I’ve been using cell phones1 since their early days2, and the one thing I hate more than bank fees is carrier fees. In bygone days, every US vacation we took involved a trip to the ATT or T-Mobile shop for a cheap travel SIM. All this to say it’s been ingrained in me to make unusual communications preparations in advance of travel.

Back in my working days3 I had a company-reimbursed cell phone plan4 with Rogers. My job involved travel now and again, usually to the USA. And I usually made use of Rogers’ “Roam Like Home” feature. When this feature was first introduced, it was pretty innovative; before it existed, you normally had to contact the carrier to temporarily add roaming to your plan, which was a hassle. The idea behind Roam Like Home was attractive. It was automatic, it allowed you to use your phone in exactly the same way (no need to keep track of your “roaming minutes” or “roaming data usage”)5. And, at launch, it was a reasonably priced, at $5/day for US roaming. As most of my travel was of the day or two variety, this seemed like a perfect fit for the business traveler.

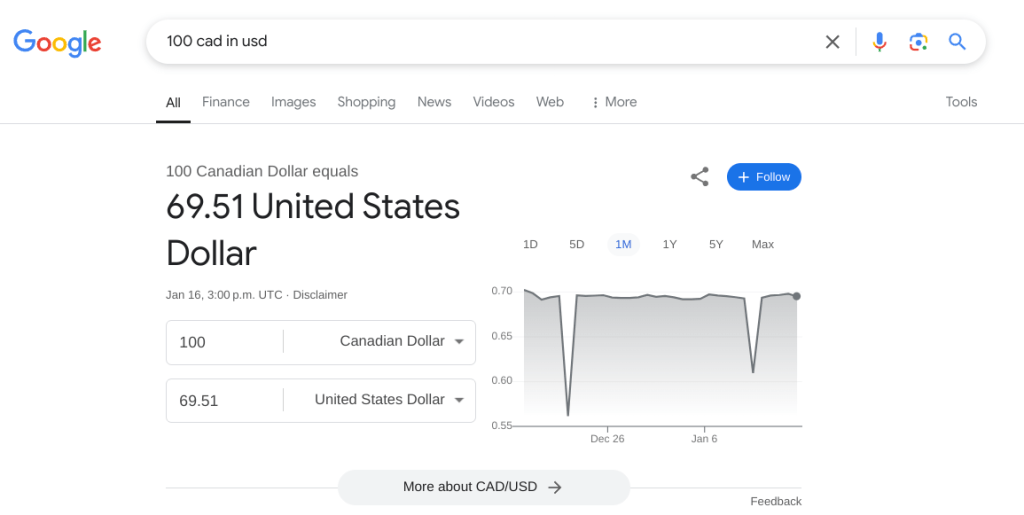

But surprise, surprise, Rogers got greedy. As a shareholder6, I approve, but as a user, their now $12/day charge is nothing short of robbery.

And that’s when I discovered the world of travel eSIMs. An eSIM allows you to install a 2nd, virtual SIM card in your phone so you can benefit from MUCH cheaper roaming rates. I’ve been a long time user of Airalo for my travel eSIMs. And a quick look at the prices will show you why. The $12 Rogers charges me daily would pay for two weeks of typical US travel using Airalo.

Like all things, there’s no free lunch here. A few warnings that may make eSIMs not for you:

- Your phone has to support eSIM technology. Most phones purchased in the last 5 years do. But do check.

- The very cheapest eSIMs don’t support voice calling or SMS. Just data7. So if talking on your phone is important, then make sure your eSIM supports voice8. With the plethora of apps that allow texting and voice (WhatsApp, Messenger, Signal, Facetime) and the prevalence of free apps like TextNow, my world hardly ever needs voice or SMS, at least not with friend groups. YMMV.

- Setting up an eSIM can be a little intimidating the first time; the instructions are clear enough, but you do have to mess around a bit in settings menus you may not be very familiar with

I’ve used Airalo successfully on multiple US trips, in Europe (Germany, Switzerland), and in Asia (Hong Kong, Thailand). Never had a problem.

Airalo isn’t the only one out there, it’s just the only one I’ve personally used. Their focus is more on short-term travel needs with plans as short as 7 days. An alternative provider my trusted neighbour Steven swears by is eskimo. Their focus is on bulk, so if you frequently travel to the same place, it may be a better choice for you.

If you want to give Airalo a spin, mentioning my referral code will get you $4.50: ROB1033.

- AKA mobile phone, smart phone, handy ↩︎

- And in my very first use of same, the first words I uttered, with no small amount of delight, from a bag phone (remember those?) were “Guess where I’m calling from?” ↩︎

- Which ended last month, just to be clear. ↩︎

- My current provider now that I’m paying the bills is Fizz, Videotron’s low-cost carrier. So far, so good. My referrer code on Fizz is INSWI, in case you want to get some free cash 🙂 ↩︎

- It was not uncommon in those days to hear a tale of woe involving a roaming charge of several hundred dollars charged to a less-attentive traveler. ↩︎

- I own Rogers via XGRO since it’s part of the S&P/TSX 60 ↩︎

- Be very careful, Apple iOS users. The Messages app is either SMS or a data service, depending on the colour of your bubbles. Blue bubbles — it’s a data service, green bubbles means it’s an SMS. ↩︎

- But again, careful. An eSIM with voice comes with its own phone number. That’s fine if you’re the one making calls, but not if you’re the one expecting to be reachable on your usual phone number. An answered inbound call is roaming, I’m afraid. ↩︎