This is a (hopefully monthly) look at what’s in my retirement portfolio. The original post is here. Last month’s is here.

Portfolio Construction

The retirement portfolio is spread across a bunch of accounts:

- 7 RRIF accounts (3 for me, 3 for my spouse, 1 at an alternative provider as a test)

- 2 TFSA accounts

- 3 non-registered accounts1, (1 for my spouse, 2 joint)

The target for the overall portfolio is unchanged:

- 80% equity, spread across Canadian, US and global markets for maximum diversification

- 15% Bond funds, from a variety of Canadian, US and global markets

- 5% cash, held in savings-like ETFs.

The view as of this morning

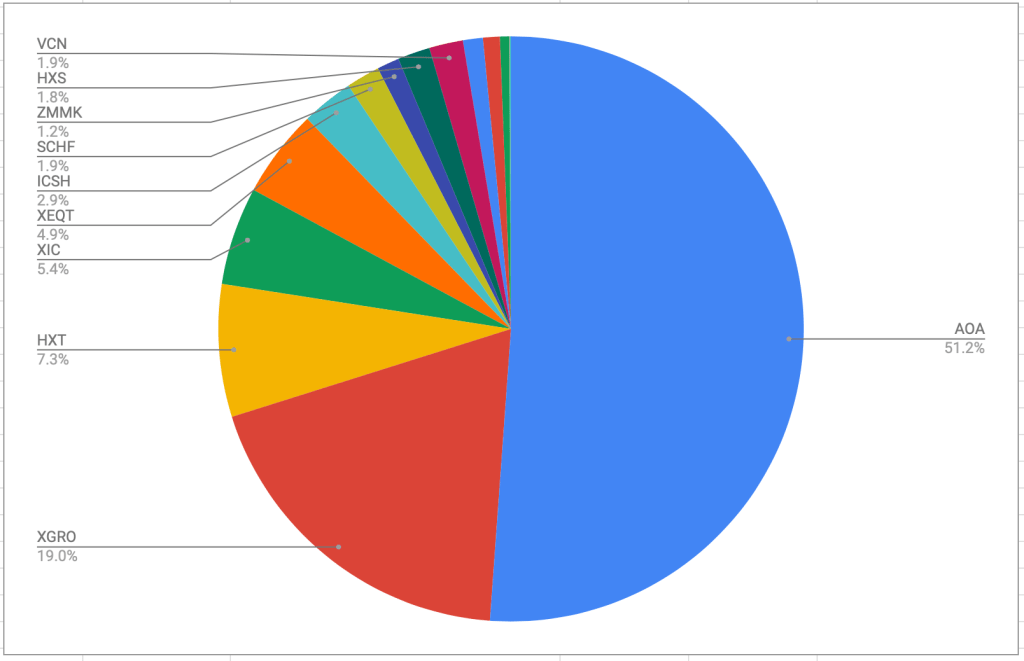

As of this morning, this is what the overall portfolio looks like:

The portfolio, as always, is dominated by AOA and XGRO which are 80/20 asset allocation funds in USD and CAD, respectively. The rest are primarily either cash-like holdings in two ETFs: ZMMK in CAD and ICSH in USD) or residual ETFs held in non-registered accounts for which I don’t want to create unnecessary capital gains just for the sake of holding AOA or XGRO.

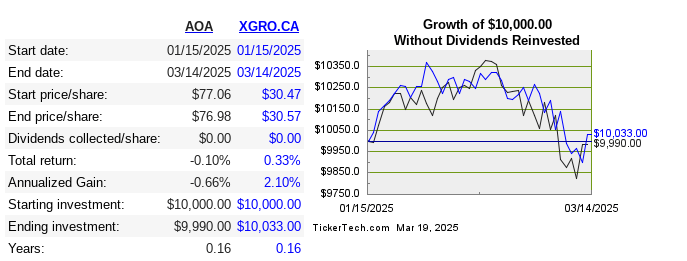

The biggest month over month change was a small decline in AOA and a small uptick in XEQT, about a 1% shift overall. This was because I shifted some of my USD assets to CAD assets in the RRIF using Norbert’s Gambit2. I chose XEQT over XGRO because the contribution of bonds in the portfolio was slightly over my asset allocation target3. XEQT is essentially XGRO, minus the bond holdings (it’s a 100% equity fund).

There was also a noticeable reduction in the contribution of ICSH to the portfolio; this was largely due to the unfavourable change in the USD/CAD exchange rate over the course of the month, and not due to any change in the holdings there.

Plan for the next month

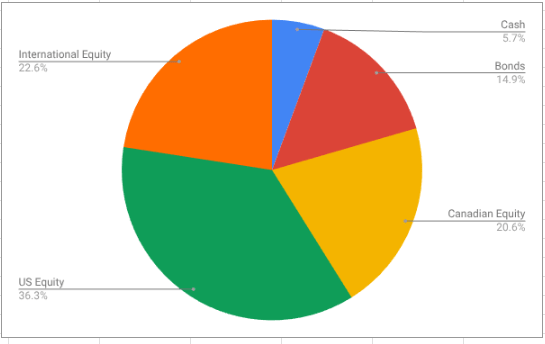

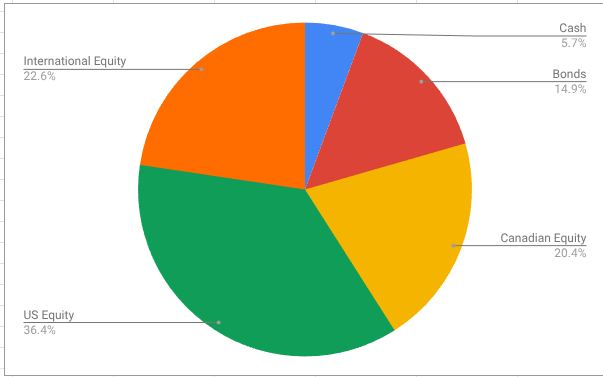

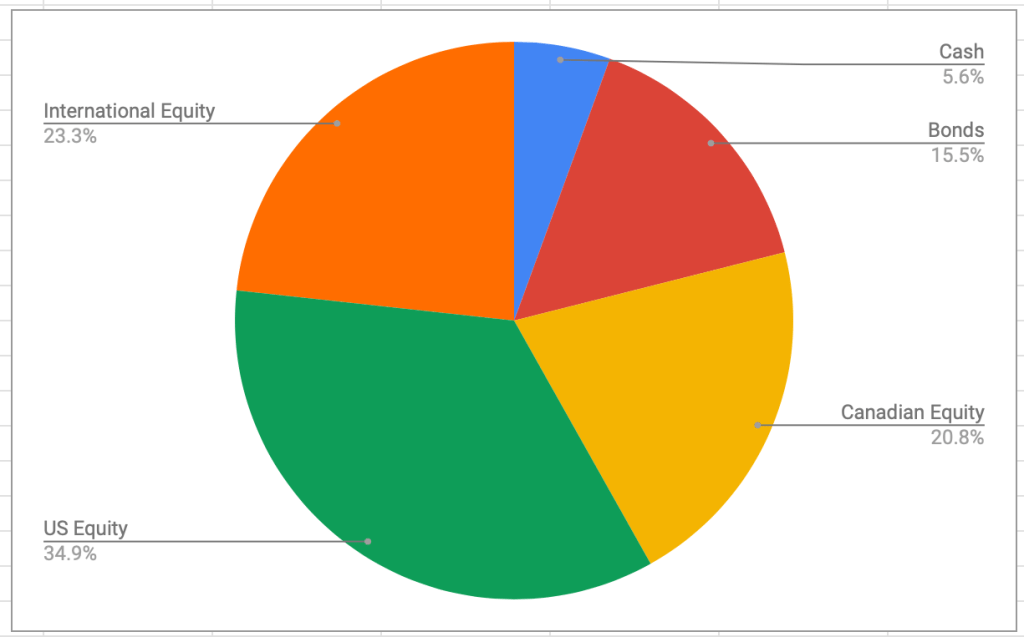

The asset-class split looks like this

This looks to be pretty close to my target percentages which haven’t changed:

- 5% cash or cash-like holdings like ICSH and ZMMK

- 15% bonds (almost all are buried in XGRO and AOA)

- 20% Canadian equity (mostly based on ETFs that mirror the S&P/TSX 60)

- 36% US equity (dominated by ETFs that mirror the S&P 500, with a small sprinkling of Russell 2000)

- 24% International equity (mostly, but not exclusively, developed markets)

So, the plan for next month is, do nothing out of the ordinary. Reinvest cash (dividends, TFSA contributions) in one of AOA, XEQT/XGRO, ICSH or ZMMK depending on the asset category most in need on the day of the reinvestment. All these ETFs are covered on my ETF All-Stars page.

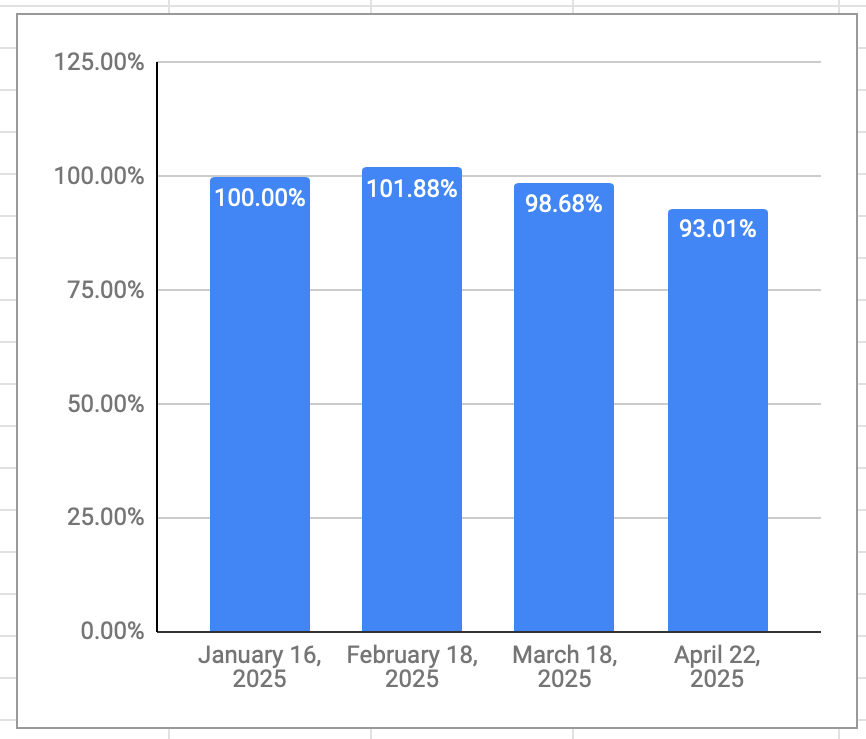

Overall

My retirement savings declined 5.75% over the month (down 7% since January) due to the continuing meltdown in the equity markets. It’s not a pretty picture!

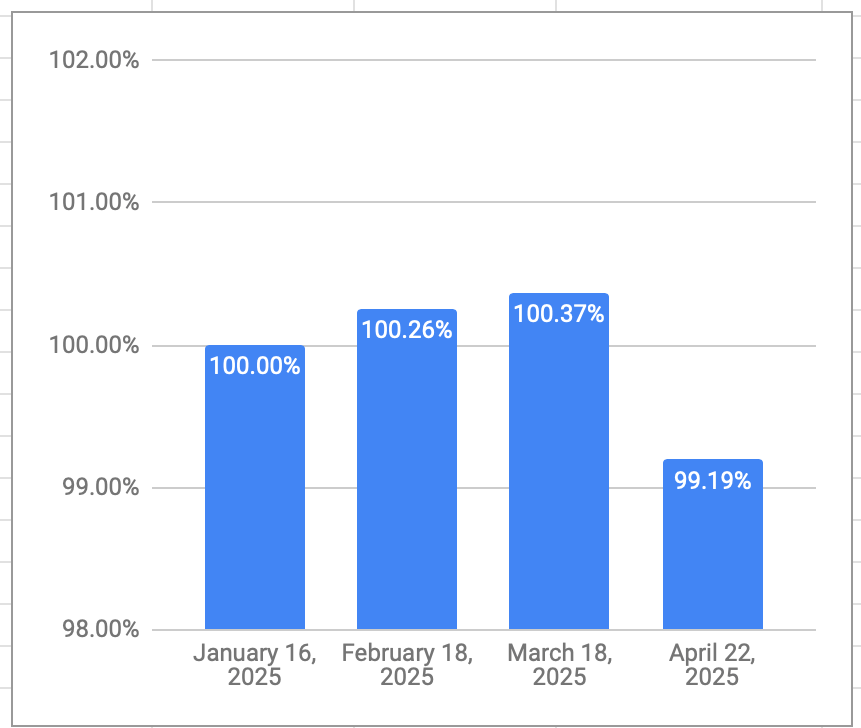

This has not translated to a the same degree of change in my monthly salary. Why? My retirement payouts are calculated by Variable Percentage Withdrawal (VPW), which I cover here. VPW has a built-in cash cushion, which serves to dampen month to month swings in my net worth, either up or down. As you can see in the chart below, my monthly salary has stayed within a 1% band of the first salary I drew in January.

- Since Questrade combines USD and CAD assets under the same account umbrella, I was able to reduce the number here. ↩︎

- I shift funds from the USD to the CAD side of the RRIF more or less quarterly since all RRIF payments are currently coming out of the CAD side of the portfolio. ↩︎

- That’s the optimistic point of view; it’s perhaps more accurately stated as “bonds haven’t melted down quite as much as the equity portion of my portfolio”. ↩︎