Norbert’s Gambit is a way to change USD to CAD or vice-versa cheaply. (Most brokers take 1.5% off of such transactions). I talked a bit about the Gambit previously, and a very up-to-date blow by blow account of how to do it is found here, but I figured I’d show the practical benefits of doing it.

On April 14th, I decided it was time to covert some of my USD RRIF holdings into CAD. I did this by selling some of my AOA shares. I then immediately purchased DLR.u on the TSX, using the US dollars from the AOA sale. (DLR is the usual ETF people use to do the Gambit, but any inter-listed stock/ETF will do.)

After making sure I had sufficient cash in my account to cover the journaling fees ($9.95 plus HST = $11.24 CAD), I submitted the journal request on the Questrade website.

Two days later (April 16th), the journaling fee was charged to my account.

And then one day later, April 17, DLR showed up in my account, replacing the DLR.u that had been there.

I immediately sold the DLR shares to create CAD in my account, which I then used to buy XEQT.

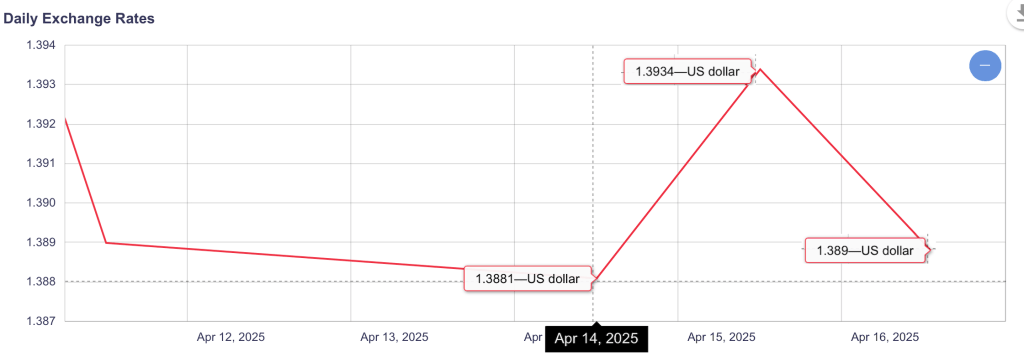

After subtracting the fees, my effective conversion rate was 1.385. Compare this to the Bank of Canada’s published rates, and I think you’ll agree that it’s a pretty sweet deal:

I’m tracking all my Gambit transactions over here, so I can see how often I come out ahead.

Discover more from The Money Engineer

Subscribe to get the latest posts sent to your email.

[…] 1% shift overall. This was because I shifted some of my USD assets to CAD assets in the RRIF using Norbert’s Gambit2. I chose XEQT over XGRO because the contribution of bonds in the portfolio was slightly over my […]

LikeLike

[…] unlimited journaling feature of Questrade Plus targets people like me who do Norbert’s Gambit to convert USD to CAD on the cheap, but since I don’t do this sort of thing super-frequently […]

LikeLike

[…] is most excellent. They do charge a $9.95 journaling fee which is required in order to pull off a Norbert’s gambit but since this is not something I do frequently, it’s a small annoyance. It’s still way […]

LikeLike

[…] I have a dedicated non-registered account in my retirement portfolio that is the cash cushion for VPW’s decumulation strategy. You can read about the details of how I currently get paid in retirement here. […]

LikeLike

[…] Since I hold a fair amount of USD in my retirement portfolio and most of my expenses are in CAD, I do have to convert between the two worlds from time to time. Most of the time I’m converting USD to CAD, but because of higher US interest rates, I’ve recently converted some CAD into USD to take advantage of that fact and earn a little more money on my cash positions1. My normal way of dealing with this conversion is using Norbert’s Gambit, which I’ve talked about here and here. […]

LikeLike

[…] Gambit: This is something I use all the time given that i have a large amount of USD holdings in my retirement portfolio. The best thing about […]

LikeLike

[…] Questrade Example: Exchanging USD/CAD with Norbert’s Gambit […]

LikeLike