***Updated numbers February 2026***

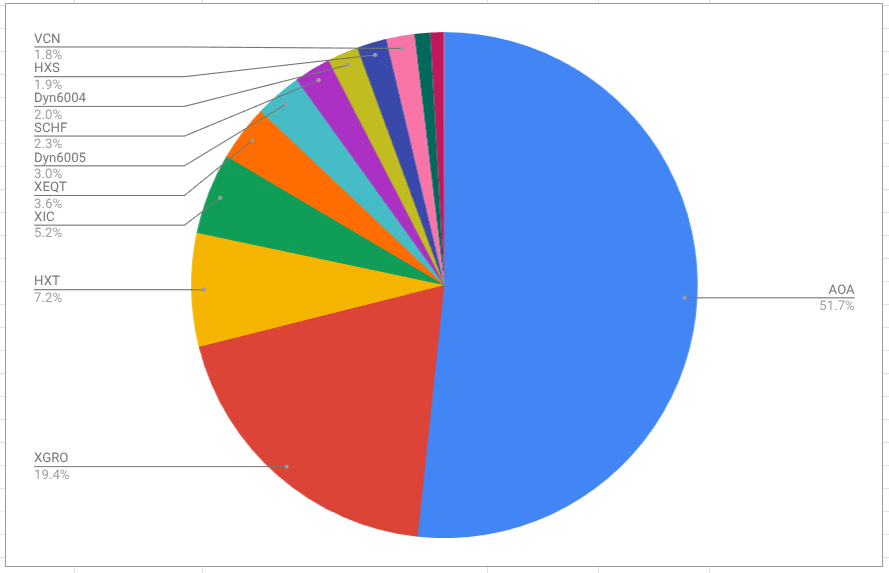

As mentioned elsewhere, I rely heavily on all-in-one ETFs in my retirement portfolio. New to all-in-ones? Read a bit about them here.

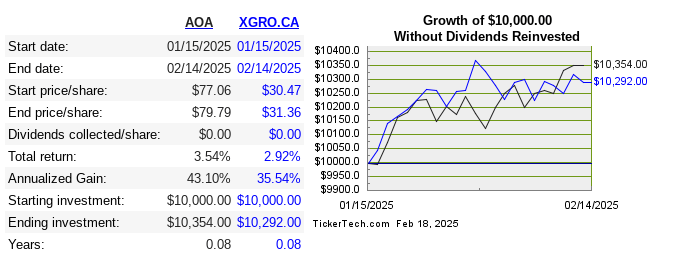

Previously ,I covered what’s in XGRO, which is an all-in-one you can purchase on the Canadian market. Because I also happen to have a lot of US dollar-based retirement savings, I have the majority of those funds invested in AOA. AOA is an 80/20 fund 1 offered by BlackRock. It seems that this sort of all-in-one is not as popular in the US as Canada, not sure why2. I see offerings from State Street that sound similar. BlackRock has other members of their asset allocation family with different equity percentages — there’s something for everyone!3

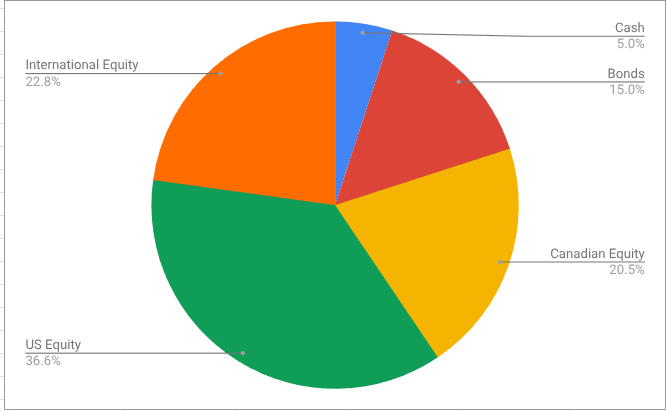

I thought it would be interesting to see what, exactly, is underneath every $100 you invest in AOA. So by reading AOA’s ETF description, following the ETF descriptions of what’s inside AOA, and doing a little math, I came up with the following breakdown4:

| Fund | What is it? | How much? | Colour Commentary |

|---|---|---|---|

| IVV | US stock coverage that tracks the S&P 500 Index, 500 of the largest US companies | $44.53 of your $100 investment (of which ~3.50$ is in Nvidia, ~$3 in Apple, and ~$2 in Microsoft, with ~$1 in Amazon, Alphabet, Meta, Broadcom and Tesla) | The Magnificent 7 and 493 other companies |

| IDEV | Broad international (ex-US) developed market stock coverage that tracks the MSCI WORLD ex USA IMI Index, about 2250 companies | $23.02 of your $100 investment (of which ASML gets 42 cents, Roche gets 26 cents…) | This also includes a tiny slice of Canada…top holding is RBC at 18 cents of your $100 |

| IUSB | Broad US Bond market exposure, about 16,000 bonds from government and corporate entities | $16.36 of your $100 investment (of which $6.45 is in US Treasury, $1.44 is in the Federal National Mortgage Association…) | 12 month trailing yield is 4.18%, not too shabby |

| IEMG | 3500 or so international companies from emerging markets, following the MSCI Emerging Markets Investable Market Index | $9.29 of your $100 investment (of which $1.06 is in Taiwan Semi, 42 cents is in Samsung..) | 23% China, 22% Taiwan, 16% South Korea, 14% India, … |

| IAGG | About 5800 international bonds tracking the Bloomberg Global Aggregate ex USD 10% Issuer Capped (Hedged) Index5 | $2.83 of your $100 investment (of which 30 cents is Japanese T-Bills) | Trailing 12 month yield = 3.27%, has lost a full point in the last year |

| IJH | US Midmarket stocks that track the S&P MidCap 400 Index | $2.59 of your $100 investment (of which 2 cents is in Lumentum, who I’ve never heard of) | 25% Industrials, 15% Financials… |

| IJR | US Small Cap stocks that track the S&P SmallCap 600 Index | $1.22 of your $100 investment (largest holding is Solstice Advanced Materials) | IJH+IJR+IVV is sort of similar to ITOT |

Like XGRO, investing in an all-in-one like AOA provides you with exposure to a bunch of different asset types across many different geographies in one product, including all of the “hot” stocks you read about ad nauseam. Diversification under one banner.

The big difference from XGRO is the very tiny representation of Canada overall. I worked it out to about 2.5% of the overall number, which makes sense given the size of Canada on a global scale.

I came across the “Three Fund Portfolio” popularized by Bogleheads over 15 years ago. AOA and its family members is more or less that concept.

- Shorthand for “80% equity, 20% bonds”. There remains a lot of disagreement about the appropriate asset allocation, e.g. https://www.bogleheads.org/forum/viewtopic.php?t=210178 ↩︎

- Instead, I see a lot of “target date” retirement ETFs, which are in some ways similar, but lower the equity percentages as you get closer to the target date. ↩︎

- There’s also AOR (60% equity), AOM (40% Equity) and AOK (30% Equity) ↩︎

- Compare with the XGRO breakdown at https://moneyengineer.ca/2025/01/30/whats-the-deal-with-xgro/ ↩︎

- That’s a mouthful. ↩︎