I provide some rules here to help you understand some of my own biases. They may not align with yours. But at least you know where I’m coming from.

Retirement investments are distinct from savings and day-to-day expenses

I have always maintained a firewall between investments and all other money. “Investments” for me always meant “money to be accessed only in retirement”. Whether that money was in an RRSP, TFSA or non-registered account made little difference. I never mixed the two. My rationale was that by keeping things separate, I made it much more difficult to “borrow” from retirement to fund today’s expenses. And it allowed me to take on the appropriate level of risk in my long-term investments, which helped boost my returns in the long run. I had another rainy-day cache of money to deal with unexpected expenses, and this money had to be absolutely liquid (no GICs, for example). My long term investments were always in place for “future me”.

More return requires more risk which requires holding more of your investments in stocks (aka “equities”)

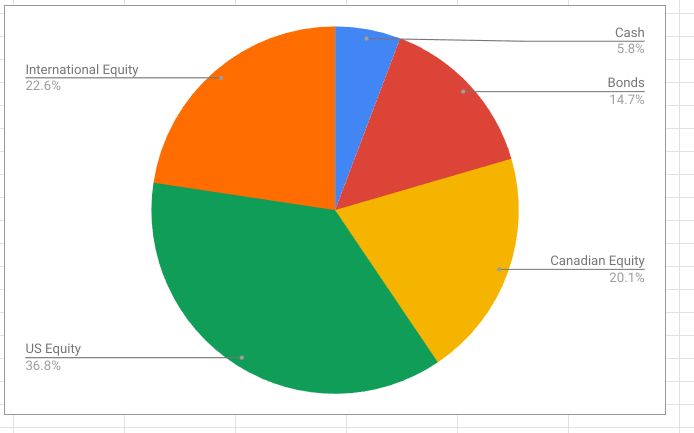

If you want more return on your investments, you have to take on more risk. “Risk” doesn’t (or shouldn’t) mean “my money may go to zero” (that’s called “gambling”), but it does mean that in a given short-term period (one quarter, one year, three years) your money may not grow or even shrink. I have always maintained an 80/20 portfolio — 80% equity, 20% bonds. As I neared retirement, I moved to 80% equity, 15% bonds, 5% cash. Here’s my portfolio in real time (love Google Sheets for this).

Diversification helps mitigate risk

I don’t pick stocks. I only buy indices. You can certainly build a great portfolio at rock-bottom prices by buying individual stocks but I’m too lazy to do the necessary research. I’ve always spread my investment equity in different markets: Canada, USA, International. You can do this all through ETFs purchased on the Canadian stock market. Did I say “ETFs”? You can actually buy the 80/20 (or 60/40…or 40/60) portfolio in exactly ONE (1) ETF. More on that in a future post.

Dividends are nice, but total return is what really matters

I think a lot of the literature out there focuses on dividend stocks because they generate income. I think this is seen as attractive because many people can’t bear the thought of selling their holdings to pay the hydro bill. (“I want to just live off my dividends”). And while you can certainly be successful by buying into dividend stocks exclusively, I think you can miss out on maximizing the total return of your portfolio this way. And you may end up with a larger-than-intended estate when you die. The overall yield of my portfolio is somewhere around 2.5%, which is pretty paltry, but the total return is much higher.

Discover more from The Money Engineer

Subscribe to get the latest posts sent to your email.

[…] lack of focus on generating income in my portfolio (as stated elsewhere, total return is what matters to me) drags down my overall score — but with one click, that […]

LikeLike

[…] Saving is different from investing (my view here) […]

LikeLike

[…] a dedicated low-fee ETF investor (new to ETFs? read more here), most of my holdings are actually tied up in various index funds; as […]

LikeLike