So what’s in my retirement portfolio these days? A fair question. My portfolio is 100% in ETFs excepting the cash position. For historical reasons, a lot of my retirement savings are in US dollars. As as result, you’ll see ETFs listed here that trade on the US stock exchange, in US dollars. It’s not an approach I’d recommend for most people as it adds a lot of complexity to the mechanics of moving money around, which is really what decumulation boils down to!

The pie

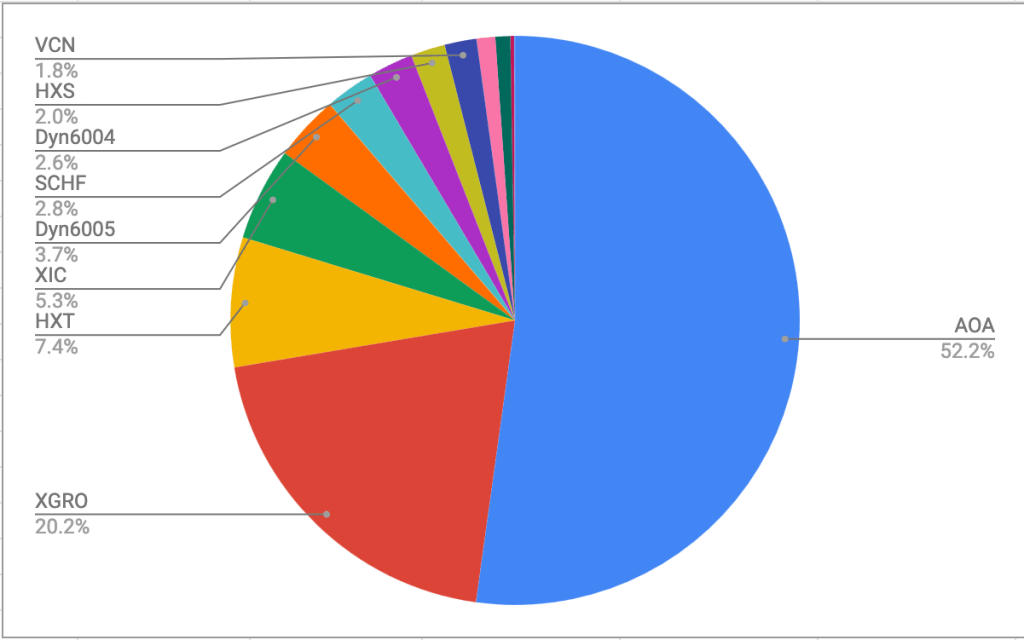

The chart shown below is the summary of all my accounts: personal and spousal RRIFs in CAD and USD, TFSAs for me and my spouse, and non-registered accounts in USD and CAD. It comes pretty close to my target of 80/15/5: 80% equity, 15% bonds, 5% cash. Let’s visit how that comes about.

Summary of funds held in my retirement portfolio

What’s in the pie?

AOA: This is what I call an “All-in-one” ETF that trades on the US stock exchange. It’s an 80/20 fund, 80% equity, 20% bonds. Its US weighting is pretty high, its Canadian weighting is pretty small (about 2.4% by my calculation).

XGRO: This is the Canadian sibling of AOA. An “all-in-one” ETF that trades on the Canadian stock exchange. It’s also an 80/20 fund, with a much stronger tilt to the Canadian equity market.

HXT: Is a fund that I only hold in my non-registered account. Through behind-the-scenes accounting and swap contracts, it provides no-dividend access to the S&P/TSX 60. This is useful from a tax perspective if you’re still earning a salary since it effectively defers any tax impact until you sell shares.

XIC: A variant of the S&P/TSX 60 that caps the contribution of any one company to prevent the “Nortel effect” seen in the late 1990s. I’ve been too lazy to clean this out of the account.

DYN6004/DYN6005: Are Scotiabank HISAs in Canadian and US funds (High Interest Savings Accounts). On my provider’s trading platform, they look like mutual funds, but are just savings accounts that pay a decent interest rate, monthly. They have consistently provided the best rates of all the HISAs available on my provider’s platform.

SCHF: A very low cost equity fund that trades in USD. It provides exposure to international developed markets except the USA. It has about 8.5% weighting for the Canadian equity market. I used to have this in my registered accounts, but dropped it in favor of AOA. It’s still in my non-registered accounts so I don’t have to take an unnecessary capital gain.

HXS: The sibling of HXT, but it covers US markets. Only held in non-registered accounts.

VCN: Provides broad exposure to the Canadian market including smaller companies.

In an ideal world, my portfolio would just hold AOA/DYN6005 for US funds and XGRO/DYN6004 in Canadian funds. Eventually, as I decumulate my holdings, that’s what it will look like. Simple is best.

So why is my portfolio not aligned with my ideal model? Three main reasons:

- Some of the “extraneous” holdings are in my non-registered accounts and I don’t want to incur a capital gain just to make the portfolio simpler.

- I want a little bit more Canadian market exposure since I do live and spend money here.

- No pressing need to. The splits between Canada/US/International equities are fine where they are. I try to trade only when necessary.

I’ll revisit this post from time to time as I go through decumulation to see how it evolves. Prior to hitting the button on retirement, I had a lot more ETFs in the list, basically attempting to build the equivalent of XGRO and AOA through other ETFs. For a small cost, (roughly 0.15%) AOA and XGRO rebalance their holdings quarterly so I can just let them run on autopilot, confident that they will always be close to my desired 80/20 splits. That’s why these two ETFs make up the lion’s share of my retirement portfolio.

Discover more from The Money Engineer

Subscribe to get the latest posts sent to your email.

[…] shown over here, the vast majority (about 80%) of my holdings are in four investments: two asset-allocation ETFs […]

LikeLike

[…] mentioned elsewhere, I rely heavily on all-in-one ETFs in my retirement portolio. New to all-in-ones? Read a bit about […]

LikeLike

[…] of my investment philosophy is to have 5% of my overall holdings in cash (as for the rest, it’s 15% in bonds, 80% in […]

LikeLike

[…] This is a (hopefully monthly) look at what’s in my retirement portfolio. The original post is here. […]

LikeLike

[…] is a (hopefully monthly) look at what’s in my retirement portfolio. The original post is here. Last month’s is […]

LikeLike

[…] is a (hopefully monthly) look at what’s in my retirement portfolio. The original post is here. Last month’s is […]

LikeLike

[…] is a (hopefully monthly) look at what’s in my retirement portfolio. The original post is here. Last month’s is […]

LikeLike

[…] is a (hopefully1 monthly) look at what’s in my retirement portfolio. The original post is here. Last month’s is […]

LikeLike

[…] is a (hopefully monthly) look at what’s in my retirement portfolio. The original post is here. Last month’s is […]

LikeLike

[…] is a monthly look at what’s in my retirement portfolio. The original post is here. Last month’s is […]

LikeLike

[…] is a monthly look at what’s in my retirement portfolio. The original post is here. Last month’s is […]

LikeLike

[…] is a monthly look at what’s in my retirement portfolio. The original post is here. Last month’s is […]

LikeLike

[…] This is a monthly look at what’s in my retirement portfolio. The original post is here. […]

LikeLike

[…] This is a monthly look at what’s in my retirement portfolio. The original post is here. […]

LikeLike

[…] This is a monthly look at what’s in my retirement portfolio. The original post is here. […]

LikeLike