Something I never paid much attention to when I was building my retirement savings were the delays built into the system when it comes to moving money around. The Mechanics of Getting Paid in Retirement: 2026 Edition shows the steps I use to get a monthly paycheque, but it doesn’t show the delays. When I was working, I could predictably expect a paycheque twice a month. No guesswork. Now that I rely on these money movements to do things like pay bills, I’ve become a lot more attentive to where things slow down. Stressing about them isn’t helpful, but knowing about them in advance means you can build them into your plan so you don’t get caught in a cash flow crunch.

I should preface this by saying that I use Questrade and Wealthsimple for my providers, and how your provider handles things can be quite different, so take these as examples, not as absolutes. So where have I seen things slow down?

Time between selling an asset and having useable cash

Here I’m talking about cash as cash, not cash to immediately do another trade, i.e. sell ETF “a” and then use the proceeds to buy ETF “b”. For that example, I think most brokers allow you to sell to buy immediately after the trade executes, at least in my experience.

Here I’m talking about selling ETF “a” so you have the cash to pay your credit card balance. This is usually a multi-step process. The first step is having access to the cash you gain from the proceeds of a sale. This is generally speaking a business day after the trade executes. So if you sell on Monday, the cash appears in your account on Tuesday. If you have a margin account (which I do for my non-registered holdings), then it has the nice side benefit of providing access to the cash immediately after the trade executes.

So now that the cash is there in your trading account, you then have to get it to a place where you can spend it. And here there will be a lot of variability depending on who your broker is, who you bank with, and how you actually move the money (EFT, wire transfer, physical cheque).

For me, I use EFT withdrawals to my CIBC chequing account. And this has delays too.

As an example, I executed a trade in my Questrade non-registered account to help fund my December paycheque.

- December 23rd: sold some HXT in the morning, immediately requested a withdrawal to my CIBC account using an EFT. The money was available instantly because I have margin in that account.1

- December 29th: deposit received to my chequing account

- # of business days: Dec 23rd (0.5) Dec 24th(1), December 29th (2)= 2.5 days to get my $$$

I also sold some funds in my Wealthsimple account on December 23rd. I wasn’t able to withdraw anything until the following day since this account isn’t a margin account. But on the 24th, when I made the request via EFT, the money appeared in my chequing account in minutes. This was 1.1 days2 to get my $$$$.

I do recall when I managed my parent’s BMOI account cash in a non-registered account could immediately be used for bill pay, cheque writing, eTransfers or ATM withdrawals, thanks to their “AccountLInk” service.

Delays in moving money between accounts at the same brokerage

In my VPW-driven decumulation methodology, I have a non-registered Questrade account that is exclusively used as the “cash cushion” — about 5 months of rolling average salary, invested in ZMMK and ICSH, two funds that are on my ETF All-Stars page. Every month, I either get paid from this account or I move money into it from my non-registered account. Getting paid undergoes the same delays as I mentioned above: about 2.5 days, but moving money into this account from another account (one would think) is instantaneous, no? No, not with Questrade.

Typically, it takes a day before the money becomes useable in the destination account. Not so with Wealthsimple, where transfers are instantaneous.

Delays in getting dividend payments

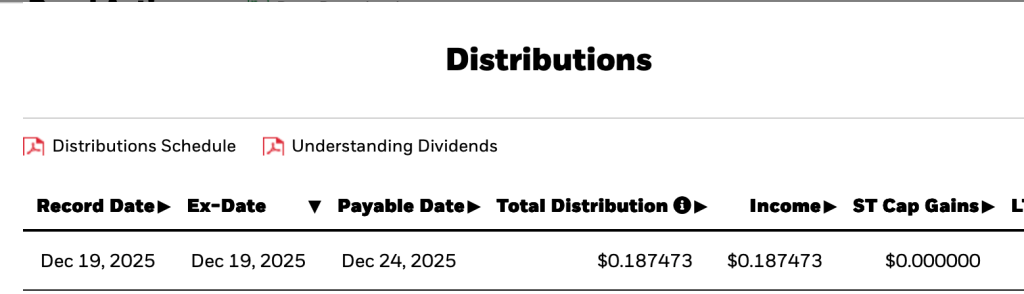

All ETFs publish their dividend schedule. For example, here’s what ICSH’S looks like:

“Ex-Date”, at least for my provider (Questrade) is the date used to indicate a “dividend event” notification. But “ex-date” isn’t when you should look for your dividend payment; you have to own the ETF in question by ex-date to take part in the next dividend payment. And so “Payable Date” is the one of interest, and the lag between the ex-date and the payable date is highly dependent on the ETF in question. Since most of my ETFs pay out either quarterly or monthly, often declaring ex-dividend on the last business day of the month, the first week of January will be active with new dividend funds rolling into my various accounts.

Delays: Just Roll with it

While I do find it irritating that my own money gets tied up for days at a time for no discernible reason, I’ve adapted my expectations accordingly and don’t worry about it. In the early days of retirement, be aware that things may not happen as quickly as you expect, so it’s probably a good idea to have a bit of cash flow leeway in the first month or two as you work out the kinks in your own decumulation system.