This is a monthly look at what’s in my retirement portfolio. The original post is here.

Portfolio Construction

The retirement portfolio is spread across a bunch of accounts:

- 6 RRIF accounts (2 for me1, 3 for my spouse, 1 at an alternative provider as a test)

- 2 TFSA accounts

- 4 non-registered accounts, (1 for me, 1 for my spouse, 2 joint)

The target for the overall portfolio is unchanged:

- 80% equity, spread across Canadian, US and global markets for maximum diversification

- 15% Bond funds, from a variety of Canadian, US and global markets

- 5% cash, held in savings-like ETFs.

You can read about my asset-allocation approach to investing over here.

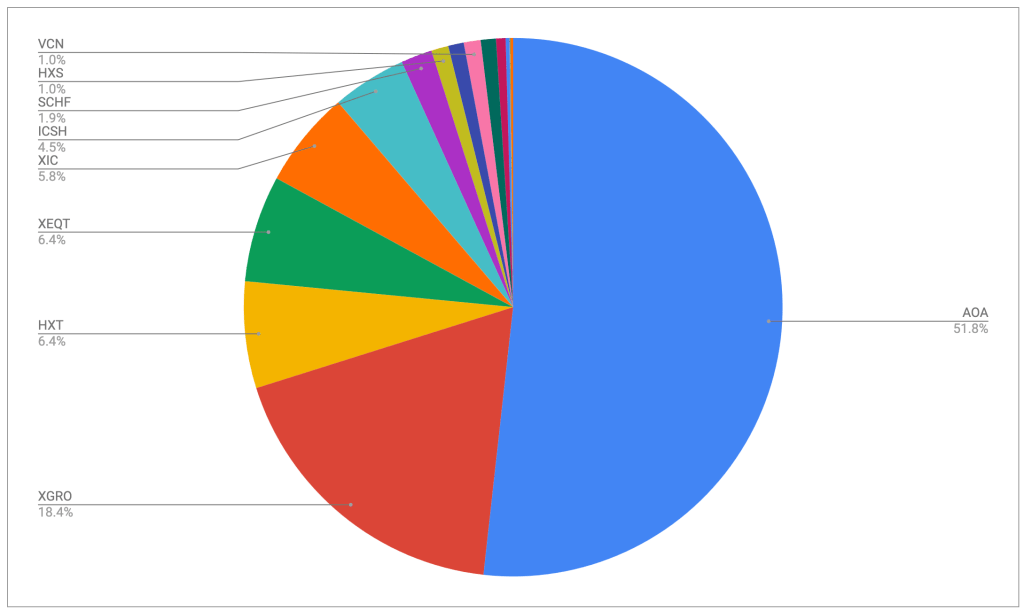

The view post-payday

I pay myself monthly in retirement, so that’s a good trigger to update this post. On November 25th, this is what it looks like:

The portfolio is dominated by my ETF all-stars; anything not on that page is held in a non-registered account and won’t be fiddled with unless it’s part of my monthly decumulation. Otherwise I’ll rack up capital gains for no real benefit.

No notable changes this month; HXT is down slightly because that’s the fund I sold in my non-registered account this month to help pay the bills. I’ve sold quite a few shares of this fund this year and I’m seeing the capital gains mounting, but it’s around where I expected to be. I try to keep taxes owing reasonable; nonetheless I’m guessing I will certainly be moving to quarterly instalments in FY 2026; that’s the downside of having no withholding tax of any kind this year.

Plan for the next month

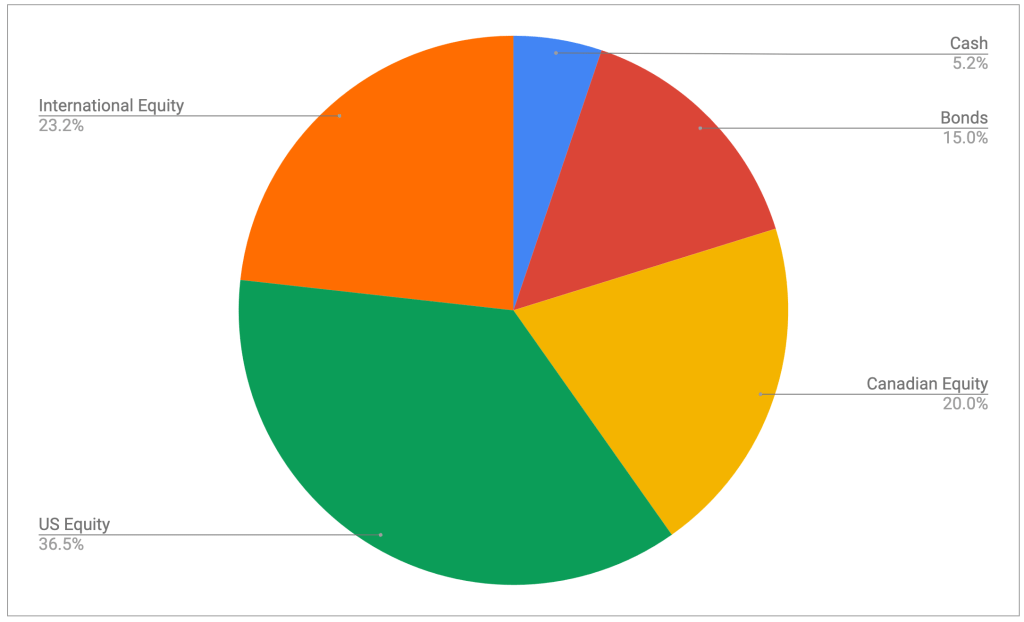

The asset-class split looks like this

It’s looking pretty close to the targets I have, which are unchanged:

- 5% cash or cash-like holdings like ICSH and ZMMK

- 15% bonds (almost all are buried in XGRO and AOA)

- 20% Canadian equity (mostly based on ETFs that mirror the S&P/TSX)

- 36% US equity (dominated by ETFs that mirror the S&P 500)

- 24% International equity (mostly, but not exclusively, developed markets)

All looks to be in order from an asset allocation perspective, no need to do anything here. Cash is slightly elevated as a result of the pending closure of the three remaining QTrade accounts and will drift back to the normal 5% over the coming few weeks, I expect.

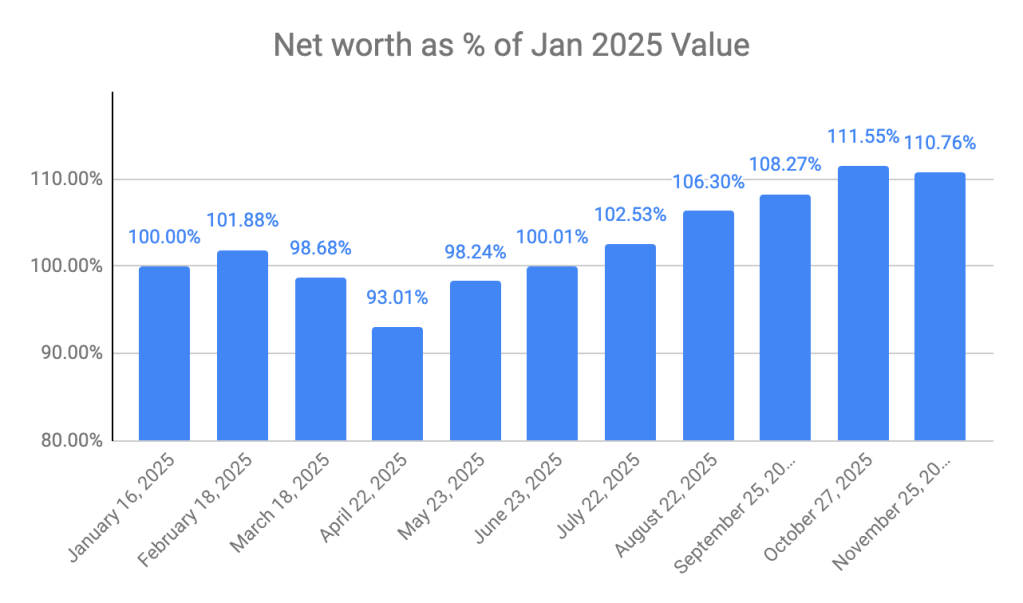

Overall

Net worth overall stopped its 6 month winning streak and I’m down slightly month over month. But I will reiterate: my net worth is still growing even though I’m taking a living wage every month. You might think that “decumulation” means “a steady reduction in net worth” but it needn’t be the case. And, in my particular case, my retirement income will include no pensions, so it’s probably a good thing that it keeps increasing overall.

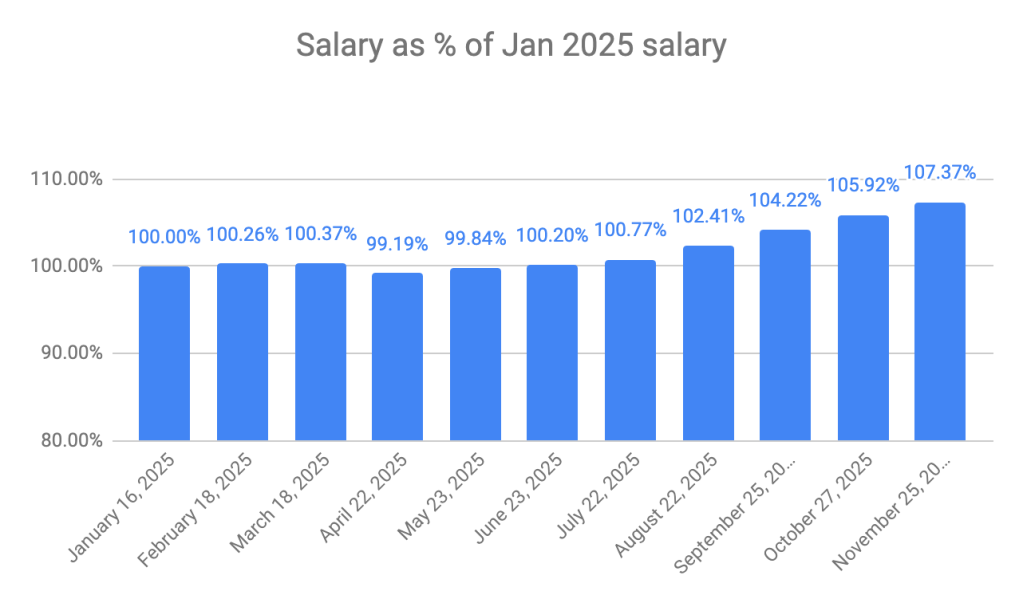

My VPW-calculated salary continues to grow for the 7th straight month in spite of the step back this month in my net worth. That’s a feature of the “cash cushion” that is integral to the VPW withdrawal. It serves as a shock absorber to the monthly ups and downs of the stock market.

Next month will end my relationship with QTrade as I move the final 3 RRIF accounts to Questrade2.

- My QTrade one is no more, transferred to Wealthsimple to take advantage of their Summer promotion. ↩︎

- I had hoped to move these to Wealthsimple and generate more free money, but alas, they still don’t support self-directed spousal RRIFs, which is very odd indeed. ↩︎

Discover more from The Money Engineer

Subscribe to get the latest posts sent to your email.

[…] of course I immediately tried to build my idealized portfolio, which is what my “What’s in my Retirement Portfolio” would look like without the non-registered […]

LikeLike

[…] can see the comparision of net worth versus salary below. (Taken from my most recent monthly “What’s in my Retirement Portfolio” update.) The net worth moves quite a bit month-to-month (generally upward, which is nice), […]

LikeLike