I am not a lawyer, accountant or tax expert. Your situation may be a lot different than mine. Seek professional guidance if needed.

Part 1 of this blog is found here, Part 2 is here, and Part 3 is here.

Current Status or Why is the CRA so dysfunctional?

Yesterday, I received a series of emails1 from CRA (I had registered for electronic notifications for all things pertaining to the estate, which I highly recommend2). Two of the emails (totally identical) informed me that the address of the estate had changed (what?!!?) and one email, reading very carefully, I think was telling me that a Notice of Assessment for the Estate return had been completed. Here, judge for yourself, this is what the email looked like:

The Canada Revenue Agency (CRA) sent new mail online to ESTATE OF xxx called:

Notice of assessment

This mail may require your attention.

If you have My Trust Account, sign-in via Represent A Client and click on “Mail” to read the mail.

If you signed up to receive mail online but don’t have My Trust Account, go to the CRA web page to register.

Ok, I am going to rant a little bit at this point in time about how inept this communication is.

- Why is it so hard for the CRA to send email communications that don’t sound like form letters?

- Here’s how a normal human might write this: “A Notice of Assessment has been completed for your estate account. Login to Represent a Client3 using your Rep ID and the Trust Account Number to view it.“

- Why doesn’t CRA know that I have a My Trust account? Of course I do, that’s how you’re emailing me about matters pertaining to the estate.

- Why is no detail offered around where to register for a My Trust account? (“The CRA web page” is about as helpful as saying “Google it”4).

Of course, this is all nit-picking. My biggest beef is that this Notice of Assessment is being posted 17 weeks after they cashed the cheque for taxes owing on the estate return. In a world where we have self-driving cars how is it ok that it takes 4 months to feed a form into some software somewhere? And this is normal, per the CRA website.

Of course, it gets better. I now go to login to My Trust Account (a term I hadn’t heard before, it’s accessed the same way as you Represent a Client), and I see that the address of the estate is correct (phew), but there’s no indication of any Notice of Assessment, and the status message concerning the T3 that was showing up a week ago has disappeared. Clicking through to the “Balances” portion generates a vague error message.

Perhaps it’s helpful to explain what I expected to see at this juncture:

- An electronic Notice of Assessment

- A balance of zero

Not hard, right?

And so, off to the CRA call centre I went. Speakerphone? Check. Coffee? Check.

After listening to the various options (which take a really long time to work through, especially since one has to listen to messages about My Account and being nice5) I did reach a human in about 10 minutes, which is actually pretty good. Lori was pleasant and helpful, but after about 50 minutes of various holds and questions asked and answered, Lori decided that this was actually a problem for the digital services team to handle. And so I was transferred. I crossed my fingers, since what often happens at this stage is to either get disconnected or punted to the back of a 2 hour queue. Instead, I was connected to another pleasant and helpful agent immediately.

In less than 10 minutes, Sandra had an answer for me: the reason I couldn’t see the Notice of Assessment that was posted was because the estate, in CRA’s eyes, had ceased to exist. The final return was successfully submitted, the balance was zero and so online access was clearly no longer needed.

And so, I therefore needed to wait for a paper Notice of Assessment delivered via snail mail which could take anywhere up until mid-November, per the helpful agent.

Next steps

Patience in wrapping up an estate, as I hope this post has illustrated, is an absolute requirement. Even if you do all the things right like

- filing on time

- using CRA’s e-services like My Account, Represent a Client and My Trust Account

- paying your balance promptly

You can still expect lengthy, CRA-imposed delays.

Once I get the paper Notice of Assessment, my accountant tells me filing for a Clearance Certificate (form TX19) is fast. But once again, you’ll have to deal with CRA’s service standard, which is currently stated to be 120 calendar days from form reception (4 months in human terms).

If all goes well, I should be done about a year after I filed and paid the two tax returns (final return and estate return) with CRA; these delays are all CRA-imposed. Instead of talking about non-stories like the $660k tax bill6, perhaps the Canadian media would prefer to take a closer look at how Canadians are being served (or not) by the CRA when it comes to estates.

Questions? Comments? Let me know at comments@moneyengineer.ca!

- Total: 3, all received in rapid succession ↩︎

- Especially given how unreliable snail mail has become with labour disruptions and whatnot. ↩︎

- Represent a Client is a super-useful CRA service if you’re a financial caregiver. I used it when my parents were alive to help with tax matters, and it’s the same login when dealing with an estate, except then the CRA seems to call it “My Trust Account” in that case. ↩︎

- Yeah, sure, don’t include hyperlinks in emails, I know, I know. But is this really the best we can do here? ↩︎

- I make extensive use of any digital service offered by the CRA. Telling me about them isn’t necessary. Nor is it necessary to tell me to be nice, I’m always very nice to people on the phone. They are trying to help me and it’s not their fault that they don’t have the tools they need to do their job well. I do wonder whether warnings to “be nice” actually have any effect on the caller who is habitually aggressive or abusive? I really doubt it. ↩︎

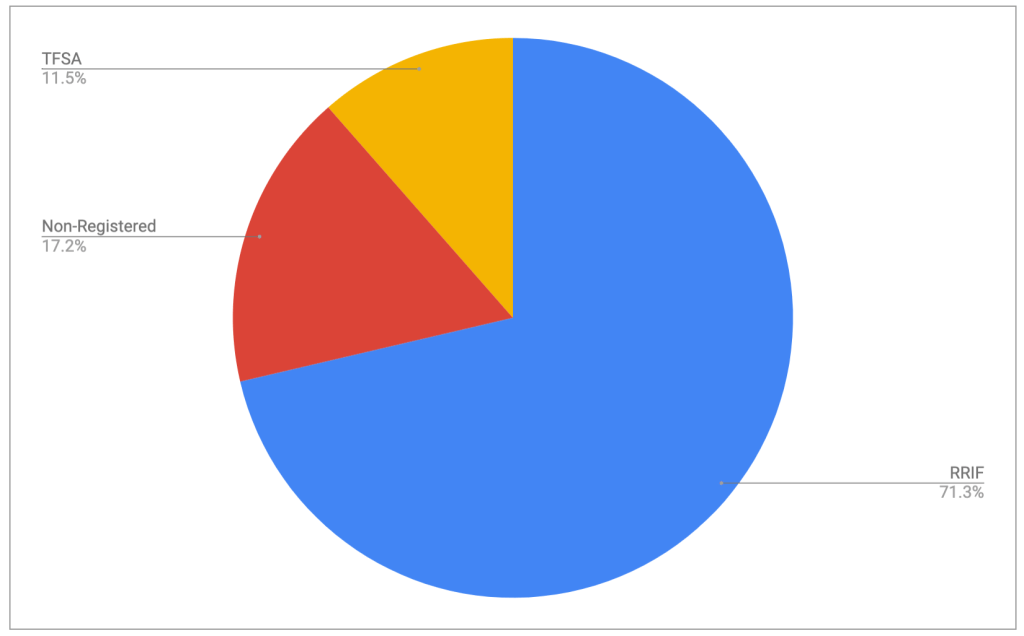

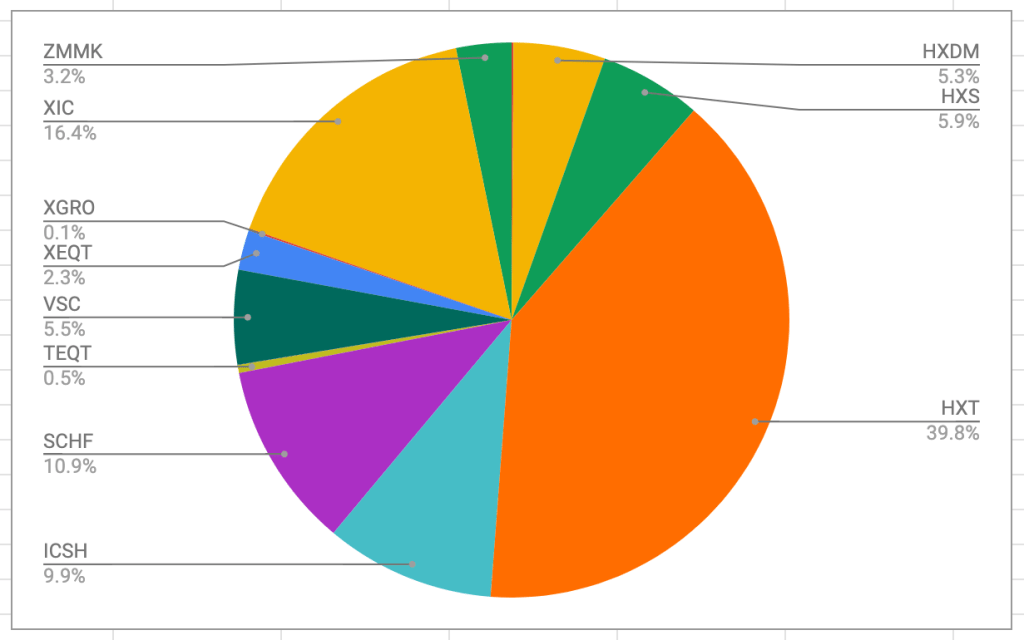

- Why is it a non-story? Because the “news” is that if you have a massive net worth (715k RRSP, million dollar secondary property), you can expect to pay a massive tax bill when you’re dead. Is this surprising to anyone? ↩︎