DIY investing also means DIY decumulation. In 2026, I’ll be paying myself from my various RRIFs as well as from non-registered funds. I’ll refer to the letters in the diagram below so you can follow along1:

A: Calculate Net Worth over all retirement accounts

“Retirement accounts” include 3 non registered accounts, 2 TFSAs and 5 RRIF accounts. All of these are at Questrade except for one RRIF account held at Wealthsimple. My net worth calculation ignores my day-to-day spending accounts, and any other assets (my house, for example). In 2026 I could look up this number using Passiv, but I’m not 100% clear on what the fate of my Passiv account will be once Questrade cuts ties with them (March 2026). I still have a spreadsheet with lots of details and pretty graphs based on my multi-asset tracker.

B: Use VPW Methodology to Calculate Monthly “Suggestion”

VPW stands for “Variable Percentage Withdrawal” and it’s the playbook I use to guide my monthly withdrawals from my retirement accounts. I talk a bit about it here. The suggestion is generated by a VPW spreadsheet, but the inputs are pretty simple:

- current net worth

- current age

- current pension amounts2

- future pension amounts, and age you’ll be when you take them3

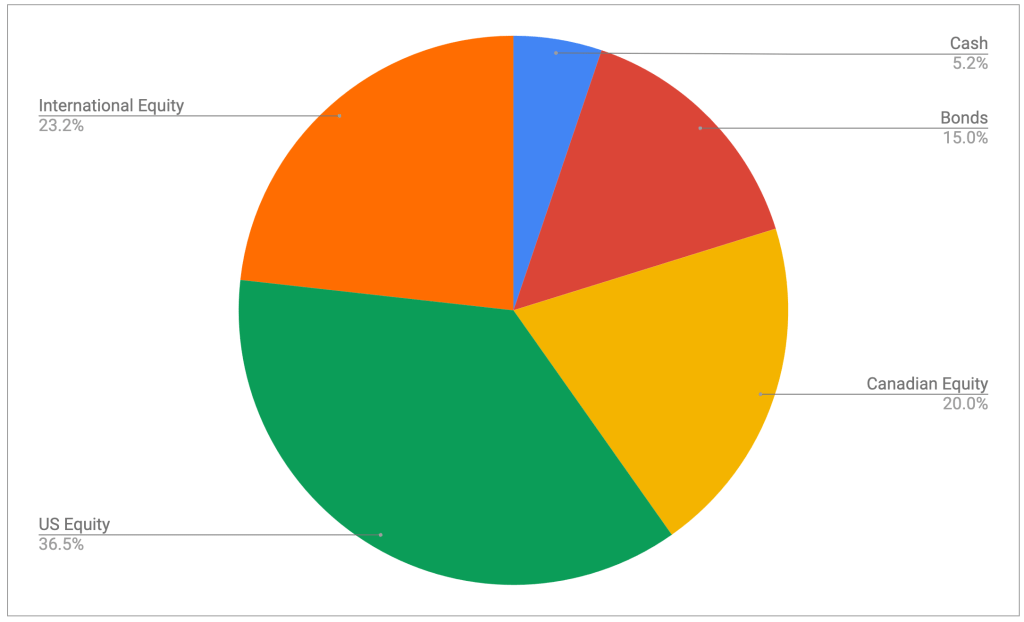

- asset allocation breakdown (%stocks versus %bonds)

This “suggestion” represents the maximum value of the assets I am advised to sell this month. You could take more or you could take less. It’s merely a suggestion. For me, I take the suggestion at face value and sell the assets needed to meet the value of the “suggestion”.

C: Calculate the Salary

The “Suggestion” in step B is NOT your salary. The VPW methodology enforces one more step to calculate that. The VPW methodology requires the use of a “cash cushion”, which has the effect of making sure you don’t need to make drastic month-to-month changes in your salary, either upward or downward. The cash cushion is roughly 5x the “suggestion”4 and your salary is 1/6th of “suggestion” plus “cash cushion”. The “salary” represents the amount that will eventually turn up in your chequing account.

To make things easier to track, my “cash cushion” is a totally separate non-registered joint account that holds one of four things: Canadian dollars, US dollars, ZMMK or ICSH. I keep a little cash floating around in this account to avoid having to do monthly trades. It just makes tax reporting and ACB tracking a bit simpler, at a small loss of interest income. Also, Questrade doesn’t support fractional shares of either ZMMK or ICSH, and since they routinely trade at roughly $50/share, mathematically, I’ll always have $25 CAD and $25 USD on average 🙂

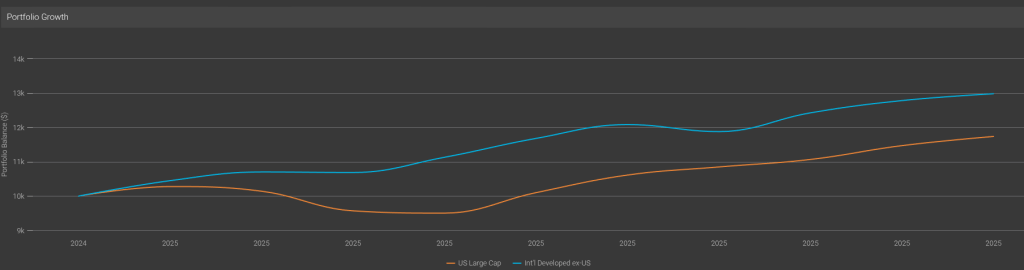

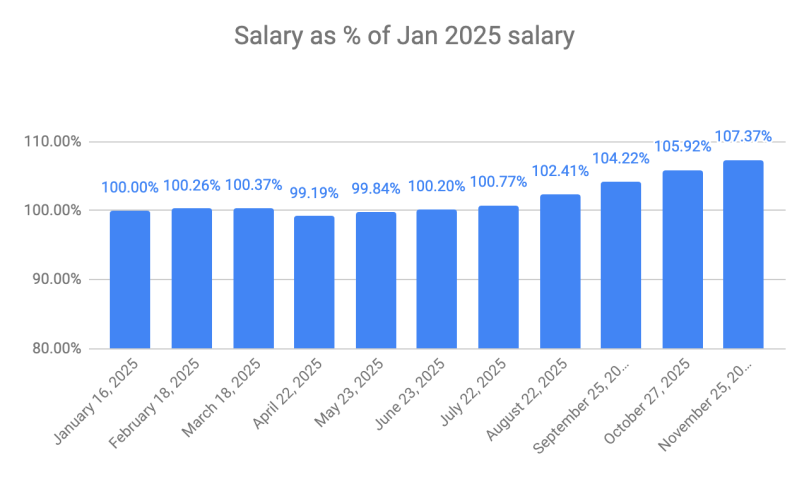

D/D’: Compare the Suggestion to the Salary and act accordingly

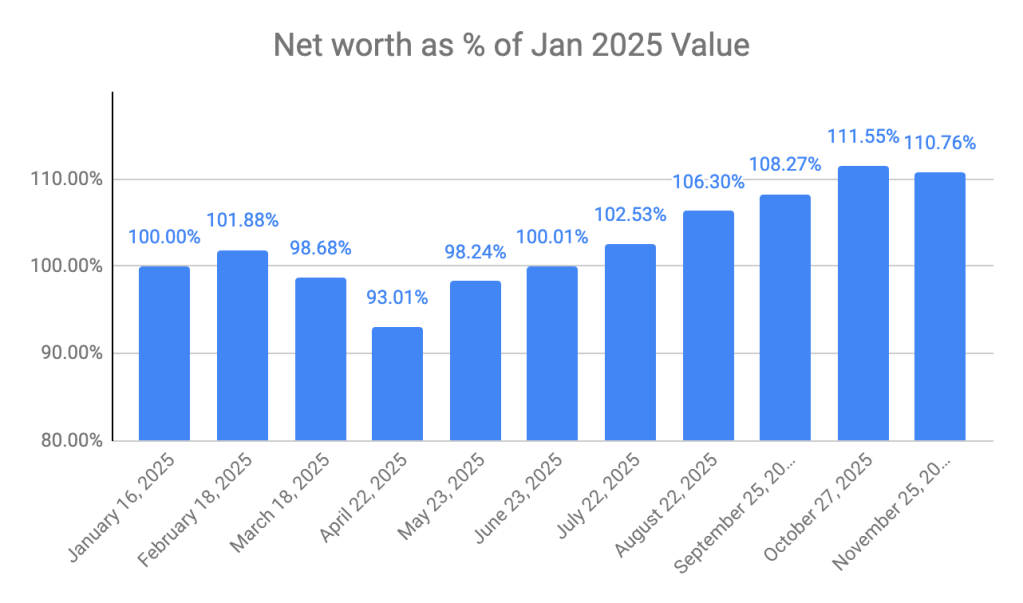

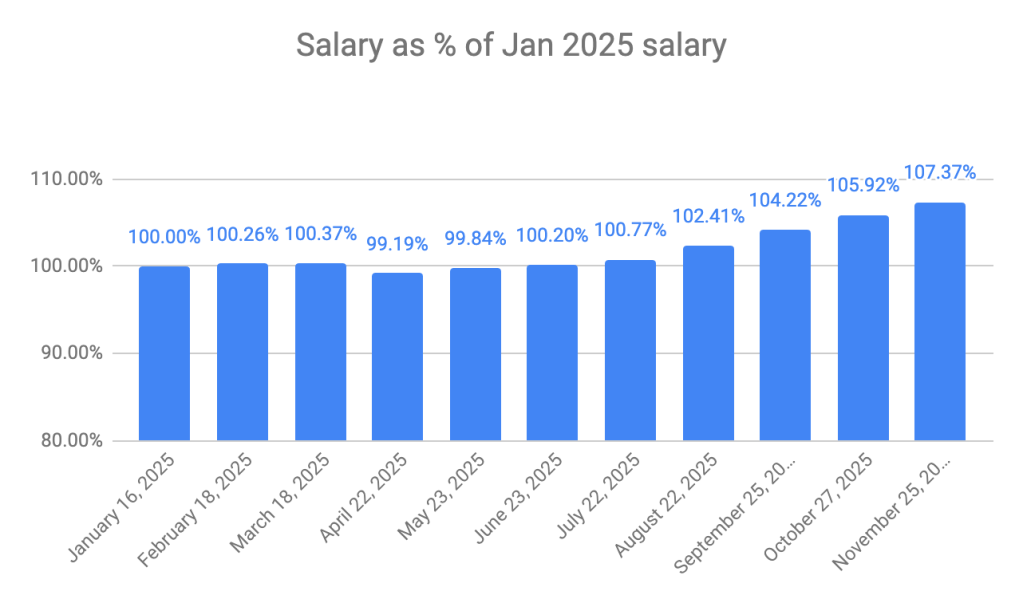

Since the cash cushion is effectively a 5-month moving average Salary, the Suggestion could be more than or less than the Salary. If my net worth is down (or up) month over month, then it follows that the Suggestion will also be down (or up) month over month. My Salary may or may not be down (or up), depending on how long the downturn has lasted. Just to give you a sense of how the cash cushion smooths out the market gyrations, you can see the comparision of net worth versus salary below. (Taken from my most recent monthly “What’s in my Retirement Portfolio” update.) The net worth moves quite a bit month-to-month (generally upward, which is nice), but my salary is much smoother (but also generally upward).

Anyway, what all this means is that I’m either going to move some of the Suggestion money into the cash cushion (because my Salary is less than the Suggestion), or I’m going to pay myself from the cash cushion because my Salary is higher then the Suggestion5. It’s one or the other; as yet, I haven’t had the Salary be equal to the Suggestion, but it is mathematically possible, of course.

E/E’: Make sure the 4 Questrade RRIFs have cash to cover the monthly payment

At the end of 2025, I’m expecting some sort of communication6 from Questrade as to what my minimum monthly7 RRIF withdrawal needs to be for 2026 for each of the four RRIF accounts in my household8. This is a standard “feature” of anyone holding a RRIF — your provider makes a calculation based on the value of your RRIF on the last day of the year and your age (or your spouse’s age) at the end of the year. That’s RRIF minimum — the minimum amount you’re obligated to take. This coming year, I’ll stick with RRIF minimum again to avoid having to deal with spousal attribution rules.

So for 2026, I will know exactly how much cash I will need every month in every Questrade RRIF account. And since I’ve done such a good job in simplifying my RRIFs9 (pats back) I can also calculate exactly how many shares of XGRO need to be sold in each RRIF account every month, in real time10.

So generally, this step involves placing 4 sell orders to put cash in the account.

The E’ step — moving cash from the RRIF to the chequing account — I’m expecting to be automatic, but since I haven’t had to do this with Questrade before, I’m not certain.

F/F’: Generate cash equal to RRIF minimum in the Wealthsimple account and move it to the chequing account

Like with Questrade, I’m expecting Wealthsimple to communicate my RRIF minimum. From what I can see from their website, it appears that they actually make it really obvious.

The same good work I did with my Questrade accounts is even better in my Wealthsimple RRIF account since I hold no USD at Wealthsimple. So here, and thanks to fractional shares, 100% of my RRIF is invested in XGRO, with no additional cash.

Their help article makes it sound like both F and F’ are under my control, which is fine. I’ll just do this step at the same time I do the Questrade step. Maybe I only have to do F’ once and pay out in “Installments”? Not sure.

G/G’: Use the non-registered account(s) to generate cash equal to Suggestion minus all the monthly RRIF payments

I already know my five RRIF minimum payments will fall well short of the VPW “Suggestion”, so every month I have to sell assets from the non-registered accounts to make up the shortfall. This cash will either go 100% to my chequing account or some of it may be diverted to the cash cushion.

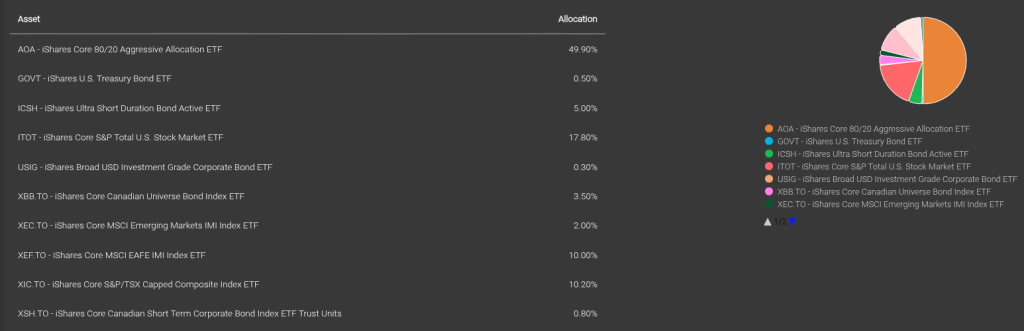

Normally this comes from my, not my spouse’s, non-registered account. Since my spouse is still working, I leave hers alone to avoid generating capital gains. Unfortunately, my non-registered accounts are a bit of a dog’s breakfast, and although I’ve made efforts to use spreadsheet formulas to make automated suggestions11, it’s proving a bit more difficult.

In the end, this is again a sale of one or more assets. For step G’, I can then immediately use Questrade’s “Withdraw Money” to move the cash into my chequing account, or “Move Money” to move cash into the Cash Cushion account.

Conclusion

And that, my friends, are the steps I take monthly in retirement. I try to perform these steps in the dying days of every month while allowing enough time for trades to settle to ensure cash is well and truly in hand before I move it to my chequing account.

In my household, a very large portion of this process gets spit out as a step-by-step “do this, do that” set of instructions I’ve built into a macro-enabled spreadsheet. The trades required for Step G are still decided on the fly, manually. Of couse, given that Questrade has APIs, I could conceivably make automatic trades based on the work I’ve done, but I’m not sure I want to take that step. Retirement project?

- I don’t really know if any of my readers find this particular articl useful, exasperating or confusing. But for me, it’s useful to write down how it works! ↩︎

- For me, zero. ↩︎

- For me, CPP, OAS and the OAS supplement. The current plan is to defer CPP/OAS until age 70 to maximize my inflation-indexed income. ↩︎

- which, in my case, since I withdraw monthly, is about 5x my salary ↩︎

- I’ve run this algorithm ten times so far this year: 3 times I had to pay myself out of the cash cushion and 7 times I added to the cash cushion. That’s the general upward trajectory of this year’s market in action ↩︎

- My last provider, I actually called them to check. I had of course calculated it myself (and they were very close) but my numbers don’t matter to the CRA. I’m hoping Questrade makes it a bit more obvious, but I’m pessimistic. ↩︎

- I had set it up as monthly. I could’ve chosen quarterly or annually. I like monthly. ↩︎

- Individual and spousal RRIFs for each of us. ↩︎

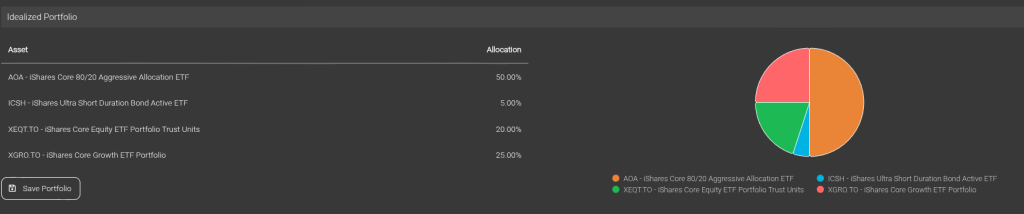

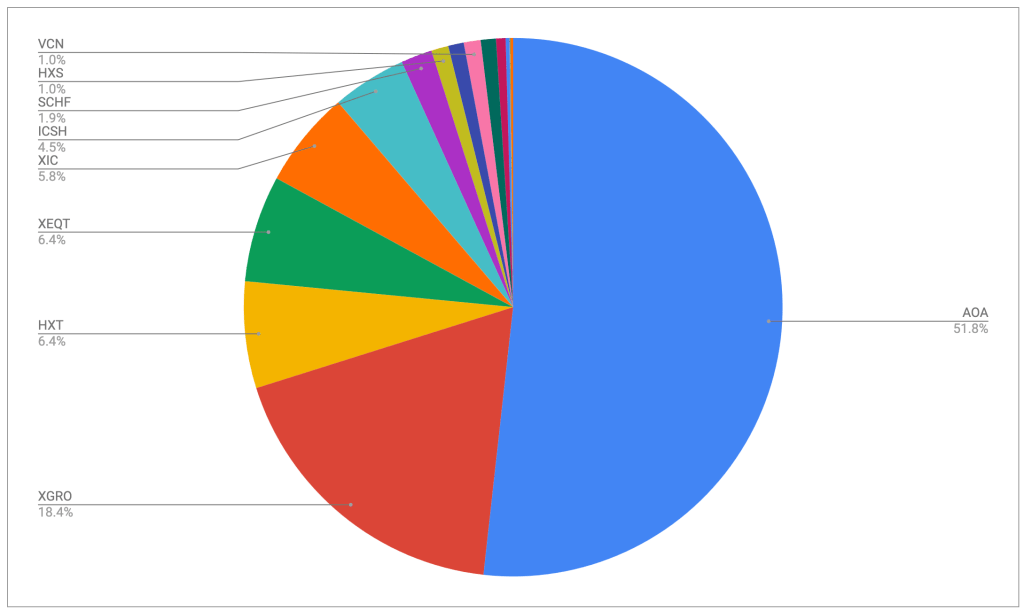

- My RRIF accounts hold one of five assets: Canadian and US dollars (because I can’t buy fractional shares), ICSH, AOA, or XGRO. ICSH is held in RRIFs to keep me at 5% cash in my retirement overall, and I routinely convert (quarterly) AOA into XGRO using Norbert’s Gambit. ↩︎

- And yes, I have a macro-based spreadsheet that tells you exactly how many shares to sell at that moment based on share price and current cash in the account. ↩︎

- The most appropriate thing to sell in any given month is an asset for which I’ve become overweight per my multi-asset tracker. But when you hold all-in-ones in the portfolio, it’s a bit trickier to work that out. I just need to set aside some time to come up with a spreadsheet-based solution. I would much prefer this decision to be made algorithmically. ↩︎