So you’ve decided to make the leap and keep more of your own money. Congratulations! Here’s a list of things you need to do to put that plan into action.

Disclaimer: I treat my retirement assets separately from any other assets (rainy day funds, day-to-day expenses). If you blend these sort of things together, it may change things like step 1.

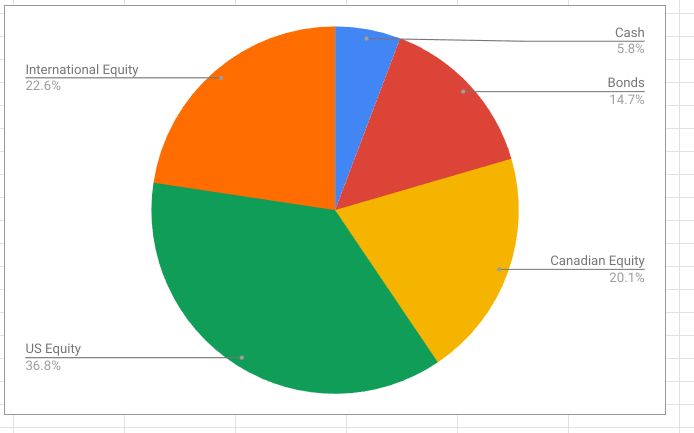

1. Determine your desired asset mix

“Asset mix” is just another way of describing your risk profile, or in really plain English, what percentage of your portfolio is going to be invested in equity. There’s a quick questionnaire over here that will put you in one of 5 buckets:

- Very Conservative: This means 20% Equity.

- Conservative: This means 40% Equity.

- Balanced: This means 60% Equity.

- Growth: This means 80% Equity.

- Aggressive Growth: This means 100% Equity.

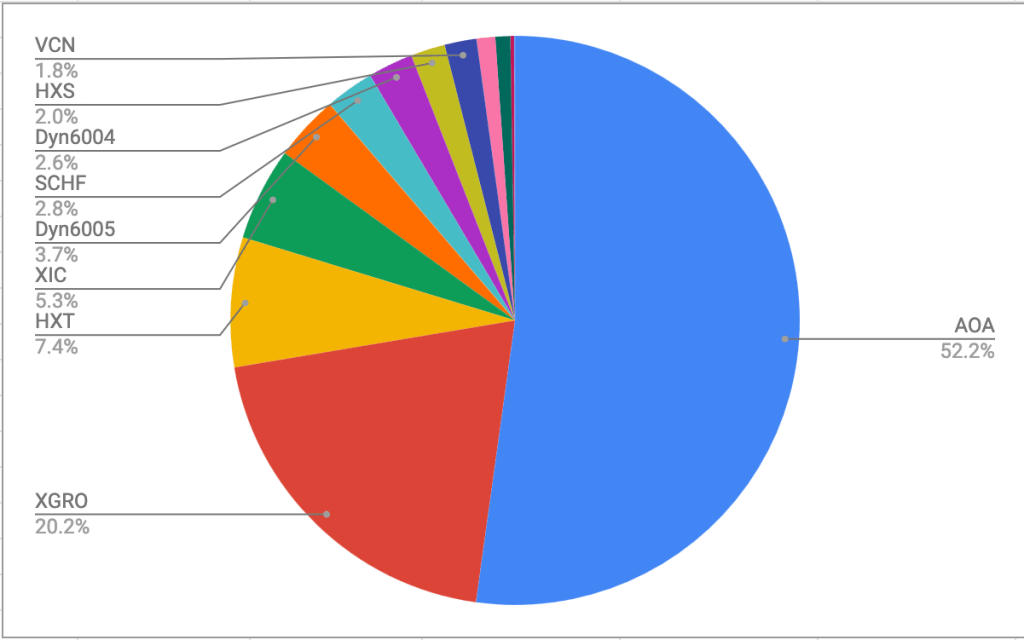

If you’re happy with the way your existing portfolio is performing, then you can instead calculate the percentage of equity in it and use that as your asset mix. For simplicity, I would consider any stock as “equity” and any cash, HISA, Bond fund or GIC as “not equity”. If your portfolio holds ETFs, then you need to see what’s inside them. You can typically read that on the “fund facts” page. They are usually one or the other, unless you already hold funds like XGRO.

2. Choose your platform and create login(s) for it

But which one? I talk about some of the things to consider over here, or you can investigate a trustworthy source like the Globe and Mail’s annual rankings. Some providers (e.g. QTrade, Questrade) allow you to make trial accounts to test drive them. I myself use QTrade for my investments. Like all providers, it does some things really well, and others, not so much. I have either personal experience or friends using (in alphabetical order) BMO Investorline, Interactive Brokers, iTRADE, QTrade, Questrade and Wealthsimple. Any of them will do. Many of them run promotions1 trying to entice you to switch. Might as well take advantage of that if it makes sense23. Also consider if they will reimburse you the transfer fees imposed by your soon-to-be-ex provider of choice4.

The heading of this section says “login(s)” because if you’re part of a spousal team, you should really do this as a team.

This step also usually entails form-filling and proof of life uploads/emails/faxes5 (photo ID, banking info….). Put on your favourite tunes and the time will be filled with pleasant sounds.

3. Figure out how to move money to and from your new platform

If you’re still contributing to your TFSA/RRSP/RESP, or if you have non-registered accounts, or are close to retirement and about to set up a RRIF, then it’s pretty important to know how money will move in/out of these accounts. Typical things you’ll have to do are

- set up your new account(s) as “Bill Payees” online banking6

- set up EFTs7 between your bank account and new platform

- set up new Interac eTransfers8

- Get cheques/bank card for your non-registered account, if applicable9

4. Collect all your existing account information

To successfully complete the transfer, you are going to need to know the details of all your existing accounts. The usual information requested is found on your monthly/annual statements. Client number, account number, rough value of what’s in each.

If applicable, you’ll also want to have a very good handle on exactly how much you’ve contributed to capped government savings vehicles (e.g. RRSP, TFSA) so you don’t inadvertently over contribute in the year you make the shift10.

There may be a snag at this step. You may hold assets at your old provider that are not supported at your new provider. This may or may not be a big deal. Typical issues are caused by

- GICs11. The reason you get good interest rates from them is because the money is locked away. You may or may not be able to move them without incurring penalties. You’ll have to ask your new provider what they are willing to do. In most cases, the answer will be “sorry, can’t help you, if you want to move them, you’ll have to sell them first”12.

- Mutual Funds. Many of these are private to that provider,13 and constitute, in their estimation, considerable value add. For these, you are almost certainly going to have to say goodbye (and good riddance) .

For GICs, you can choose not to move those assets, wait until they mature, or eat the cost of cashing them in early.

For Mutual Funds, selling them usually isn’t a concern, unless you hold them in a non-registered account, in which case there may be undesirable capital gains that will cause a tax hit.

For most people, the costs involved in moving assets are small compared to the money you’ll ultimately save by firing your advisor. But don’t say I didn’t warn you.

5. Initiate account transfers from your newly selected platform

This is the first step where things get real.

Different providers will do this somewhat differently, but it’s usually called something like “Transfer Account”. In my experience, providers are highly motivated to be highly helpful at this stage ;-).

But in essence, initiating an account transfer will involve two things:

- The creation of the kind of account you’re moving (e.g. TFSA, RRSP, Spousal RRSP, RRIF14) AND

- The details of that account (client number, account number….all collected in the previous step)

It’s also possible you have to create the account (TFSA, RRSP….) on your new platform FIRST, and once it’s created THEN you can initiate a transfer.

You will have to answer a question of moving the existing assets “in kind” or “as cash”. If you hold portable assets at your old provider (e.g. cash, stocks, ETF), “in kind” is fine. If you don’t (e.g. GICs, mutual funds) then “as cash” will allow your new provider to trigger a sale of those assets.

You will have to do this for EVERY account you’re moving. Were I to switch, I’d have to move

- 4 RRIF accounts (2 each for me and my spouse; one in CAD, one in USD)

- 2 spousal RRIF accounts (1 for each spouse)

- 2 TFSA accounts (1 for each spouse)

- 5 investment accounts (2 for me, 1 for my spouse, and 2 joint15)

- 1 RESP account

6. Wait for the funds to arrive

This always seems to take forever. Expect a delay of 5-10 business days at this point. Expect a panicky call from your soon-to-be-ex advisor. Take the time to set up Trading Authority (TA) for your personal accounts (spouse, adult child, other relative) so they can make trades on your behalf. There’s a form for that. Having TA for my spouse’s accounts means I can see our ENTIRE retirement portfolio from my login which is Highly Desireable.

7. Buy the correct ETF in line with step 1.

As as example, if you were to use the Blackrock family of asset allocation funds:

- Very Conservative: This means 20% Equity. This means XINC.

- Conservative: This means 40% Equity. This means XCNS.

- Balanced: This means 60% Equity. This means XBAL.

- Growth: This means 80% Equity. This means XGRO.

- Aggressive Growth: This means 100% Equity. This means XEQT.

The reason for choosing an asset allocation fund is for automatic re-balancing. You pay about 0.15% for that service, which is baked into the price of the fund. It’s more or less what your advisor should do for you today.

8. Pay as much or as little attention as you like

As you invest new funds (e.g. for TFSA/RRSP), buy more units. You might also consider setting up a DRIP at this stage so as dividends roll in (typically, monthly or quarterly), you automatically purchase more of the same. Autopilot.

If you want a second set of eyes to assess your holdings, then dropping some cash on a fee-for-service advisor from time to time may make sense.

Eight steps to save potentially thousands of dollars. You’re worth it!

- Googling (for example) “Wealthsimple promotion” would be one way to find the current one. ↩︎

- Read the fine print, there are almost always caps on rewards, as well as obligations to stick with the provider for a period of time. ↩︎

- Here is one rare case where there may indeed be something pretty close to a free lunch. ↩︎

- Almost all providers do this; there is almost always some sort of lower limit…$15k is pretty typical. ↩︎

- Any provider wanting faxes should disqualify them as a provider, just sayin’. ↩︎

- This is how QTrade does it. ↩︎

- Electronic fund transfers. You provide institution/transit/bank account number using a blank cheque. That’s how QTrade knows where to put my RRIF payments. Another form to fill. ↩︎

- Only Wealthsimple seems to allow this. It’s fast, but has upper daily/weekly/monthly limits that may make it impractical. ↩︎

- Both BMO Investorline and Wealthsimple allow this. I’m guessing that it’s a common feature for providers that also operate bank services (e.g. CIBC, TD, National Bank, Scotiabank). My provider (QTrade) does not. ↩︎

- Your new provider will have no idea what your TFSA limits are; only CRA knows that. Most providers will track what you contribute IN THEIR ACCOUNT in a given year, so that’s somewhat helpful. ↩︎

- The lack of liquidity of GICs is the main reason I don’t use them. ↩︎

- The one exception I’ve encountered thus far is that BMO Investorline was willing to accept the GICs purchased via BMO Advisor Services. There may be others. ↩︎

- Manulife and Sunlife, much loved by employers for DPSPs, are notorious for their 1.5% MER index funds. ↩︎

- Don’t forget to properly designate beneficiaries or survivor annuitants. ↩︎

- These are CAD and USD versions of the cash cushion required by the system I use to pay myself in retirement. ↩︎