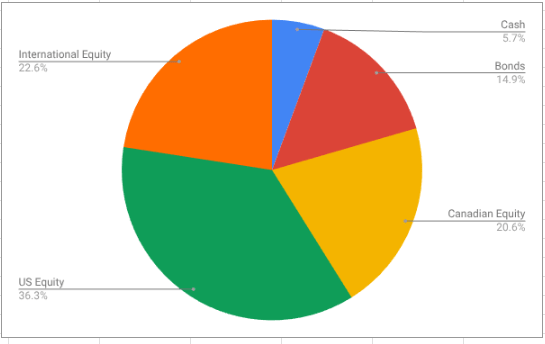

At QTrade, I had 3 separate RRIF accounts:

- One individual RRIF in CAD

- One individual RRIF in USD

- One spousal RRIF in CAD

QTrade makes you have different accounts for CAD and USD, whereas Questrade does not (hooray)3.

The individual and spousal RRIFs are set up to pay out RRIF minimum on a monthly basis, on the last day of the month. I expect this is a little unusual, since a lot of people seem to take their payments annually. In a weird QTrade wrinkle, one can only make payments from a CAD RRIF account, even though the USD RRIF account is used to calculate RRIF minimums4.

The RRIF transfer-out requests were initiated the instant the RRIF account was approved by Questrade, in the opening days of March (March 2 or March 3), a day or two after my February RRIF payment was processed by QTrade. Plenty of time, I figured.

Trouble Afoot?

About 2 weeks ago now, I got a cryptic email indicating that my RRIF transfer out request had been rejected by QTrade due to having “insufficient funds for RRIF payout”. Looking at my QTrade account, it looked to me like the US RRIF was moving (QTrade had already kindly charged me the $150 transfer-out fee), but the CAD RRIFs showed no signs of a transfer being initiated.

Thinking a little about it, I realized that perhaps QTrade wouldn’t release the RRIF assets to Questrade unless they could be sure Questrade could make the monthly RRIF minimum payment, which strikes me as silly, but I expect there’s some regulation that makes this mandatory. And so I immediately sold a few shares of XGRO in each of the RRIF accounts to ensure enough cash existed to cover the RRIF minimum payments and re-initiated the transfer out request.

But again, rejection. What?

But that, apparently, was not fully correct.

Current State of Play, and Some Advice

Today, I was informed by QTrade that no, they are obligated to pay out the ENTIRE RRIF payment for the year before they hand off the account to Questrade. Given the state of the market, I’m not exactly jumping up and down at the thought of having to sell 9 months worth of RRIF payments all at once. (This was, after all, EXACTLY why I set up the RRIFs to pay out monthly.)

So, I’ve decided to leave the QTrade RRIFs alone for the time being. This is far from ideal (multiple providers breaks all my rules about retirement investments being simple), but I take solace in the fact that

- I will fix this at the end of the year, once most of my RRIF has been paid out

- Maybe there will be another promotion before then 🙂

All this to say that make sure you have sufficient funds to cover any anticipated RRIF payouts BEFORE initiating a transfer-out request!