Disclaimer: I’m not a tax expert, accountant or lawyer. My only expertise comes from being the financial caregiver to my late parents.

Say you’re the financial caregiver for your parent1. And you have come to the realization that they are going to die with a large estate. Maybe they have a good work pension. Maybe they have sold their principal residence and their monthly expenses would take 86 years to eat through the assets. Maybe they have both.

I’m going to make the assumption that your assessment is sound. That your parent does, in fact, have more money that they will need for what is left of their life2. I’ll go one further and make the assumption that your parent isn’t so keen on leaving a big legacy to the CRA. So what should you look out for?

Asset = part of estate = subject to estate tax

Anything of value (property, stocks/ETFs, GICs, art, furniture, cars, cash) owned by the parent at time of death becomes part of the estate, and is therefore subject to the “estate administration tax3” aka “probate tax”. And this money becomes frozen until the courts grant probate, something that takes months, if not years.

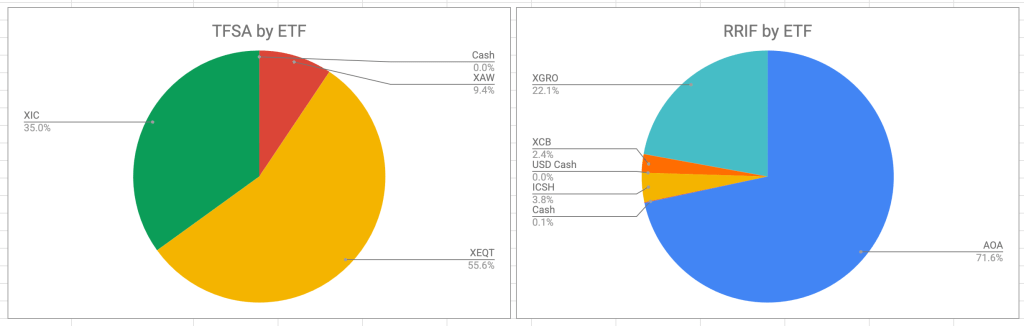

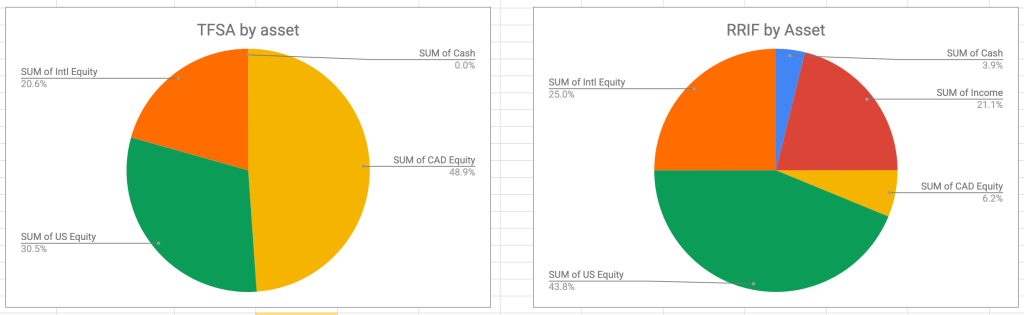

One way to dodge some of this probate tax is to name beneficiaries for TFSAs and RRIFs. Assets inside accounts set up this way will not be subject to the estate administration tax, and will not get tied up in probate court. But do be careful — a RRIF that flows to beneficiaries will still attract the same tax time bomb mentioned below, and this has to be taken into account because in my case, no tax was withheld!

RRIFs are a tax time bomb

Recall that RRIFs4 are just RRSPs in reverse: the RRSP is the growth phase, the RRIF is how you shrink it. And recall that RRSP contributions subtract from your taxable income in the year you make them. Did you think the government was going to let you pay no tax forever on that subtracted income? Of course not. That’s why RRIF income is treated as, you guessed it, income in the hands of the RRIF owner, and is taxed the same way as any income5.

Annual RRIF payments can be as large as the RRIF owner likes. Payments above the minimum6 attract witholding tax, which is normal, if you think about it. Taking out more the minimum can allow for some tax avoidance. Why? Taking a small tax hit for a few years is almost certainly preferable to the big tax bomb that happens when a parent dies with a large RRIF remaining. The parent in this situation will be assumed to have taken the entire RRIF as income on the day of death. If the RRIF is large, then you’ll be dealing with tax at the top rates7. By spreading out the RRIF income over a few tax years, you should be able to make the income small enough to avoid the top tax bracket; otherwise you’re not really saving much of anything. That will take some finessing.

Donate shares from non-registered accounts to charity

If there are ETFs or stocks held in non-registered accounts, the tax treatment of donated shares is quite generous. Not only do you get the charitable credit based on the market value of the donated shares, you avoid any capital gains tax. Larger charities accept stock donations, but if they don’t, you can also make use of a service like Canada Helps.

Give money away

Giving money to a charity generates a tax credit, which is good. Giving money to children, friends, relatives, strangers — also good. Gifts are tax-free for the giver and the recipient. Gifting houses or stocks is less good since doing this results in what CRA calls a “deemed disposition” meaning that CRA treats the gift as though your parent had sold the asset first, attracting the usual capital gains.

Of course, to give money away, you either have to have cash on hand, or you have to take it from the RRIF (where it’s treated as income to the parent who owns the RRIF), or you have to take it from non-registered accounts (where you may have to sell assets and attract capital gains), or you have to take it from the TFSA (which is effectively problem-free, other than you can’t put the money back in the same calendar year).