I am not a lawyer, accountant or tax expert. Your situation may be a lot different than mine. Seek professional guidance if needed.

Part 1 of this blog is found here, and Part 2 is here.

I’m in the tax season stage of wrapping up my Mom’s estate, who died a little over a year ago, a year and a bit after my father died.

Current status

I decided to hire a pro to do the Final Return and the Estate Return since I couldn’t figure out the fine details1 of doing an Estate Return. The Final Return (that’s the easy one, it’s just a regular tax return, except you have to inexplicably file it on paper) would have been within my skill set, but the Estate Return (the one that you have to file to deal with any income generated by the estate after death) was new and confusing to me.

I knew I was going to have to pay taxes on both returns, and using the tax calculators referenced here, I had a pretty good idea of what tax was going to be owed. In essence,

- The Final Return takes the full value of the RRIF on the day of death as income. This will mean a lot of tax if the RRIF is sizable.

- The Final Return also assumes any non-registered assets are liquidated on the day of death, which in the case of equity holdings, typically attracts capital gains and the associated taxes2.

- The Estate Return is going to have to pay tax on any dividends, interest, or capital gains realized by the assets in the estate. Here the tax rate is high, because an Estate is treated as a Trust, and trusts don’t get personal deductions, meaning you get taxed on the first dollar of gains you manage.

A few wrinkles

Submitting the necessary paperwork to the accountant was the usual tedium of getting scans of T-slips, charitable donations and the like to the accountant. I did encounter a few problems.

BMO Investorline Problem 1: Sending T-slips to invalid addresses

My Mom’s assets were all held with BMO Investorline. Imagine my surprise when her retirement home let me know that snail mail from BMO (not BMO Investorline) had arrived at the home. I changed the address of all communications with BMOI to me nearly a year ago at that point, so you can imagine I was less than happy about having to drive across town to pick up what turned out to be a T-slip for the HISA I bought in her self-directed account. At that point, I was a few steps away from livid.

After spending some time with hapless agents who could not tell me why the mail ended up at an invalid address, I penned a note to the formal complaint department of BMO. I just figured that if there was some systemic issue at play here, that at least I could help those who followed me.

The complaints department ultimately admitted it was a screwup on their part and offered their apology. Whether or not it will happen to someone in my shoes in the future is unknown to me, but beware.

BMO Investorline Problem 2: Not providing an RC249 slip

The RC249 is a CRA slip that covers the losses incurred by a RRIF post-death.

It makes some sense: as mentioned above, the owner of the RRIF is assumed to get income equal the the value of the RRIF on day of death. But the RRIF assets aren’t automatically liquidated; they remain invested in whatever they were invested in. If that includes stocks/ETFs and the like, then it’s possible for the value of the RRIF to actually decline post-death. And that is what happened in my case. This loss becomes a tax benefit to the estate return, but only if you have an RC249 to prove it.

Now, the RC249 is clearly intended to be filled out by the issuer/carrier of the RRIF, in my case BMOI. And so, you would expect that to be automatically provided, wouldn’t you? Wrong again.

Another set of back and forth, first with the standard BMOI agents, and then the BMOI estate department, eventually produced a valid RC249 that I could send to the accountant.

Paying taxes owed

As much as I disliked the entire process of working with BMOI’s estate department, the one thing I did like about BMOI was that their non-registered accounts can be linked with a bank account (AccountLink) against which cheques can be written3. (This is something I set up months ago to help distribute some assets early to the beneficiaries). So once the accountants informed me of the eye-watering tax bill (which was pretty much aligned with what I expected), I was able to write the cheques and drop them off with little fuss. Thinking about how you will do that is something to consider in dissolving the estate.

Final Return Notice of Assessment

This was received in pretty short order, a few weeks after it was submitted, and the tax bill was correct.

Next steps

I await the Notice of Assessment for the Estate Account, at which point my accountant will be able to apply for a clearance certificate from CRA. This certificate essentially tells me that CRA considers all business with my mom and her estate closed. Once I have this, I can fully distribute all funds from the estate without having the CRA come after me for monies owed. This takes “up to 120 days” per the website.

- More accurately: I couldn’t bear spending hours reading arcane text on various CRA websites hoping I didn’t make a mistake ↩︎

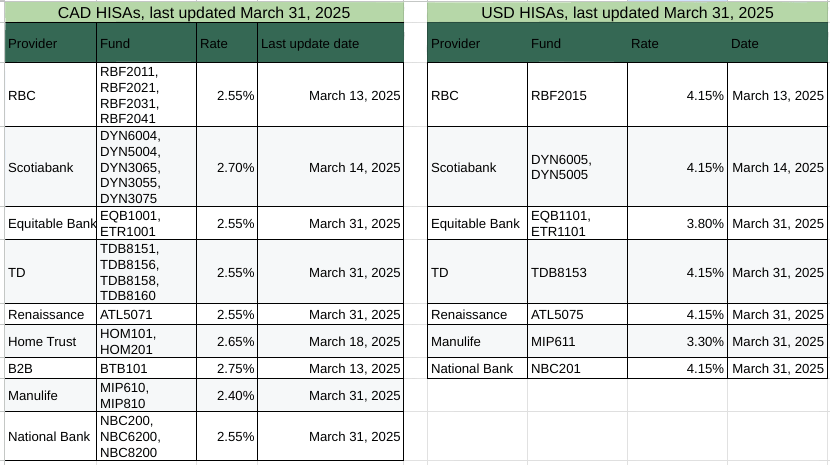

- Note that unless directed, the liquidation doesn’t ACTUALLY take place. In my case, I moved all assets to HISA accounts once I gained control of the assets via probate, (a delay of a few months) and then liquidated the assets at the end of 2024. This I did to avoid earning any income from the estate holdings in 2025, which would have delayed the estate return. ↩︎

- No matter how hard I tried, I could not convince anyone at BMOI/BMO to send me a debit card for the account, which would have allowed me to “Bill Pay” CRA instead of writing cheques. ↩︎