Stop me if you’ve heard this before, but XEQT, one of my ETF all stars, recently made some changes under the hood1. Specifically, in their words:

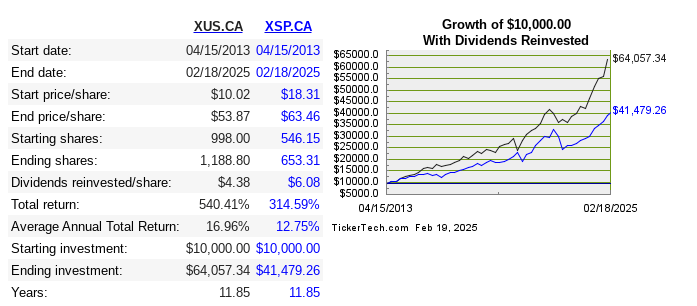

XEQT primarily accesses its broad market U.S. equity exposure using …ITOT, a U.S.-domiciled ETF. In certain circumstances, U.S.-domiciled ETFs … are subject to limits on the sale of their shares to non-U.S. domiciled investment funds such as XEQT. Prior to July 2025, iShares Core S&P 500 Index ETF (XUS) had been held as an additional instrument… Effective July 2, 2025, XEQT has replaced XUS with iShares Core S&P Total U.S. Stock Market Index ETF (XTOT). Going forward, XEQT is expected to hold a mix of XTOT and ITOT.

https://www.blackrock.com/ca/investors/en/literature/product-brief/core-etf-portfolios-product-brief.pdf

So, in other words:

- XEQT isn’t allowed2 to hold “just” ITOT (a broad US market ETF) to cover the US market3

- XEQT used XUS (the 500 largest US stocks) to get around this restriction until very lately

- XEQT now uses XTOT which is 99% the same as ITOT to get around this restriction

- TL/DR: XEQT is now pretty much what it was at the very beginning of 2025

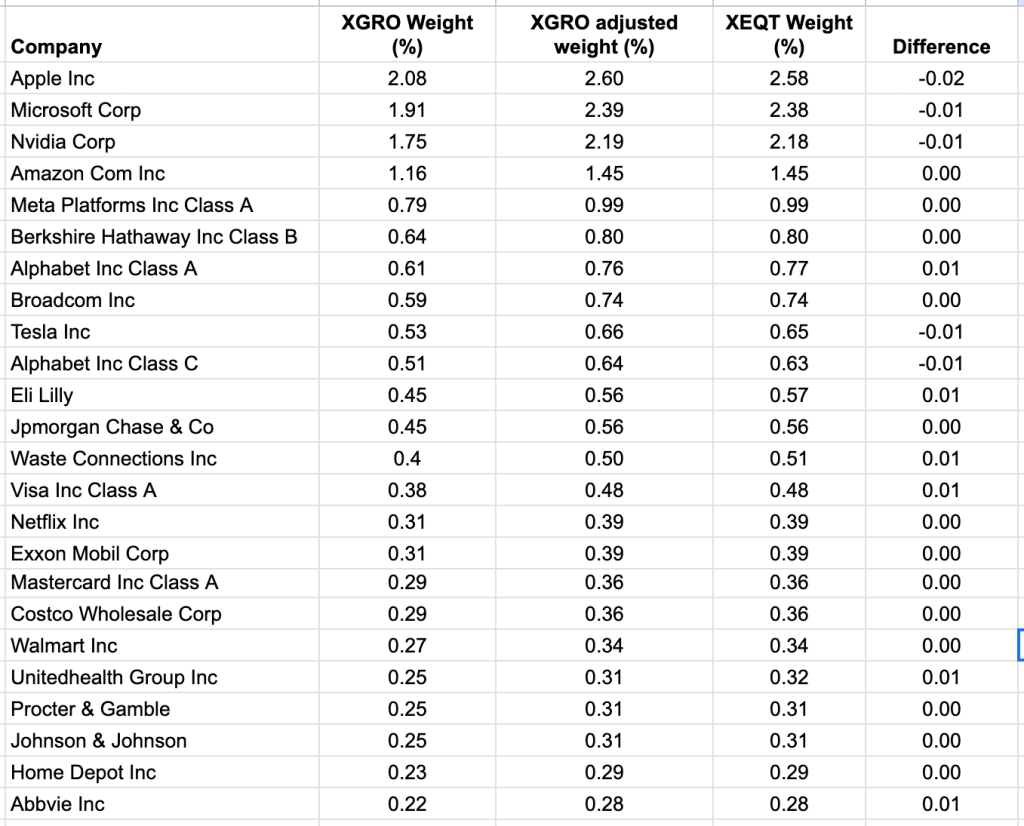

What this means is that lately4, XEQT has reduced its exposure somewhat to the very largest US stocks. I did a little analysis to convince myself, summarized below:

| Stock5 | % delta change XEQT6 | % delta change ITOT7 | delta XEQT/ITOT8 |

|---|---|---|---|

| Apple | -1.7% | 1.2% | -2.9% |

| Microsoft | -2.9% | 0.2% | -3.0% |

| NVIDIA | 3.5% | 6.5% | -3.1% |

| Amazon | -1.3% | 2.3% | -3.6% |

| META | -9.2% | -6% | -3.2% |

| Berkshire Hathaway | -6% | -3.4% | -2.6% |

| Alphabet A | 2.6% | 6.4% | -3.8% |

| Broadcom | -1.0% | 2.3% | -3.3% |

| Tesla | -6% | -4% | -1.9% |

| Alphabet C | 1.6% | 6.5% | -4.9% |

The change in the contribution of the largest 10 US stocks has been consistently reduced in XEQT in the past month — that’s what the last column shows. This is what one would expect by removing the “double investing” that was going on previously when XEQT was holding both ITOT and XUS.

To me, that’s all round a good thing, since it provides greater diversification when holding XEQT. I’ve updated the What’s the deal with XEQT? post accordingly!

- Thanks to r/JustBuyXEQTfor pointing this out ↩︎

- And I don’t know why this is ↩︎

- XGRO, my normal go-to in this all-in-family, has not changed at all and continues to hold ITOT and never bothered adding XUS. I guess since the US portion of XGRO is smaller than that of XEQT, it can skirt this restriction. ↩︎

- Since July 2 to be precise ↩︎

- These are the top 10 US holdings of XEQT, and the top 10 for ITOT. ↩︎

- This is % change in the % contribution of each of these stocks between June 30 2025 and July 25, 2025 as reported by the XEQT “underlying aggregate holdings” data on its product sheet. The XEQT change is driven by both the differential in the monthly returns, AND a reduction in the weight of each of the underlying stocks. ↩︎

- This is the % change in the % contribution of each of these stocks between June 30 2025 and July 25, 2025 as reported by the ITOT “underlying aggregate holdings” data on its product sheet. The ITOT change is driven purely by differential monthly returns of the stocks. ↩︎

- Simply subtract the two previous columns ↩︎