Summary: The mechanical details of getting paid in retirement require careful review of how your provider allows cash movements between accounts, a handle on how much money is coming in via a RRIF, and, for bonus points, an annual decumulation plan to minimize household taxes.

I covered how I get paid in retirement previously, but this was nothing more than a restatement of how VPW (Variable Percentage Withdrawal) works. My reality is not quite as simple as the Idealized Monthly Routine I laid out in that post.

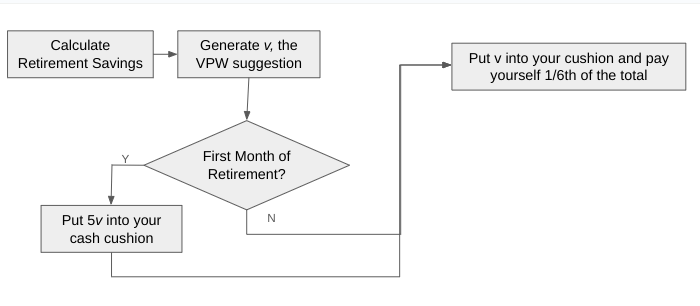

The actual work required looks more like this:

The first 3 steps are the ones I covered in the last post, and there’s nothing new to talk about there. In brief, you calculate your retirement savings, enter that number into the VPW spreadsheet, and out pops the monthly VPW suggestion (“v”), which is then added to the current value of your cash cushion (“c”) to calculate your salary (“s”).

It’s probably worth noting what specific accounts I hold at my provider to make things a bit clearer1

- There are 4 total RRIF accounts (two for me, two for my spouse)

- There are 2 non-registered accounts that hold retirement investments (one for me, one for my spouse)

- There is 1 non-registered joint account that serves the role of VPW’s cash cushion, which is invested in DYN6004 so I can earn a bit of risk-free interest.

So ideally, my RRIF payments would flow into the cash cushion account, and I would pay myself out of the cash cushion account to my everyday joint chequing account. That is unfortunately NOT how it works.

Let’s pick up the process starting at step 4.

Do the RRIF minimum payments cover the calculated salary?

When I opened my RRIF accounts (and yes, there’s more than one2), one of the questions asked was “what bank account should the payments go to?” Asking for RRIF payments to go to a non-registered account was not presented as an option, and it’s not possible. So already the simple RRIF to cash cushion transaction outlined in the ideal scenario wasn’t possible.

The other questions asked by my provider was: how much do you want to be paid? (RRIF minimum, some percentage/amount higher than that, gross/net?)

(If you’re new to the RRIF world, or if you think that RRIFs are just for 71-year-olds, you may want to check out my previous post on debunking this and other myths.)

The amount each of my RRIFs3 pays me monthly is a well-known fact since I opted to collect RRIF minimum from each RRIF — and RRIF minimum is based on my RRIF value and age as of January 1, 2025. It will stay constant throughout 2025. So while simple, the amounts involved aren’t enough to pay my suggested salary. I’m free to ignore the suggested salary and simply (try to) live off my RRIF minimums, but that would be counter to my “you can’t take it with you” ethos. And so, I have to augment my RRIF minimum salary with money from elsewhere.

If your RRIF minimum payments are higher than the salary, then I suppose it makes sense to re-invest those payments somewhere. Or give the money away. Up to you 🙂

Sell required assets in non-registered account and move $ manually

The title is clear enough — sell something in the non-registered portfolio and use it to make up the salary shortfall. But whose holdings4? Which ones?

To help me decide, at the beginning of the year, I played around with tax scenarios using the calculators referenced in Tools I Use to concoct a high level plan on how to best minimize my household’s collective tax bill. (This was a tip my financial advisor gave me; her advice was to try to pay no more than an average tax rate of 15%5).

I assumed my income sources were

- My RRIF minimum payments (same for my spouse)

- My spouse’s salary

- Minor dividend income6

- Capital gains caused by the sale of non-registered assets7

Since the first three items above were already known, there was no decision to make; the tax owing on those was already clear8. The capital gains were the only variable — how much should I take versus my spouse? There was a bit of estimation involved in the actual amounts here (the actual gains would depend on the actual sale price), but it gave me a high level plan for 20259. Any additional income needed would be paid by capital gains realized from MY holdings since my income was forecast to be lower than that of my spouse10.

With the pre-work done, it boils down to making the required sell trade, waiting two days for the cash to settle, and then clicking the right buttons to get the cash out of my investment account and into my chequing account. Should be simple, but if you’ve never done it before, you need to make sure it’s all working as you expect.

Sell required assets in RRIF

Yes, you have to make sure that there’s cash available in your RRIF accounts (and remember, I have 4) BEFORE the monthly payment goes out. My provider would only be too happy to do this on my behalf, charging me their “telephone trading rates” for the trade — something like $30 plus $0.06 a share for XGRO. Compared with “free” if I do the work myself, that’s a pretty decent hourly rate…Do not forget that it takes two days for a trade to settle into cash. Since my provider does not pay interest on cash holdings, I’m highly motivated to keep any cash balance to a strict minimum. I hate not earning money on my money.

Adjust cash cushion up or down by comparing VPW suggestion to calculated salary

In my previous post I talked about moving “v” to the cash cushion and then simply taking 1/6th of it as salary. And that is exactly what I do. But practically, it’s impossible to do this maneuver in exactly the way I describe with my current provider (QTrade). Here are the specific reasons I can’t do what VPW asks me to do:

- QTrade RRIF payments must be made to an external bank account. So right away, part of my salary cannot flow through an intermediary cash cushion account.

- QTrade does not allow cash transfers between non-registered accounts on their online platform. This means that the asset sales in my non-registered account cannot be moved directly to the cash cushion accounts either11.

I have worked around the limitations imposed by my provider by either

- moving money from my chequing account to my cash cushion if the VPW suggestion is higher than my salary (market is moving up)

- moving money from the cash cushion to my chequing account if my salary is higher than the VPW suggestion (market is moving down)

I have set up smart-ish spreadsheets to break down all the various movements of money which I will share at some point once I figure out how to make them a bit more generic. I’ve also documented a step-by-step guide for my spouse which she uses as we sit together walking through the monthly tasks12 so that I have confidence she could execute on them if I became incapacitated. There is no substitute for handing over the controls to see where the gaps in knowledge — and documentation — are.

The future

Having witnessed what happens to savvy adults as they get older, I know deep down that this DIY strategy isn’t sustainable forever. There are too many moving parts, and too many opportunities to make mistakes.

At present, I don’t have a future plan mapped out. I have updated my “death binder“, but beyond this, nothing more. I will dedicate more research (and future posts) on that topic.

- For your benefit I have not mentioned the USD variants I have of a few of these. This post is long enough as it is, and I presume that most readers don’t hold assets that are traded on US stock exchanges. ↩︎

- My own RRIF and my spousal RRIF account for two, and my spouse has two as well. Total four. They are with the same provider. Spousal RRIFs are generated from spousal RRSPs, in case you were wondering. If you deal with more than one RRIF provider (I would NOT recommend that), you’ll also have to consider that. All this to say that I saw 4 distinct payments made to my joint chequing account on Friday last week, one for each of the 4 RRIFs. ↩︎

- I keep saying “my RRIFs” for simplicity, but all 4 RRIFs (2 in my name, 2 in my spouse’s) are treated the same way. All four payments end up in our joint chequing account. ↩︎

- Both my spouse and I have non-registered accounts. My spouse’s was funded via a spousal loan I set up years ago to achieve some degree of income splitting. ↩︎

- After years of thinking of taxation in terms of what I paid on the LAST dollar I earned, this was admittedly a very different way of considering the problem. ↩︎

- Most of my dividend income (via XGRO and AOA) is buried in my RRIF and TFSA to avoid any taxation of it ↩︎

- Because I make a lot of use of HXS and HXT in my non-registered portfolio, I earn no dividend income; it’s all capital gains… ↩︎

- If you’re not aware, RRIF payments are treated as no-special-treatment taxable income, reported on a T4-RIF form by CRA. ↩︎

- Since I get paid monthly, I could always adapt if my assumptions were radically off. ↩︎

- I could have also paid the extra from my TFSA holdings, but my advisor suggested that this is the LAST bucket to use in retirement. ↩︎

- Unless I like waiting on hold. I do not. ↩︎

- Who says romance is dead? ↩︎