(New to asset allocation ETFs aka all-in-ones? Here’s a good place to start.)

Asset allocation ETFs can be purchased from any number of companies. In this article, we look at 4 of the biggest names:

- TD, with TEQT, TGRO, TBAL et al

- Blackrock/iShares with XEQT, XGRO, XBAL et al

- BMO with ZEQT, ZGRO, ZBAL et al

- Vanguard with VEQT, VGRO, VBAL et al

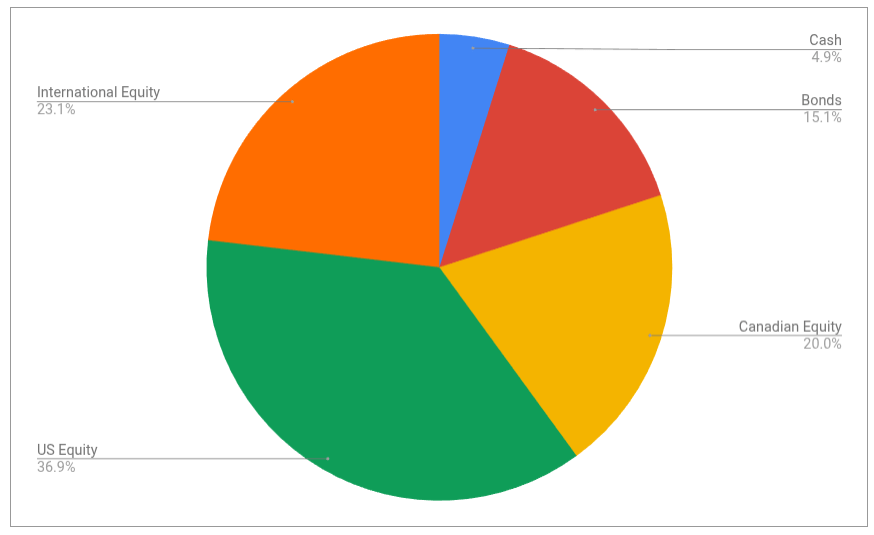

The blueprint for each of these ETFs are similar: pick Canadian, US, International and (where applicable1) bond indices, pick a target percentage allocation for each slice of the pie, and carry on…

I previously talked about the variations in percentage allocation (the size of the pie slices) between the major funds over here.

But what about the indices that each of the major fund families track? What’s in the pie? Are there significant differences? Here’s a summary of what I found:

| TD | iShares | BMO | Vanguard | |

|---|---|---|---|---|

| TEQT, TGRO, TBAL | XEQT, XGRO, XBAL | ZEQT, ZGRO, ZBAL | VEQT, VGRO, VBAL | |

| CAD Equity | Solactive Canada Broad Market | S&P/TSX Capped Composite | S&P/TSX Capped Composite | FTSE Canada All-Cap |

| US Equity | Solactive US Large Cap CAD Index | S&P Total Market | S&P 500 S&P Midcap 400 S&P SmallCap 600 | CRSP US Total Market |

| Int’l Equity | Solactive GBS Developed Markets ex North America Large & Mid Cap CAD | MSCI EAFE® Investable Market, MSCI Emerging Markets Investable Market | MSCI EAFE Index, MSCI Emerging Markets Index | FTSE Developed all-cap, FTSE Emerging all-cap |

| Bonds | FTSE Canada Universe Bond Index | FTSE Canada Universe Bond Index and others | FTSE Canada Universe Bond Index and others | Bloomberg Global Aggregate Canadian Float Adjusted Bond |

So there is variation in the pie recipes (the underlying indices), but is it really of any significance? At a glance, I wonder how different the offerings from iShares and BMO actually are — the same index providers show up in each. Without looking at what stocks are actually found in each of these, here’s a quick take, simply based on the names of the indices:

- Canadian Equity: All of these funds hold the broad Canadian market, over three different index providers23. iShares and BMO use a capped index, which, in theory, should limit exposure to the very largest Canadian businesses somewhat.

- US Equity: Three different index providers seen here (Solactive, S&P and CRSP). TD only holds large US companies, the others hold smaller and midsized US companies. In the last ten years, this has been a winning strategy, but it’s not always been that way.

- International Equity: Three different index providers: Solactive, MSCI, FTSE. TD excludes emerging markets (e.g. Brazil, Russia, Taiwan, China, India). The others don’t.

- Bonds: Hard to tell just based on the names, but three of them use the same FTSE index. Vanguard uses a Bloomberg index. So I’ll say that it’s likely that Vanguard’s bond portfolio will look different from the other three.

In a future post, I’ll delve into what the main holdings of each of these funds are in each of these categories to see what differences emerge. And whether these differences actually matter!