Summary: In a previous post, I talked about preparing your portfolio for retirement. But now that the paycheques have stopped, how do I get paid from my DIY portfolio?

I got (retirement) paid for the first time today! This is indeed a cause for celebration, at least personally. As a DIYer who is self-funding retirement1, it’s not exactly sitting back and waiting for the cheque to arrive2. There’s a fair bit of work that has to be done if you want, as I do, a monthly salary.

As mentioned elsewhere, I’ve adopted the brilliant strategy of VPW (Variable Percentage Withdrawal) to calculate how much I can get paid every month.

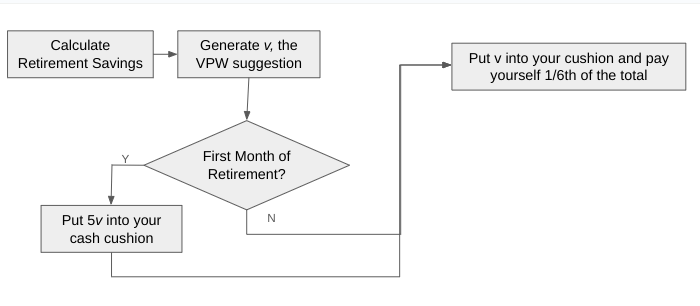

Here’s the high-level flowchart of how VPW works:

Let’s go through step by step.

Calculate Retirement Savings

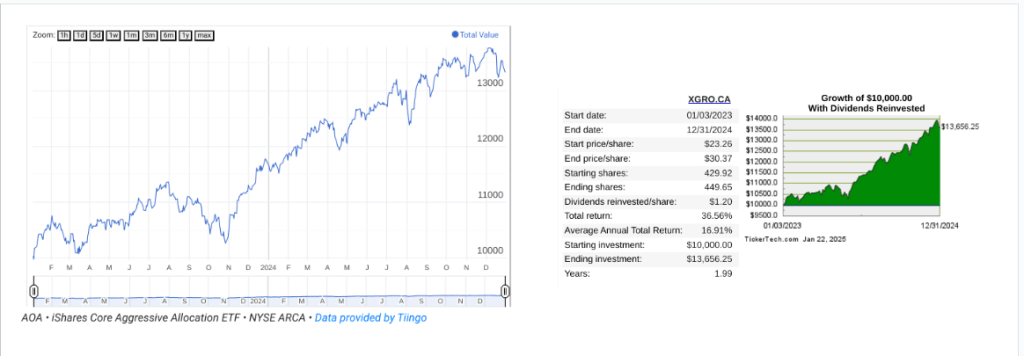

If you’ve simplified your retirement portfolio, this is probably as simple as logging in to your online broker’s portal and looking at what you’re worth today. For more complex scenarios (like mine, because I am test driving a new provider) you’ll need some sort of spreadsheet. Mine is based on this template. I don’t include day to day chequing accounts or anything like that. My retirement portfolio remains firewalled from all the daily puts and takes.

Generate v, the VPW Suggestion

This uses the VPW worksheet available over here. Basically, you enter a few parameters (how old you are, what your asset mix3 is, what your retirement savings are and what pensions (CPP, OAS or employer) you may have now or in the future. Predicting future CPP was made easier for me by using CPP Calculator. The first time you fill in the worksheet, it’s a bit more effort, but most of it (aside from retirement savings) doesn’t change much (if at all) month to month. Enter all the parameters, and out comes v, the monthly VPW4 “suggestion”.

Now, if this is the very first time you’re running through this, meaning that it’s your first month of retirement, there’s one additional step, and that is creating what the VPW folks refer to as a “cash cushion”. I think of it as a shock absorber myself, and my DIY enthusiast neighbour5? He thinks of it as the source of a cash waterfall you drink from monthly.

Whatever you choose to call it, the cash cushion, as the name implies, sits between the VPW suggestion and your retirement salary, dampening possible month to month swings caused by swings in your net worth. A sudden drop in the stock market won’t translate immediately to a sudden drop in your salary, and by the same token, a sudden rise in the stock market won’t translate immediately to a sudden rise in your monthly salary.

Creating the cushion the first time is easy. Just take 5 times what VPW suggests and put that in your cushion. That ought to be a firewalled account that pays decent interest.

Put v in your cushion and pay yourself 1/6th of the total

In the very first month, the astute reader will note that my salary is v, the VPW suggestion. As time goes on, the salary will vary with my retirement savings, and the cushion acts like a moving 6 month average function.

That, in essence, is what the monthly routine looks like.

The reality behind the scenes takes quite a bit more steps due to factors like

- How many RRIFs you have (personally, I have two…or maybe three6)

- Whether or not your scheduled RRIF payments cover your VPW-generated salary (mine do not and probably will not ever do so)

- The time lag between asset (stock/ETF) sale and cash availability7

- The ability (or not) to easily move money around between accounts8

I will show you the actual work behind the scenes in a future post, but be aware and take the time to work through the details before you pull the plug for real.

- I’m delaying CPP and OAS until much later to get more monthly money of inflation-indexed protection. ↩︎

- Or an envelope of cash, apparently. The things you get when you type “paycheque” in the search engine… ↩︎

- All VPW cares about is how much of your savings are in stocks AKA equity. More stocks = higher returns = more risk. ↩︎

- VPW also supports quarterly or annual calculations. I’m sticking with monthly since it’s much closer to what is typical cash flow management for my household. ↩︎

- And volunteer copy-editor, thanks Steve 🙂 ↩︎

- One spousal RRIF based on the spousal RRSP my spouse contributed to, one personal RRIF based on my personal RRSP. I also have a USD personal RRIF but my provider treats it as part of my personal CAD RRIF. My portal shows three accounts, but I only get two payments. ↩︎

- Typically, two days ↩︎

- I learned, sadly, that my current provider offers no way to move money between non-registered accounts without resorting to a phone call. As I have already reached my hold music limit for 2025, there’s no way I’m going to put up with that. And so the chequing account comes into play as a way to move money around at the cost of delay. Dear QTrade, please fix this. ↩︎