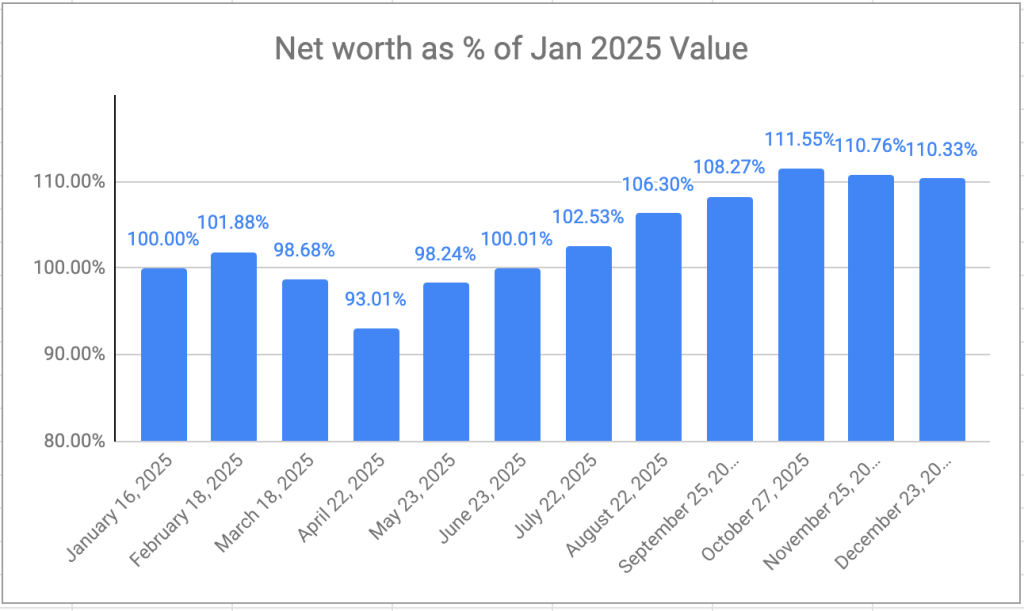

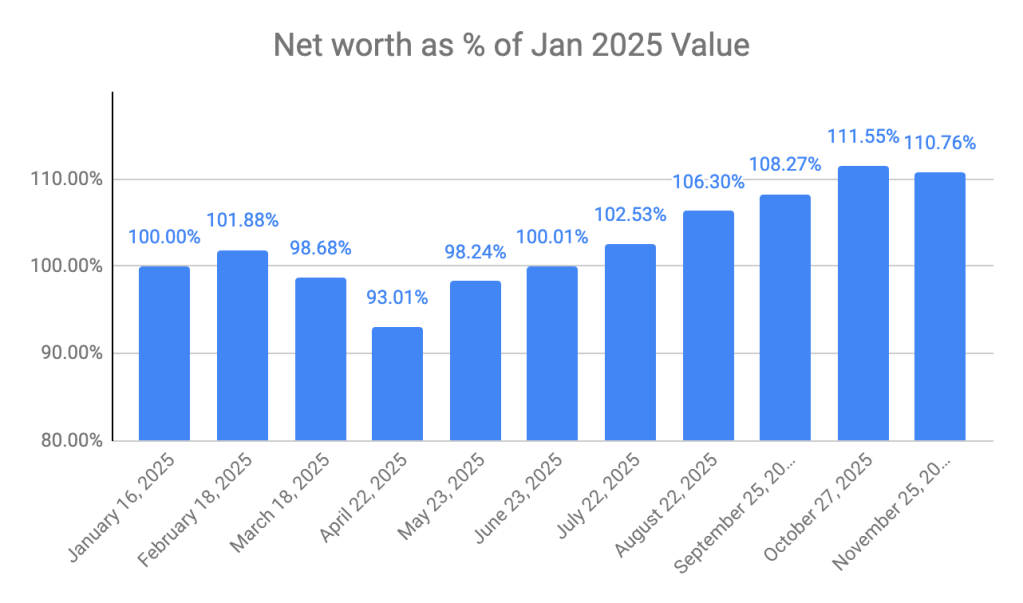

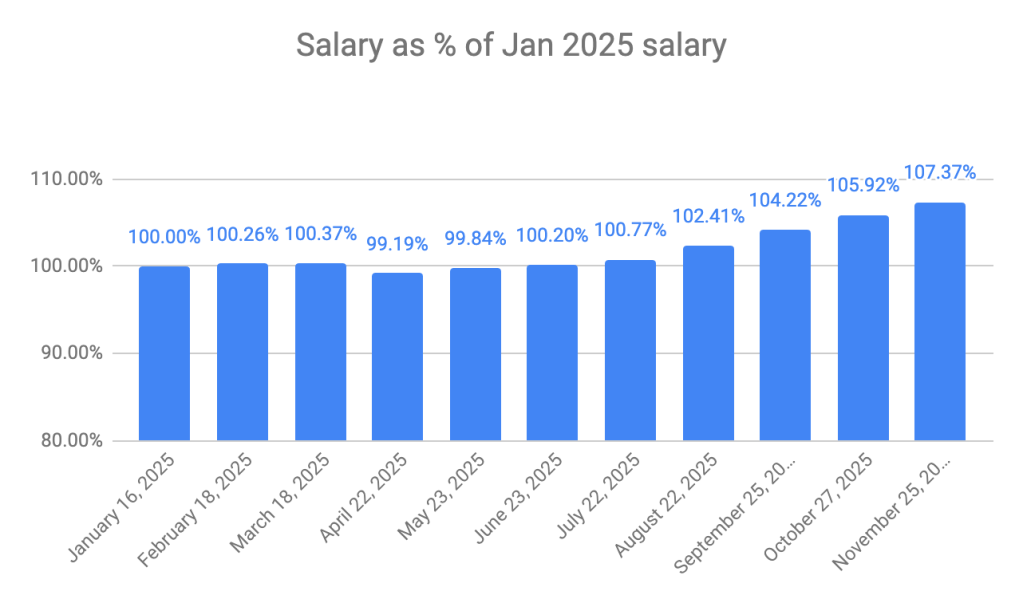

Happy New Year! A new year means it’s a good time to take a look at what went on in the retirement portfolio.

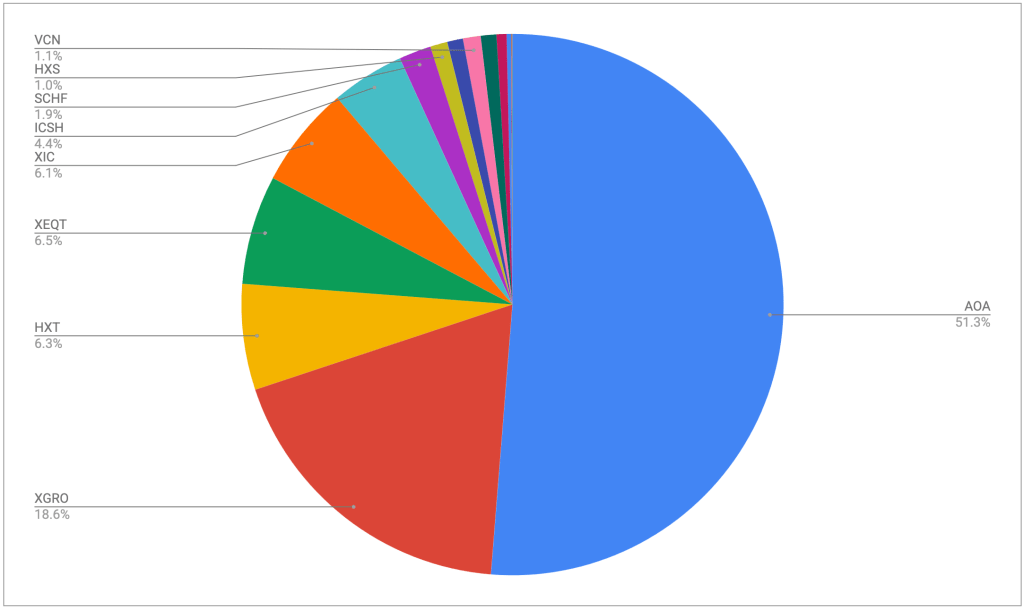

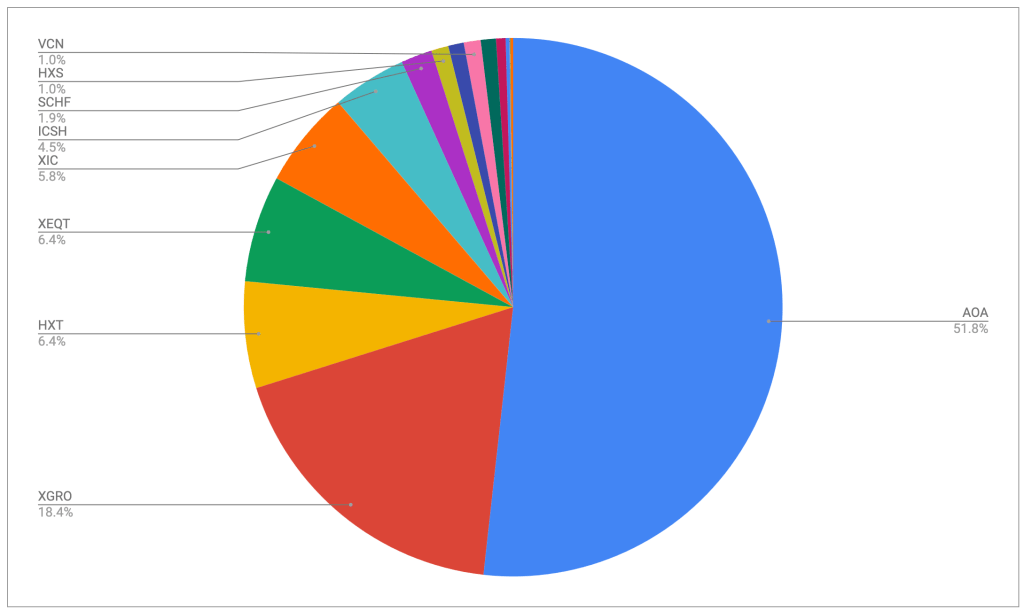

Let’s start by comparing the makeup of my portfolio at the beginning of the year versus my last update:

| Position | January 2025 | December 2025 | Notes |

|---|---|---|---|

| AOA: USD 80/20 | 52.2% | 51.3% | Used for RRIF payments1 |

| XGRO: CAD 80/20 | 20.2% | 18.6% | Used for RRIF payments |

| ICSH: USD short term bond | 0% | 4.4% | Cash cushion, plus additional “cash” inside RRIF2 |

| ZMMK: CAD short term bond | 0% | 0.6% | Cash cushion CAD funds |

| SCHF: International Equity | 2.8% | 1.9% | Used for monthly salary; held only in non-registered |

| XEQT: CAD 100% Equity | 0% | 6.5% | Mostly in TFSA |

| HXT: CAD Equity | 7.4% | 6.3% | Used for monthly salary; held only in non-registered |

| XIC: CAD Equity | 5.3% | 6.1% | Did not add or subtract from this holding this year |

| DYN6005: USD HISA | 3.7% | 0% | Replaced by ICSH |

| DYN6004: CAD HISA | 2.6% | 0% | Replaced by ZMMK |

| HXS: USD Equity | 2% | 0% | Sold off from non-registered accounts to fund monthly expenses |

| VCN: CAD Equity | 1.8% | 1.1% | In TFSA; reduced in favour of XEQT |

What didn’t change much

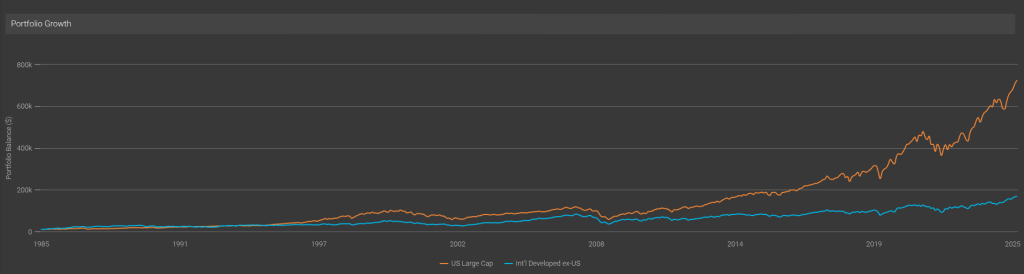

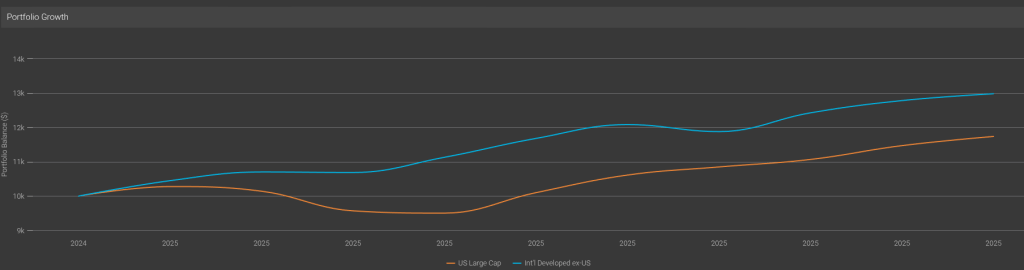

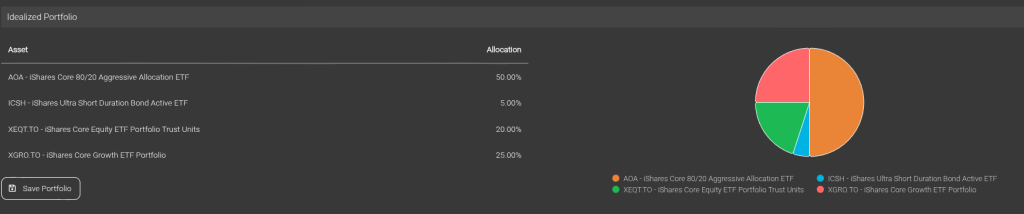

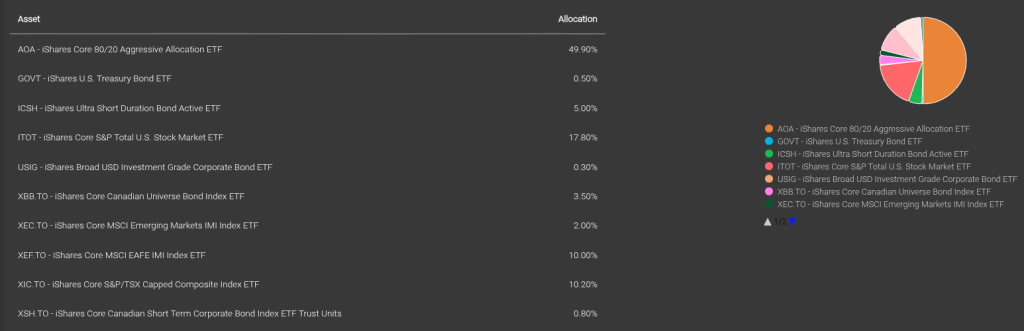

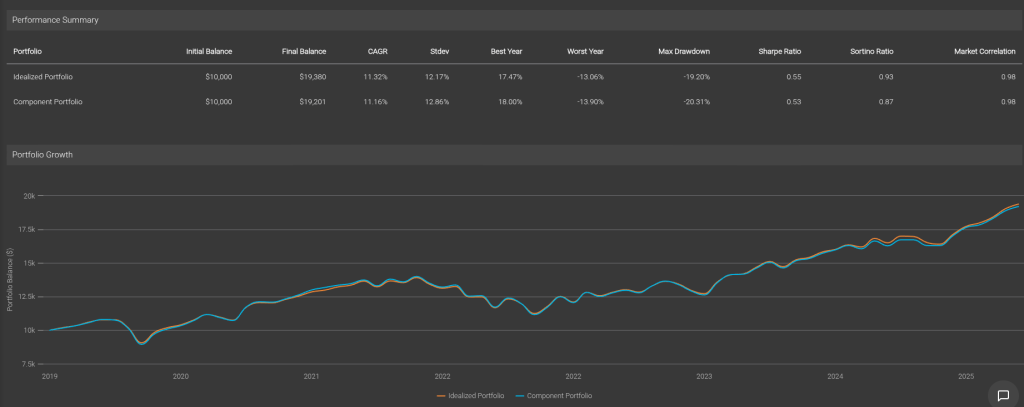

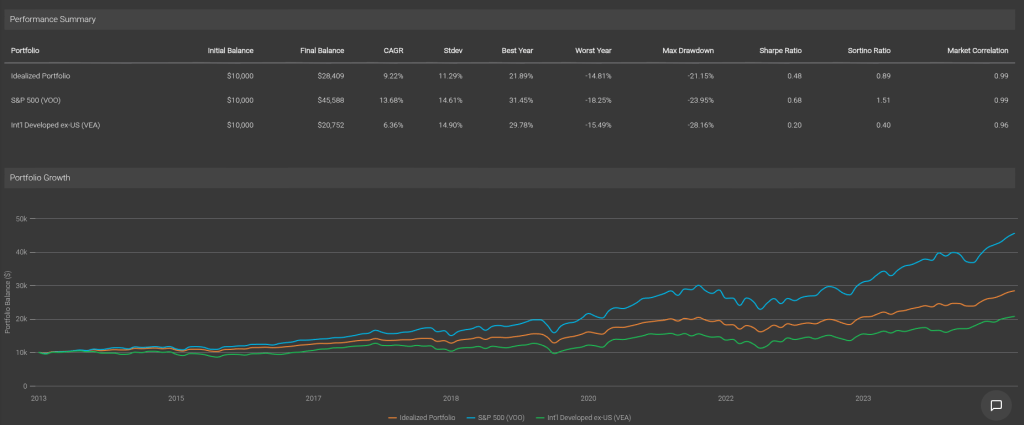

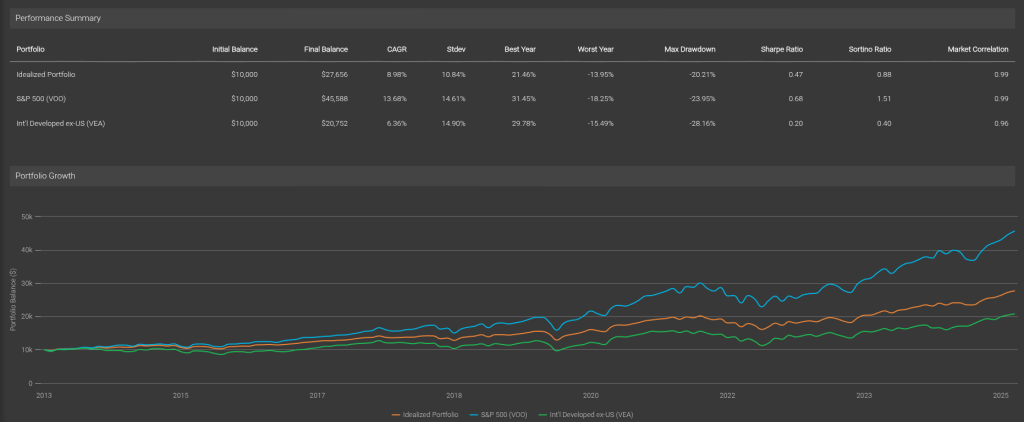

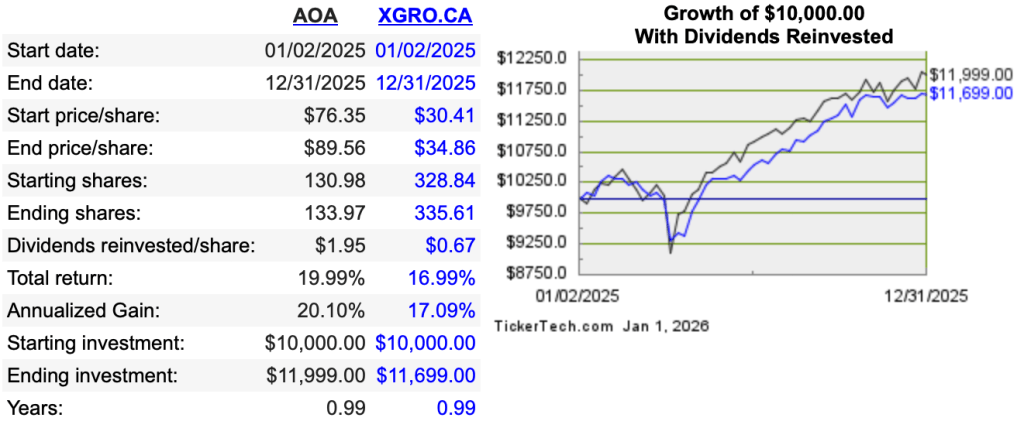

The portfolio is still dominated by XGRO and AOA (not coincidentally, these are two of my ETF All-Stars) and they both had excellent years, as shown by this tool:

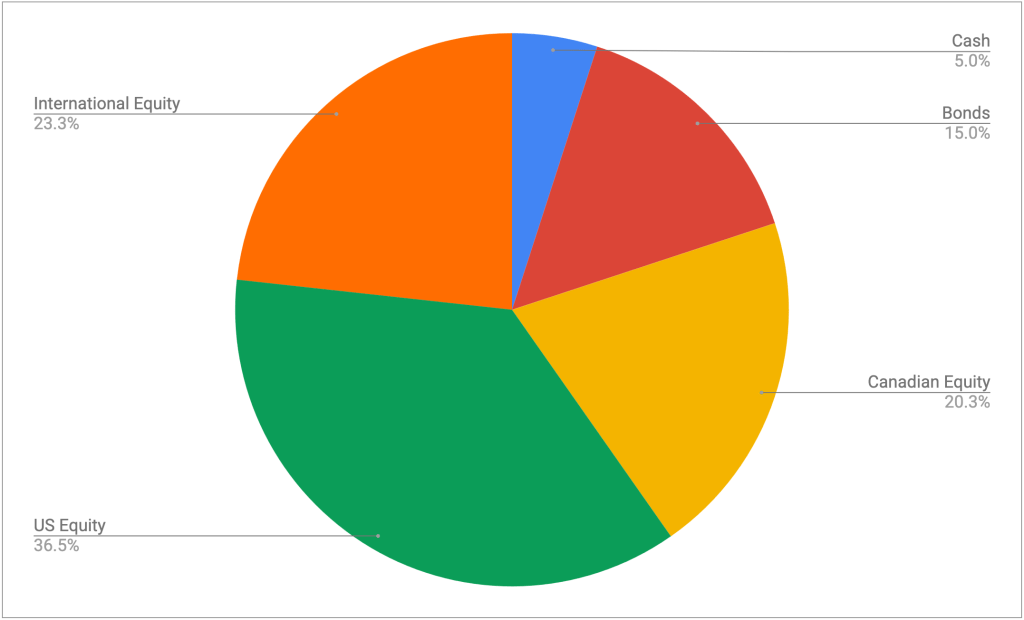

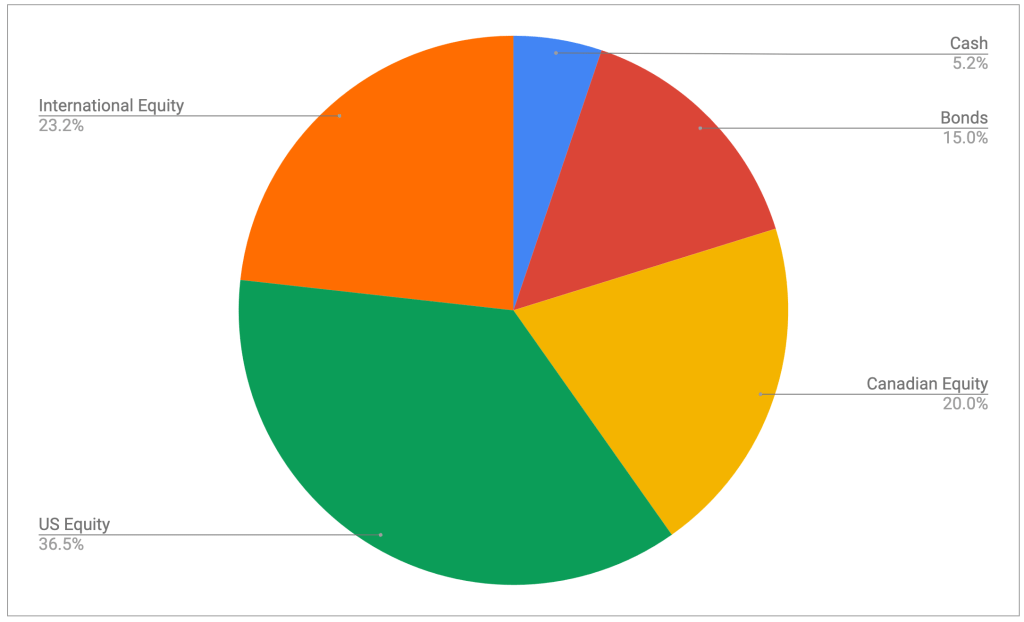

What also didn’t change is my overall approach: decisions for shifting funds is totally dependent on maintaining my asset allocations that haven’t changed either:

- 5% in cash or “cash like” holdings

- 15% in bonds

- 20% in Canadian Equity

- 36% in US Equity

- 24% in International Equity

This approach meant that what I sold off in my non-registered portfolio to fund my day to day expenses changed throughout the year; as the year progressed I sold HXDM, then HXS (reducing this to zero), and then finally HXT, all in the service of keeping my assets in line with my targets.

What did change

As a result of changing brokers (QTrade to Questrade), I lost the ability to cheaply hold HISAs. And so I had to change tactics and hold “HISA-like” ETFs instead. (which, on Questrade, like all ETFs, can be bought and sold at no charge). At the same time, I realized that I could increase my returns by shifting more to the US market. Significantly higher interest rates in the US means that I can get more for my “safe” funds, with the small annoyance that I have to deal with USD. You can see the latest rates on my frequently updated page.

As I sold off “pure” equity funds from my non-registered accounts, I had to make changes to keep my bond percentages aligned with my targets3. This is the reason XEQT (a global 100% equity fund) now makes an appearance in the overall picture. The nice side-effect of adding XEQT is that my portfolio is now 76% held in all-in-one funds, up about 4% from the beginning of the year. All-in-ones do the rebalancing for you, which is a good way to avoid bad behaviours.

Behind the scenes I also tried to better focus each of the account types to make things simpler and clearer:

- TFSAs are now 90% equity, with the rest held in bonds. The rationale here is that TFSAs will be the last things I touch to fund retirement, and hence have the longest time horizon. There are still too many individual ETFs here, and my January resolution is to simplify this further.

- RRIFs now have only three funds: AOA, XGRO and ICSH.

- Investment accounts will remain a bit chaotic as most of my retirement expenses are coming out of these. It also happens to be the place where my “free money” payments end up and so there is a small amount of inbound cash to purchase things with. The 2026 plan is to continue to draw down my non-registered funds since my spouse is still working and would be taxed higher on her capital gains.

What’s ahead in 2026: RRIF

My own calculations4 show that my household RRIF-minimum income will be up 19% YoY, a result of good returns in the RRIF (roughly 11% YoY by my calculation) and being a year older. Selling XGRO every month will cover the required payments, and quarterly I will shift a portion of AOA into XGRO, converting the USD to CAD using Norbert’s Gambit.

What’s ahead in 2026: TFSA

January will see an effort to reduce the number of ETFs here. There are multiple CAD equity ETFs which I should consolidate into one, for instance.

We continue to contribute monthly to the TFSAs. The goal is to maximize equity percentage while minimizing the number of funds held. Once the cleanup is done, I expect to purchase XEQT monthly. Questrade introduced automated investing which I’ll likely set up to accomplish this.

What’s ahead in 2026: Non-Registered Accounts

The same strategy as 2025 will continue. Shortfalls in my monthly salary will be covered by selling assets in the non-registered accounts. I ended last year up 2% YoY in my non-registered accounts; I don’t really expect a repeat there. All things being equal, I should be down in my non-registered accounts at this time next year.

- Indirectly. I haven’t tried to do a USD withdrawal for a RRIF payment, but in theory it should be possible. Instead I convert my AOA into XGRO a little at a time using Norbert’s Gambit. ↩︎

- My VPW cash cushion is about 50% of my cash position in the retirement portfolio. The other 50% of my cash position is inside the RRIF in order to avoid taxation on those monthly distributions. ↩︎

- AOA and XGRO are both 20% bonds, not 15%, and so mathematically this has to be offset with 100% equity somewhere in the portfolio. ↩︎

- My providers will give me the real numbers sometime in the coming weeks. How much hassle this will be is TBD. ↩︎