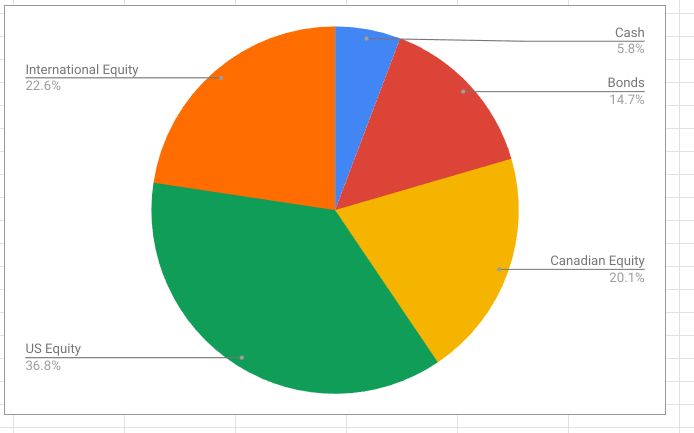

I’ve talked about my approach to investing before, which is slavishly devoted to maintaining a constant asset allocation across all my accounts. And as I’ve mentioned, my current targets are:

- 20% is Canadian Equity, 36% is US Equity, and 24% is International Equity, for a total of 80% equity overall

- 15% bonds

- 5% cash

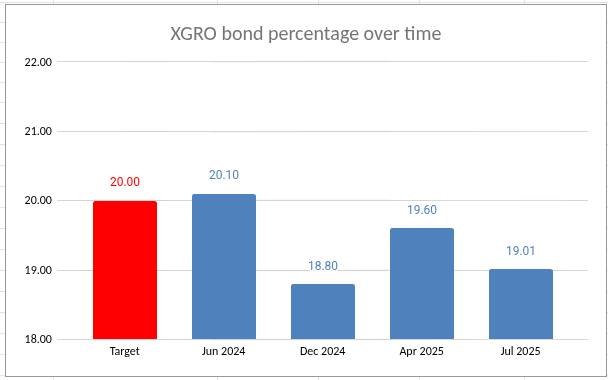

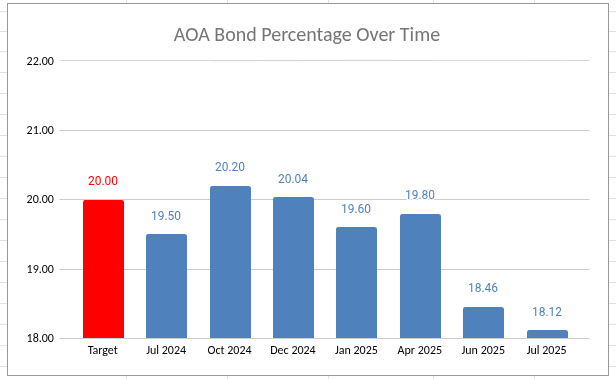

My allocation targets were picked to align with XGRO1, which, over time, will make up more and more of my retirement portfolio2.

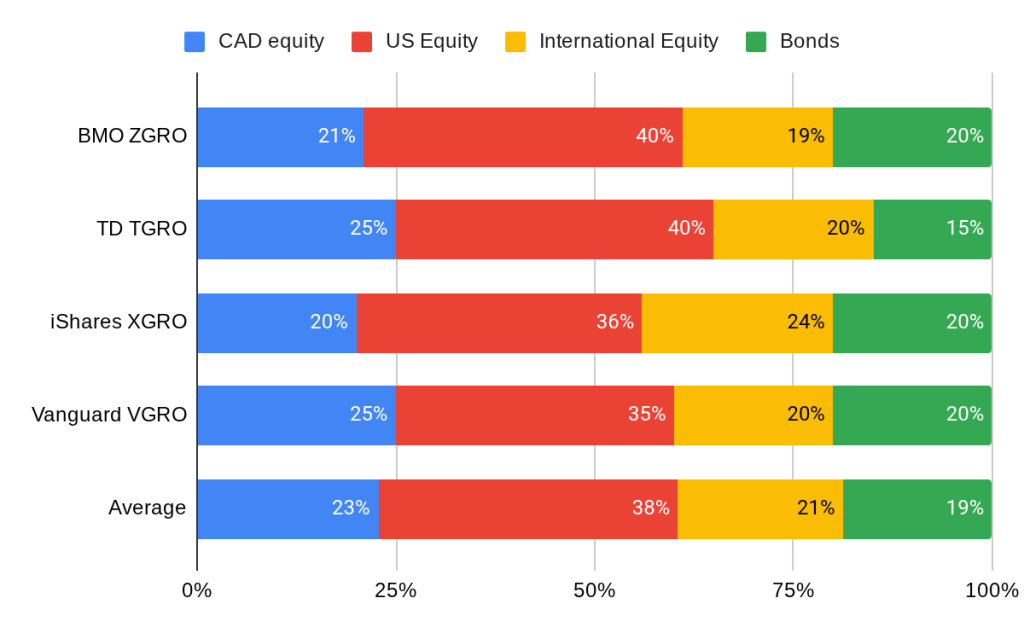

As I’ve written elsewhere, these are pretty broad categories and could be sub-divided further. I’ve not bothered with this myself, but I thought it would be an interesting exercise to survey what the major all-equity and high-growth funds have under the hood. And so, I present this comparison:

A few notes on the above:

- Canadian Equity: Some use an all-cap index (TGRO, VGRO) while some use a capped composite index (ZGRO, XGRO).

- US Equity: VGRO and XGRO use an all-cap index, TGRO sticks to large cap, and ZGRO holds large, mid and small cap indices. TGRO is a bit of an outlier because it doesn’t hold small cap..

- International Equity: TGRO takes an all countries approach, whereas the other three split between developed and emerging markets. Net effect is pretty much the same thing.

- Bonds: Here you find the greatest variation; VGRO is the only ETF to hold bonds outside of North America whereas TGRO holds only Canadian bonds. XGRO and ZGRO are pretty similar, with XGRO having a bit more Canadian bond exposure over ZGRO.

The most notable difference between my allocations and the average allocation of the big 4 funds is that I have more international exposure than other funds, and that’s because I’ve chosen to hitch my wagon to the iShares/XGRO family.

The reason? I started investing in the iShares family some time ago because it was the family that my old provider (QTrade) allowed me to trade without fees. With my current provider (Questrade), all of the families are free to trade, and hence my continued devotion to iShares/XGRO no longer holds that attraction — I could buy any of the all-in-ones. (Indeed, I’ve actually been adding some TD all-in-ones because their management fees are a bit lower).

But this exercise has given me food for thought; perhaps I have a bit too much bias to the international equity portion of the portfolio. But honestly, I can’t believe it makes that much of a difference, and churning my portfolio simply to reduce my international exposure a point or two seems unnecessary3.

- Why XGRO and not an all-in-one from another company? Read on. ↩︎

- I’m slowly converting my main holding (AOA, which trades in USD) to XGRO on a quarterly basis so that I’m never over exposed to foreign exchange variations. I convert a percentage of these holdings annually, corresponding to the percentage at which I’m draining my RRIF. ↩︎

- Running some numbers through https://www.dividendchannel.com/drip-returns-calculator/ demonstrates that XGRO is the bottom of the performance pile over the past 5 years or so as compared to TGRO, ZGRO and VGRO. The difference isn’t massive, and the window is short because these funds haven’t been around all that long, but it’s another data point to consider…p.s. the tool above doesn’t (yet?) understand the 3 for 1 reverse split ZGRO undertook in August, so best to end any simulation involving the BMO funds at August 1,2025. ↩︎