My post talking about BMO’s fee reduction for their asset allocation family enticed me to revisit competitive asset allocation funds. TD’s low-low fees (0.17% versus the 0.20% of iShares) are tempting.

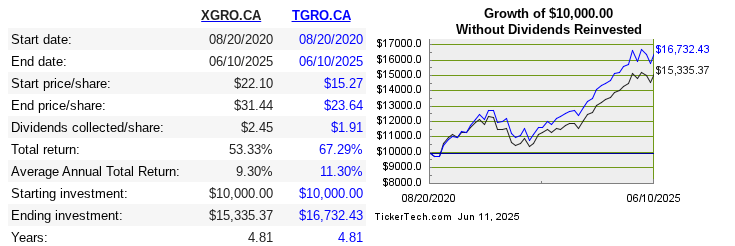

So, quick sanity check — what’s the historical performance of XGRO versus TGRO?12

Per https://www.canadastockchannel.com/compound-returns-calculator/ (featured in Tools I Use) I see:

What? The TD fund has returned a full 2 percentage points better? This is a bit hard to believe. They must be rather different somehow?

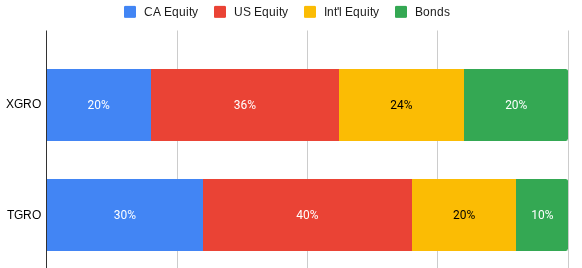

Ah, yes. Revisiting their respective fund pages reveals that TGRO has a lower allocation for bonds — it’s only 10% versus the 20% for XGRO. More bonds will definitely lower return as a reward for lower volatility (I showed that effect here), so that probably explains the difference.

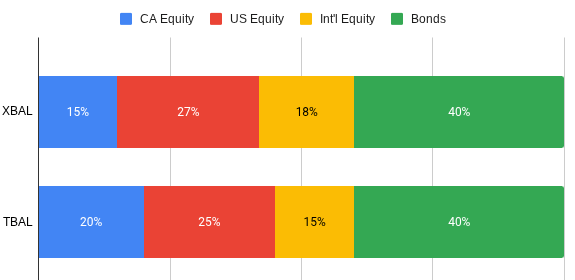

So comparing the returns of XGRO versus TGRO wasn’t an apples to apples comparison. I could instead measure the relative returns of XBAL versus TBAL since the equity/bond ratios of these two are equivalent (both at 60% equity, 40% bonds)3. There are, however, some minor differences in the equity side of the equation:

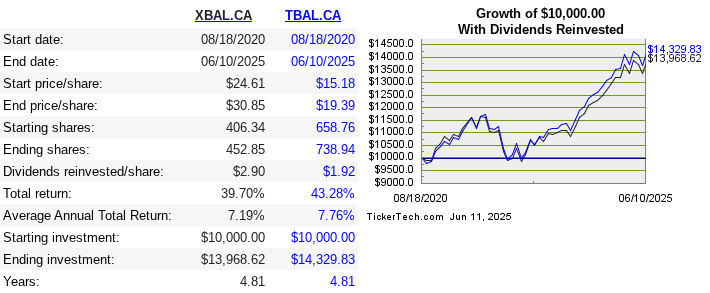

TBAL has a higher weighting in Canadian equity at the expense of some International equity, let’s see how that translates in the overall return:

That’s a lot closer, but the advantage still tilts TBAL’s way, which is another positive argument for considering it.

I am curious about how different these two are under the hood.

The first obvious difference is that they use different market indexes to build their portfolios, summarized below:

| TGRO/TBAL | XGRO/XBAL | |

|---|---|---|

| CAD Equity | Solactive Canada Broad Market Index | S&P®/TSX® Capped Composite Index |

| US Equity | Solactive US Large Cap CAD Index | S&P Total Market Index |

| Int’l Equity | Solactive GBS Developed Markets ex North America Large & Mid Cap CAD Index | MSCI EAFE® Investable Market Index, MSCI Emerging Markets Investable Market Index |

| Bonds | FTSE Canada Universe Bond Index | FTSE Canada Universe Bond Index and others |

So sure, the indices are different, but is it really a big deal? Doing a bit of digging I can confidently say that:

- On the Canadian Equity front, TGRO’s holdings are more broad and include smaller stocks.

- On the US Equity front, the opposite is true — XGRO holds more smaller US stocks

- On the International Equity front, XGRO has exposure to Emerging markets that TGRO lacks

- On the bond front, XGRO includes non-Canadian holdings, so a bit more diversified

Are any of these differences of great significance? No idea. Doubtful. TGRO has a recent small (0.5%) advantage, which is still worth digging in to. I took a look at the underlying assets…It’s easiest to do that by looking at the ETFs that underpin TGRO, one by one (TPU, TTP and TTE). XGRO’s product page shows the underlying assets so you don’t have to do the same (tedious) exercise for it.

| Top CAD Equity | Top US Equity | Top Int’l Equity | |

|---|---|---|---|

| TEQT/TGRO/TBAL | RBC, Shopify, TD, Enbridge, Brookfield | Microsoft, NVIDIA, Apple, Amazon, Meta | SAP, ASML, Nestle, Novo Nordisk, Roche |

| XEQT/XGRO/XBAL | RBC, Shopify, TD, Enbridge, Brookfield | Microsoft, NVIDIA, Apple, Amazon, Meta | Taiwan Semi, SAP, ASML, Nestle, Novo Nordisk |

Hmph. Almost the same. I guess the difference is really coming down to an advantageous geographic mix for TBAL over XBAL, which may or may not be repeated. As compared to TBAL, XBAL’s greater focus on equities outside North America hurt its performance in the last 5 years.

All this to say that TGRO/TBAL look like fine products, with no real reason not to recommend them. For me, one small complexity with TGRO is its bond allocation, which is lower than XGRO’s, meaning that to keep my usual 20% bond allocation, I would have to either buy a standalone bond fund or buy a TEQT/TBAL combo (a 50/50 ratio works, I did the math).

Perhaps you’ll start to see some of these funds in my monthly update — stay tuned!

- I wouldn’t normally do this, especially since the funds don’t have a long history, but in this case I see that the TD funds use obscure (to me) indices so I want to quickly see if there’s a major difference in return. ↩︎

- XGRO is the mainstay of the CAD portion of my retirement portfolio and TGRO looks to be the same thing. ↩︎

- You may wonder if this is really a valid comparison since what I actually care about is TGRO versus XGRO. I think it is a valid comparison since TBAL and XBAL are still relying on the same underlying indices to build their respective funds, it’s just that the percentages vary. That’s pretty much how most all-in-ones approach the problem of building multiple risk levels: take a set of ingredients (the indicies) and mix them in different ratios to get to the final all-in-one product. It’s really a test to see if TBAL’s indices are somehow “better” than XBAL’s. ↩︎

Discover more from The Money Engineer

Subscribe to get the latest posts sent to your email.

[…] are generally from younger investors who are looking for an easy way to invest and forget. Given my recent analysis, I’ll probably start buying into TEQT to save a few dollars on the MER […]

LikeLike

[…] that matches it. All-in-ones are offered by many companies, here’s a list I put together. (TD is currently the low-cost winner, […]

LikeLike

[…] Equity, 90% Equity, 60% Equity, 30% Equity. Read more here and […]

LikeLike

[…] TD versus iShares: XEQT/XGRO/XBAL versus TEQT/TGRO/TBAL […]

LikeLike