As you may have read, last month, I began the journey of switching credit cards to take advantage of better benefits with lower fees. A side effect of this was switching my tv/phone/internet provider to Rogers. This turned out to be more effort than I expected, but not for the reasons you might think.

I had decided to get the Rogers Red Elite Mastercard which offers 2% cashback on all purchases if you have any Rogers services, and effectively 3% if you purchase Rogers services with the card. This was just fine with me, as my Bell Fibe services had been creeping upward in price for months — it was time to churn providers, too.

Applying for the Rogers card was the easy part. It arrived quickly and setting it up was relatively pain-free. One unexpected downside was that its credit limit was a lot lower than my former primary credit card; about once a year, normally around vacation time, that actually becomes important. (I always, always, always pay credit balances in full). So, instead of getting one new card, I got two:

- Rogers Red for most things (but with a lower credit limit)

- And a CIBC Costco Mastercard1 to replace my fee-based CIBC Dividend card. “Replacement” in this case is quite literal; I called CIBC and explained I wanted to switch credit card products, and confirmed that this was possible — credit limit and all.

So the cheapskate plan needed two more things to complete:

- The installation of my Rogers service

- The delivery of my CIBC Costco Mastercard (actually two — one for me, one for my spouse)

Little did I know that this would turn into two separate sagas…

The Rogers Saga

TL/DR: Two installation technicians, many hours on the phone with support, a formal complaint to the CCTS, and I now have fully functioning internet, television and home phone service. I would not wish their home phone service on my worst enemy. Oh, but I am getting 2% back on all my purchases now!

October 19: Technician arrives. Modem installed with no issue. TV “settop” installed, no issue. Dial tone on my home phone. Calls in/out seem to work (tested with cell phone). I sent the installer on his way after about 45 minutes.

October 20: I attempt to set up my home phone voicemail. *98 to get access. “Welcome to Rogers Wireless Voicemail”. uh oh. Mailbox not recognized, can’t leave a voicemail to my home phone. Off to support. Ticket of some kind raised.

October 21: Weird. My “Myrogers” profile shows i have no services installed, and my installation appointment (that took place 2 days ago) shows pending. I report this to support as well. They don’t seem to fussed about that, convinced it will show up in a day or two.

October 27th: still no change. I’m a bit annoyed. A highly articulate Rogers staffer calls me on Saturday morning, wondering why I’ve called support so many times. I walk her through the experience. She comes to the conclusion that the easiest solution is to send a 2nd installer to my house to try again.

October 27th: installer number 2. Installs new modem2. Can’t seem to get the phone to work properly. He’s talking with his own support. He also sees that the internet performance of the new modem is craptacular, more dial-up speed than high-speed. This will require a “push” from the “back office” to correct. I warn my installer friend that the Jays will be on in an hour or two, and I would like to watch the game. He splits the coax and leaves both old modem and new modem connected. I continue to watch tv off the old modem, so peace is saved.

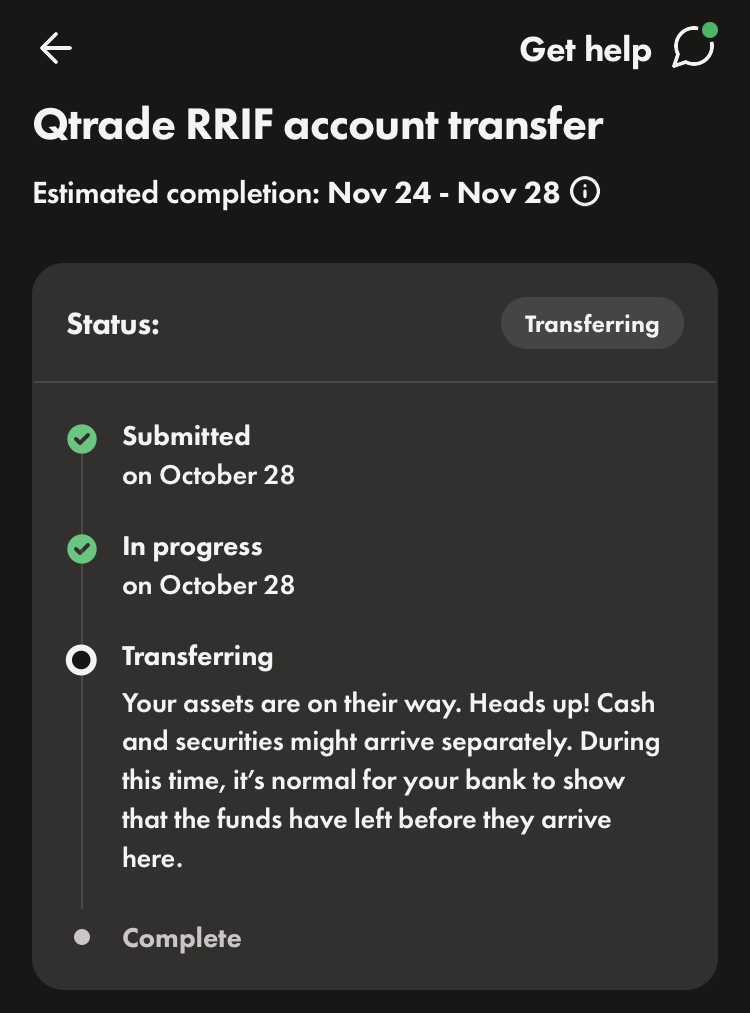

October 28th: the promised push from the back office materializes and the new modem now performs like a high speed modem should. I move my home network to it. Still no working voicemail on my home phone, but now my MyRogers profile shows tv and internet services, so progress.

October 29th: This was my breaking point. After talking to someone senior, they decided that I’ve been talking to the wrong Rogers team and need to call the number portng team or something like that. 90 minutes of hold music, and I was done dealing with anyone from Rogers. I submitted a formal complaint to the CCTS3. https://www.ccts-cprst.ca/about-ccts/.

November 4th: I talk live with a person from “The Office of the President” (sounds important) who commits to resolving my issue. Some junior tech calls the next day to report that they need “a day or two” to resolve. What?

November 6th: I talk to an articulate tech person who I feel fully understands the issue (one could have expected him to read the case notes, but whatever). He suspects (as I do) that because I *used* to be a Rogers home phone customer (over 2 years ago), this caused problems when I tried to port my number *back* to Rogers (from Bell).

November 10th: I notice i have a phone profile in “MyRogers”. Voicemail now works. Wow. I say nothing, wondering how long the crack team at Rogers will take to figure out that they have fixed my problem.

November 14th: The articulate tech person from last week contacts me and asks to ensure my phone service is working. I assure them it is. An hour later the Office of the President emails me to tell me that they now consider the matter closed. i still haven’t been billed, but my profile shows a $90 credit. For what, I have no idea. Pain and suffering?

So net: everything works, I am getting 2% back, and I haven’t received a bill yet. Stay tuned…

The CIBC saga or does any Canadian company have decent customer service?

So as I mentioned, I called CIBC to confirm that I could switch credit cards. I should have done it on call one, but I wanted to make sure that it wasn’t going to have unintended consequences on preauthorized charges. The day I decided to make the change was a day I was routed to a call center that sounded somewhat like an airport gate area. Unbelievably noisy and hard to hear what the agent was telling me4.

After 25+ minutes on the phone, most of it repeating and re-repeating my Costco membership numbers, it seemed I was good to go. A few minutes after hanging up, I got an email from CIBC letting me know that I could choose to get delivery of my new cards5 to a branch instead of my home. Given the ongoing Canada Post work actions, I figured a branch might be a better bet.

A week or so later, I got an email from CIBC congratulating me on the use of my new card. Which would be impossible since I didn’t get it yet. Paranoia sets in, and so I hop on the line with CIBC to make sure someone hadn’t intercepted my card somehow. After being disconnected after explaining my predicament the first time, I tried again. (The first agent was just as confused as I was…he seemed to know the number of my new card, even if I didn’t). The second agent assured me nothing untoward was going on, just an automated email. Fine. (Well, not fine, so if anyone at CIBC is reading this, you might want to look into how those emails get generated).

A day or so later, my wife received her card via Canada Post. Naturally.

I waited a few more days, no contact from my branch. I was in the neighbourhood so I stopped in and asked. The teller seemed to think it wasn’t really possible for a letter addressed to me to go unreported to me, but in the interest in humouring me, she look a look in the drawer (!) behind the counter. And to her surprise, there was indeed an envelope waiting for me. She laughed it off and handed it to me without comment, apology or anything else to say other than “my old PIN will work fine”.

I ended up in the branch again a few days later on an unrelated matter (depositing a cheque addressed to my. late mother’s estate…only possible via a human-to-human interaction), when the teller there thought she thought I had mail at the branch. Turns out it was a PIN code letter. Which again, no one had told me about, and one that I had been told wouldn’t be coming my way.

Anyway, I changed the PIN at the branch and went on my way.

Everything else worked as expected. In a strange twist, since this was a card change, my Apple wallet updated itself automatically to start using the new card as soon as I enabled it.

- I’m already a Costco member, so no big deal. The cashback isn’t as good as the Rogers card, with the exception of restaurants and Costco gas, both of which give 3% cashback (with a cap). ↩︎

- Actually, I think he tried two or three different ones. ↩︎

- Possibly my new favourite organization. Thanks! ↩︎

- I personally think every CEO should call their own call centres at least monthly. Most of them are terrible. ↩︎

- 2 cards, 2 emails. Weird. But ok. ↩︎