As a recent and relatively young retiree, I get this question a lot. I’ll try to break down the significant steps in the journey….

It started with knowing how much I actually had saved and tracking it

When you have multiple accounts across multiple providers, this can be more difficult than it should be. The full list circa 5 years ago looked something like this:

- Joint investment account in Canadian Dollars

- Joint investment account in US Dollars1

- My spouse’s investment account2

- My TFSA account

- My spouse’s TFSA account

- My RRSP in Canadian dollars

- My RRSP in US dollars

- My wife’s Spousal RRSP in Canadian dollars

- My wife’s Spousal RRSP in US dollars

- My spousal RRSP

- My RRSP at my employer-mandated provider3

- My DPSP4 at my employer-mandated provider

So yeah, a lot of accounts to keep track of. Not to mention that the RRSPs and TFSAs still had active monthly contributions, so aside from stock market changes, the actual amount being invested kept changing, too.

I built a partly-automated Google Sheets spreadsheet to keep track of everything. The template I used is over here if you’re interested.

Knowing how much I had saved for my retirement allowed me to start charting progress, and even allowed me to build models with calendar predictions for hitting milestones.

Then, I started researching how others figured this out

A book that made a lot of sense to me at the time was Fred Vettese’s great book, “Retirement Income for Life“. This started me down the rabbit hole of the many, many forecasting tools out there. A small sample included:

These tools provided me with three very important pieces of information.

First, it forced me to think about what retirement might look like from a budget perspective. What will I spend per month/per year in retirement on housing, utilities, transportation, entertainment, medical expenses, charitable giving, clothes, subscriptions….the list can be very long.

Second, it also forced me to think about how income would work in retirement. Would I radically change what I was investing in? Would I still earn money part-time? How much would that bring in? For how long?

Third, every simulation I ran showed me that I was quite close to retiring. But honestly, the amount of effort I put into running the numbers through these free tools was not very high. So I was still not feeling very sure I really had a handle on things.

I paid for a professional assessment

One habit of mine is that unless I have money invested in something, I’m unlikely to follow through. I want to learn piano, so prepaying for a year of lessons provides me with the incentive to put in time at the keyboard every day without fail. The same held true for making a retirement plan. Until and unless I put some money against it, I was likely to keep putting off making a decision. So I started searching for an independent financial planner who specialized in retirement. Someone local to me was Retirement in View5 and with appointment booked and payment sent, I was on my way to have a pro look at what I had concocted. How did I pick this provider? I had a short list of must-haves:

- They didn’t sell products, only services. Providers who sell products (e.g. mutual funds, ongoing subscriptions) are always going to have some degree of a conflict of interest. I wanted to pay for advice, not stuff I didn’t need.

- They had professional designations (CFP is the usual one)

- They seemed to have a clue about retirement

The process of producing a detailed plan forces you to put a stake in the ground with respect to the questions I raised in the previous section: what’s your net worth, what’s it invested in, what’s your budget, what’s your work plan and so on.

The net result of the assessment from two years ago was that I was in good shape to retire two years from now, in 2027. It also provided me with the specific, per account totals I should have in place in my retirement savings. Those totals became my obsession, since they represented “the number” I needed to retire. The assessment also gave me a realization that the mechanics of withdrawing from your holdings isn’t trivial if you’re also trying to reduce taxes (and who isn’t, right?). The big things I learned from my encounter were:

- I had become accustomed to thinking of taxes in terms of marginal rates, i.e. the rate of tax you are paying for the last dollar you earn. For retirement, it makes a lot more sense to think of overall tax rates, meaning the average rate of tax you’re paying. And since RRIF/RRSP income is treated differently from capital gains income which is treated differently from dividend income, you can play with sequencing to have some control over your annual tax bill.

- Start with drawing down your RRSP6 holdings. Otherwise, by the time you start collecting CPP and OAS, you’re going to be paying a lot of tax, and maybe foregoing the income-tested OAS.

- Delay CPP and OAS as long as possible, since this income may be the only income you have that is inflation-adjusted. (ok, this wasn’t really new, just about every pundit out there recommends you do this)

Some Lingering Doubts, But Onward!

And so, in 2023, I resigned myself to retiring sometime in 2027 and continued doing what I was doing, namely tracking my retirement savings and contributing to TFSA and RRSP. I even built a little “number tracker” to show how close I was to the targets I had for retirement.

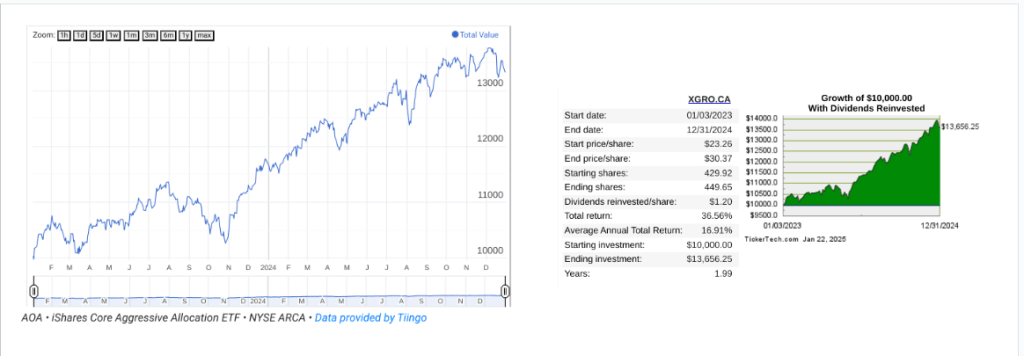

And then, in 2023 and 2024, the stock market had back-to-back banner years, and early in 2024, barring a total disaster, it was looking quite promising that I would hit “the number” in the next 6 months. What? The assessment I paid for showed quite clearly that I shouldn’t have hit that number until 2027!

I realized that ALL the modeling, ALL the assessments, ALL the forecasts are based on static assumptions. Static inflation. Static growth from your portfolio. Static spending budgets, adjusted for inflation. And while static assumptions certainly make modeling easier, real life does not work that way, proven, in my mind, by the fact that my portfolio was a full 2 years ahead where it was predicted to be 2 years prior. And sure, you could build models that account for all kinds of changes, but you’re at that point building guesses on guesses. It all left me feeling rather unsatisfied.

Regardless, at that point, I made the decision that I would “officially” retire at the end of 2024 as long as the numbers held up midway through 2024. And they did. And I did.

But there was still the nagging problem I felt. 2023 and 2024, were certainly to my advantage, but what about the next two years? And the ten years after that? What happens if the stock market were to take a large beating the week after I stopped collecting a paycheque? Would I have to stock up on cheap ramen as a fallback?

It was in the last 12 months or so I discovered the concept of VPW — variable percentage withdrawal. A concept that much better models the real world. More on that next time.