Quite a lot of my portfolio is tied up in all-in-ones. My Canadian holdings are dominated by XGRO. (If you’re new to the concept of all-in-ones, you may want to give this a read.) I noted with interest a post this week about how XEQT was shifting investments from ITOT to XUS. In plain English, the post was concerned about XEQT’s US holdings moving from the “total” US stock market (ITOT is a mix of small, medium and large companies) versus the S&P 500 (XUS holds the largest 500 companies in the US.)

Now, I don’t hold a ton of XEQT1 (which is 100% stocks); instead, I prefer to hold XGRO, which up until now, I figured was (in my simple way of thinking about such things) “XEQT, except with 20% in bonds”.

The post made me look to see if the report was accurate2. Sure enough, referring to the “Holdings” section of both ETFs, you can see the difference easily.

| Ticker | Name | XEQT Weight | XGRO weight | XGRO Adjusted Weight |

|---|---|---|---|---|

| ITOT | IShares Core S&P Total US Stock | 34.35% | 35.16% | 43.73% |

| XEF | IShares MSCI EAFE IMI | 26.33% | 20.76% | 25.82% |

| XIC | IShares S&P/TSX Capped Composite | 25.88% | 20.55% | 25.56% |

| XEC | IShares MSCI Emerging | 4.97% | 3.93% | 4.89% |

| XUS | IShares S&P 500 | 8.28% | 0% | 0% |

“XGRO adjusted weight” takes into consideration that you can’t just compare the weight of a given equity component since XGRO is roughly 20% bonds. “XGRO Adjusted weight” can be read as “the % contribution of this stock to the equity portion of XGRO”. This allows an apples to apples comparison between XEQT and XGRO.

Clearly, there’s 8.28% that XEQT is investing in the S&P that isn’t in the XGRO portion. So this means that XEQT has a slight bias towards the larger portion of the US stock market over XGRO. I like diversification, so I was mildly concerned that perhaps this wasn’t a good idea. So I did some number crunching by downloading the detailed assets from both of these ETFs.

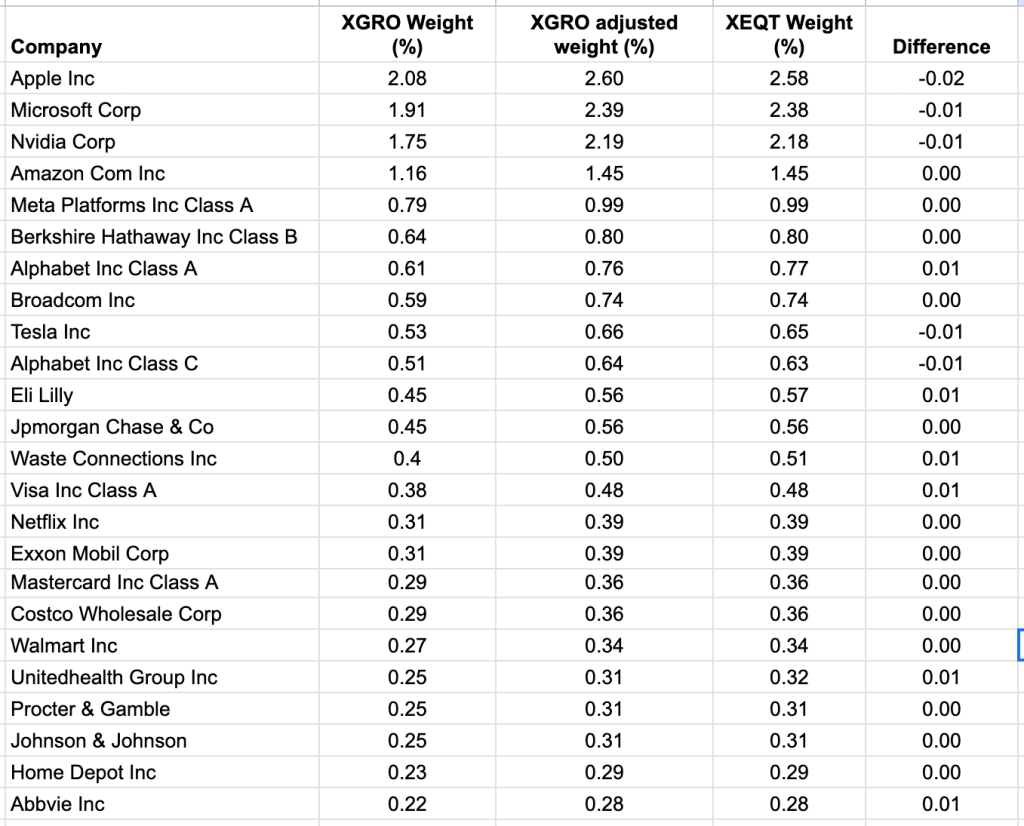

And this is what I found

So while there are some differences in the largest stocks I looked at, there wasn’t a consistent bias towards the large stocks. In fact, the sum of the “difference” column shown here is precisely zero.

But why? Shouldn’t XEQT’s double purchasing of large US stocks (via both ITOT and XUS) result in a bias towards the large US stocks at the expense of smaller US stocks? It should, but right now, at the moment, it doesn’t.

This is because XGRO, at the moment, actually has a slightly larger US bias than XEQT, and both of them are actually below target (as per their reference guide):

| Current XEQT US equity weight | Target XEQT US Equity Weight | Current Adjusted XGRO US equity weight | Target Adjusted XGRO US Equity Weight |

|---|---|---|---|

| 42.63% | 45% | 43.73% | 45% |

This, I suppose, will wash out in the coming weeks/months as both XGRO and XEQT buy up more US stocks to get closer to their targets. In short, there isn’t anything to worry about in the near term; in the longer term, owning XEQT will probably tilt the US equity bias a bit towards larger stocks, which I’m not too fussed about.