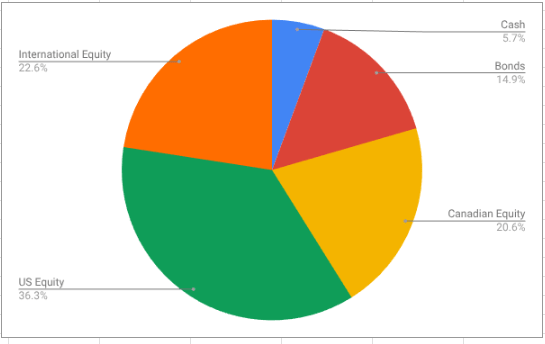

If you adhere to asset-allocation strategies (as I do) then rebalancing your assets to reset them back to your targets is a way to make sure you stay on track1. Some people do this on a regular basis (monthly, quarterly, annually) but I try to do it whenever the drift becomes noticeable (more than 1% off of my targets2). The targets for my portfolio are

- 5% cash

- 15% bonds

- 20% Canadian equity

- 36% US Equity

- 24% International equity

Given the week we’ve just had, it’s not really a surprise to see that I’m overweight in cash, and underweight in foreign equity. Some of my cash is untouchable because it’s the built-in cushion that Variable Percentage Withdrawal (VPW) requires3, so that’s out. The majority of the cash in play is found in my RRIF accounts, and most of that is found in USD.

So the problem to solve for is to find a low-cost International Equity ETF that sells on the US market. Let’s walk through the steps I go through for that.

Copy what’s in my USD all-in-one ETF

Long time readers will know that most of my USD holdings are invested in AOA. (What’s the deal with AOA? Asked and answered here.) Since AOA is an all-in-one ETF, and since I know that AOA has international holdings (around 28%), and I know that AOA is inexpensive to hold, I can just do what AOA does, right?

So that is certainly a possibility, but as it turns out, AOA invests in TWO international ETFs, namely:

- IDEV, which is a broad international ETF that tracks the developed world (you can see the Sector and Geographic breakdown here)

- IEMG, which is a broad international ETF that tracks emerging markets (Sector and Geographic breakdown here)

IDEV and IEMG are both excellent funds, but I don’t really want to buy two funds if I can help it. AOA holds these two in a roughly 3:1 ratio, and I am too lazy to keep that straight.

So time for plan B.

Google for an appropriate ETF

So I type “international ETF USD” into Google and see what I get.

The first hit is linking to etfdb.com which isn’t my favourite website. They always list 100 ETFs when I want to choose from maybe 4. So I skip that link.

Then I get a hit for IXUS, which is an iShares product. This one I’ve heard of, and it has a clever name (ex-US, get it?). On IXUS’ overview page, I see three promising factoids:

- It provides “exposure to a broad range of international developed and emerging market companies4“

- It has a MER of 0.07%, which is acceptable.

- It’s not clear to me how much is in emerging markets, but the geographic exposure breakdown includes some non-G7 economies, so that’s good.

So that’s pretty good, but I want to look at least one more ETF to be a good comparison shopper.

A little bit further down I get a hit for VXUS, a Vanguard product. Like IXUS, it has a clever name (ex-US, get it?) and so I feel compelled to look closer.

And I see three factoids again:

- It provides “Broad exposure across developed and emerging non-U.S. equity markets”

- Its MER is 0.05%

- The geographic exposure breakdown looks an awful lot like IXUSes, even though the underlying index it’s tracking is different5

And so, with that, the decision is made: we go with VXUS because it’s 0.02% cheaper than IXUS.

Actually DOING the rebalancing

This will be new ground for me, because it will be using my new provider for the first time (Questrade). My old provider let me sell one ETF and immediately buy another, and I assume that Questrade will also allow this, but until I try it, I’ve learned not to assume things.

Oh, yes, the “cash” in my USD RRIF is actually also an ETF, namely ICSH, which is because Questrade doesn’t provide any other means to earn money on “cash”.

So anyway, on Monday, a few hours after the stock market opens, I’ll take a look and see if trading is still a advisable — has the market suddenly recovered? Is it so volatile it warrants sitting on the sidelines? I’m guessing both of those will be a solid “no”, but I will wait until Monday to follow through.

Rebalancing (Somewhat) Complete

I signed in yesterday to my brokerage account around lunchtime so I missed all the morning’s excitement. After everything I wrote above, I didn’t buy VXUS after all — since my US equity portion was also significantly below target, I bought AOA instead, thus increasing both my US and International equity positions at the same time. I used a limit order since the bid/ask spread was like 20 cents, far higher than I’m used to seeing.

When markets are this nutty, I don’t like making all purchases at once. Since Questrade trading of ETFs is now totally free, I can take my time and incrementally shift the portfolio back to targets.

- Long time readers may wonder why rebalancing in my portfolio (which is dominated by asset allocation ETFs) is required at all — one of the reasons to invest in an all-in-one is BECAUSE it rebalances automatically. The answer is simple — although MOST of my portfolio is in all-in-ones, not ALL of it is. As I prepared my portfolio for retirement (read more about that here), I couldn’t justify selling assets and attracting capital gains in my non-registered account just to make the portfolio simpler. ↩︎

- I track those targets using the Multi-Asset tracker found here ↩︎

- VPW is how I get paid in retirement. You can read about the method here. ↩︎

- Closer reading of the product page shows IXUS tracks the MSCI ACWI ex USA IMI Index ↩︎

- VXUS tracks the FTSE Global All Cap ex US index ↩︎