Online brokers are busily throwing money around to attract new customers; a quick search reveals many active promotions as I write this from Webull Canada, RBC, TD, QTrade, Wealthsimple….All of it has a bit of “if this seems too good to be true, it probably is” flavour to it.

I asked this same question on Reddit and the consensus seemed to be that this is the new normal in the online brokerage world, just like it’s normal for telcos/cablecos/ISPs to throw around big discounts in order to steal customers from one another.

But yet, I feel a little uneasy how money for nothing has become the norm. For DIY investors like me, it’s hard to see how my providers make any money off of me. I did a bit of research into the best proxy I could think of…Robinhood.

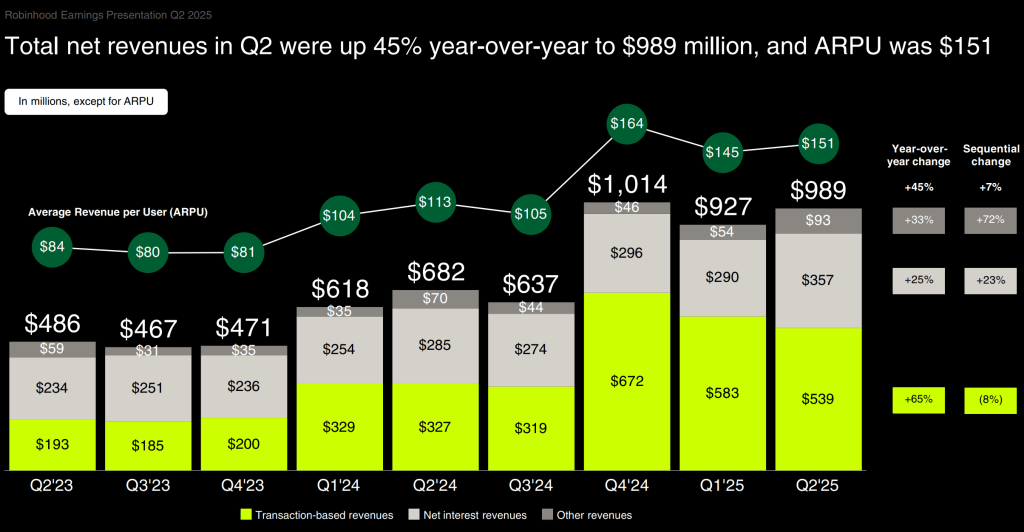

As I mentioned in a previous post, Robinhood is now part of the S&P 500 lineup; this is no fly-by-night company. Their quarterly results are public, and it was quite illuminating. Robinhood’s most recent quarter’s results are shown below.

So it looks pretty straightforward; revenue is coming from three sources, and their average revenue per user (ARPU) is a pretty healthy $151 dollars. Let’s look a bit further:

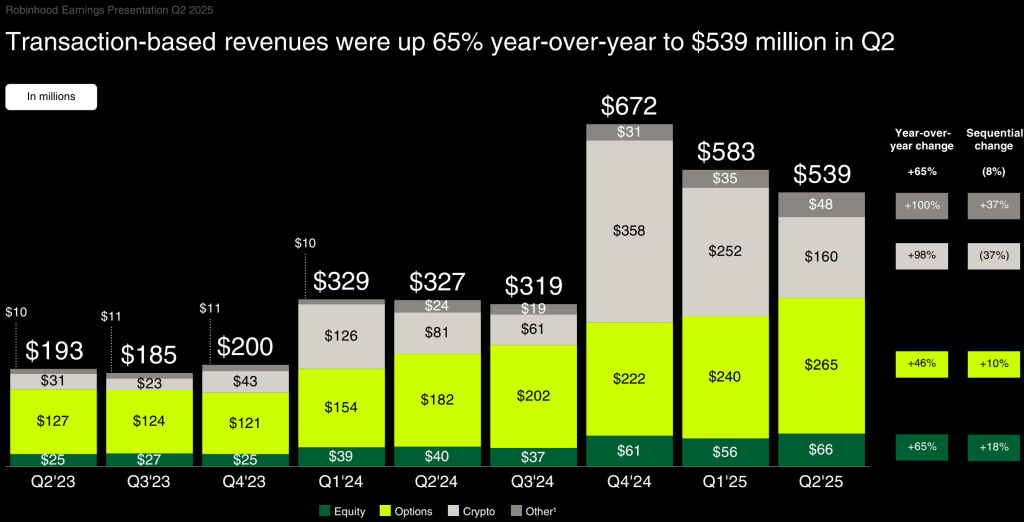

- Transactions: Options trading and Crypto trading make up the bulk of the revenues here, but roughly 15% of their transaction revenue comes from basic equity trades ($66M in Q2’25).

- Interest: a large chunk of this is interest made from margin ($114M in Q2’25), but a growing percentage comes from credit card interest charges.

- “Other”: not elaborated further, but it’s small, so we can ignore it. Perhaps this accounts for the revenue from their 3.5M “Robinhood Gold” subscribers1

The transaction revenue was surprising to me since equity trades are free on Robinhood, yet they are still finding a way to make money. Further reading indicates that the exchanges are sharing some of their bid/ask spread revenue with Robinhood, which seems like a win/win/win: Robinhood makes a tiny bit of revenue on each trade, the exchange gets more volume which allows them to make more spread revenue, and the customer gets free trades2.

So, assuming the Wealthsimples and Questrades of the world are following Robinhood’s lead, they are making money off of me every time I place a trade. (Sorry, I don’t trade options, I don’t trade crypto, I don’t trade on margin, and I don’t run a balance on any credit card I use). Since switching to Questrade (and getting free trades) I can tell you that my own behaviour has changed; I have always hated seeing non-productive cash in any of my accounts, and so with free trades, I can freely buy one share of something to clean up the last dribs of cash I may have in any given account. My “getting paid in retirement” strategy also requires a monthly flurry of trades (see the details here).

All this to say I feel less uneasy about the free money being thrown around; Canada’s online brokerage community seems to be following a successful playbook:

- Get lots of customers, even if you have to pay them to get on board

- Expand your offers, especially profitable offers, and entice as many of your army of fans to use them (crypto, margin trading, options trading, credit cards, subscription offers)

- Invest just enough in your platform to not lose too many clients; switching online providers can take a lot of work (I know, I did it: read more here)

So my advice is to absolutely take advantage of the free money out there and enjoy the gravy!

- Perhaps serving as the inspiration for Questrade Plus? ↩︎

- Not everyone thinks this is a great idea ↩︎