I got an email this week from a reader (who contacted me via comments@moneyengineer.ca, I read all my email) who was asking about ideas for non-registered investments after the tax-advantaged accounts (e.g. TFSA, RRSP) have been maxed out.

I too was in this happy predicament a number of years ago, and some of was, admittedly, a bit ad-hoc. I know a bit better now.

The first thing I’ll mention is that my non-registered holdings are 100% equity1; I don’t see the point in generating interest income since it’s taxed at your highest marginal rate. Interest bearing investments are better off in your RRSP or TFSA, in my view.

The second thing I’ll mention is my non-registered assets are held across TWO non-registered accounts, one in my name, one in my spouse’s name. Since my spouse made less money than I did (and hence lived in a lower tax bracket), I set her up with an investment loan as a form of rudimentary tax splitting.

Lastly, most of my holdings here are in a capital gain situation. There’s no opportunity for tax-loss selling, no opportunity to offset capital gains. That’s just the reality of being a buy and hold investor.

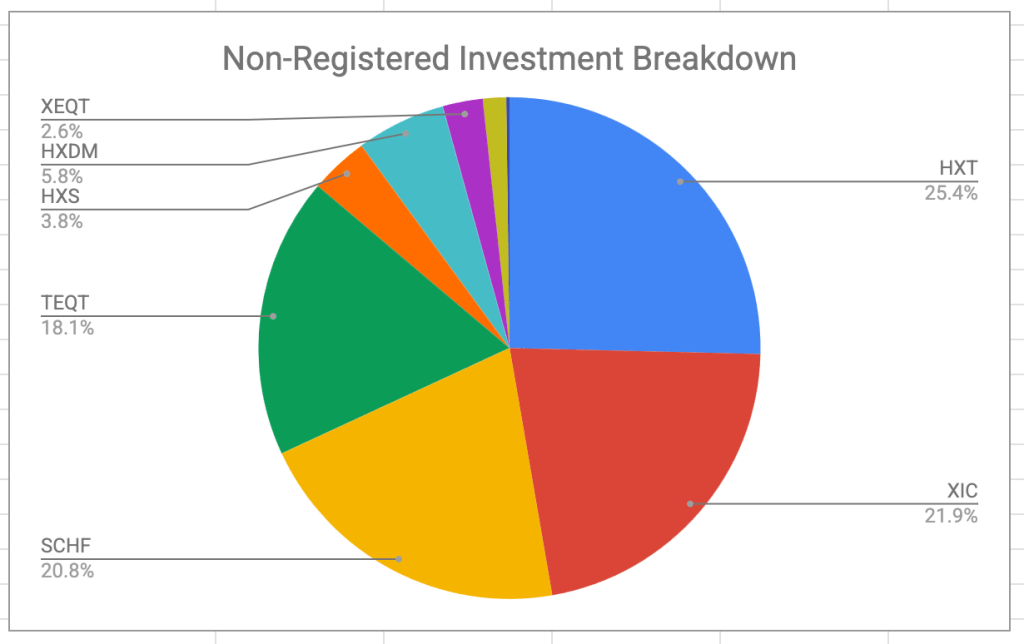

Here’s what the non-registered portfolio looks like (minus the cash cushion2, since those investments don’t really fit the criteria of the initial question):

So what have we got under the hood?

HXT, HXS, HXDM: Horizons “Corporate Class” ETFs

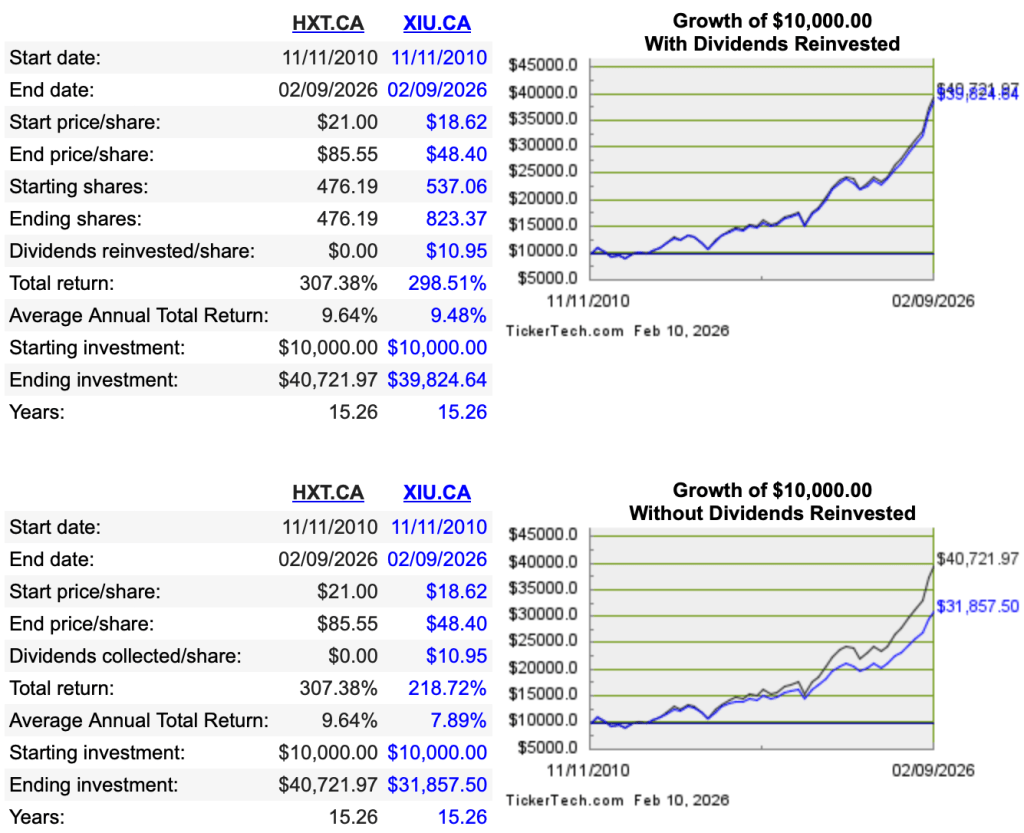

These refer to HXT, HXS, and HXDM, which track Canadian, US, and International equity indices, respectively. These three funds make up about 35% of my non-registered investments. Under the hood, they are structured in such a way as to avoid paying out dividends and income, instead burying that income in the per unit price of the ETF3. This works pretty well. Here’s what HXT versus XIU looks like, which both track the Canadian S&P/TSX 60 index.

As you can see, the total return is practically identical assuming all dividends thrown off by XIU are reinvested4. I see these Horizon funds as a way to potentially reduce your current tax bill. Even though Canadian dividends get special tax treatment, these may not apply to your particular tax situation if you are in a high enough tax bracket. If this is the case, deferring tax on dividend income (by buying HXT instead of XIU) may pay off later in life when you instead have to pay tax on capital gains and are potentially in a lower tax bracket.

The Horizons funds are also good choices for the lazy investor who doesn’t like keeping track of ACB; since there are no dividends to reinvest, there are no new unit purchases happening every quarter. (Of course with a tool like adjustedcostbase.ca, tracking your ACB is quite straightforward).

XIC: A Solid Canadian Equity Fund

XIC creates low-cost exposure to the total Canadian Equity market. It’s different from the aforementioned HXT because it generates dividends, and instead of just covering the largest 60 Canadian companies, it covers the whole Canadian market.

SCHF: A very low-cost international fund in USD

I have a lot of investments in USD. One of the big reasons was the MER of an ETF like SCHF. Yes, 0.03% for a basket of international stocks, which is lower (far lower) than any Canadian ETF out there. It’s still hard to beat the rock-bottom fees of some of these large US funds. So if you have access to USD, and don’t mind the complexity (and added FX volatility) of dealing with USD, it’s another solid way to round out your international holdings. VT (global fund) and VTI (total US market) are also frequently cited by index investors for this reason.

TEQT, XEQT, ZEQT: All-in-one 100% Equity funds

These are a small but growing portion of my non-registered holdings. “Growing” because free money delivered by Questrade (a new client bonus) has to go somewhere. XEQT I’m not adding to because I like to hold different ETFs in non-registered and registered accounts to avoid any “superficial loss” problems with the CRA. ZEQT and TEQT are both solid 100% equity with slightly different proportions of Canadian/US/International equity.

- It wasn’t always true, but it is now. ↩︎

- The cash cushion is a third non-registered account that holds income investments (ZMMK and ICSH) which smooths out my monthly salary. You can read about how I decumulate my holdings over here. ↩︎

- I’ll reiterate: the only thing I care about is TOTAL growth. Dividends or unit price growth, it makes no difference to me. ↩︎

- And hopefully also clear by comparing the two charts is that XIU generated about $9000 in dividends during the 16 year backtest period. ↩︎