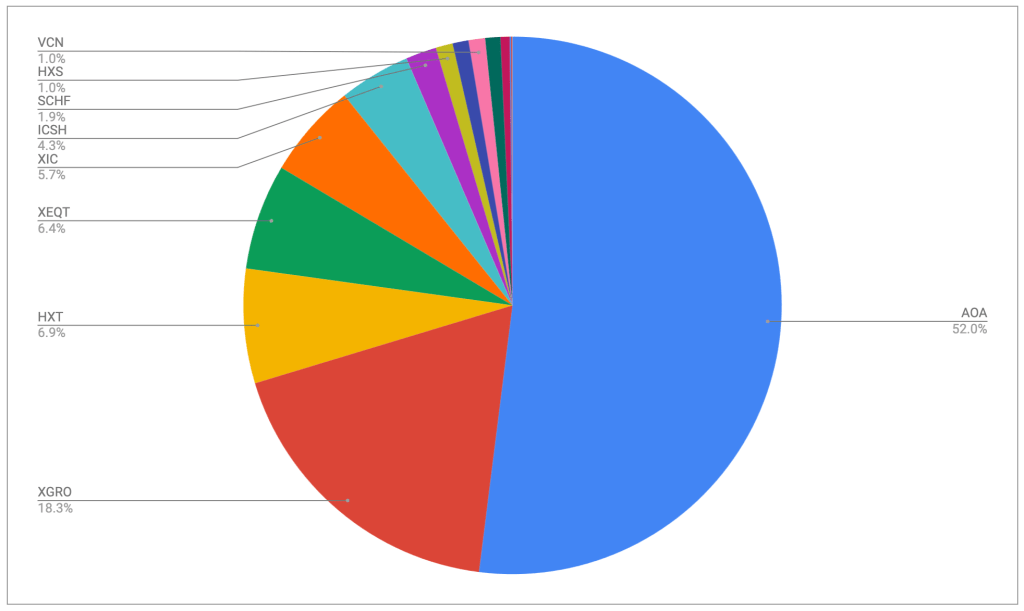

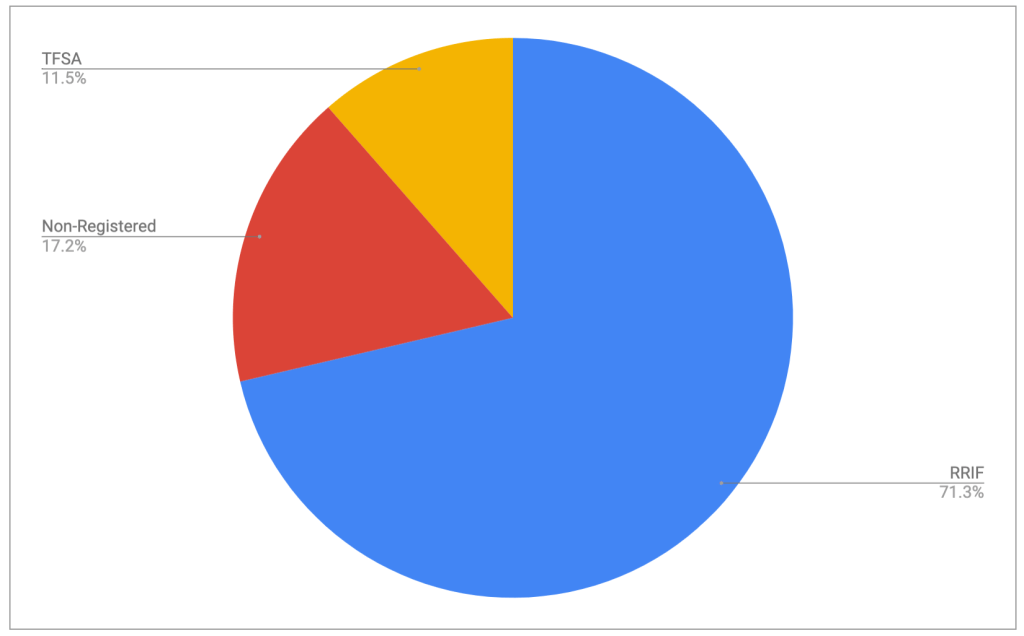

Every month, I try to share with you what’s in my overall retirement portfolio (September 2025 post is here). That retirement portfolio is actually distributed over a bunch of accounts held by me and my spouse and includes RRIFs, TFSAs and non-registered accounts. This is what it looks like at the moment:

(My multi-asset tracker is a handy tool to help you quickly create charts that look like the above one).

My current strategy for these three account types looks like this:

- RRIF: This is 100% invested in my ETF all-stars. I’m currently withdrawing RRIF minimum payments for two main reasons:

- TFSA: This is mostly invested in the ETF all-stars, but there’s a few stragglers in here1 that I really ought to get rid of. Nothing wrong with the funds in there, but it’s a needless complexity. The TFSA continues to get new funds since it’s hard to beat tax-free growth, and I only buy all-stars with those funds. It will get drawn down last in my retirement planning.

- Non-registered accounts: Here it’s a bit of a dog’s breakfast, with very little invested in the all-stars, mostly because most of the equity found here was bought long ago, and changing what I hold would attract capital gains that I would prefer to take on my own terms. It’s where the majority of my early-retirement decumulation takes place.

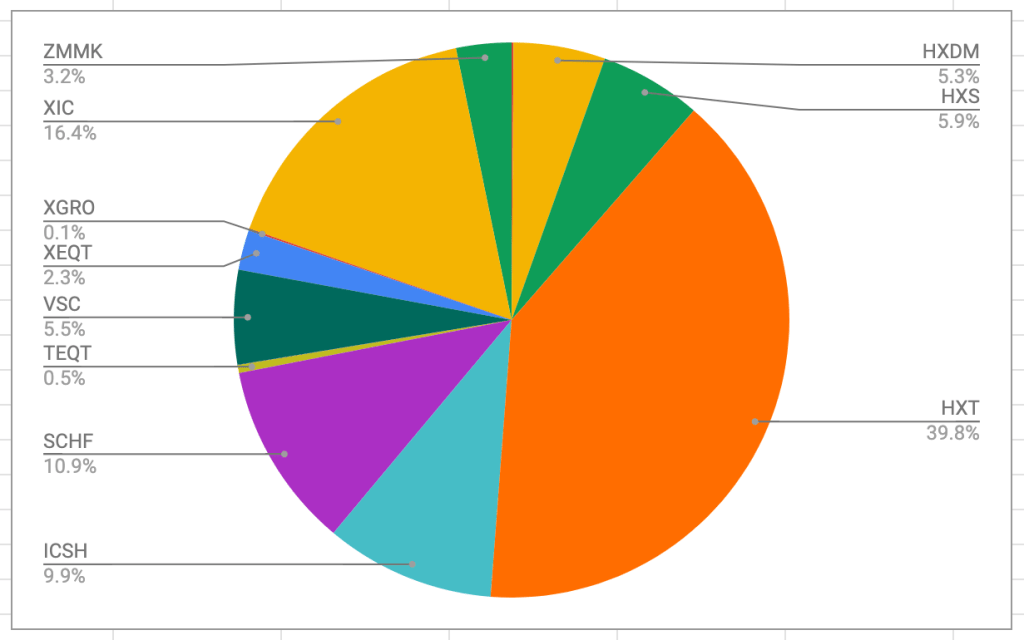

Here’s what that breakfast looks like:

Here’s a look at each holding, from highest to lowest percentage.

HXT: This is a Canadian equity ETF that does not pay dividends, instead using some wizardry to bury it all in the per-unit price of the ETF. This simplifies taxes, and I have held this fund for a long time. Due to increasing costs of this ETF, it’s among the first to get liquidated as I need funds.

XIC: Canadian equity fund, very popular. I think I bought it to create a bit of dividend income. It will get liquidated after the Horizons funds go (HXS, HXT, HXDM).

SCHF: A very low-cost international equity2 fund in USD that I’ve held for a very long time. It’s funds like SCHF that attracted me to investing in USD, which, at present, adds a lot of complexity.

ICSH: This is one of the all-stars. It is what my VPW cash cushion is invested in3. I use ICSH more than ZMMK in the cash cushion because US interest rates are quite a bit higher than Canadian rates at the moment. I talked about that here.

HXS: Same idea as HXT, except it invests in the S&P 500. This one is held only by my spouse who is still working for a living, so this will just stick around a while, until she stops working and can take on the capital gains.

VSC: A bond fund held by my spouse. I may sell this to harvest some capital gains losses.

HXDM: Same idea as HXT, except international equity. It is on the list to liquidate.

ZMMK: An all-star, held in the same account as ICSH.

The rest (XEQT, TEQT, XGRO) are all new arrivals in the portfolio, purchased using dividends4 from the other funds as well as the bonus payments I keep collecting from Questrade for switching to them.

My non-registered accounts are only a small portion of my retirement holdings, but there’s a fair bit of complexity there. Over time, these accounts will go to zero other than the cash cushion portion (ZMMK, ICSH or whatever replacements I discover) which will remain as long as VPW is my decumulation strategy.

- Mostly pure Canadian equity funds. This is to offset AOA that has next-to-no Canadian equity component. ↩︎

- 0.03% MER. Cheap! ↩︎

- VPW = Variable Percentage Withdrawal, an absolutely brilliant strategy for making sure you don’t run out of money in retirement and don’t leave a lot on the table. Read all about it here. ↩︎

- With all ETF trades being free, I hold very little actual cash in any of my accounts. ↩︎