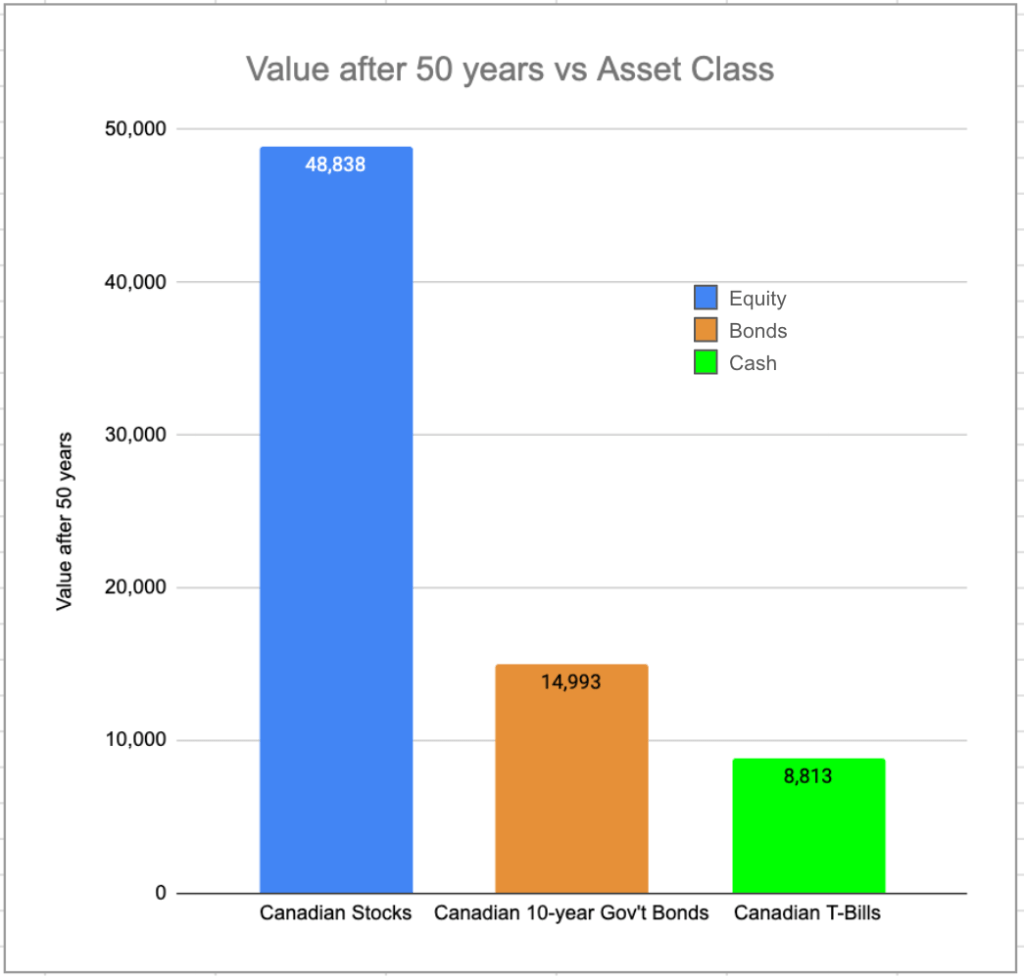

Previously, we talked in broad terms about the categories of what you can invest in, namely Equities, Bonds, and Cash. Having % allocation targets for each of these classes is a necessary starting point for making decisions. Here’s a post that talks about how to get there.

Maybe it’s helpful to take a look at some examples of what you can buy to hit each of these categories. I’m going to use iShares as the guinea pig since it offers a lot of products, but you could play the same game with any provider you like.

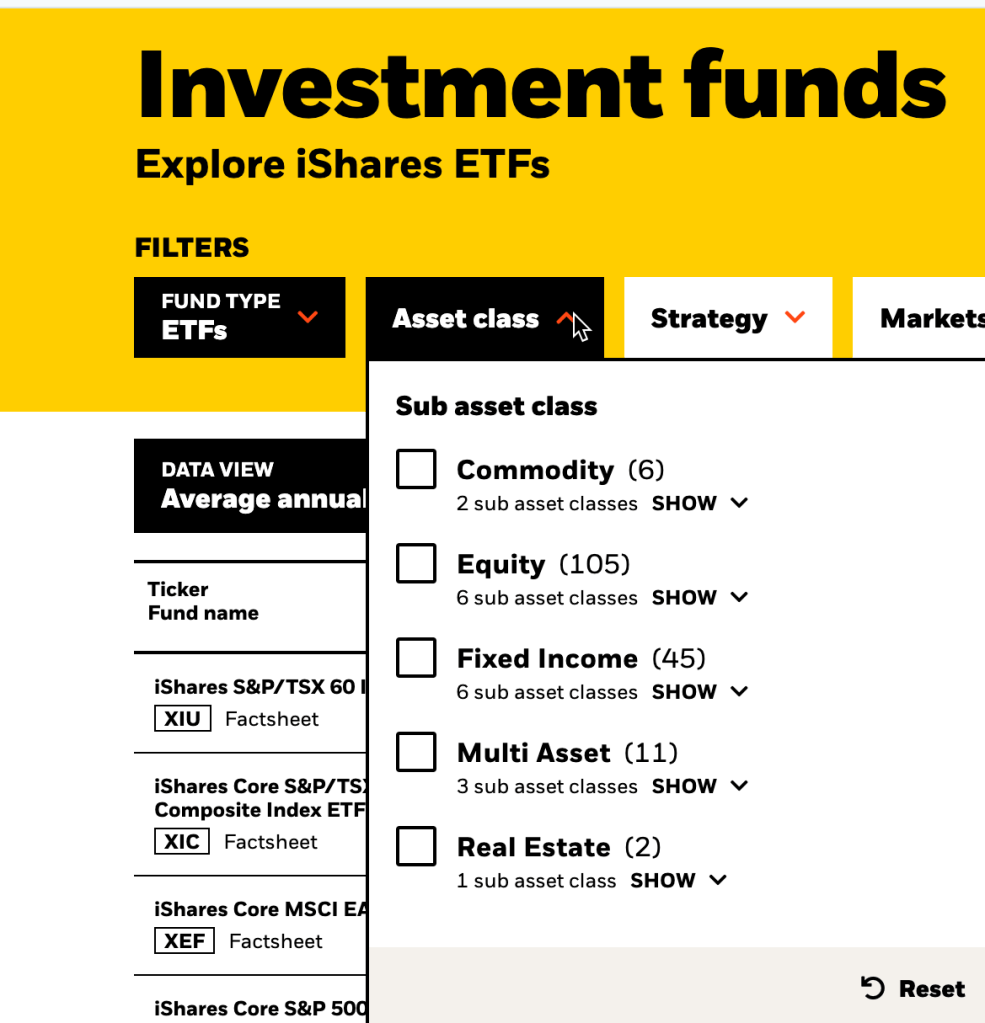

So if you visit iShares ETF page (this is what I’m looking at as I write this), you are presented with a list of (and I’m not joking here), 169 different ETFs. Ouch. How can anyone decide which of these is the best fit?

Helpfully, the page includes an “Asset Class” Filter:

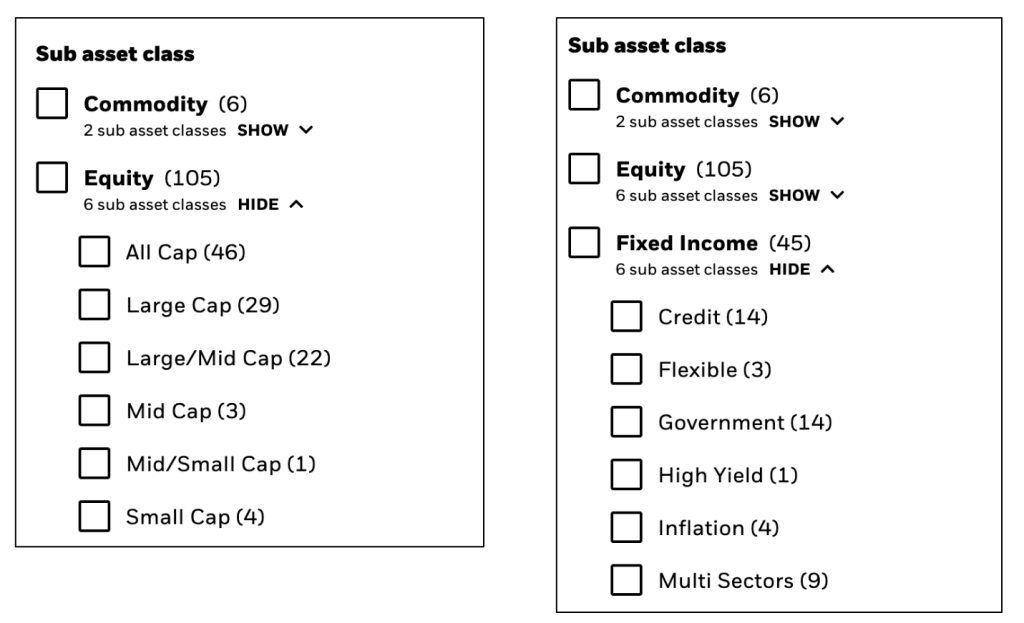

…and now you can quickly recognize “Equity” (with 105 different ETFs to choose from). “Fixed Income” is the other term of interest — this will include bonds and probably something that looks more like cash. So this is now looking a little more sane. Wait, what’s this? They each have “sub classes”?

This narrows things down somewhat. Let’s break these down further.

Equity Sub-Classes

The term “Cap”1 comes up here. This is short for “capitalization” or, in plain English, “How big is the company we’re investing in?”. I don’t like to place bets on which companies are the most appropriate, so I would gravitate to the “All Cap” sub asset class here. “Large Cap” is probably the next best bet, since large companies tend to dominate the returns in the markets they serve. So let’s select both2.

We’re still left with 75 ETFs with that filter. Still a lot to take in. I suggest sorting by “Net Assets” with the largest on top by clicking in the appropriate column. I figure if other people are investing in these funds, why shouldn’t I?

So here’s my take on the ETFs I see on my screen:

| ETF Symbol | Class | Consider? | Comments |

|---|---|---|---|

| XIU, XIC | CAD Equity | Y | Both variations of TSX. I would lean towards XIC because it is cheaper to own. |

| XSP, XUS, XUU | US Equity | Y | XSP is “hedged” meaning it tries to take away the FX variations, and I normally don’t worry about that. XUU would be my top pick here. |

| XEF, XFH, XSEM, XEC | Int’l Equity | Y | XSEM/XEC are solely emerging markets, and I would never just hold it absent something like XEF/XFH as well. If I had to pick one, it would be XEF since it’s unhedged. If I could add a second, it would be XEC because it’s cheaper to own. |

| XQQ | US Equity | N | This is too narrowly focused on 100 Nasdaq stocks; the point of buying a asset category is to buy as many companies as possible |

| XAW | US Equity + Int’l Equity | Y | An easy way to get non-Canadian Equity exposure with one ETF |

| XGD, XEI, XDV, XFN, XEG, CPD, CDZ, CIF, XIT, XHC | CAD Equity | N | These are all too narrowly focused and/or trying to make bets on specific parts of the market. Asset allocation is about buying the whole market. |

| Everything else | No idea | N | There are probably funds that I would consider further down the list but there’s only so many hours in the day, ya know? |

Fixed Income Sub-Classes

One thing I’ve learned is that Fixed Income is harder to parse than Equity. My quick impression of the names I see on my screen:

- Credit: No idea what this might mean

- Flexible: ibid

- Government: ok, that’s easy, this is only looking at bonds issued by governments. This tends to be the most popular segment of the bond market because (a) there’s a lot of them3 and (b) they are seen as safe investments.

- High Yield: This is code for “junk bonds”. More risky, but higher rates of interest.

- Inflation: My guess is that this is what is intended to mean “cash”

- Multi-Sectors: My guess is that this trying to build a broad universe of bonds.

So, for simplicity, I think I’ll ignore the sub-segments but give you my take on the largest offering here again.

| ETF Symbol | Sub Asset Class | Consider? | Comments |

|---|---|---|---|

| XBB | Multi-Sector | Y | “Core Canadian Universe” sounds like it’s got a lot of holdings across the spectrum, and it’s cheap to own. Perfect. This is clearly “Bonds” in my nomenclature. |

| XSB | Multi-Sector | Y | “Short Term Bond Index” makes me wonder if this is leaning towards a cash-like investment. The fact sheet puts the loan duration at “1 to 5 years” which isn’t cash-like enough for me. This is “Bonds”, albeit rather conservative ones. |

| XCB, XSH | Credit | Y | This is just the corporate bond market with no government. XSH is less risky because its bonds have a shorter duration on average. |

| CMR | Multi-Sector | Y | “Premium Money Market” sounds like “Cash” to me, and reading the fact sheet4 makes it sound a lot like ZMMK which was my previous winner in this category. |

| XGB | Gov’t | N | Nothing wrong with it, but I don’t buy “just” government bond ETFs. Without some corporate exposure, they don’t generate enough returns for my liking. I’ll take the risk. |

| XLB | Multi-Sector | N | This only buys long-duration bonds. This would be ok if you had holdings elsewhere on the shorter side. |

| Everything else | No idea | N | There are probably funds that I would consider further down the list but there’s only so many hours in the day, ya know? |

I do have to break away from the largest list to mention some ETFs on the Fixed Income chart that I didn’t know you could buy on the Canadian Market: XSTH and XSTP, which track the TIPS Bond Index. The TIPS index is well known to US investors5 because it’s a very cheap way to buy an inflationary hedge — it’s in the name, as TIPS stands for “Treasury Inflation-Protected Securities”. Now, of course, this refers to US Inflation, and unless you’re buying XSTH (which is the same as XSTP, except hedged to avoid FX changes) you’re also buying into a security that will vary with the CAD/USD exchange rate. So, not sure it’s of interest to the average Canadian investor, but it’s something I didn’t know about before.

Other classes in the iShares List

We only looked deeply at the Equity and Fixed Income categories, but what about the others?

- The Commodity category holds ETFs that trade in one of Gold, Silver or Bitcoin. None of these provide predictable returns and are very narrow bets, so for that reason, I have no interest.

- The Multi-Asset category contains funds that are a mix of Equity and Fixed Income, with the exact ratios depending on which specific fund you buy. This category contains funds I invest heavily in, namely XGRO and XEQT. I cover “all-in-one” funds like this in this article. Multi-asset funds basically take all the work of trying to balance your Equity and Bond percentages out of your hands for a very low price.

- The Real Estate Category is just another segment of the Equity category and like other sub-segments, I don’t pay any attention to this one either.

A Final Word

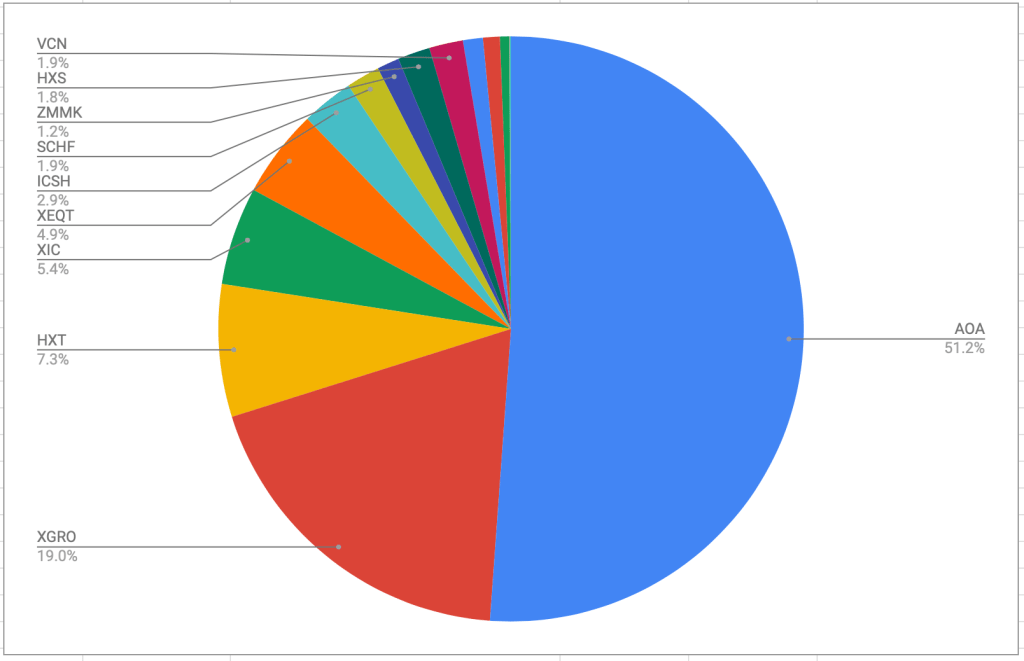

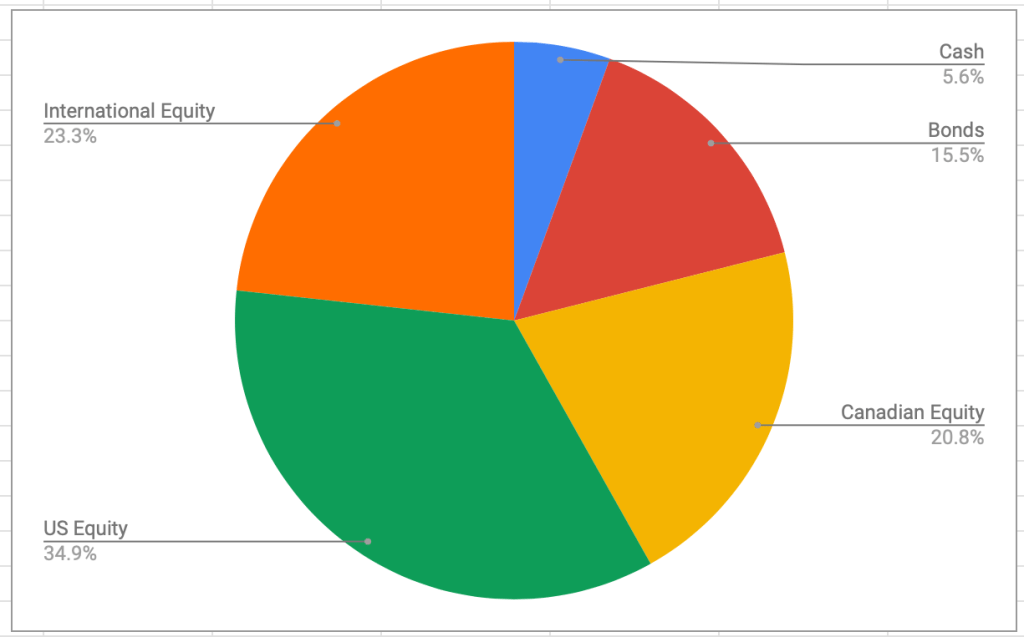

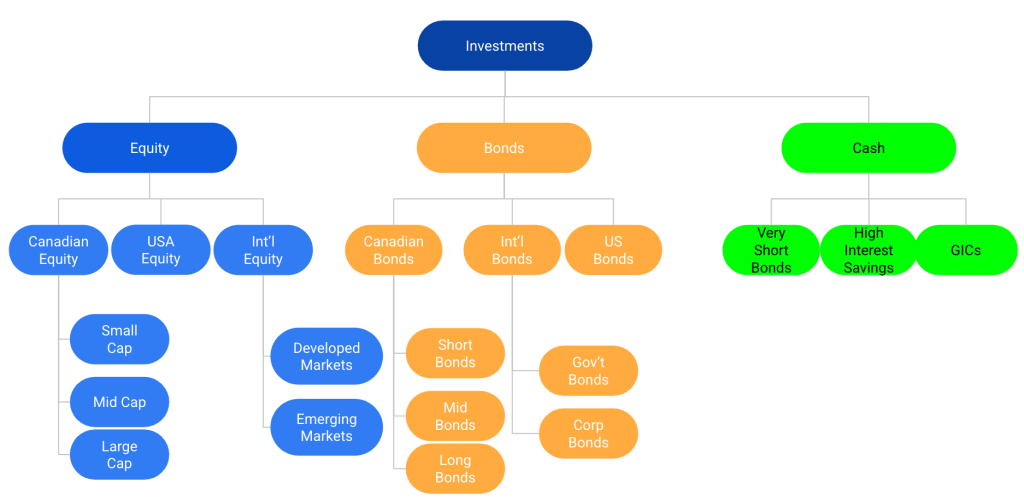

It’s easy to slice and dice the three broad asset categories (Equity, Bonds, Cash) many different ways and you can spend many pleasurable6 hours finding the absolute “best” ETF for any subsegment listed above, or you could invent your own (Ultra Short Term Emerging Market High Yield Bonds Canadian Hedged?). It’s easy to go overboard here, and in the course of simplifying my portfolio, I have restricted myself to 5 broad categories when i think about my investments:

- Equity: divided into 3 buckets for Canadian, US and International Equity

- Bonds: There are no sub-buckets here, but the products I buy have broad geographic, segment, and duration coverage. Are they allocated optimally? No idea.

- Cash: Everything in this category is held in either USD or CAD ultra-short term bonds.

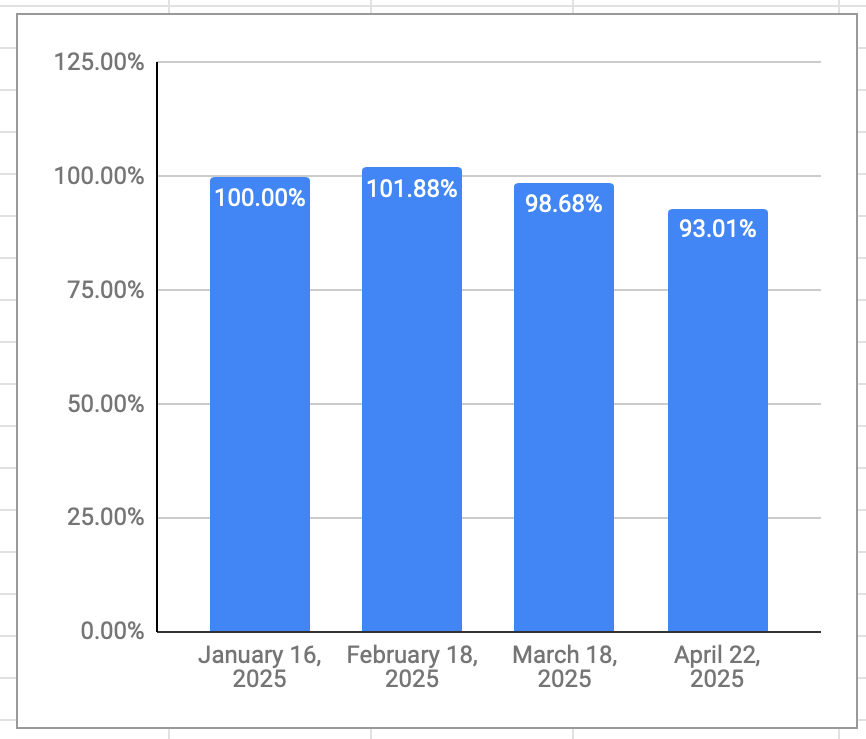

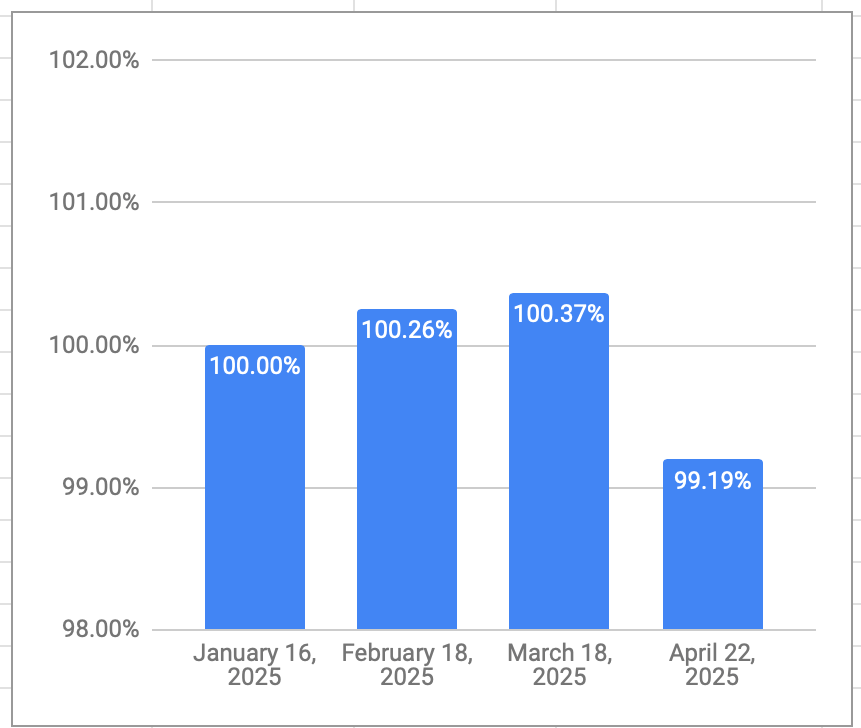

You can see the specific holdings in my portfolio by looking at any of the “What’s in my Portfolio” posts (April 2025 is here or a series of 3 videos is found here) or you can just see the 4 ETFs I hold for the long term here.

And in the course of writing this article, I discovered this fun Asset Mixer you can use to experiment with different asset allocations yourself. It’s like making cocktails, except with money 🙂

- Bill Barilko disappeared… ↩︎

- Full disclosure: I cheated here. I couldn’t figure out why I wasn’t seeing TSX funds under “all Cap” but that’s because the usual TSX 60 fund is listed as a large cap fund. ↩︎

- Governments do love deficit spending ↩︎

- In Feb 2025, CMR added commercial paper to its holdings, making it look a lot more like ZMMK. I’ll have to take a closer look at this one. ↩︎

- Especially Bogleheads. Look it up. ↩︎

- Well, for some of us ↩︎