There’s really no avoiding paying taxes, even in retirement. You probably have to do some budgeting to make sure you aren’t being caught unaware, though.

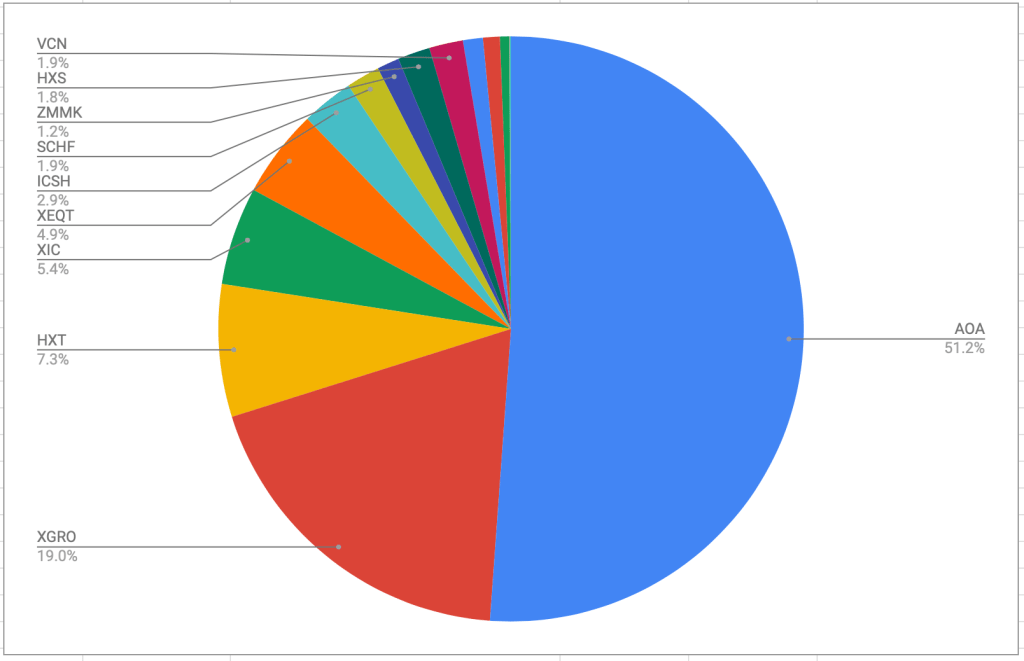

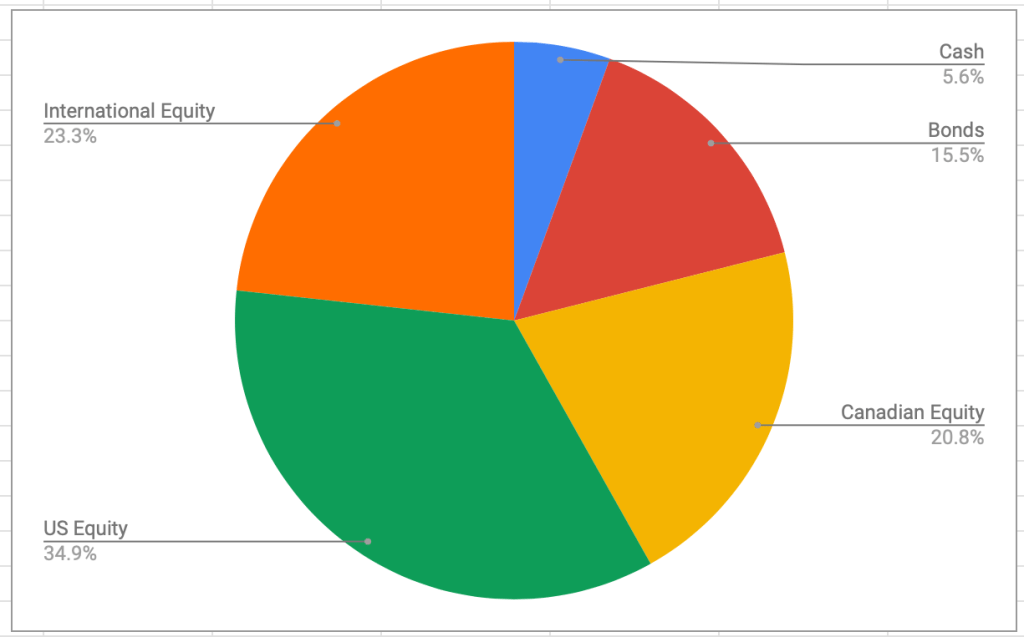

My retirement today is funded from a combination of my spouse’s part-time salary, my/my spouse’s RRIF, selling off assets from my non-registered account, and interest/dividend income from non-registered accounts.

The big difference, as I’m slowly becoming aware, is that aside from my spouse’s paycheque (which has the usual tax deductions / CPP contributions / EI contributions), there is nothing being set aside to pay my tax bill come April 2026. So it goes without saying that I had better make sure there’s a nugget somewhere that I set aside for the upcoming tax bill.

How much should that be? Enter a tool I use to help figure out that sort of thing, referenced in the “Tools I Use” section of this blog: namely, the Basic Canadian Income Tax Calculator1.

The basic tool, as implied, is pretty basic. It doesn’t include any sorts of deductions aside from the basic personal deduction and dividend tax credits. There’s an advanced calculator that has a bunch more inputs, but for the purposes of this article, the basic tool is good enough.

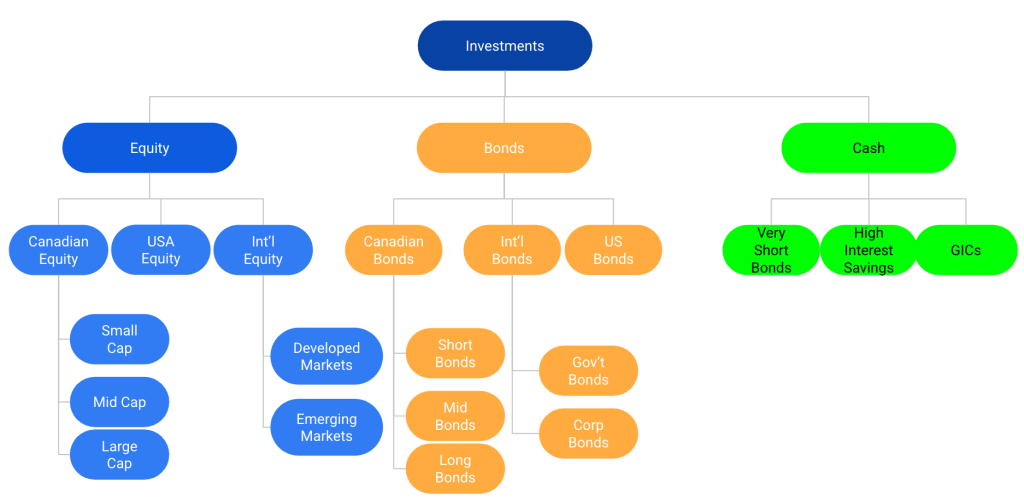

For the purposes of this tool, your income is in 4 buckets:

- Other income: This is how 100% of RRIF payments are treated, as well as interest from non-registered assets (e.g. interest from a GIC, bank account, HISA, some ETFs)

- Capital gains: This is only applicable to non-registered accounts. Note that many ETFs actually generate capital gains and a corresponding T3/T5 slip even if you don’t touch the fund at all2. Larger capital gains are typically generated when you sell an ETF that you’ve held for a while, which includes everything I hold in my non-registered accounts.

- Canadian eligible dividends: This includes dividends paid by all public companies in Canada.

- Canadian non-eligible dividends: I don’t have any of those, but if you own shares in a private corporation, you might.

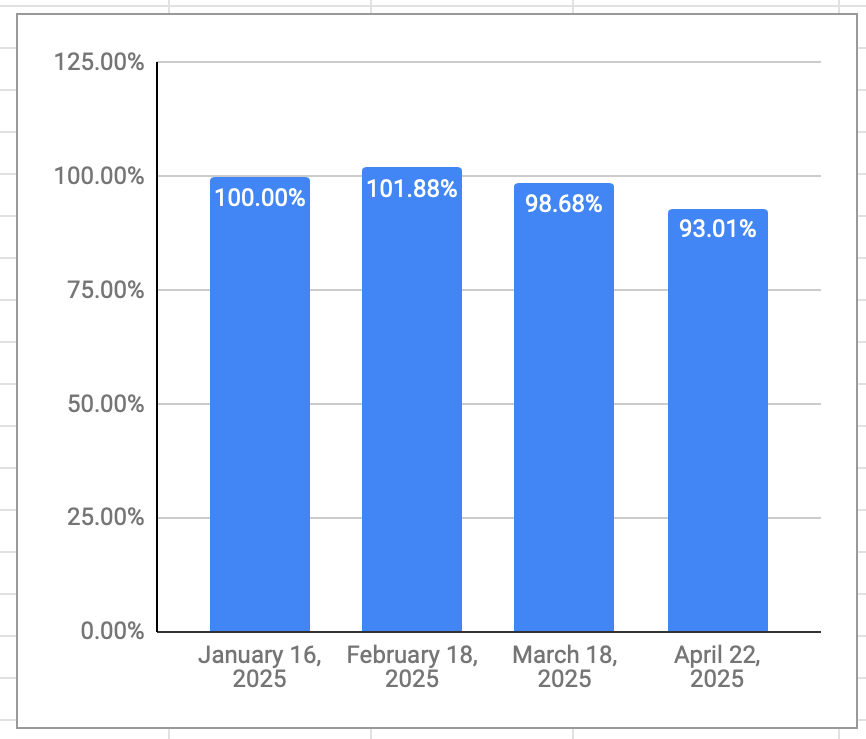

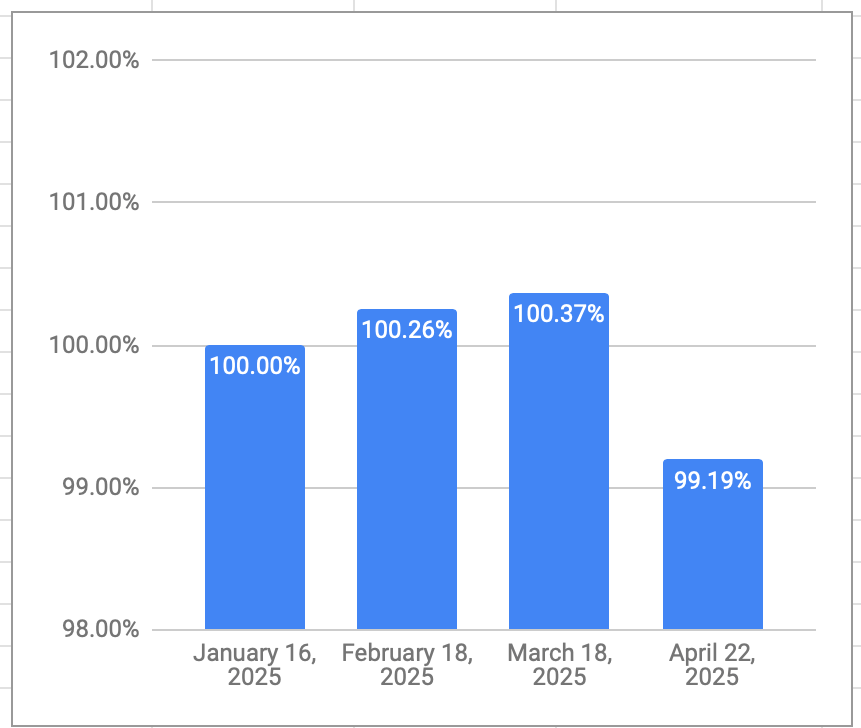

Since my 2025 strategy is to simply collect RRIF minimum payments, I already know what that dollar amount is. I also execute non-registered asset sales monthly to fund my retirement, as I mentioned here. This generates capital gains every month; the exact amount this will sum up to in 2025 is unknowable in advance since it depends on factors like:

- what specific asset I choose to sell

- the price of the asset at the time I choose to sell

- how many shares of the asset I sell at that price

I do track a metric I call “capital gain dollars per dollar of asset sold3” so I can compare the capital gain impact of generating (say) $1000 cash for every asset I own in my non-registered account. So I have a bit of control over the capital gain metric for a given year, but not a lot. My spouse also has non-registered assets in her name, but since she’s earning a salary, I’ll let that be for now.

Some examples might help illustrate the different tax impacts of different withdrawal strategies.

Let’s consider 4 examples, all of which give you 100k gross salary, before taxes:

- The “RRIF and interest only” strategy: All income for the year is generated by either RRIF payments or interest payments from non-registered accounts.

- The “non-registered asset sale only” strategy: All income for the year is generated by selling assets in non-registered accounts that create 70 cents of capital gain for every dollar of income thus generated4.

- The “Dividends only” strategy: All income for the year is in the form of dividends. You’d need a pretty large portfolio to generate 100k of dividend income, just sayin’.

- The “Blended Approach” strategy: Income comes from a mix of RRIF payments, non-registered asset sales, and dividends. You could play with the percentages yourself; this is an excellent way to see how different liquidation strategies generate (in some cases) very different tax bills.

The table below uses the basic tax calculator to generate the tax bill of the different payment strategies.

| Withdrawal strategy | RRIF + Interest income | Income from asset sales | Actual Capital Gain | Dividends | Total Gross Income | Total Tax Bill (ON) | Avg Tax Rate |

|---|---|---|---|---|---|---|---|

| RRIF and Interest only | 100k | 0 | 0 | 0 | 100k | 21.4k | 21.4% |

| Non Registered asset sales only | 0 | 100k | 70k | 0 | 100k | 3.9k | 5.6% |

| Dividends only | 0 | 0 | 100k | 100k | 3.3k | 3.3% | |

| A blended approach | 50k | 25k | 17.5k | 25k | 100k | 10.6k | 11.5% |

Fair warning: don’t try to use this table to estimate your own situation. I chose 100k to keep the math easy, but since Canadian tax brackets have different tax rates, the overall gross salary chosen makes a huge difference in the tax bill — enter the numbers yourself!

My retirement planner advised me to target an average tax rate of no more than 15%, and besides the “RRIF and interest only” approach, all of the withdrawal strategies in the table accomplish that. The other takeaway is that on an income of $100k, all of the approaches generate a tax bill in excess of $3k — which happens to be the magic number CRA uses to determine whether or not you have to pay tax in installments.

As a result of doing this exercise, I’ve started a monthly automated contribution to a separate “tax” account5 so that I have money at the ready to pay my tax bill next year. All DIY retirees may want to do the same!

- You will probably have to close a bunch of ads before ultimately getting to the page that matters. It’s a forgivable tax to for this useful site, IMHO. ↩︎

- If you prefer to avoid annual capital gains, dividends and interest payments, then Global X has ETFs that are designed to do just that. I hold HXT (for Canadian Equity) and HXS (for US Equity) in my non-registered accounts for this reason. ↩︎

- This is just the per share capital gain divided by the current share price. I use Adjusted Cost Base to keep track of my capital gains. ↩︎

- This is a bit higher than the average of my portfolio, which is about 60 cents for long-held assets. You could choose a different number based on your own holdings. You only pay tax on half of your capital gains, and the calculator knows this. ↩︎

- I used Wealthsimple for this since it’s stupidly easy to create a new investment account. And they pay a reasonable amount of interest. ↩︎