XGRO is one of my ETF all stars. I updated my What’s the deal with XGRO? post today, and here I show you how I break down the various stocks and funds within it using the ETF fact sheets:

XGRO is one of my ETF all stars. I updated my What’s the deal with XGRO? post today, and here I show you how I break down the various stocks and funds within it using the ETF fact sheets:

“Backtesting” is a commonly-used tactic to see how well the portfolio you have (or are considering) would have performed historically. While “past performance does not guarantee future results” it’s better than not knowing.

I stumbled upon valuetesting.io when I was trying to backtest…something, I don’t really remember what I was up to. Anyway, my random internet walk found valueinvesting.io, which seems to be chock full of all kinds of tools that I haven’t looked at, so I’m just going to focus on the backtesting tools, which I did spend a few hours playing around with. You have to navigate to https://valueinvesting.io/backtest-portfolio to access this portion, and if you want to save portfolios, you have to create an account.

So what, in a nutshell, does this tool do? In their words:

Our portfolio backtesting tool allows you to evaluate the historical performance of up to 3 portfolios. We support 2 portfolio types: asset classes and tickers (stock, ETF, mutual funds). Multiple backtesting scenarios are supported such as periodic capital inflows or outflows, allocation rebalancing frequency and leverage type. Our tool provides historical returns, risk metrics, drawdowns and rolling returns information about your selected portfolios.

https://valueinvesting.io/backtest-portfolio

Let’s take a look at the two kinds of portfolio types they support: asset classes and tickers.

The downside of this tool as a Canadian investor is pretty obvious when you try to build a portfolio using asset classes. (Asset classes are integral to the way I think about my retirement portfolio — you can read more about my approach here.) There’s no “Canadian Equity” category to choose (boo!).

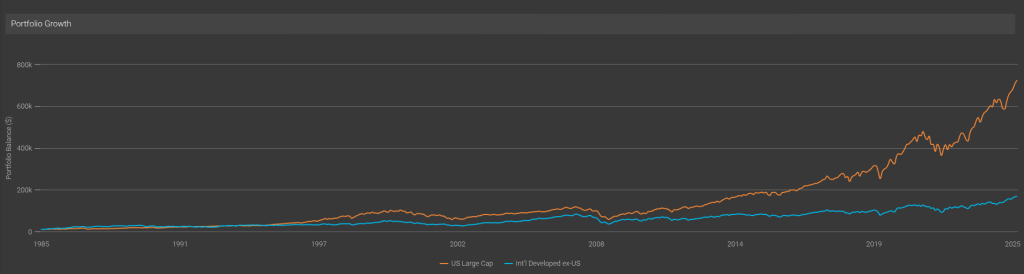

The class that would hold the most Canadian equity would be “Intl Developed ex-US Market”1, so let’s compare that to say the “US Large Cap” (which I take to be a good proxy for the S&P 500).

The good old S&P has left the rest of the developed world in the dust, it seems…Well, except for THIS year:

Anyway, the asset classes are good fun and all, but without a Canadian index to track, it’s not too useful to me. (And, inexplicably, nowhere could I find a definition of any of these in the tool, and an email to the support address remained unanswered at the time of publication). So let’s move on to something more interesting, namely the ticker backtesting!

As the name implies, this portion allows you to enter tickers, and there’s full and complete support for Canadian ETFs that I tried.

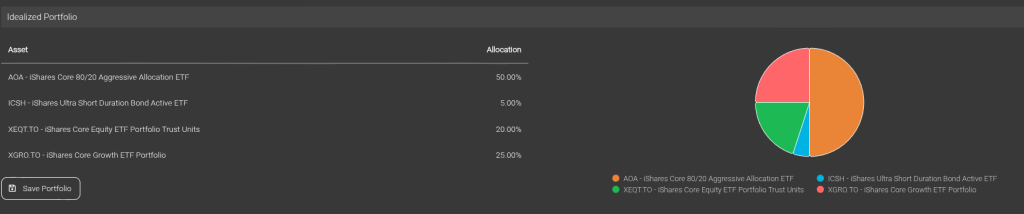

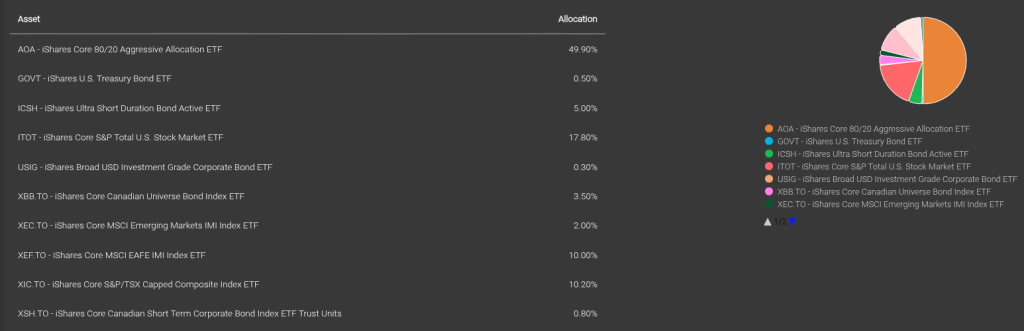

So of course I immediately tried to build my idealized portfolio, which is what my “What’s in my Retirement Portfolio” would look like without the non-registered assets2.

The problem? XEQT and XGRO (two of my ETF all-stars) haven’t been around all that long, and so I can’t backtest very far. No matter, by looking at the composition of XEQT and XGRO and doing some clever math, I can create the equivalent decomposed portfolio:

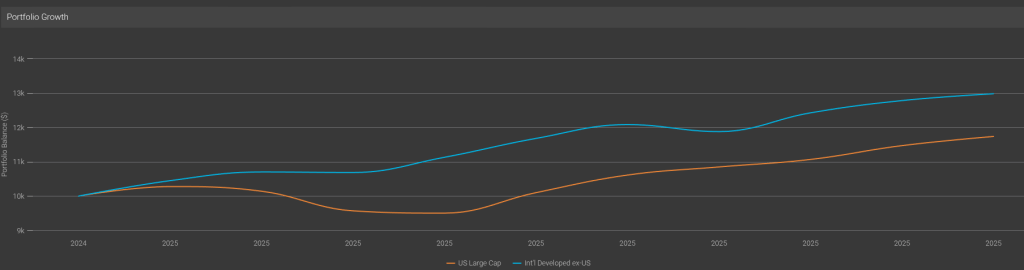

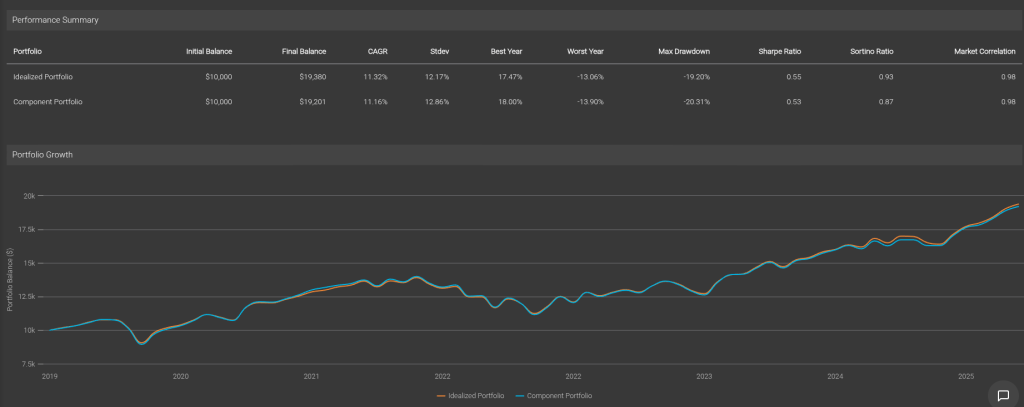

And I can prove that I got it right by backtesting the two against each other. Pretty good, eh?

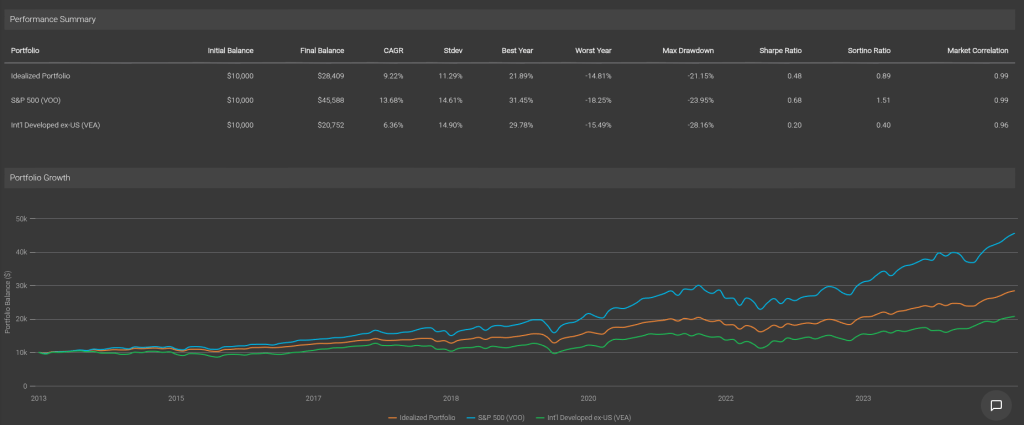

So with my decomposed portfolio at the ready, I can compare its performance long-term against (for example) just buying the S&P 500 index (VOO) or the International Developed ex-US index (VEA).

As expected, my portfolio has quite a bit poorer performance than the S&P, but better than the International ex-US. The bond/cash component smooths out the standard deviations (that’s “volatility”) so my worst years (although still a bit scary) are still a bit less than experience of owning 100% equity.

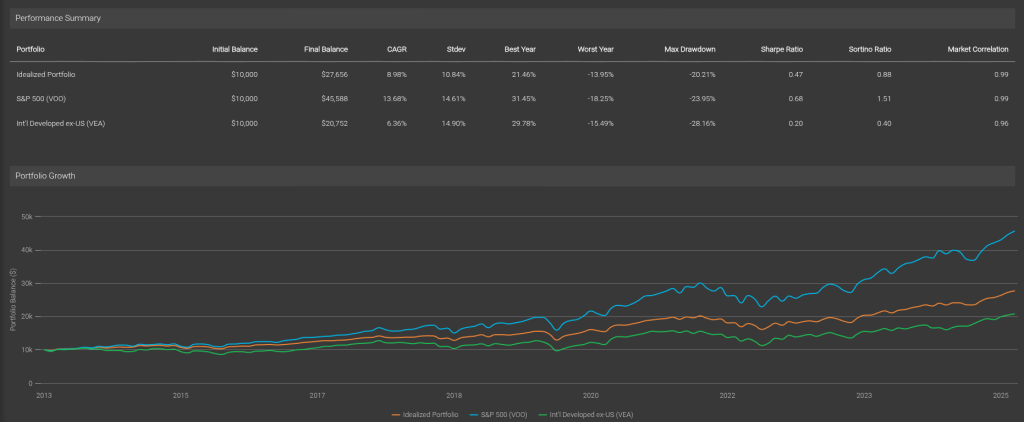

One more thing to look at — this backtesting assumes we don’t rebalance anything. That’s not correct, since that’s one of the benefits of holding ETFs like AOA, XGRO and XEQT — they automatically rebalance periodically. valueinvesting.io lets you choose monthly, quarterly, semiannually and annually. I know for a fact that AOA rebalances twice a year, so we will assume XGRO/XEQT do the same. This is what the result looks like:

This reduces the volatility and the return a bit, which if you stop and think about it, makes sense: equities consistently outperform bonds and cash over time so the rebalancing exercise makes sure the equities remain at an 80% contribution to the portfolio.

The backtesting portion of valueinvesting.io is a good tool to test various combinations of ETFs / stocks you may be interested in. There’s not very much documentation on the site, but it’s easy enough to use. The free account (which requires registration) is enough to get you that far.

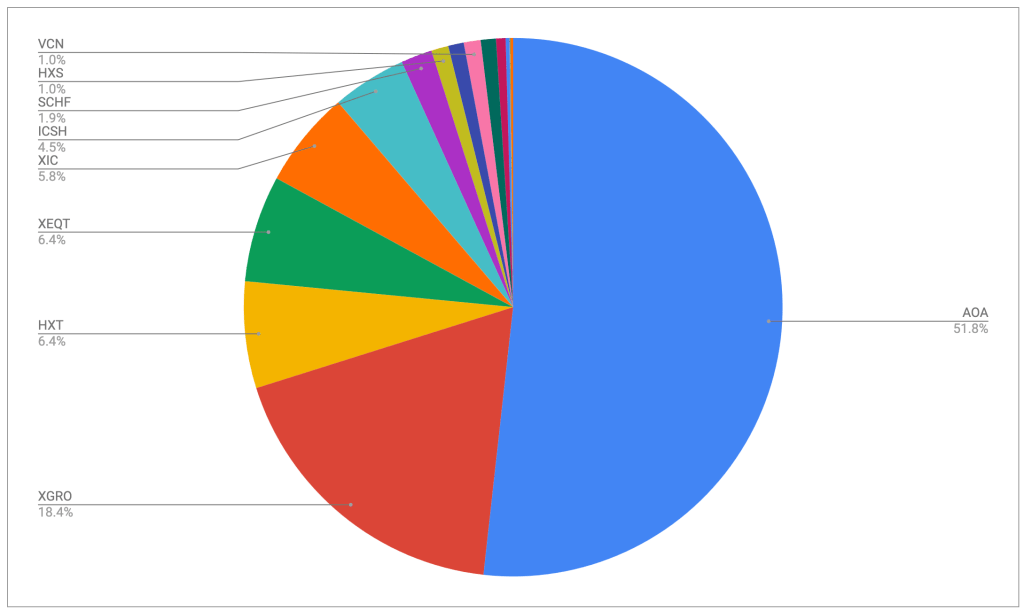

This is a monthly look at what’s in my retirement portfolio. The original post is here.

The retirement portfolio is spread across a bunch of accounts:

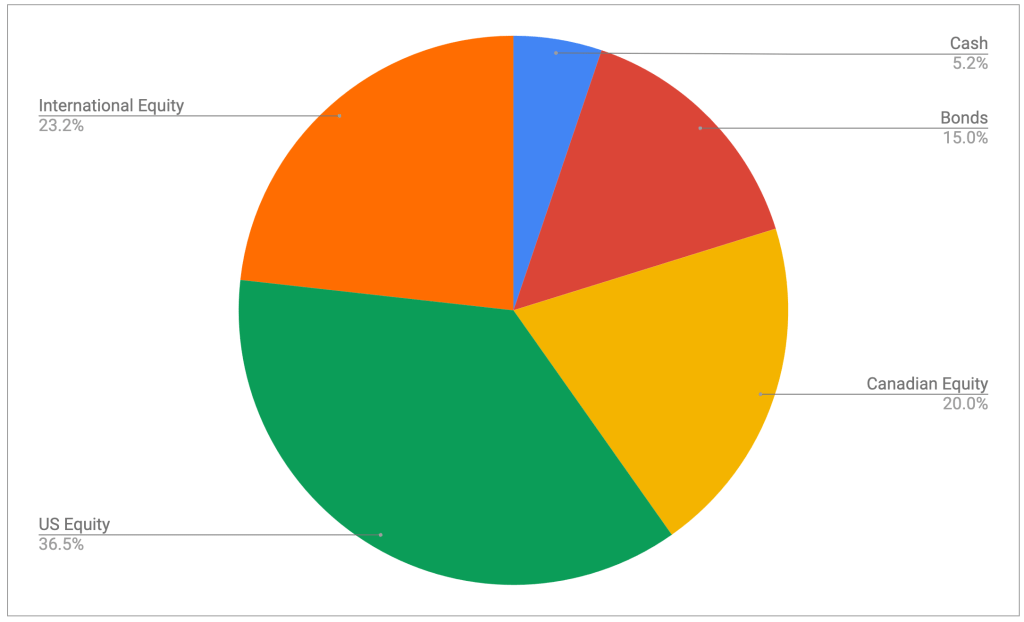

The target for the overall portfolio is unchanged:

You can read about my asset-allocation approach to investing over here.

I pay myself monthly in retirement, so that’s a good trigger to update this post. On November 25th, this is what it looks like:

The portfolio is dominated by my ETF all-stars; anything not on that page is held in a non-registered account and won’t be fiddled with unless it’s part of my monthly decumulation. Otherwise I’ll rack up capital gains for no real benefit.

No notable changes this month; HXT is down slightly because that’s the fund I sold in my non-registered account this month to help pay the bills. I’ve sold quite a few shares of this fund this year and I’m seeing the capital gains mounting, but it’s around where I expected to be. I try to keep taxes owing reasonable; nonetheless I’m guessing I will certainly be moving to quarterly instalments in FY 2026; that’s the downside of having no withholding tax of any kind this year.

The asset-class split looks like this

It’s looking pretty close to the targets I have, which are unchanged:

All looks to be in order from an asset allocation perspective, no need to do anything here. Cash is slightly elevated as a result of the pending closure of the three remaining QTrade accounts and will drift back to the normal 5% over the coming few weeks, I expect.

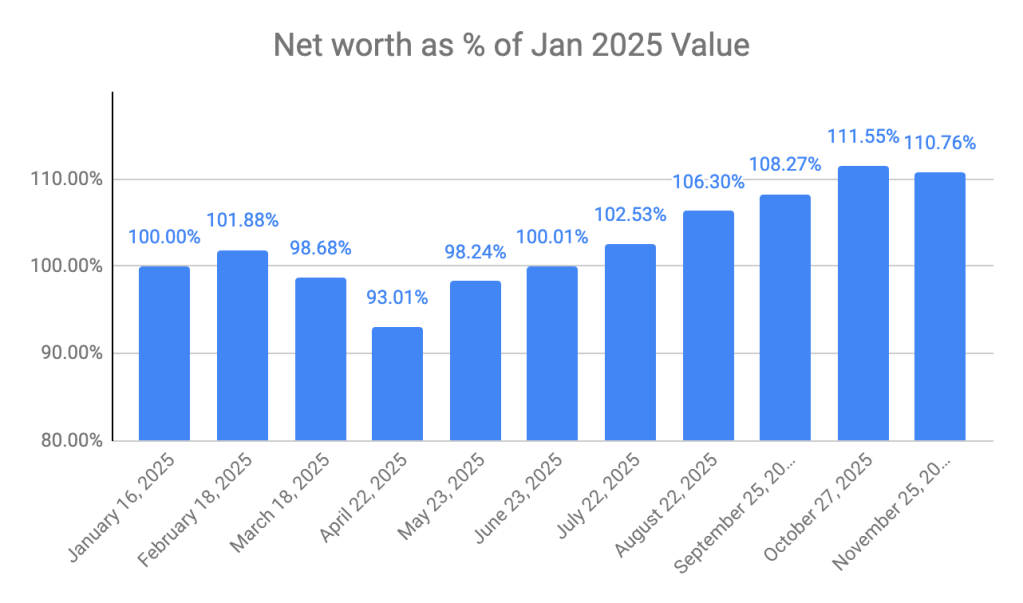

Net worth overall stopped its 6 month winning streak and I’m down slightly month over month. But I will reiterate: my net worth is still growing even though I’m taking a living wage every month. You might think that “decumulation” means “a steady reduction in net worth” but it needn’t be the case. And, in my particular case, my retirement income will include no pensions, so it’s probably a good thing that it keeps increasing overall.

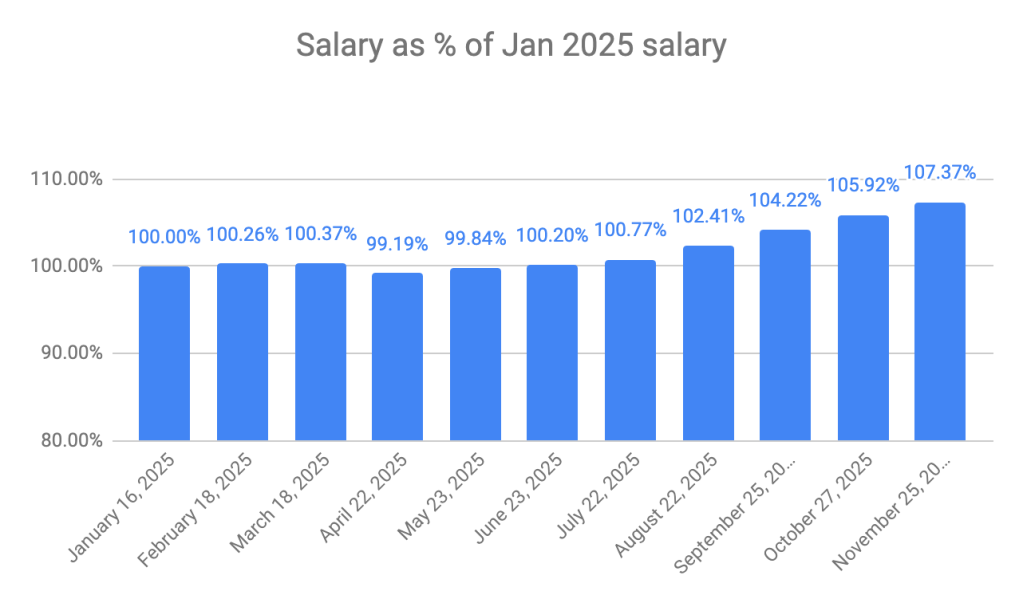

My VPW-calculated salary continues to grow for the 7th straight month in spite of the step back this month in my net worth. That’s a feature of the “cash cushion” that is integral to the VPW withdrawal. It serves as a shock absorber to the monthly ups and downs of the stock market.

Next month will end my relationship with QTrade as I move the final 3 RRIF accounts to Questrade2.

Summary: Vanguard asset allocation funds aka all-in-one funds VEQT, VGRO, VBAL, VCNS. VSIP have reduced their management fees to 0.17%, down from 0.22%, effective November 18, 2025.

It’s a good time to be an all-in-one investor, as I am. New to all-in-ones? Read all about them here.

The summary pretty much says it all. It just got cheaper to own Vanguard’s all-in-one funds. The amount of the reduction amounts to 50 cents for every $10001 invested per year, but compounded over many years, and multiplied by however much you have saved for retirement, it can be a surprisingly large number.

All-in-ones are much cheaper than either roboadvisors or your typical financial advisor, but as we studied before, they’re not without some cost, so fee reductions are always welcomed. Vanguard joins TD and BMO in reducing the cost of their all-in-ones. We looked at the makeup of each of these funds lately; there’s not a huge amount of difference, no matter which one you pick.

Anyway, you may note that Blackrock’s XEQT/XGRO/XINC family is now the most expensive of the lot; there’s no reason for that to be true given the competitive landscape. I would expect Blackrock to follow suit, or if not, I’ll probably be making some moves to get to lower fees, since a lot of my retirement portfolio is currently tied up in XEQT/XGRO. ZEQT/ZGRO I think is the closest in makeup to the XEQT/XGRO family.

People still working are always fascinated with what a recent retiree gets up to. I guess the short answer is that I’m still busy, still procrastinating, still learning — but with far fewer constraints on how I spend my day.

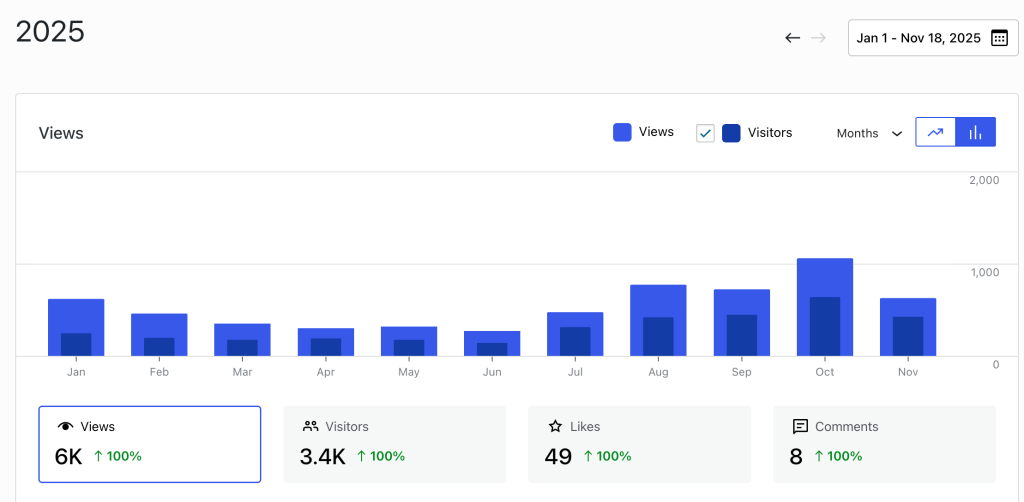

MoneyEngineer.ca was an idea that grew out of something I had been doing occasionally before I retired. I would discover something interesting in the world of being a DIY investor or in being a cheapskate and I would tell a bunch of friends and family about it, usually via email. But I figured that I could tell more people about what I’ve learned by starting a blog.

Knowing my procrastination habits, I took steps to make sure I would get that going on day 1. So in late December 2024 I prepurchased 2 years of WordPress and registered a domain. Investing a bit of cash in my proposed endeavor I knew would motivate me to actually DO it.

The time I spend on the blog now versus the early days has diminished quite a bit (partly because I’m now way more familiar with how WordPress works) but I enjoy the structure of heading down to the basement office and doing the work of researching and putting words on the page. And watching the website grow in popularity has also been gratifying. So thanks to all for reading and sharing!

I do enjoy managing my own retirement income, and chasing whatever deal gets thrown my way. And I do try to simplify as much as I can. Being a cheapskate sometimes has the cost of adding complexity, it’s true. And outside the blog, I’m a frequent contributor to investing-related subreddits.

There are many organizations out there who are happy to put a recent retiree to work either on a recurring or on a one-off basis. Getting out of the house is a good thing, I figure. Here are a few of the places I’ve spent my time:

I’ve always been a fan of outdoor exercise — gyms have zero appeal for me, and so even before I retired I made a habit of getting outside to ski, ride, run or walk thirty minutes four to five times a week. In retirement, I’ve become more interested in running and entered my first distance races this year; to avoid injury, I’ve added more miles and more structure2.

I have never liked strength training, but know that as I get older, that’s something I have to pay attention to. I recently discovered darebee.com and am following their strength training program; lots of variety and it’s mostly based on body weight exercises, so I can do them practically anywhere.

Both my kids took lessons and we own an upright as a result. The kids are both out of the house and instead of letting the instrument collect dust, I’ve started learning myself.

Once again, in order to prevent myself from avoiding doing the daily work, I invested in an annual subscription to pianote.com3. I suppose most accomplished musicians would frown upon anything other than in-person, tailored lessons, but the approach of pianote really appealed to me: playing songs but with enough technique to build skills.

On most days, I spend between 30 and 60 minutes at the piano. I’m currently working on the piano accompaniment to “Someone Like You“.

So there you have the view of what this retiree gets up to — what have you found that fills your days after work? Let me know at comments@moneyengineer.ca. I’m always curious about new things to try!