You can think of this as the video version of https://moneyengineer.ca/2025/03/28/how-i-think-about-investing-asset-classes/.

Enjoy!

You can think of this as the video version of https://moneyengineer.ca/2025/03/28/how-i-think-about-investing-asset-classes/.

Enjoy!

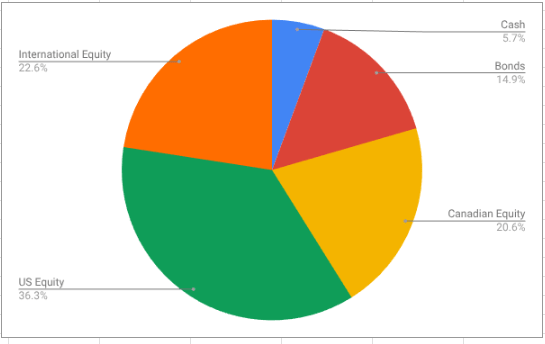

If you adhere to asset-allocation strategies (as I do) then rebalancing your assets to reset them back to your targets is a way to make sure you stay on track1. Some people do this on a regular basis (monthly, quarterly, annually) but I try to do it whenever the drift becomes noticeable (more than 1% off of my targets2). The targets for my portfolio are

Given the week we’ve just had, it’s not really a surprise to see that I’m overweight in cash, and underweight in foreign equity. Some of my cash is untouchable because it’s the built-in cushion that Variable Percentage Withdrawal (VPW) requires3, so that’s out. The majority of the cash in play is found in my RRIF accounts, and most of that is found in USD.

So the problem to solve for is to find a low-cost International Equity ETF that sells on the US market. Let’s walk through the steps I go through for that.

Long time readers will know that most of my USD holdings are invested in AOA. (What’s the deal with AOA? Asked and answered here.) Since AOA is an all-in-one ETF, and since I know that AOA has international holdings (around 28%), and I know that AOA is inexpensive to hold, I can just do what AOA does, right?

So that is certainly a possibility, but as it turns out, AOA invests in TWO international ETFs, namely:

IDEV and IEMG are both excellent funds, but I don’t really want to buy two funds if I can help it. AOA holds these two in a roughly 3:1 ratio, and I am too lazy to keep that straight.

So time for plan B.

So I type “international ETF USD” into Google and see what I get.

The first hit is linking to etfdb.com which isn’t my favourite website. They always list 100 ETFs when I want to choose from maybe 4. So I skip that link.

Then I get a hit for IXUS, which is an iShares product. This one I’ve heard of, and it has a clever name (ex-US, get it?). On IXUS’ overview page, I see three promising factoids:

So that’s pretty good, but I want to look at least one more ETF to be a good comparison shopper.

A little bit further down I get a hit for VXUS, a Vanguard product. Like IXUS, it has a clever name (ex-US, get it?) and so I feel compelled to look closer.

And I see three factoids again:

And so, with that, the decision is made: we go with VXUS because it’s 0.02% cheaper than IXUS.

This will be new ground for me, because it will be using my new provider for the first time (Questrade). My old provider let me sell one ETF and immediately buy another, and I assume that Questrade will also allow this, but until I try it, I’ve learned not to assume things.

Oh, yes, the “cash” in my USD RRIF is actually also an ETF, namely ICSH, which is because Questrade doesn’t provide any other means to earn money on “cash”.

So anyway, on Monday, a few hours after the stock market opens, I’ll take a look and see if trading is still a advisable — has the market suddenly recovered? Is it so volatile it warrants sitting on the sidelines? I’m guessing both of those will be a solid “no”, but I will wait until Monday to follow through.

I signed in yesterday to my brokerage account around lunchtime so I missed all the morning’s excitement. After everything I wrote above, I didn’t buy VXUS after all — since my US equity portion was also significantly below target, I bought AOA instead, thus increasing both my US and International equity positions at the same time. I used a limit order since the bid/ask spread was like 20 cents, far higher than I’m used to seeing.

When markets are this nutty, I don’t like making all purchases at once. Since Questrade trading of ETFs is now totally free, I can take my time and incrementally shift the portfolio back to targets.

Using the Multi-Asset tracker, I can break out my retirement savings in any number of ways. Here we take a look at the breakdown of my retirement portfolio between RRIFs, non-registered Investment accounts, and TFSAs.

Early on when I first launched this blog, one of my friends suggested that video content would be ideal for the topics I wanted to cover. “I’m a visual learner” was her pitch1. I did hesitate because I wasn’t sure what I would post there.

But the hesitation is over, and I’ve launched a YouTube channel which you can find in the top menu (“Videos”) or you can go to it directly: https://www.youtube.com/@MoneyEngineerCA.

The first video2 is a quick intro to the Multi-Asset Tracker, a Google Sheets template that’s based on my personal spreadsheet that I’ve developed over the years.

Today’s video is a quick look at BlackRock’s family of asset-allocation ETFs (XEQT, XGRO, XBAL, XCNS and XINC) and what makes the members of the family different.

My philosophy is to keep the videos short with no window dressing. There’s no big intro, no sponsor plugs3, no big plea to “Like and Subscribe”, and no theme music. We get going right from the opening frame. I reserve the right to jazz things up later, but with 2 views thus far I’m not too worried about going viral anytime soon.

If you have thoughts/comments/ideas about the videos, feel free to drop me a line at comments@moneyengineer.ca.

I’m starting my fourth month with Fizz, a newish provider of cellular services, owned by Quebecor/Videotron. I previously talked about my experience with US roaming (TL/DR: it was positive1) but this week, I found another way to save money, if you’re a Fizz user in Ontario or Quebec.

That is thanks to the Fizz Wallet.

In essence, the wallet allows you to pay as you go for services you don’t use a lot. For me, that could be SMS messaging. With the rise of data-based messaging apps (iMessage, Messenger, WhatsApp to name a few) the need for sending2 SMSes3 in my world is diminishing on a daily basis.

Right now I’m paying $20/month for unlimited Canada wide voice/text and 3GB of data. Right now I could choose to change my plan, eliminate texts and save $4/month, but 3GB monthly data is no longer an option — it’s either 1GB (which I’m not sure is sufficient) or 7GB (which is way more than I’d ever need, and $1 higher4 than what I’m paying now).

Fizz isn’t perfect: no 5G, no caller ID and I still haven’t quite figured out the limitations regarding roaming and voicemail, but it certainly is inexpensive: the current low-price offer is $19/month for unlimited Canada-wide calling, SMS, voicemail and 1G of data. Crank that up to 7G and it’s still just $25/month.

My dear wife became a client yesterday to take advantage of the $35 referral bonus; with Fizz eSIM support, the migration to Fizz took about 30 minutes from start to finish. And since I had a bunch of data piling up, I sent her 500M to get started.

If you want to give Fizz a try, my referral code is INSWI — it’s worth $35 to you (and me :-)).