Passive investing while ensuring good diversification has been my strategy for decades. But how do I define “diversification”? For me, it’s always been about paying attention to how much of my total portfolio was invested in each of five1 asset classes and keeping them aligned with my targets:

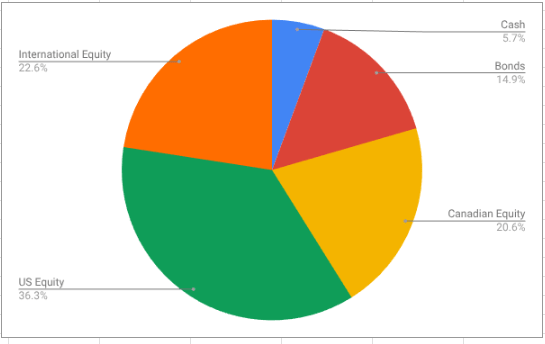

I got this idea from my last financial advisor who provided me with a lovely Cerlox4 bound annual report showing me how hard they were working on my behalf5. The report included a pie chart of how my investments broke down. This is what that pie chart looks like in my portfolio this morning:

This pie chart has been my guiding principle: have a target percentage for each asset class in mind, and adjust your portfolio as needed to keep the percentages in line. This simple principle has been adopted by so-called asset allocation ETFs aka “all-in-ones” like (my personal favourites) XGRO6 and AOA7.

But are these even the right asset classes? Where are REITs8? Where’s precious metals? Where’s Bitcoin9? What’s your bond duration? Do you have enough exposure to high-growth geographies?

Short answer: just like I’m too lazy to pick stocks, I’m too lazy (and not smart enough) to pick a “winner” of a given asset class. The “periodic table” of investment returns by asset class is a must-read for DIY enthusiasts out there: https://themeasureofaplan.com/investment-returns-by-asset-class/ (go ahead, take a look, I’ll wait).

The folks at Measure of a Plan agree that trying to figure out the “hot” asset class is a very difficult task:

It’s no easy feat to pick the winner in a given year. The asset class rankings appear to be randomly tossed about over time, with the top performer in one year often falling down to the middle or bottom of the table in the next year.

https://themeasureofaplan.com/investment-returns-by-asset-class/

By keeping an eye on the pie chart, and shifting investments to align with my targets, I’m never at risk at being overweight in any one asset-class, and beaten-down asset-classes naturally get more funds to get the percentages right. It’s naturally causing “buy low, sell high” behaviour.

So: what about the asset classes I’m using? Are 5 asset classes too many? Too few? I don’t know. “Good enough” is sort of my philosophy in the spirit of trying to keep things simple.

The spreadsheet I’ve used to help me track my portfolio breakdown is found here. In future posts, I’ll talk a bit about how to make it work for you.

- For a long time, “cash” was not part of the consideration. Leading up to retirement, I started to carry a 5% cash weighting to help cushion market swings. ↩︎

- In years past, I did try to keep track of short-term versus mid-term versus long-term bonds. I gave up on that. ↩︎

- In years past, I did try to keep track of developed markets versus emerging markets. I gave up on that. ↩︎

- I had to look up how this was spelled. https://www.collinsdictionary.com/dictionary/english/cerlox ↩︎

- The fact that this report looked the same as the reports generated by two other advisors led me to the conclusion that my hard working advisor was perhaps being assisted by commercial software. ↩︎

- Overview of XGRO’s asset allocation strategy: https://www.blackrock.com/ca/investors/en/literature/product-brief/ishares-core-etf-portfolios-brochure-en.pdf ↩︎

- Overview of AOA’s asset allocation strategy: https://www.ishares.com/us/literature/product-brief/ishares-core-esg-allocation-brief.pdf ↩︎

- My first list of asset classes prepared circa 20 years ago did include REITs but I dropped that class, figuring (perhaps incorrectly) that the bond portion of the portfolio was good enough. Doing a bit of digging, I see that both AOA and XGRO hold REITs, and both consider them “equity” investments. ↩︎

- It’s actually obligatory for any article on investing to mention one (or more) cryptocurrencies, and/or one (or more) meme stocks 😉 ↩︎

Discover more from The Money Engineer

Subscribe to get the latest posts sent to your email.

[…] asset rebalancing, possibly. (If you want to better understand how I think about asset allocation, this article might shed a bit of light on […]

LikeLike

[…] you adhere to asset-allocation strategies (as I do) then rebalancing your assets to reset them back to your targets is a way to make sure you […]

LikeLike

[…] You can think of this as the video version of https://moneyengineer.ca/2025/03/28/how-i-think-about-investing-asset-classes/. […]

LikeLike

[…] They also have a bunch of their segment ETFs doing the same thing, but I don’t do segment bets. Just asset classes. […]

LikeLike

[…] I chose XEQT over XGRO because the contribution of bonds in the portfolio was slightly over my asset allocation target3. XEQT is essentially XGRO, minus the bond holdings (it’s a 100% equity […]

LikeLike

[…] talked about asset allocation / asset classes before in this space, most recently here. But while watching a recent post1 from one of my favourite experts, The Loonie Doctor2, it […]

LikeLike

[…] This breakdown would give me the 80% equity, 15% bonds, 5% cash that I strive for in my asset allocation targets. […]

LikeLike

[…] since they adhere to my rules about being passively managed, low cost, and aligned with my asset-allocation strategy. The simplest purchases here would be one of the TD or Vanguard all-in-ones (new to all-in-ones? […]

LikeLike

[…] XEQT, you currently see XSH, a bond fund9. This exists in order to keep my target asset allocations in line, and because I don’t really want the monthly distributions landing in a taxable […]

LikeLike