This is a (hopefully monthly) look at what’s in my retirement portfolio. The original post is here. Last month’s is here.

Portfolio Construction

The retirement portfolio is spread across a bunch of accounts:

- 7 RRIF accounts (3 for me, 3 for my spouse, 1 at an alternative provider as a test)

- 2 TFSA accounts

- 4 non-registered accounts, (1 for me, 1 for my spouse, 2 joint)

The target for the overall portfolio is unchanged:

- 80% equity, spread across Canadian, US and global markets for maximum diversification

- 15% Bond funds, from a variety of Canadian, US and global markets

- 5% cash, held in savings-like ETFs.

You can read about my asset-allocation approach to investing over here.

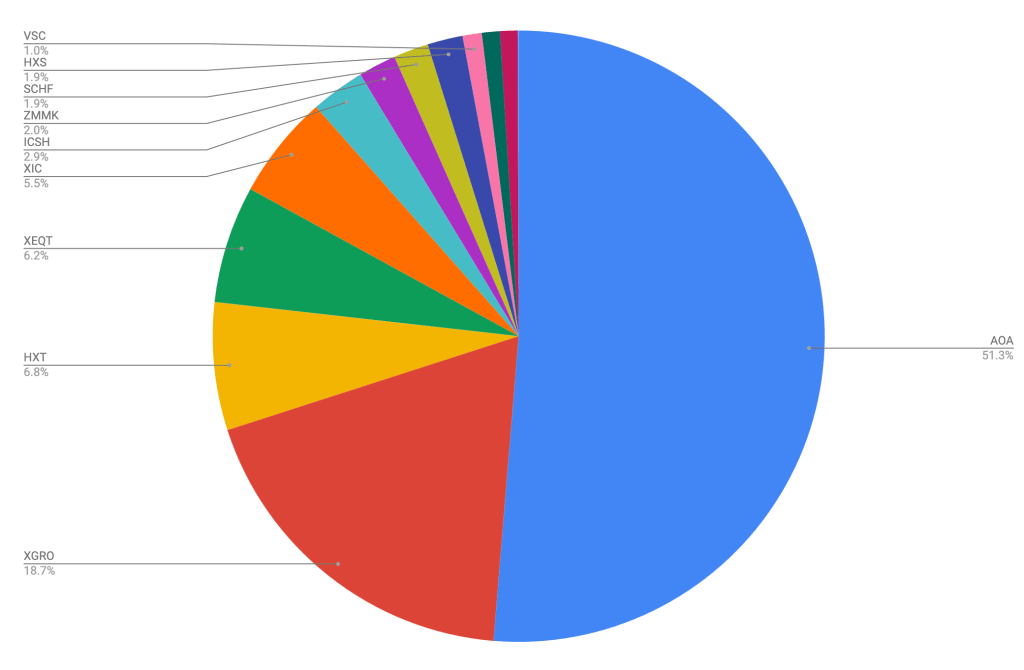

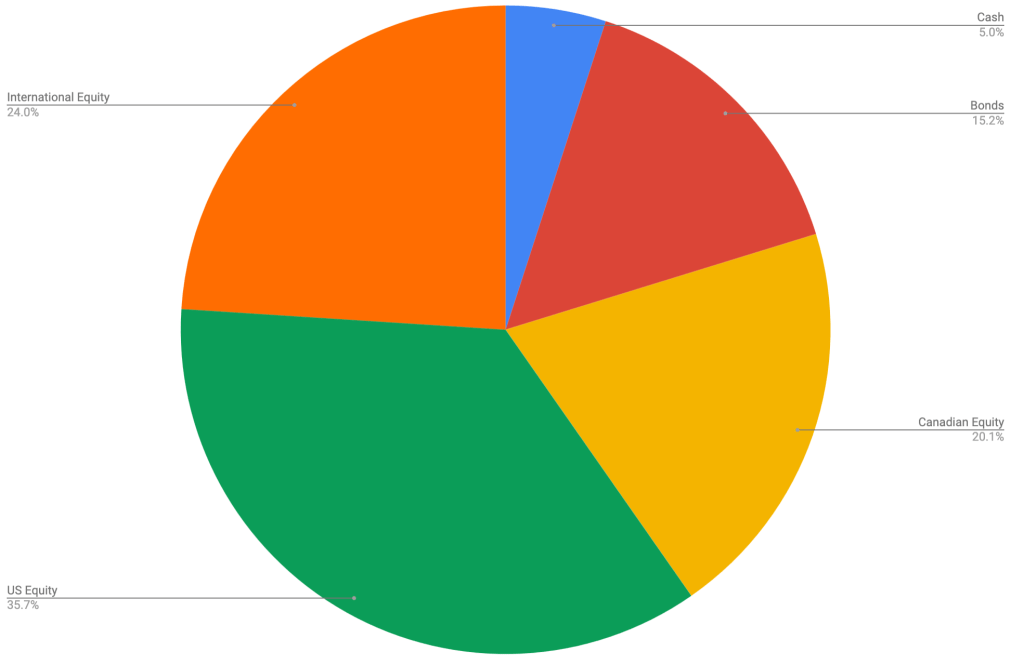

The view as of this morning

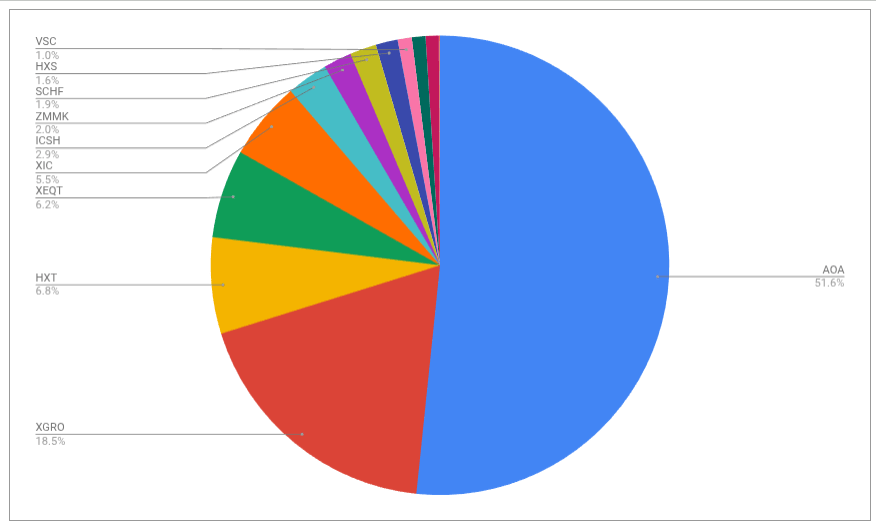

As of this morning, this is what the overall portfolio looks like:

The portfolio is dominated by my ETF all-stars; anything not on that page is held in a non-registered account and won’t be fiddled with unless it’s part of my monthly decumulation. Otherwise I’ll rack up capital gains for no real benefit.

There weren’t big changes this month. My monthly decumulation from my RRIF accounts involves selling enough XGRO to meet RRIF-minimum payments, and the rest of my retirement paycheque is funded by my non-registered accounts. This month, given the run in the US stock market of late, that involved a sale of some shares of HXS1.

Plan for the next month

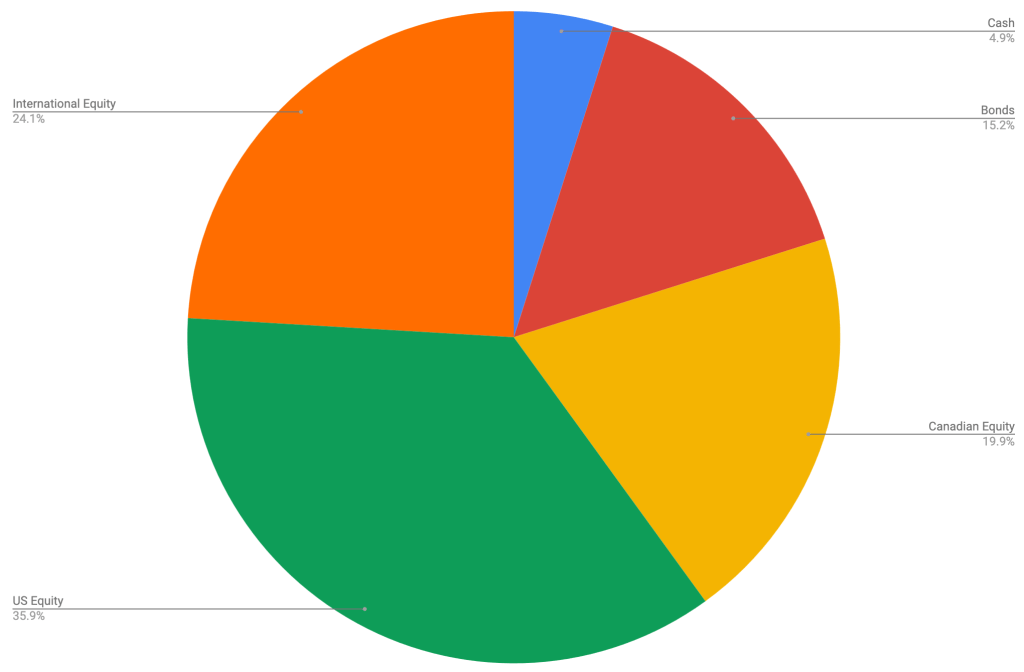

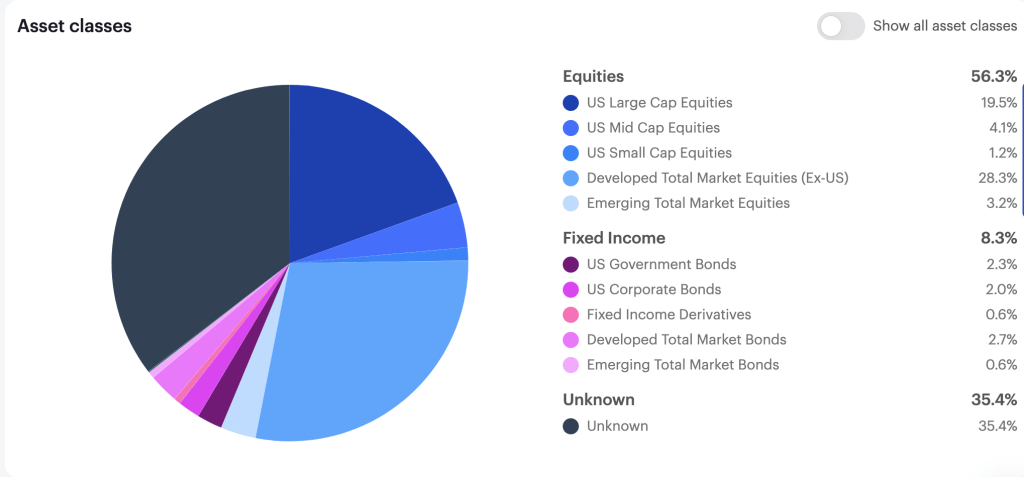

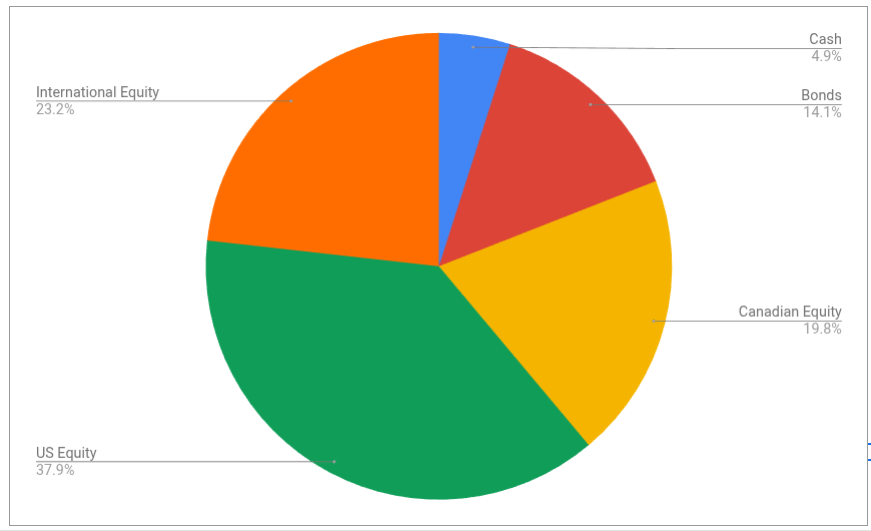

The asset-class split looks like this

The bond portion of the portfolio is a little smaller than I would like. The targets for my portfolio are unchanged:

- 5% cash or cash-like holdings like ICSH and ZMMK

- 15% bonds (almost all are buried in XGRO and AOA)

- 20% Canadian equity (mostly based on ETFs that mirror the S&P/TSX 60)

- 36% US equity (dominated by ETFs that mirror the S&P 500, with a small sprinkling of Russell 2000)

- 24% International equity (mostly, but not exclusively, developed markets)

The change in the bond portion of the portfolio was amplified because I hadn’t updated the asset split of AOA in my multi-asset tracker in a while. AOA has drifted quite a bit since it only rebalances twice a year (next time in October). More on drifting in multi-asset ETFs here.

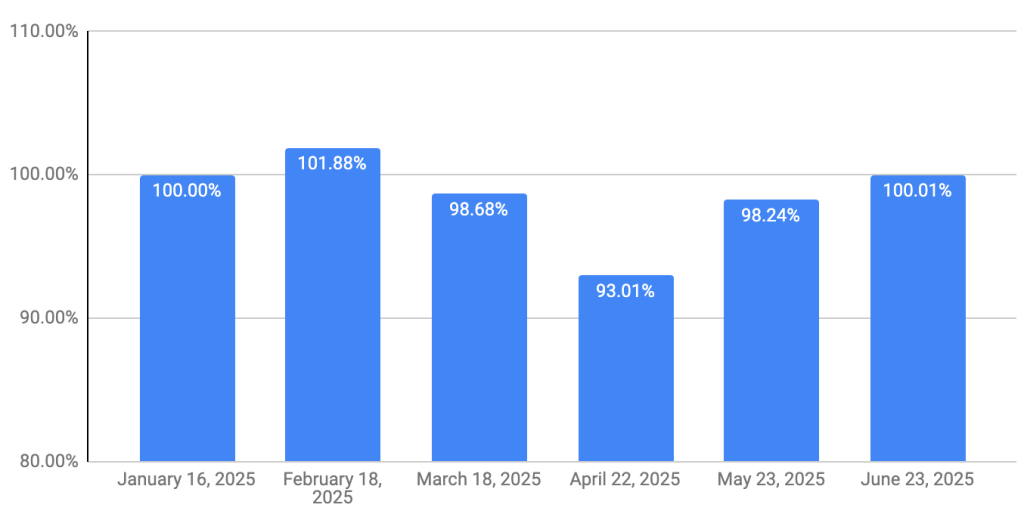

Overall

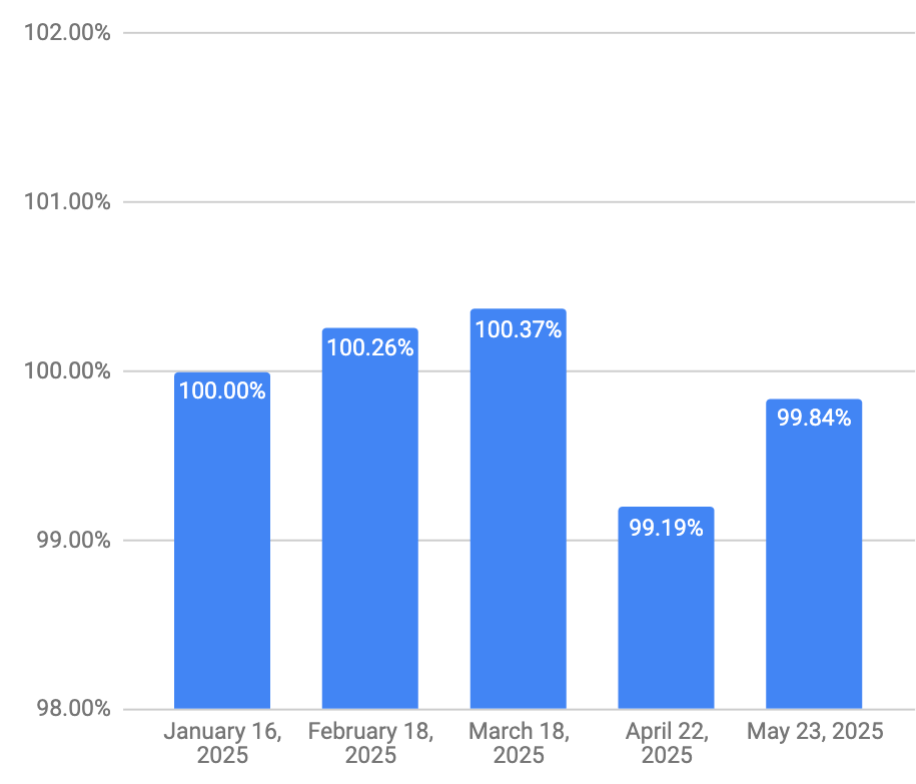

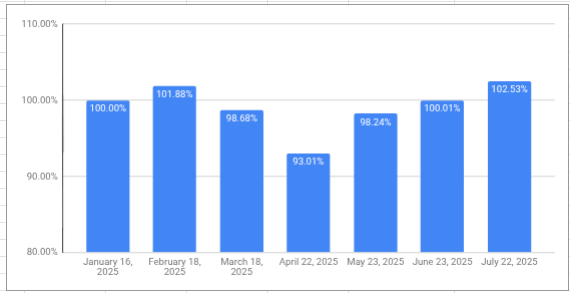

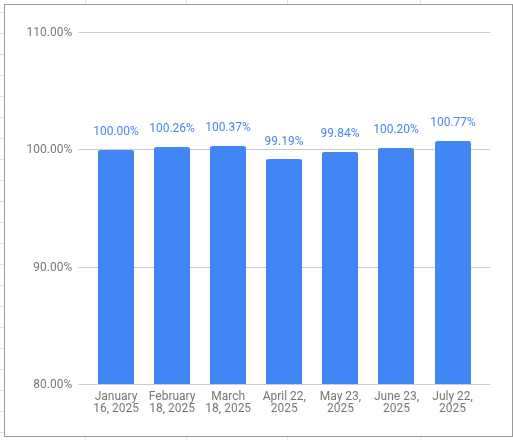

The retirement savings look quite healthy; even though I’ve been drawing a monthly salary for 7 months, I’m now ahead of where I was when I started my retirement journey. This is aligned with what my retirement planner told me to expect, but as you can see, the journey has had some interesting ups and downs already.

My VPW-calculated salary has hit a new high this year, a dizzying 0.77% higher than my first draw in January. This stability is thanks to the built-in shock-absorber of the VPW model (a 6-month cash cushion which smooths out the market gyrations considerably). I also think it’s an endorsement of my choice to take retirement payments monthly; my exposure to short-term market hiccups is greatly reduced since I’m not making big sales of ETFs to fund a year of spending all at once.

- Which particular ETF I sell from my non-registered portfolio is based on what asset class is the most overweight at that point in time. If it’s US Equity, then I sell US Equity. If it’s Canadian Equity, then I sell Canadian Equity. ↩︎