You can think of this as the video version of https://moneyengineer.ca/2025/03/28/how-i-think-about-investing-asset-classes/.

Enjoy!

You can think of this as the video version of https://moneyengineer.ca/2025/03/28/how-i-think-about-investing-asset-classes/.

Enjoy!

Early on when I first launched this blog, one of my friends suggested that video content would be ideal for the topics I wanted to cover. “I’m a visual learner” was her pitch1. I did hesitate because I wasn’t sure what I would post there.

But the hesitation is over, and I’ve launched a YouTube channel which you can find in the top menu (“Videos”) or you can go to it directly: https://www.youtube.com/@MoneyEngineerCA.

The first video2 is a quick intro to the Multi-Asset Tracker, a Google Sheets template that’s based on my personal spreadsheet that I’ve developed over the years.

Today’s video is a quick look at BlackRock’s family of asset-allocation ETFs (XEQT, XGRO, XBAL, XCNS and XINC) and what makes the members of the family different.

My philosophy is to keep the videos short with no window dressing. There’s no big intro, no sponsor plugs3, no big plea to “Like and Subscribe”, and no theme music. We get going right from the opening frame. I reserve the right to jazz things up later, but with 2 views thus far I’m not too worried about going viral anytime soon.

If you have thoughts/comments/ideas about the videos, feel free to drop me a line at comments@moneyengineer.ca.

I’m starting my fourth month with Fizz, a newish provider of cellular services, owned by Quebecor/Videotron. I previously talked about my experience with US roaming (TL/DR: it was positive1) but this week, I found another way to save money, if you’re a Fizz user in Ontario or Quebec.

That is thanks to the Fizz Wallet.

In essence, the wallet allows you to pay as you go for services you don’t use a lot. For me, that could be SMS messaging. With the rise of data-based messaging apps (iMessage, Messenger, WhatsApp to name a few) the need for sending2 SMSes3 in my world is diminishing on a daily basis.

Right now I’m paying $20/month for unlimited Canada wide voice/text and 3GB of data. Right now I could choose to change my plan, eliminate texts and save $4/month, but 3GB monthly data is no longer an option — it’s either 1GB (which I’m not sure is sufficient) or 7GB (which is way more than I’d ever need, and $1 higher4 than what I’m paying now).

Fizz isn’t perfect: no 5G, no caller ID and I still haven’t quite figured out the limitations regarding roaming and voicemail, but it certainly is inexpensive: the current low-price offer is $19/month for unlimited Canada-wide calling, SMS, voicemail and 1G of data. Crank that up to 7G and it’s still just $25/month.

My dear wife became a client yesterday to take advantage of the $35 referral bonus; with Fizz eSIM support, the migration to Fizz took about 30 minutes from start to finish. And since I had a bunch of data piling up, I sent her 500M to get started.

If you want to give Fizz a try, my referral code is INSWI — it’s worth $35 to you (and me :-)).

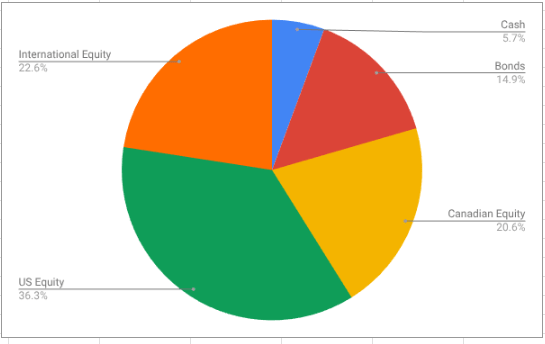

Passive investing while ensuring good diversification has been my strategy for decades. But how do I define “diversification”? For me, it’s always been about paying attention to how much of my total portfolio was invested in each of five1 asset classes and keeping them aligned with my targets:

I got this idea from my last financial advisor who provided me with a lovely Cerlox4 bound annual report showing me how hard they were working on my behalf5. The report included a pie chart of how my investments broke down. This is what that pie chart looks like in my portfolio this morning:

This pie chart has been my guiding principle: have a target percentage for each asset class in mind, and adjust your portfolio as needed to keep the percentages in line. This simple principle has been adopted by so-called asset allocation ETFs aka “all-in-ones” like (my personal favourites) XGRO6 and AOA7.

But are these even the right asset classes? Where are REITs8? Where’s precious metals? Where’s Bitcoin9? What’s your bond duration? Do you have enough exposure to high-growth geographies?

Short answer: just like I’m too lazy to pick stocks, I’m too lazy (and not smart enough) to pick a “winner” of a given asset class. The “periodic table” of investment returns by asset class is a must-read for DIY enthusiasts out there: https://themeasureofaplan.com/investment-returns-by-asset-class/ (go ahead, take a look, I’ll wait).

The folks at Measure of a Plan agree that trying to figure out the “hot” asset class is a very difficult task:

It’s no easy feat to pick the winner in a given year. The asset class rankings appear to be randomly tossed about over time, with the top performer in one year often falling down to the middle or bottom of the table in the next year.

https://themeasureofaplan.com/investment-returns-by-asset-class/

By keeping an eye on the pie chart, and shifting investments to align with my targets, I’m never at risk at being overweight in any one asset-class, and beaten-down asset-classes naturally get more funds to get the percentages right. It’s naturally causing “buy low, sell high” behaviour.

So: what about the asset classes I’m using? Are 5 asset classes too many? Too few? I don’t know. “Good enough” is sort of my philosophy in the spirit of trying to keep things simple.

The spreadsheet I’ve used to help me track my portfolio breakdown is found here. In future posts, I’ll talk a bit about how to make it work for you.

There are significant birthdays every DIY investor should be aware of. Did you know about all of them?

The list below is a gross simplification — like all things in the Canadian Tax code, the exceptions and caveats fill many pages, but this is roughly correct. I’ve included links so you can read the relevant sections yourself and see if you agree with my simplifications!

Per the feds, a birth certificate for your child is all you need to apply for a Social Insurance Number. And although their working days are far into the future, their RESP eligibility starts right away — but you can’t open an RESP for a child unless that child has a SIN. The lifetime limit for donations to an RESP is currently set at $50k/child. The sooner those contributions start, the sooner you can collect free money (the CESG, $500/year, $7200 per child lifetime), and the longer your contributions can benefit from the power of compounding.

This is significant one for a number of reasons!

Once you turn 181, you can open a TFSA and begin contributing. Even if you don’t start contributing, your TFSA limit starts to accumulate the year you turn 18. In 2025, that annual limit is $7000 per year, and it grows at the rate of inflation2. It’s cumulative, so it’s not a “use it now or lose it forever” kind of proposition. At the start of every calendar year, there are a flurry of announcements indicating the new annual limit.

You can contribute to your TFSA forever, even in retirement. I am!

If you’re over 18 and earn more than $3500 a year, you’ll have to pay CPP contributions. While current you may balk at this sort of reduction in your take-home pay, future you will appreciate the inflation-index adjusted salary you can collect later in life.

You can open a First Home Savings Account on your 18th birthday…or maybe your 19th birthday3. And the year you open it, you add $8000 in eligible contribution room…which continues every year, to a maximum of $40000.

The so-called “age of majority4” in Ontario allows you to roll in free money in the forms of GST credits, Trillium benefits5 (in Ontario) and carbon tax credits6 . The cost of admission is filing a tax return. No excuses — plenty of online providers offer free returns for “simple” returns and my friends at Wealthsimple offer “pay what you want” tax filing.

This is also a time you are eligible to open an RRSP7, which may make sense if you’re already maxing out your TFSA contributions.

An RESP can only be open for 35 years.

This is the first year you can choose to collect CPP; generally speaking, most experts recommend that you delay collecting CPP for as long as possible, for two reasons:

My tools page includes the very helpful CPP calculator, which can help you make a decision concerning your CPP start date.

This is the first year you can choose to collect OAS. Experts are a little more split on whether or not to delay this one — the benefits to delaying to age 70 are not as strong as for CPP8. My plan is to delay, as it’s another inflation-adjusted benefit.

If you’re collecting any sort of pension (RRIF payments, CPP, employer pension) this is the first age at which you can split that income with your spouse. This can reduce your tax bill.

You have to start taking CPP and OAS by this time.

You can no longer contribute to an RRSP and you have to open a RRIF. Lots of the literature out there seems to imply that this is the ONLY time you can open a RRIF, but rest assured, there’s no minimum age for opening a RRIF — I’ve been collecting from mine since the start of the year 🙂

This is the last year you can start collecting from an ALDA (advanced life deferred annuity) you have set up. The ALDA is a vehicle I just learned about, and need to do a bit more research. It may be a way to fund income in your later years when the complexity of managing withdrawals in a DIY fashion may be too cognitively overwhelming.

What birthdays are you thinking about? Let me know at comments@moneyengineer.ca.