This is a monthly look at what’s in my retirement portfolio. The original post is here. Last month’s is here.

Portfolio Construction

The retirement portfolio is spread across a bunch of accounts:

- 7 RRIF accounts (3 for me, 3 for my spouse, 1 at an alternative provider as a test)

- 2 TFSA accounts

- 4 non-registered accounts, (1 for me, 1 for my spouse, 2 joint)

The target for the overall portfolio is unchanged:

- 80% equity, spread across Canadian, US and global markets for maximum diversification

- 15% Bond funds, from a variety of Canadian, US and global markets

- 5% cash, held in savings-like ETFs.

You can read about my asset-allocation approach to investing over here.

The view post-payday

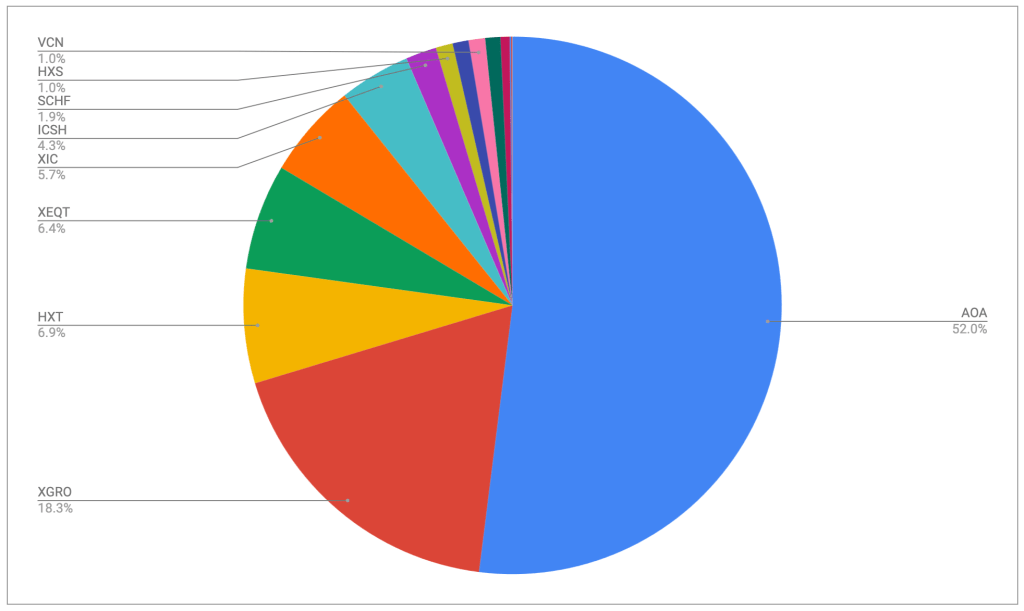

I pay myself monthly in retirement, so that’s a good trigger to update this post. At market close, September 25, this is what it looks like:

The portfolio is dominated by my ETF all-stars; anything not on that page is held in a non-registered account and won’t be fiddled with unless it’s part of my monthly decumulation. Otherwise I’ll rack up capital gains for no real benefit.

No massive changes this month; the one you might notice is a reduction in HXS, which holds US stocks exclusively. I picked this one to sell out of my non-registered accounts as my US equity allocation was a bit high.

Plan for the next month

The asset-class split looks like this

It’s looking pretty close to the targets I have, which are unchanged:

- 5% cash or cash-like holdings like ICSH and ZMMK

- 15% bonds (almost all are buried in XGRO and AOA)

- 20% Canadian equity (mostly based on ETFs that mirror the S&P/TSX 60)

- 36% US equity (dominated by ETFs that mirror the S&P 500, with a small sprinkling of Russell 2000)

- 24% International equity (mostly, but not exclusively, developed markets)

I don’t need to make serious changes at this juncture, but there will be some need to make some noticeable tweaks in the coming month:

- Q3 dividends will flow in to the account which will make for some movement, especially in XGRO and AOA. (Payout date for XGRO is September 29th , AOA is estimated to be October 8th.

- I will need to convert some of my US RRIF holdings into CAD. I do this quarterly. Why quarterly? It allows me to smooth out any big swings in the FX rate over the course of the year. This will show up as a reduction in AOA and an increase in XGRO next month.

- And, at the very end of October, AOA will rebalance. This is not foreseen to be a big deal.

- All these moves will be tracked through my multi-asset tracker; it may be I have to buy a bit more foreign equity as I see I’m a touch light in that category.

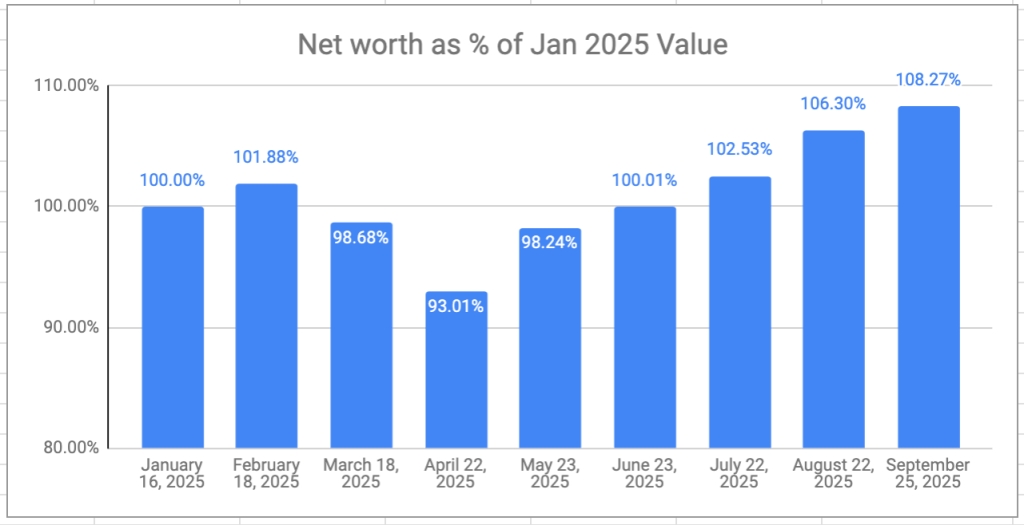

Overall

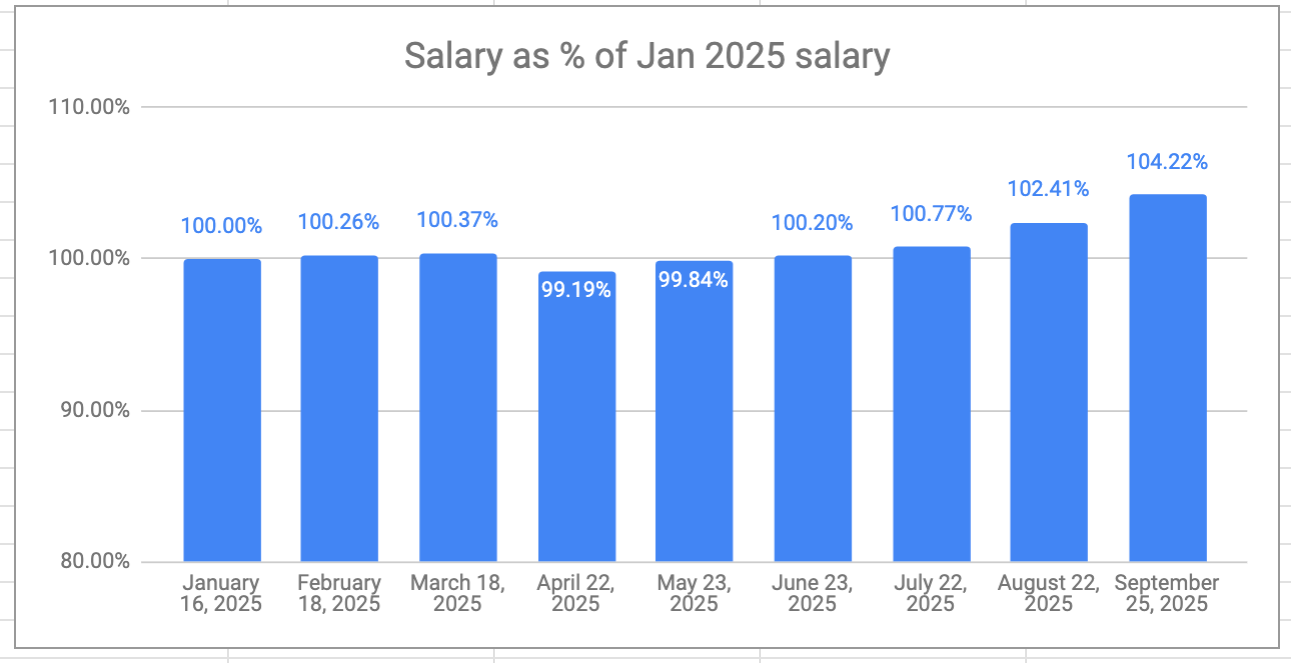

The retirement savings had a great month, again. Overall, I’m now 8% ahead of where I started even though I’ve been drawing a monthly salary since the beginning of the year. This is aligned with what my retirement planner told me to expect, but as you can see, the journey has had some interesting ups and downs already.

My VPW-calculated salary has hit a new high this year, 4.22% higher than my first draw in January1. This is also expected, since it tracks the value of the retirement portfolio, albeit in a much more controlled way. The VPW “cash cushion” smooths out the ups and downs of the monthly returns. I suppose I really should see an increase in my salary on par with inflation so that I maintain my spending power. I’ll have to think about how to track that2.