Summary: In a previous post, I talked about preparing your portfolio for retirement. But now that the paycheques have stopped, how do I get paid from my DIY portfolio?

I got (retirement) paid for the first time today! This is indeed a cause for celebration, at least personally. As a DIYer who is self-funding retirement1, it’s not exactly sitting back and waiting for the cheque to arrive2. There’s a fair bit of work that has to be done if you want, as I do, a monthly salary.

As mentioned elsewhere, I’ve adopted the brilliant strategy of VPW (Variable Percentage Withdrawal) to calculate how much I can get paid every month.

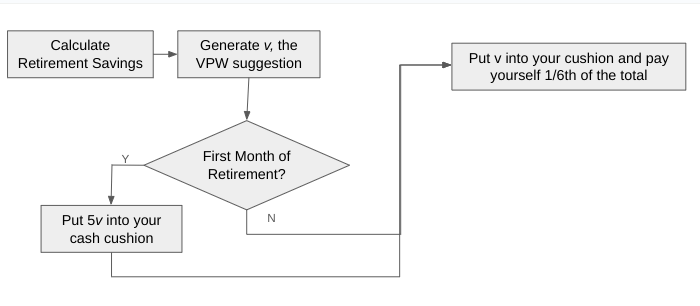

Here’s the high-level flowchart of how VPW works:

Let’s go through step by step.

Calculate Retirement Savings

If you’ve simplified your retirement portfolio, this is probably as simple as logging in to your online broker’s portal and looking at what you’re worth today. For more complex scenarios (like mine, because I am test driving a new provider) you’ll need some sort of spreadsheet. Mine is based on this template. I don’t include day to day chequing accounts or anything like that. My retirement portfolio remains firewalled from all the daily puts and takes.

Generate v, the VPW Suggestion

This uses the VPW worksheet available over here. Basically, you enter a few parameters (how old you are, what your asset mix3 is, what your retirement savings are and what pensions (CPP, OAS or employer) you may have now or in the future. Predicting future CPP was made easier for me by using CPP Calculator. The first time you fill in the worksheet, it’s a bit more effort, but most of it (aside from retirement savings) doesn’t change much (if at all) month to month. Enter all the parameters, and out comes v, the monthly VPW4 “suggestion”.

Now, if this is the very first time you’re running through this, meaning that it’s your first month of retirement, there’s one additional step, and that is creating what the VPW folks refer to as a “cash cushion”. I think of it as a shock absorber myself, and my DIY enthusiast neighbour5? He thinks of it as the source of a cash waterfall you drink from monthly.

Whatever you choose to call it, the cash cushion, as the name implies, sits between the VPW suggestion and your retirement salary, dampening possible month to month swings caused by swings in your net worth. A sudden drop in the stock market won’t translate immediately to a sudden drop in your salary, and by the same token, a sudden rise in the stock market won’t translate immediately to a sudden rise in your monthly salary.

Creating the cushion the first time is easy. Just take 5 times what VPW suggests and put that in your cushion. That ought to be a firewalled account that pays decent interest.

Put v in your cushion and pay yourself 1/6th of the total

In the very first month, the astute reader will note that my salary is v, the VPW suggestion. As time goes on, the salary will vary with my retirement savings, and the cushion acts like a moving 6 month average function.

That, in essence, is what the monthly routine looks like.

The reality behind the scenes takes quite a bit more steps due to factors like

- How many RRIFs you have (personally, I have two…or maybe three6)

- Whether or not your scheduled RRIF payments cover your VPW-generated salary (mine do not and probably will not ever do so)

- The time lag between asset (stock/ETF) sale and cash availability7

- The ability (or not) to easily move money around between accounts8

I will show you the actual work behind the scenes in a future post, but be aware and take the time to work through the details before you pull the plug for real.

- I’m delaying CPP and OAS until much later to get more monthly money of inflation-indexed protection. ↩︎

- Or an envelope of cash, apparently. The things you get when you type “paycheque” in the search engine… ↩︎

- All VPW cares about is how much of your savings are in stocks AKA equity. More stocks = higher returns = more risk. ↩︎

- VPW also supports quarterly or annual calculations. I’m sticking with monthly since it’s much closer to what is typical cash flow management for my household. ↩︎

- And volunteer copy-editor, thanks Steve 🙂 ↩︎

- One spousal RRIF based on the spousal RRSP my spouse contributed to, one personal RRIF based on my personal RRSP. I also have a USD personal RRIF but my provider treats it as part of my personal CAD RRIF. My portal shows three accounts, but I only get two payments. ↩︎

- Typically, two days ↩︎

- I learned, sadly, that my current provider offers no way to move money between non-registered accounts without resorting to a phone call. As I have already reached my hold music limit for 2025, there’s no way I’m going to put up with that. And so the chequing account comes into play as a way to move money around at the cost of delay. Dear QTrade, please fix this. ↩︎

Discover more from The Money Engineer

Subscribe to get the latest posts sent to your email.

[…] covered how I get paid in retirement previously, but this was nothing more than a restatement of how VPW (Variable Percentage Withdrawal) works. My […]

LikeLike

[…] and need to do a bit more research. It may be a way to fund income in your later years when the complexity of managing withdrawals in a DIY fashion may be too cognitively […]

LikeLike

[…] I use “Variable Percentage Withdrawal” (VPW), a scheme that is designed to make sure you only spend what you can afford based on your age, your net worth, and your current (or future) pensions. And it comes with a built-in shock absorber so that even though the market looks like a roller coaster, the payout of VPW is considerably less wild. You can read about VPW over here. […]

LikeLike

[…] Since I’m the prime manager of our family’s retirement funds, I have trading authorization over my spouse’s accounts. The prime reason to do this is so I can see all the accounts from my login3 — even if they are held exclusively in my spouse’s name. This just makes things faster and simpler to do portfolio rebalancing, or even more practically, to get paid in retirement. […]

LikeLike

[…] described the methodology I use to calculate my take-home pay in a previous post, but in essence my salary is related to my real-time net worth, filtered through a 6-month moving […]

LikeLike

[…] by design, is variable, based on my net worth calculated every month. You can read about it here. I expect that over time my salary will increase3, so “future me” will be the one […]

LikeLike

[…] Having cash on hand is a good way to smooth out the gyrations of the market. It’s a fundamental part of my own withdrawal strategy. […]

LikeLike

[…] VPW-calculated salary has gone back to more or less where I started at the beginning of the year. And even with the crazy […]

LikeLike

[…] retirement decumulation strategy is a “drain to zero” approach that allows me to spend (or give away) as much of my […]

LikeLike

[…] VPW-calculated salary has hit a new high this year, a dizzying 0.77% higher than my first draw in January. This stability […]

LikeLike

[…] VPW-calculated salary has hit a new high this year, 2.41% higher than my first draw in January3. This is also expected, […]

LikeLike

[…] VPW-calculated salary has hit a new high this year, 4.22% higher than my first draw in January1. This is also expected, […]

LikeLike

[…] am trying to be realistic about the future, however. My current retirement payment scheme is rather labour-intensive, for […]

LikeLike

[…] VPW-calculated salary has hit a new high this year, 5.92% higher than my first draw in January. The monthly salary is […]

LikeLike

[…] VPW-calculated salary continues to grow for the 7th straight month in spite of the step back this month in my net worth. […]

LikeLike

[…] VPW-calculated salary took a slight decline, breaking the 7 month growth streak. It ends the year a shade under 6% larger […]

LikeLike

[…] VPW-calculated salary resumed its upward trend, also hitting an all-time […]

LikeLike