Readers will know that I’m a fan of the asset-allocation ETF. In fact, the vast majority of my retirement savings are dedicated to them. (New to the concept of asset allocation ETFs? Here’s an intro.)

Owning asset-allocation ETFs means you can quite literally invest and forget. The target asset allocations are maintained automatically for you, eliminating the all-too-common desire to tinker/experiment/play and mess with your returns in the process.

As with all things investing, there’s no such thing as a free lunch. This automatic asset re-allocation is reflected in the MER1 of the asset-allocation ETFs. So what’s this automatic management actually costing the holder of the all-in-one?

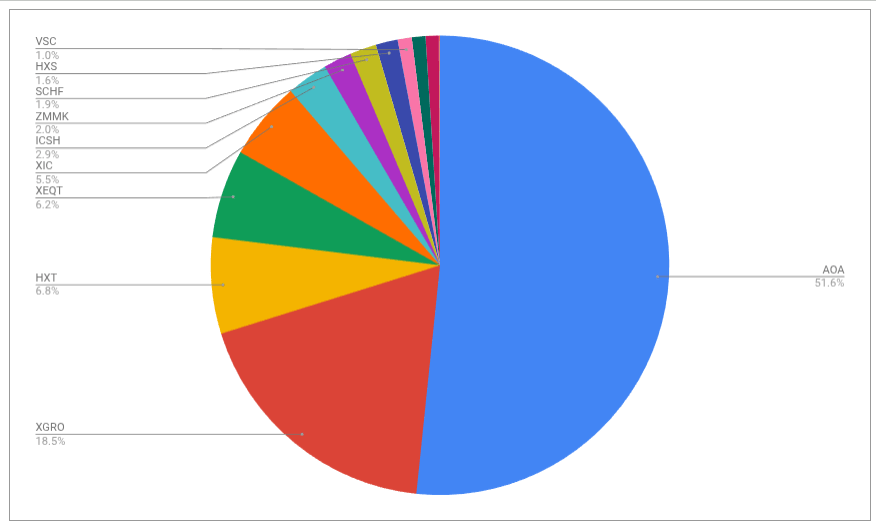

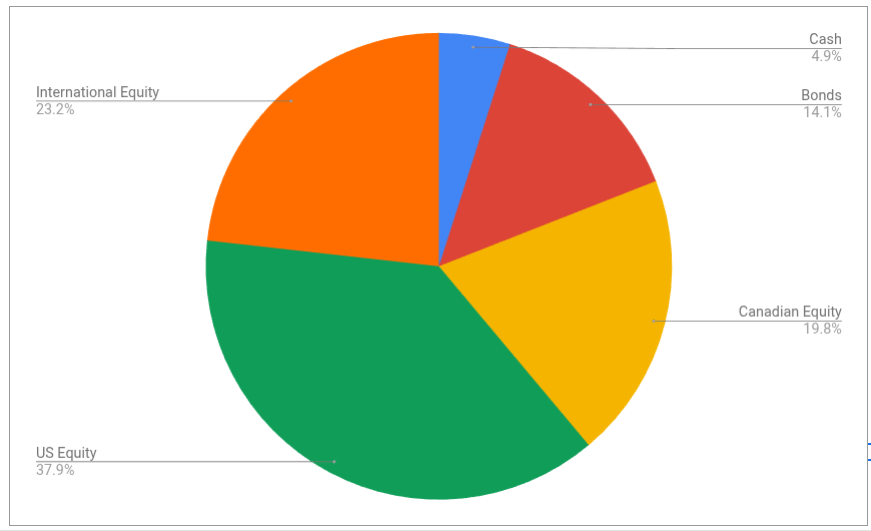

To work out the answer to that question, you have to look at how the asset-allocation ETF in question is built. Some people refer to asset allocation ETFs as “funds of funds” and this is actually quite an apt description, since most asset-allocation ETFs are just constructed by buying up index ETFs issued by the same company.

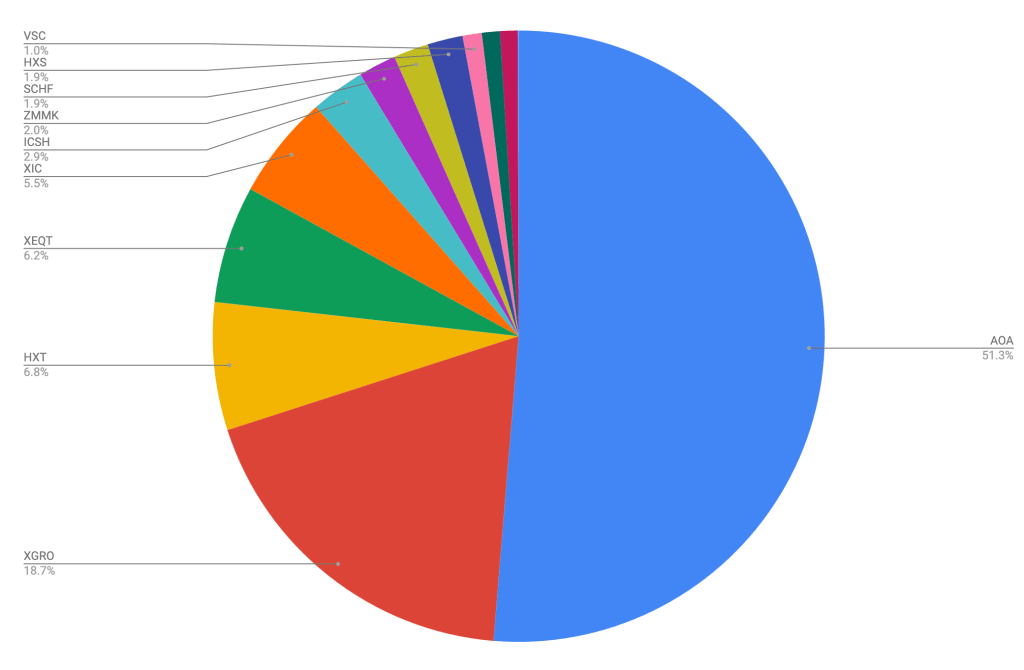

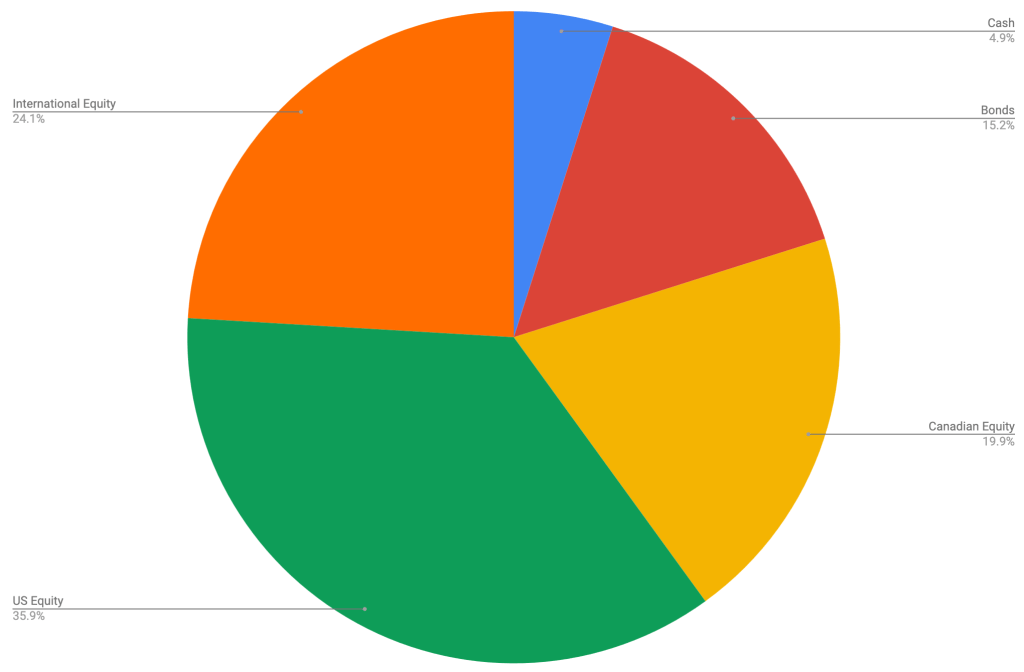

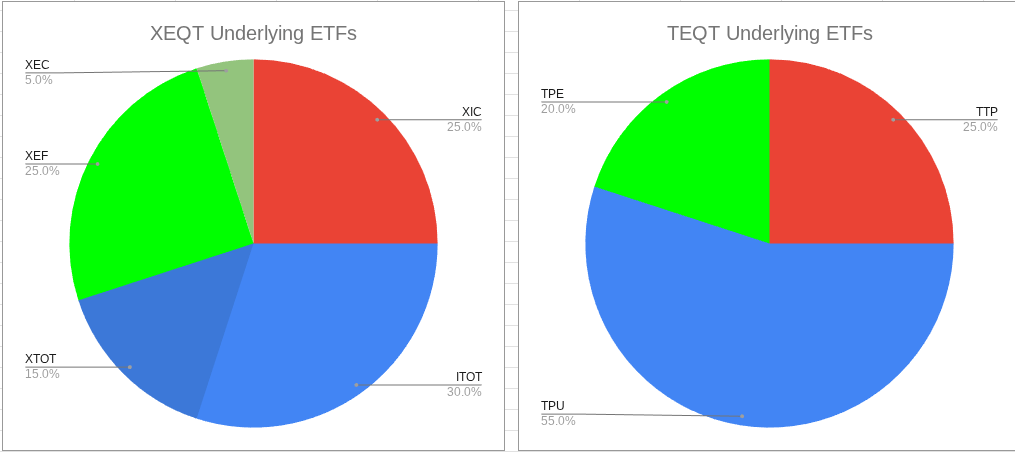

For example, iShares and TD each have an all-equity asset allocation ETF, named XEQT and TEQT2, respectively. Here’s what’s actually under the hood of each of them:

(I tried to keep the colours consistent between the two: red is Canadian equity, blue is US Equity, and other colours are international equity).

The thing about the MER of an all-in-one is that it already includes the MERs of the funds from which it is built. The tip-off is phrases like this one in iShares’ literature:

https://www.blackrock.com/ca/investors/en/literature/product-brief/core-etf-portfolios-product-brief.pdf3

…MER includes all management fees and GST/HST paid by the fund for the period, and includes the fund’s proportionate share of the MER, if any, of any underlying fund in which the fund has invested…

What this means is you can work out what the MER would be if you decided to simply manage the underlying funds yourself, and in so doing, figure out the premium that the all-in-one is adding to the mix.

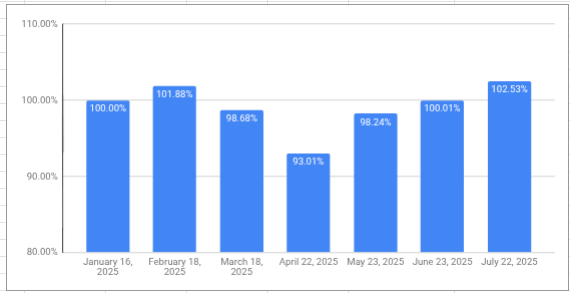

I did this exercise, and here’s what I found:

| XEQT | TEQT | |

|---|---|---|

| MER of component parts4 | 0.103% | 0.089% |

| All-in-one MER5 | 0.20% | 0.17% |

| MER premium for all-in-one6 | 0.097% | 0.081% |

| Annual premium cost per $1000 invested7 | $0.97 | $0.81 |

I offer a few takeaways from this analysis:

- The MER costs I’m talking about here are lower than a factor of 10 (at least) that what’s charged by typical investment advisors and bank-backed mutual funds

- The cost premium of the all-in-one is small, but it’s higher than I expected; even small percentage differences are greatly amplified when you work out (say) the 10 year cost of using these products.

The alternative of managing the constituent parts can be a cheapskate alternative and can save real money over time8, but one must beware of

- The added complexity inherent in managing a portfolio of multiple ETFs. The XEQT/TEQT example is the simplest one; if you add bonds to the mix (e.g. XBAL/TBAL) you will need to add a few more ETFs to replicate the all-in-one. I used to manage my portfolio without using all-in-ones. I enjoyed it (you may have noticed I have a deep interest in investing). In retirement I have chosen to be practical and have attempted to create an environment that won’t be cognitively overwhelming as I get older.9

- The greater likelihood of straying from the plan due to inaction or emotion kicking in. I myself didn’t put a lot of credence to this argument, but people smarter than me have pointed out that this is probably the one biggest factor that derails investment plans.

- The MER (Management Expense Ratio) is the cost of operating the ETF, expressed as a percentage. You don’t directly pay MER fees, but they reduce the overall returns of your investments. Lower MERs = more money for you. ↩︎

- No points for originality here ↩︎

- In teeny tiny letters at the bottom of page 1 ↩︎

- Weighted MER of each of the component ETFs. ↩︎

- You can find these on the ETF pages for XEQT and TEQT ↩︎

- Subtract 2 previous rows ↩︎

- Just multiply. Watch those decimal points, though. ↩︎

- I’m ignoring trading costs which aren’t zero but ought to be very small. Rebalancing assets is necessary of course but is perhaps a monthly, quarterly or annual exercise. ↩︎

- And even a portfolio just based on all-in-ones may prove to be too much to handle at some point. I’ve started to pay a bit more attention to the services offered by robo-advisors. ↩︎