I am not a lawyer, accountant or tax expert. Your situation may be a lot different than mine. Seek professional guidance if needed.

Part 1 of this blog is found here.

I’m still wrapping up the estate of my late mother, who died a little over a year ago, a year and a bit after my father died.

My situation

All my mom’s worldly assets were held with BMO Investorline: RRIF, TFSA and a non-registered account. This was a self-directed account; the relationship with BMO (as I came to learn) was pretty informal. Me and my siblings were named as beneficiaries of the estate, and my Mom had taken steps to name us as beneficiaries for the RRIF and TFSA. More details about how that works were covered in a previous post.

First weeks

I had ready access to estate cash because I was named as a joint account holder on my Mom’s chequing account1. This is a very useful thing to have in place, since it can cover expenses incurred after death: funeral costs, moving expenses are two that come to mind. I treated this account as part of the estate, but it allowed me to spend the estate’s money instead of my own for these things.

DIY Estate Handling

Informing BMO Investorline2 of my mother’s death was required, and that took a single call to the general help desk. After about a week I had an initial meeting with their estate department.

Once I provided proof of death, all accounts were frozen and I could no longer even see what was in them. BMOI correctly noted that we were the beneficiaries of the TFSA and RRIF and we started the paper-intensive3work of liquidating and distributing the assets held in those accounts. I checked my notes — it took about 2 months for that step to be fully completed.

What was unexpected was that BMOI gave us ALL the money in the RRIF, with no taxes withheld. From a tax perspective, a RRIF is treated as income in the hands of the deceased on the day they die. For most people, that means a substantial tax bill for that tax year. So as an executor4, I had to be VERY sure that my Mom’s non-registered account could cover the tax bill that would eventually come. Using a tax calculator helped a lot.

The non-registered account, where the bulk of the assets lay, would require a probated will, as I expected. This account remained locked and frozen.

Probate and probate fees

In the very simplest terms, probate means getting a court to certify a will as accurate. And when you think about it, it makes sense that financial services companies want to be VERY sure that the executor (aka estate trustee) is in fact the correct person.

After doing a bit of reading (mostly this source) I decided I could tackle it on my own. This was made significantly easier by the fact that I lived in the same city as my mother, and I had access to a courthouse were I could take my completed forms.

When filing your probate papers, you also have to pay probate fees (aka Estate Administration Tax), which means you have to know the total value of the estate on the day of death. BMOI was able to provide me statements up to that day so I had a to-the-penny accurate assessment of the value held there. BMOI was also able to write a cheque to the Ontario Minister of Finance for these fees using funds available5 in the non-registered account. This meant I wouldn’t have to front the money myself.

Probate fees, in my Mom’s case, were not particularly large (not compared to the estimated tax bill), and since RRIF and TFSA were not part of the estate, they were also lower than they could have been.

After filing, the wait for the court-certified document began. I had very low expectations (I had conservatively estimated a 6 month delay here), but I actually had the probated will arrive in the mail a month later, which was about 4 months after my mother’s death.

Using the Probated Will

With a probated will in hand, I could now unlock the non-registered funds in my Mom’s estate. This required me to open an estate account with BMOI and then transfer the non-registered funds to it. After all that paperwork, I once again had full access to the assets that were formerly held in my Mom’s non-registered account — I could log in to the portal, see the holdings, and most importantly, perform transactions myself at the usual self-directed transaction fees.

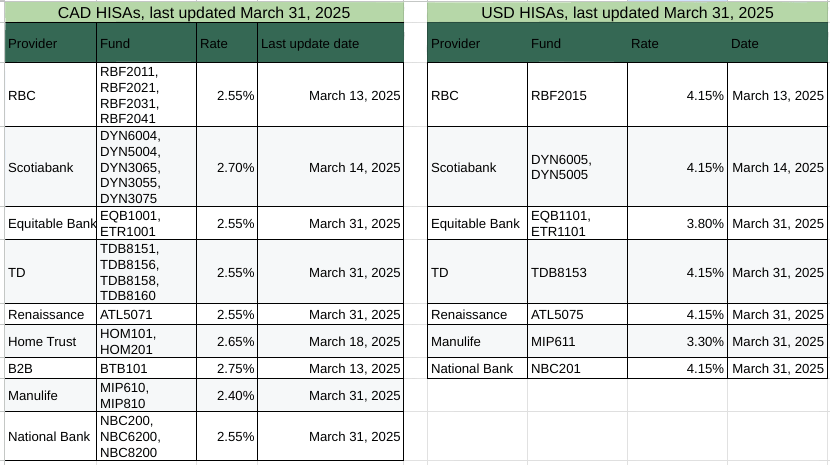

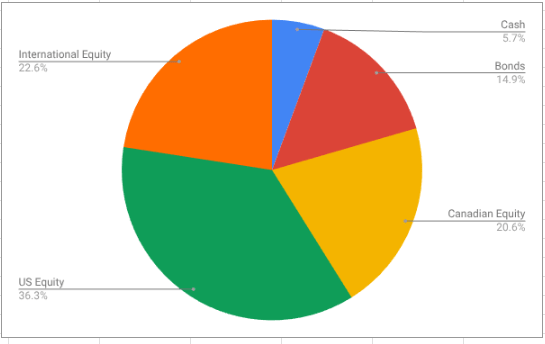

I sold all the assets (mostly ETFs, naturally) and partially distributed them to the beneficiaries. Distributing the assets was admittedly (again) more challenging than I thought. Since I was quite familiar with how BMOI worked, I requested AccountLink cheques for the estate account, figuring this would be the easiest way to distribute the funds6. This resulted in a bit of a runaround, but eventually I got a box of cheques sent to me. I held some money back7 so I could pay the 2025 tax bill; this money I invested in a HISA.

Preparing for Tax Season

In late 2024, I removed the remainder of the estate from the HISA account. This was done so as to not have any income generated by the estate in 2025. This simplifies the tax filing considerably.

After doing a bunch of reading, I gave up on the idea of attempting to do the taxes myself. I knew there would have to be both a Final Return (for my Mom) and an Estate Return (aka a T3 return) but I wasn’t really sure about all the steps, and of course CRA’s website isn’t really designed for the layperson to figure this stuff out easily. There was also the matter of filing a CRA clearance certificate. I hired a pro to figure all this stuff out. As it turns out, my Mom’s estate qualified as a GRE Trust, which is, as I understand it, pretty typical. That would appear to offer some potential tax benefits, but I’ll have to wait and see and this point.