“Backtesting” is a commonly-used tactic to see how well the portfolio you have (or are considering) would have performed historically. While “past performance does not guarantee future results” it’s better than not knowing.

I stumbled upon valuetesting.io when I was trying to backtest…something, I don’t really remember what I was up to. Anyway, my random internet walk found valueinvesting.io, which seems to be chock full of all kinds of tools that I haven’t looked at, so I’m just going to focus on the backtesting tools, which I did spend a few hours playing around with. You have to navigate to https://valueinvesting.io/backtest-portfolio to access this portion, and if you want to save portfolios, you have to create an account.

So what, in a nutshell, does this tool do? In their words:

Our portfolio backtesting tool allows you to evaluate the historical performance of up to 3 portfolios. We support 2 portfolio types: asset classes and tickers (stock, ETF, mutual funds). Multiple backtesting scenarios are supported such as periodic capital inflows or outflows, allocation rebalancing frequency and leverage type. Our tool provides historical returns, risk metrics, drawdowns and rolling returns information about your selected portfolios.

https://valueinvesting.io/backtest-portfolio

Let’s take a look at the two kinds of portfolio types they support: asset classes and tickers.

Backtesting using asset classes

The downside of this tool as a Canadian investor is pretty obvious when you try to build a portfolio using asset classes. (Asset classes are integral to the way I think about my retirement portfolio — you can read more about my approach here.) There’s no “Canadian Equity” category to choose (boo!).

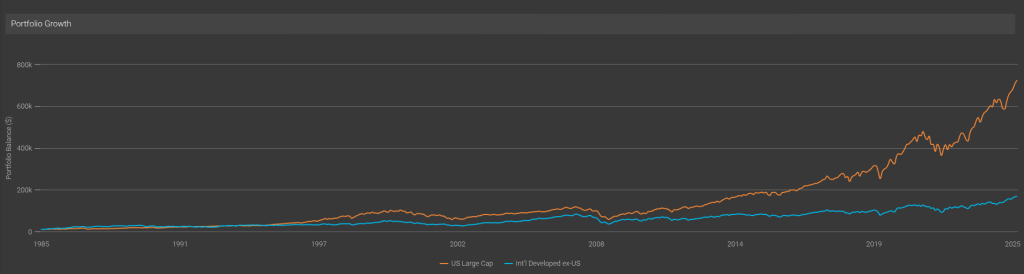

The class that would hold the most Canadian equity would be “Intl Developed ex-US Market”1, so let’s compare that to say the “US Large Cap” (which I take to be a good proxy for the S&P 500).

The good old S&P has left the rest of the developed world in the dust, it seems…Well, except for THIS year:

Anyway, the asset classes are good fun and all, but without a Canadian index to track, it’s not too useful to me. (And, inexplicably, nowhere could I find a definition of any of these in the tool, and an email to the support address remained unanswered at the time of publication). So let’s move on to something more interesting, namely the ticker backtesting!

Ticker Backtesting

As the name implies, this portion allows you to enter tickers, and there’s full and complete support for Canadian ETFs that I tried.

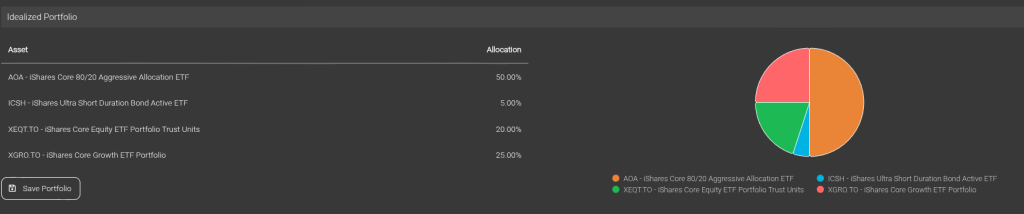

So of course I immediately tried to build my idealized portfolio, which is what my “What’s in my Retirement Portfolio” would look like without the non-registered assets2.

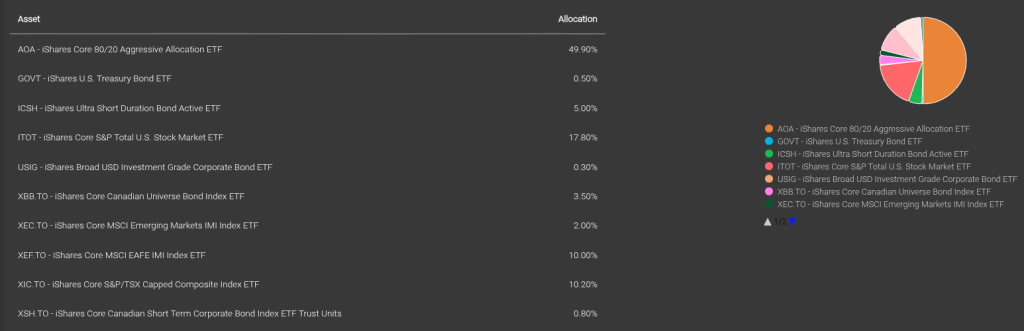

The problem? XEQT and XGRO (two of my ETF all-stars) haven’t been around all that long, and so I can’t backtest very far. No matter, by looking at the composition of XEQT and XGRO and doing some clever math, I can create the equivalent decomposed portfolio:

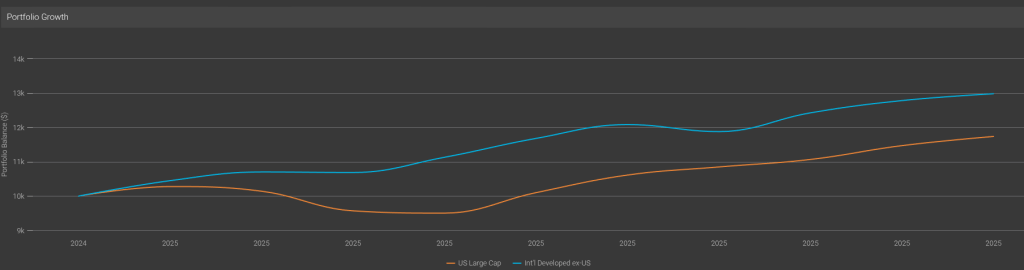

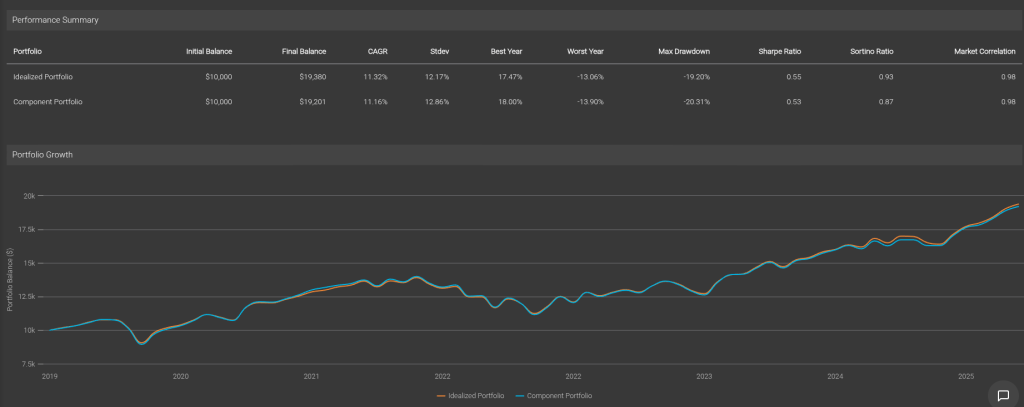

And I can prove that I got it right by backtesting the two against each other. Pretty good, eh?

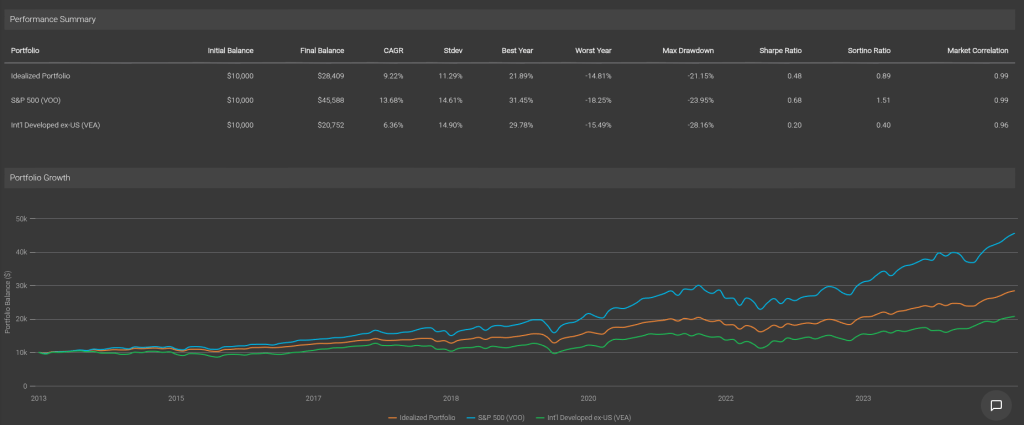

So with my decomposed portfolio at the ready, I can compare its performance long-term against (for example) just buying the S&P 500 index (VOO) or the International Developed ex-US index (VEA).

As expected, my portfolio has quite a bit poorer performance than the S&P, but better than the International ex-US. The bond/cash component smooths out the standard deviations (that’s “volatility”) so my worst years (although still a bit scary) are still a bit less than experience of owning 100% equity.

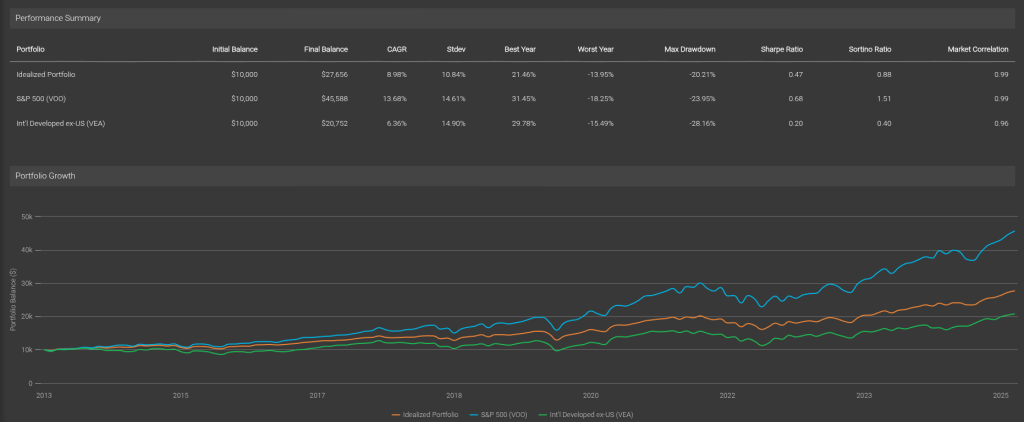

One more thing to look at — this backtesting assumes we don’t rebalance anything. That’s not correct, since that’s one of the benefits of holding ETFs like AOA, XGRO and XEQT — they automatically rebalance periodically. valueinvesting.io lets you choose monthly, quarterly, semiannually and annually. I know for a fact that AOA rebalances twice a year, so we will assume XGRO/XEQT do the same. This is what the result looks like:

This reduces the volatility and the return a bit, which if you stop and think about it, makes sense: equities consistently outperform bonds and cash over time so the rebalancing exercise makes sure the equities remain at an 80% contribution to the portfolio.

Conclusion

The backtesting portion of valueinvesting.io is a good tool to test various combinations of ETFs / stocks you may be interested in. There’s not very much documentation on the site, but it’s easy enough to use. The free account (which requires registration) is enough to get you that far.

- Did a bunch of tests and determined that VEA was the ETF that matched the performance of this index most closely. This ETF is about 11% Canadian Equity. ↩︎

- The non-registered assets are being sold off, little by little, to fund my retirement. This year, they have provided about 2/3 of my “salary” (RRIF minimum payments gave me the other 1/3), so I am –slowly– drifting toward the ideal portfolio. The AOA percentage in the ideal portfolio will get smaller over time as I transmogrify it as needed to XGRO using Norbert’s Gambit. ↩︎

Discover more from The Money Engineer

Subscribe to get the latest posts sent to your email.